This article is authorized to be reproduced from Chuxingyike (WeChat public account ID: carcaijing) of the Transportation Industry Group of Caixin Media, written by Wang Jingyi and Guo Yu, edited by Shi Zhiliang.

This is NETA’s golden age, with monthly sales exceeding 10,000 and the best capital situation; this is also NETA’s tough age, with just starting to embrace intelligentization, facing difficulties entering first-tier cities and fierce competition in the new car market.

With nearly four-fold increase in sales and heavyweight investment, NETA Auto has become a dark horse among the recent emerging players in the car industry.

It is not a widely admired company. Unlike other emerging car companies, NETA Auto entered the market with low-end and mass-market models, making their products difficult to find in Beijing, Shanghai, Guangzhou, and Shenzhen. The founding team is also not good at financing, with small fundraising scale and a road to listing that has been blocked.

“Everyone thinks that you don’t have enough signs of success, whether it’s from people, money, past experience, or behind-the-scenes shareholders, the face of the company is not good enough.” NETA Auto’s co-founder and president, Zhang Yong, told Chuxingyike (ID:carcaijing), external doubts never cease.

But with the 100,000 yuan-level electric vehicle strategy, “surrounding cities by the countryside,” NETA Auto achieved monthly sales exceeding 10,000 at the end of 2021, with an annual sales volume of 69,674 units, ranking fourth among emerging car companies after XPeng Motors (NYSE: XPEV), NIO (NYSE: NIO), and Li Auto (NASDAQ: LI).

Gong Min, head of automotive research at UBS China, told Chuxingyike (ID:carcaijing) that the sales of emerging car companies are fluctuating, and who is ahead now may not always be ahead in the future, it’s a relative process of winning or losing, depending on the product cycle and the grasp of market opportunities, which is full of dynamic changes.

The weaknesses of this dark horse are also apparent: late to embrace intelligentization, difficult to enter first-tier cities, and fierce competition in the new car market… NETA needs to work hard to catch up and win the next race.

Monthly sales exceeded 10,000, but difficult to find in Beijing, Shanghai, Guangzhou, and Shenzhen

In the second half of 2021, NETA Auto’s sales rank frequently appeared in the top three among emerging car companies, with continuous monthly sales exceeding 10,000 in November and December 2021, and a total of 69,674 units sold throughout the year, a year-on-year increase of 362%.

On January 8, 2022, NETA Auto welcomed the production of its 100,000th vehicle, joining the ranks of the first group of emerging car companies.Why did NETA’s sales increase? “Firstly, it’s due to the trend. The Chinese new energy car industry is developing well and we are following the trend. Second, you have to seize the opportunity when it comes. Our V and U series products have been polished and developed for two to three years, and we quickly launched them in the market at the right time, and we have also laid out channels and services one to two years in advance.” Zhang Yong told Caijing ID:carcaijing.

By model, the V series priced between 60,000 and 100,000 shipped 49,646 units in 2021, and the U series priced between 100,000 and 160,000 shipped 20,028 units, while the first model N01 with a starting price of 59,800 RMB has been discontinued.

Cost-effectiveness is NETA’s main selling point. Take the latest released U Pro as an example, it has a range of 400, 500, and 610 kilometers, and the price ranges from 104,800 RMB to 162,800 RMB. “This is a compact SUV with a wheelbase of 2770 millimeters. It has a large space, low price, and good cost-effectiveness. Compared with the same level of SUV, it is the cheapest.” The staff at NETA Auto’s Shanghai Gala Mall store told Caijing ID:carcaijing.

Both have monthly sales of over 10,000, but NETA’s car prices are lower among the new forces, and the average selling price of NIO cars is 440,000 RMB.

“Compared with NIO, our target market is several times larger than theirs, so although NETA’s monthly sales are on par with theirs, I think they are doing better than us. Only when my sales are two or three times higher than theirs, I think we are equally excellent. For us, monthly sales of over 10,000 are not enough to celebrate, as we are still far from doing enough.” Zhang Yong said frankly.

NETA’s car prices are not high, and the market is relatively sinking, and it is difficult to trace its presence in Beijing, Shanghai, Guangzhou, and Shenzhen. NETA Auto’s Chief Marketing Officer Zhou Jiang told Caijing ID:carcaijing that among the current users, new second-tier cities such as Chengdu, Hangzhou, and Wuhan account for the highest proportion, about 31%; followed by second-tier cities such as Wuxi and Hefei, accounting for 22%; and third-tier and fourth-tier cities account for a total of 31%, with first-tier cities accounting for 13%.It is frequently questioned in the industry how much of NIO’s robust sales are actually to individual customers since NIO had originally expressed that it was mainly targeting the corporate market.

According to Zhou Jiang, the actual delivery volume of its first product, N01, was not very high due to its product positioning and product strength being more focused on the low-end market and the needs of some corporate users. In 2019, NIO underwent a strategic transformation, and currently, the V and U series can meet the individual user needs of 60,000 to 150,000 yuan, and as of 2021, first-tier, new first-tier, and second-tier city users accounted for approximately 64% of NIO’s total individual users.

The corporate market is always a lucrative business that cannot be ignored. Three local government industry funds from Tongxiang, Zhejiang, Yichun, Jiangxi, and Nanning, Guangxi have put huge investments into NIO. The local governments and companies have shown great support for “locally-produced cars,” from government procurement of public vehicles to group purchase by enterprises and institutions, investing real money.

In 2021, NIO launched customized models for both government vehicle and ride-hail markets. For example, NIO U launched a super ride-hail version, making adjustments to passenger comfort and entertainment in the rear seats. In May 2021, NIO U Pro introduced four new customized models with a three-electric system that enjoys a longer warranty of 5 years and 500,000 kilometers, specifically aimed at the government vehicle market.

According to the Beijing Municipal Government Procurement Center’s published announcement of the bidding results for the government procurement project of designated purchases of public vehicles for municipal-level administrative and institutional units in Beijing for the years 2020-2022, NIO’s entire vehicle lineup has been included in the procurement catalog. Riding on the trend of government vehicles tilting towards domestic and new energy vehicles in recent years, NIO has been recognized by multiple local governments, winning bids and being included in procurement catalogs for at least 22 government purchases in more than ten provinces nationwide, as well as the State Taxation Bureau and other agencies.

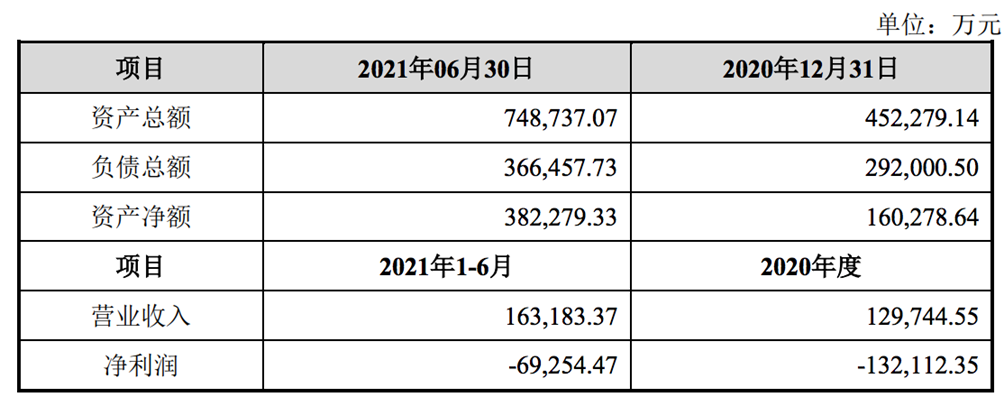

Due to the relatively low unit sales price, NIO’s revenue-generating ability is not strong. When 360 Security Technology Co., Ltd. (601360.SH) invested in NIO, it disclosed financial data. In the first half of 2021, NIO realized revenue of CNY 1.632 billion and a loss of CNY 0.693 billion. Although the revenue has increased significantly compared to the CNY 1.297 billion for the entire year of 2020, there is still a sizable gap compared to NIO’s competitor, NIO’s revenue of CNY 16.432 billion during the same period.

“We are building cars for the public, which means we cannot sell expensive cars. Being good and affordable will lead to slightly lower gross profit margins, but gross profit margins are still positive,” Zhang Yong said. “As long as the company can operate healthily, gross profit margins continue to improve, and losses gradually narrow, I think it can achieve profitability within two to three years, which is quite good. First, expand the scale, let people recognize your products and brand. I think this is the most important thing.”

## Valuation unknown, but financing is sufficient

## Valuation unknown, but financing is sufficient

Unlike the founders of NIO, XPeng, and Ideal, whose Internet business background brings them traffic and resources, NETA’s founding team comes from traditional car companies and is not skilled in finance.

“At the beginning of our establishment, we did not have much experience in capital operation. We just wanted to make good cars and run a good company. Therefore, we did not set up a VIE architecture from the beginning.” Zhang Yong previously told Carcaijing (ID: carcaijing). VIE architecture is a must for start-ups to go public overseas, and NIO, Ideal, and XPeng were the first to go public in the United States in 2020 with this.

NETA Motors have publically stated that they plan to go public on the Science and Technology Innovation Board (STAR Market) in early 2021 and lead the new energy automotive market. However, with the stricter scrutiny in the review process of STAR Market IPOs, this listing plan has not progressed. There have been recent rumors that NETA is considering going public in Hong Kong, but Zhang Yong has not commented on this.

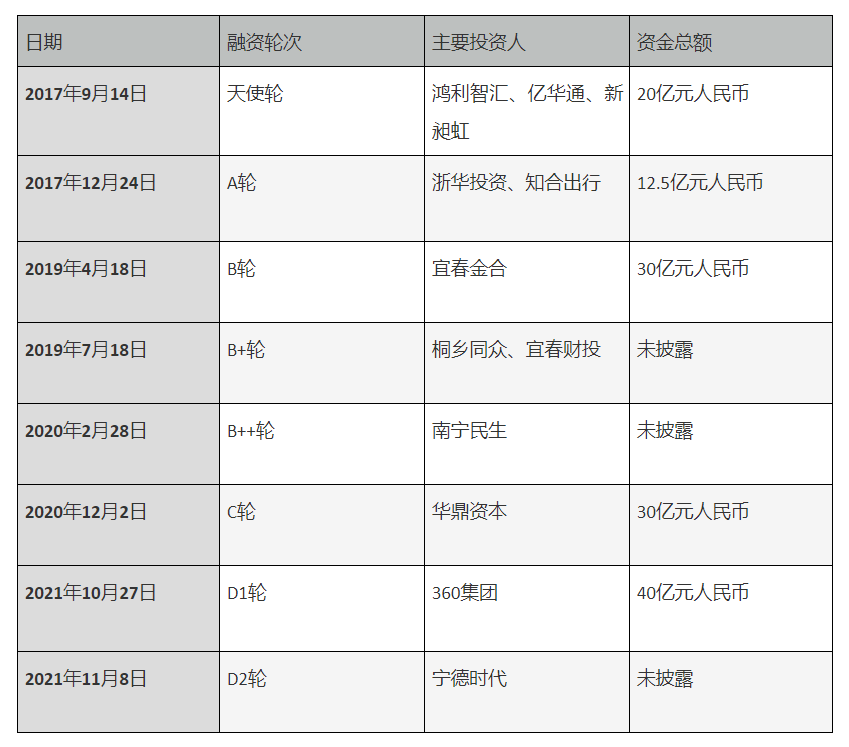

With its listing plan still not confirmed, NETA Motors, which lacks the ability to generate cash, must continue to finance. In 2021, 360 (601360. SH) and CATL (300750. SZ) announced investments in NETA. The former is a major Internet security giant, and the latter is a leading new energy vehicle battery supplier. The entry of these two major shareholders has given the market more confidence in NETA.

On April 27, 2021, NETA Motors announced its D round of financing information, with 360 taking the lead. On October 18, 360 released an announcement stating that it plans to invest 2.9 billion yuan, and after the completion of this investment, it will hold 16.5940% of the equity, becoming the second largest shareholder after the management team.

NETA’s valuation has more than sextupled over the past year. According to 360’s announcement, before the B round of financing in February 2020, the valuation was RMB 3.5 billion, and after the investment, the post-investment valuation was RMB 7.013 billion. Before the D1 round of financing in October 2021, the valuation was RMB 22 billion, but the post-investment valuation has not been disclosed.

According to incomplete statistics, since its establishment in 2014, NETA has gone through eight rounds of public financing, with a total financing amount exceeding 13 billion yuan. The industry-wide recognized threshold for new car-making companies is RMB 20 billion. Recently, the founders of new car-making companies have told Carcaijing that to become a competitive and sustainable new car-making enterprise, at least RMB 40 billion in reserve funds are needed.

“We operate the company with a practical attitude. Maybe others have three or four hundred billion yuan and can do ten things. We have only one hundred billion yuan and can only focus on one thing, which is technology research and development, and user services to implement the value of technological equality.” Zhou Jiang said frankly.Before finding the founder of 360, Zhou Hongyi, Zhang Yong contacted many investors, but the investors had different opinions on the positioning of NETA in the mass market. On the one hand, they despised the weak product and lack of foundation; on the other hand, they thought that NETA lacked Internet genes. “Only Zhou Hongyi particularly agrees with our positioning.” Zhang Yong said.

Zhou Hongyi answered why he chose NETA Motors like this: “NIO, XPeng, and Ideals have all gone public, so my choice is very limited. NETA Motors is more like a start-up team. Traditional automakers may not need me, and I also prefer to choose start-up companies.”

Another important investor is CATL. On November 8, 2021, NETA announced that CATL will participate in the D2 round of financing and fully open strategic cooperation in the fields of technology research and development and supply chain guarantee.

CATL is the leader in the new energy vehicle battery industry with a market share of more than half. According to data from the China Power Battery Industry Innovation Alliance, the cumulative installed capacity of power batteries in China in 2021 was 154.5 GWh, a year-on-year increase of 142.8%. Among them, CATL’s installed capacity was 80.51 GWh, with a market share of 52.1%.

In addition to the two major star shareholders, NETA Motors has always been deeply bound to the local governments of three places: Tongxiang, Zhejiang, Yichun, Jiangxi, and Nanning, Guangxi.

Zhang Yong revealed that before the C-round financing in 2020, the equity of local industrial funds accounted for more than 60%, the team accounted for more than 20%, and the remaining less than 20% was the Tsinghua system and social capital. After a group of new shareholders were introduced in 2021, the equity of local government industrial funds was diluted, and the specific proportion is unknown.

At the same time, in March 2021, NETA Motors obtained a credit limit of 5 billion yuan from CITIC Bank. Nine months later, it again obtained a comprehensive credit limit of 2 billion yuan from the head office of Shanghai Bank. It is mainly used for smart cabins, intelligent driving, and other intelligent technology research and development.

“As of now, it should be the best period for our financial situation,” Zhang Yong said.

“Surrounding the City from the Countryside”

It is not difficult to see from the models and sales of NETA that a clear path of “surrounding the city with the countryside” is gradually emerging: the prices of the launched models are gradually increasing; the target market is gradually penetrating from third- and fourth-tier cities to first- and second-tier cities; B-side sales mainly for government vehicles and online ride-hailing have decreased, and the C-side personal purchase rate has increased.

“Everyone wants to go from high to low, but NETA Motors does not have this condition, time and funds do not allow it, so I am definitely going to do it from low to high.” Zhang Yong believes that in the field of smart electric vehicles, consumers’ awareness of brands has not yet formed, and there is still room for growth from low to high.

NETA has a bottom-up approach: first is the expansion of the product line, different products target different market segments, gradually moving up, and the overall goal is to produce smart electric vehicles for ordinary people; second is channel expansion, expanding from 170 cities to 250 cities by 2022; the third is internationalization, with Thailand and ASEAN markets as the first step.”I don’t think there is much iteration and regularity between the product generations of NETA automobiles,” expressed Gui Lingfeng, the Greater China Managing Director of Korn Ferry, to Carcaijing (ID:carcaijing). “I haven’t seen any obvious proprietary technology investment for the chassis and key components of NETA U and NETA N01, perhaps a large proportion of them are off-the-shelf solutions from suppliers. NETA S, which will be launched later this year, has caused me more confusion because Zhang Yong once said that he wouldn’t make a car that costs more than 200,000 yuan, but the publicly available product performance parameters may be hard to achieve in this price range.”

NETA’s strategy was not established on the first day – from products, to strategies, and even brand names, NETA underwent several changes.

In 2017, Zotye Holding Group-owned Hezhong New Energy received national new energy vehicle license and its factory in Tongxiang, Zhejiang was completed. A year later, the first model, NETA N01, was launched, mainly targeted at the public market.

N01 was launched hastily. Gui Lingfeng told Carcaijing that traditional automakers generally need four to five years from construction to SOP production to final delivery, but NETA achieved it in less than three years.

“Our first product is NETA N01, with B-end accounting for over 50% and C-end accounting for over 40%. Due to insufficient product strength, it is difficult to compete in the C-end market. Car owners are mainly in third-tier to fifth-tier cities, targeting young people in small towns,” Zhang Yong explained the decision. “I am worried that N01 will affect the brand image, so we basically don’t allow it to be sold or opened up channels in mainstream cities.”

In a communication meeting in March 2019, everyone once considered giving up the “NETA” brand, considering that the already launched NETA N01 was too low-end and planned to rename the second product “Hezhong”. As a result, Hezhong U was unveiled at the Shanghai Auto Show in 2019 and was later renamed NETA U after the film NETA: Birth of the Demon Child, which was fourth in the history of Chinese box office and promoted the NETA brand. In September 2019, Hezhong New Energy re-examined its brand architecture and changed the brand logo of NETA automobiles.

On the channel level, “Beijing, Shanghai, Guangzhou and Shenzhen couldn’t see NETA in 2019, and had never heard of it. In 2019, when we started to launch NETA U, we began to build channels in first and second-tier cities. In 2020, we decided to run direct stores in first and second-tier cities,” said Zhou Jiang.

As of the end of 2021, NETA automobile had 331 offline channels, including 70 direct stores and 261 franchised stores. Among them, there are 57 newly added direct stores and 125 franchised stores in 2021.

Delayed Intelligence and Branding That Has Yet to Take offWithin six months, over 10,000 cars will be sold, and within one year, over 20,000 cars will be sold for the electric car NETA S, which will launch in the fourth quarter of 2022. Zhang Yong has high hopes for it.

NETA S is the first car model built on the self-developed Shanhai platform with two versions: extended range and pure electric. It has a maximum range of up to 1,100 km and accelerates from 0 km/h to 100 km/h in 3.9 seconds. Equipped with Huawei MDC computing platform with 200T high computing power, 2 lidars, 5 millimeter-wave radars, 12 ultrasonic radars, and 13 cameras, NETA S can achieve automatic parking, navigation-assisted driving for high-speed and urban roads, and L4 level intelligent driving in specific areas.

Zhou Jiang stated, “We satisfy users who have a car budget of only 200,000 yuan but want to enjoy the intelligent experience of cars worth three or four hundred thousand yuan. By researching and developing, lean production and operation, we provide users with high-quality and low-price products.”

Although the price of NETA S has not been announced yet, considering the already publicized hardware and software configurations, Gui Lingfeng believes that to achieve a truly competitive intelligent sports car standard in the current industry situation, hardware such as the radar chip corresponding to automatic driving and intelligent cockpit cannot be omitted. Additionally, NETA S will rely on Huawei’s intelligent computing platform, which requires a strong ability to control costs and lower the cost per car.

The core selling point of NETA S is intelligence, but NETA made a relatively late effort in the intelligent field.

In July 2021, seven years after its founding, NETA announced the development of automatic driving functions. In November, NETA released a self-developed intelligent safety platform called “Shanhai Platform.”

Zhang Yong admitted that they had fallen behind in terms of intelligent technology compared to other new car brands. However, he also said, “Being late also has its benefits. By standing on the shoulders of others, some detours can be avoided.”

Dai Dali, the chief technology officer of NETA, told Carcaijing ID: “NETA mainly focuses on software, including algorithms, perception fusion, middleware, data platforms, big data platforms, etc., and work with strategic partners and users to build electric smart car ecosystems together.”

Currently, the NETA’s automatic driving and intelligent cockpit team totals over 600 people, and they hope it will exceed 1,000 by 2022. Zhou Jiang introduced that in 2021, NETA launched the “Thousand-Person Hundred-Billion Plan,” which aims to recruit 1,000 intelligent technology talents and invest 10 billion yuan in R&D expenses. The goal is to close the gap between NETA and others by the end of this year or next year.

“Shanhai Platform is not an empty concept. It is based on our accumulated knowledge and understanding of electric vehicles and intelligence, including forecasting future technological directions,” said Dai Dali. Shanhai Platform features high intelligence, high safety, high scalability, and environment friendliness. 360 and NETA are working towards tech equity, allowing users to enjoy an intelligent driving experience in terms of driving performance, riding space, human-machine interaction, usage costs, service quality, and intelligent safety.# The Heavy Responsibility and the Challenges for NIO’S NIOES

NIOES carries the heavy responsibility of “encircling the cities with the rural revolution” for NIOES Automobile. According to Zhang Yong, it is not just a geographic meaning of entering the city, but also means entering the mainstream consumers’ minds in the urban core and entering the core camp of intelligent raceway. After its launch, NIOES will also enter the European market.

However, NIOES has potential competitors such as Xpeng P7, BYD Han EV, Tesla Model 3, and NIO ET5 which are all hot-selling models. The hardware configuration of NIOES meets the intelligent level of this price range, and even surpasses some models. But it cannot be ignored that the price and brand advantages are not obvious enough.

In the low-end market, NIOES won a stage victory by relying on price and cost-effectiveness, but when it came to the competition zone of RMB 200,000, brand also affected consumers’ purchase decisions. J.D. Power’s report shows that consumers are gradually shifting from directly focusing on models to focusing on brands first and then determining models. They have locked in their intentions to purchase brands in the initial stage of their search for models.

The way of brand building is one of the key factors for NIOES to resolve internal and external troubles. “For us, polishing the products and enriching the product line is the most important and correct thing,” said Zhang Yong. In Zhang’s view, brand marketing is important, but the cultural concepts of young consumers have changed, and there are new opportunities for new brands.

Gong Min believes that when the market competition is very fierce, one can never figure out who will continue to be the leader. With so many participants in the market, everyone has their time to rise, as well as their time to face bottlenecks, which is an extremely dynamic process. To figure out who will eventually emerge as the winner is becoming more difficult.

“Come on, General Zhang. If you fail, my NIO U Pro will not be able to buy the parts.” Some car owners exclaimed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.