“Controlling our own destiny and challenging the limits of growth” is a phrase often spoken by LI Auto CEO Li Xiang, and with LI Auto’s annual revenue reaching 123.85 billion, this phrase resonates even more.

This means that despite the price war impacting through 2023, LI Auto has still found a suitable steady-state order in the chaos, pushing upward with all its might, as Li Xiang said on Weibo:

Learn product from Apple, business from Tesla, manufacturing from Toyota, organization from Huawei, and innovation from Microsoft. With our current scale, learning is most important.

Now, LI Auto, standing at the crossroads of 2023 and 2024, will officially bid farewell to the single battlefield of range-extended electric vehicles and increase its troops on this battlefield, breaking into the pure electric battlefield with the backing of 100s of billions of revenue.

With the battlefield growing larger and larger, for LI Auto, 100 billion is just a resting point. The push upward will continue.

The Best Financial Performance in LI Auto’s History

2023 Q4 Financial Report

The fourth quarter of 2023 maintained high growth for LI Auto.

Let’s start with some key financial metrics:

- Vehicle sales revenue of 40.38 billion, a YoY increase of 133.8%, QoQ increase of 20.1%;

- Vehicle gross margin of 22.7%;

- Total revenue of 41.73 billion, a YoY increase of 136.4%, QoQ increase of 20.3%;

- Gross margin of 23.5%;

- Net profit of 5.75 billion, a YoY increase of 2068.2%, QoQ increase of 104.5%;

- Free cash flow of 14.64 billion, a YoY increase of 349.4%, QoQ increase of 10.7%.

The financial report shows that based on the breakthrough sales in the fourth quarter of 2023, LI Auto achieved impressive growth in revenue, profit, and cash flow.

It’s worth mentioning that despite the discounts in the fourth quarter lowering the average selling price, LI Auto’s gross profit remained strong. Its gross margin even grew by 1.5 percentage points compared to the third quarter, greatly outpacing Tesla’s gross margin in the same period.

Additionally, the breakthrough in sales also drove LI Auto’s other income streams. The financial report shows that the increase in sales drove the growth in charging stations as well as components and services, which contributed 1.35 billion in other sales and service revenue for LI Auto in the fourth quarter, a YoY increase of 254.6%, and a QoQ increase of 27.2%.

Clearly, driven by sales volume, LI Auto is increasingly benefiting from economies of scale.

For the first quarter of this year, LI Auto has provided the following performance expectations:

- Delivery volume between 100k and 103k vehicles, a YoY increase of 90.2% to 95.9%;- Revenue ranges between 31.25 billion and 32.19 billion, a year-on-year increase of 66.3% to 71.3%.

Currently, LI Auto delivered 31,165 vehicles in January and 10,100 by February 18th. This implies that to meet this performance expectation, LI Auto needs to deliver roughly 59,000 vehicles in the remaining half of the first quarter — a challenge mainly due in March with the launch of MEGA and the updated L7/8/9 models.

2023 Annual Financial Report

2023 was the first fiscal year where LI Auto achieved profitability every quarter, showing its best financial performance in history.

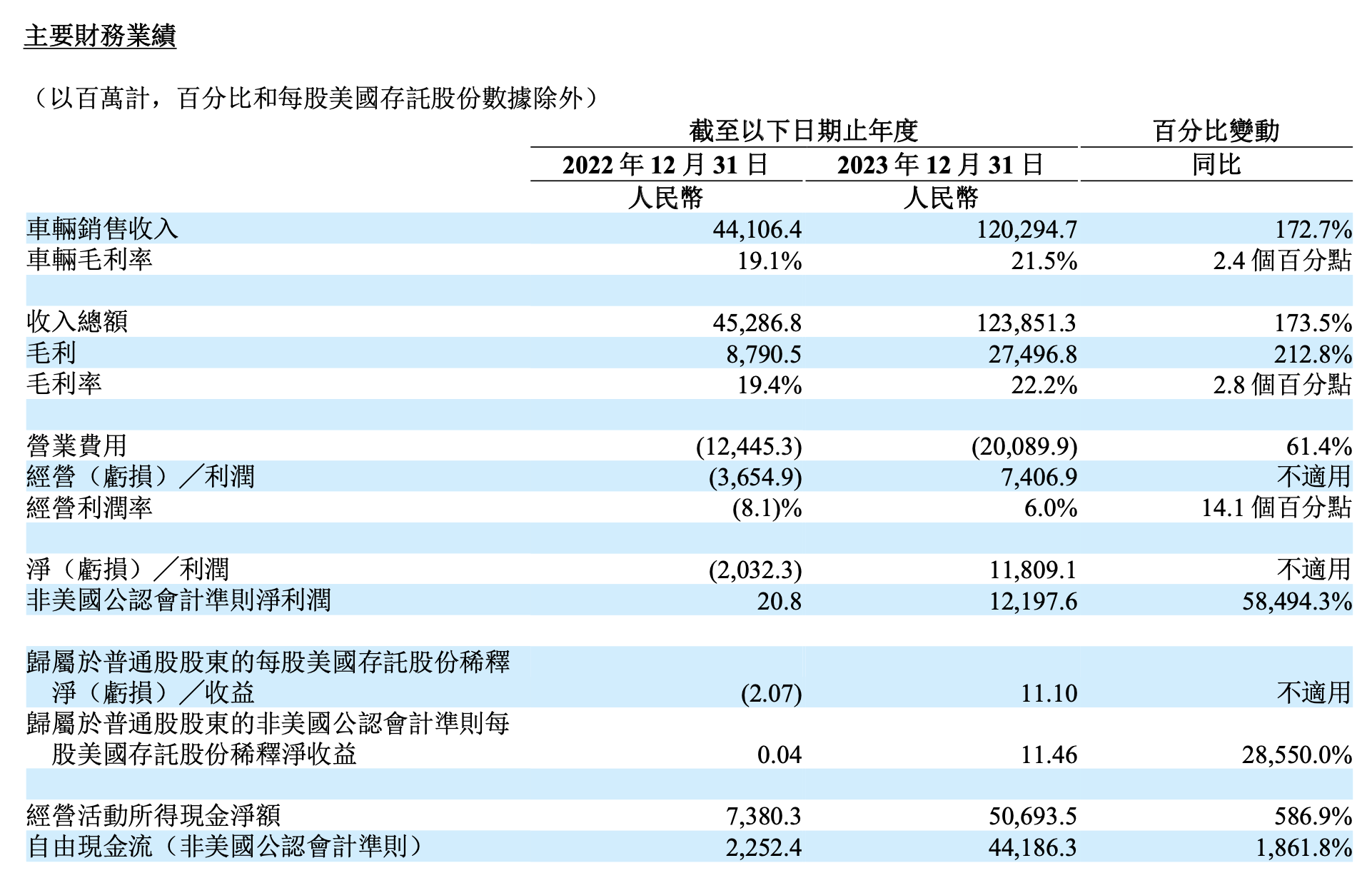

Let’s look at some key financial indicators:

- Vehicle sales revenue was 120.29 billion, a YoY increase of 172.7%;

- Vehicle gross margin was 21.5%;

- Total revenue was 123.85 billion, a YoY increase of 173.5%;

- Gross margin was 22.2%;

- Net profit was 11.81 billion, a YoY increase of 58,494.3%;

- Free cash flow was 44.19 billion, a YoY increase of 1,861.8%.

Starting from its establishment in 2015, LI Auto took 8 years to move from losses to annual profits.

Once achieved, LI Auto took the lead among new auto giants by a considerable margin — breaking through a hundred billion in revenue, generating a cash flow of 44.19 billion, and, according to its financial report, by the end of 2023, LI Auto’s cash reserves increased to 103.67 billion, with abundant funds; a gross margin of 22.2%, reaching the gross margin that Mr. Li believes tech companies should have.

Additionally, it’s worth mentioning that the capital market has further recognized and trusted LI Auto. The financial report shows that LI Auto has been included in the Hang Seng Index as a constituent stock.

Regarding the performance of this report, Mr. Li commented:

“The significant increase in scale, deepening of R&D, and continuous improvement in operational efficiency have driven us to achieve the best financial performance in history in 2023. It also laid a solid foundation for LI Auto to enter a more diversified product portfolio and market demand in 2024.”

“Don’t believe in what’s called a blind dash”

LI Auto’s 2023 revenue of 123.85 billion can’t be separated from its continuous self-growth, iteration, and correction.

As previously mentioned, Mr. Li keeps learning from others in various aspects. Meanwhile, LI Auto also fully internalizes and absorbs it, and ultimately makes it a part of LI Auto’s bloodline, just as Mr. Li said in response to netizens on Weibo:

“Knowledge learned must be fully digested and verified to become capability, must turn into revenue and profit, and growth of talent to be capacity, and these combined together becomes one’s true self. I don’t believe in what is called a blind dash, your eyes are the most crucial organ.”

“LI Auto, guided by its principle of ‘not blindly charging ahead,’ keenly eyed and calmly navigated through 2023.

In terms of products, LI Auto launched and delivered in 2023 the L7 Air/Pro/Max, L8 Air, and L9 Pro. The cumulative sales of L7/8/9 in 2023 all exceeded 100,000 units.

As such, LI Auto successfully transitioned its entire product line from the LI ONE to the L series, expanding their product range to include large five-seaters, and covered a broad market price range of 300,000 to 500,000. This move further captured the high ground in the minds of high-end family car market customers.

Regarding its distribution network, as of January 31 this year, LI Auto has already established 474 retail centers, 360 after-sales service centers, and authorized body spray centers nationwide. Remarkably, in December of the last year alone, LI Auto added over 110 stores to its retail, delivery, and service network.

In 2023, LI Auto, with its direct-sales system at its core, successfully established its distribution network through meticulous management – making efficient use of company resources and constantly optimizing teams and processes; not blindly pursuing lead quantity, but focusing on training to improve the quality of sales staff; and starting from brand influence to improve conversion rates.

In terms of marketing, Li Xiang believes that “poor marketing is the biggest harm to the R&D team.” In 2023, LI Auto’s marketing strategies can be described as shocking both inside and outside the industry.

On March 29, 2023, LI Auto released its first weekly sales leaderboard, which set off a trend of weekly sales competition in the new energy vehicle industry and added fuel to the fire of the leaderboard marketing war between brands.

Though initially besieged by criticism, with the passage of time, this weekly leaderboard increasingly gained credibility and influence, to the point where some brands started using it to boost their own image.

With unified thinking and action from top to bottom, LI Auto made a sales surge in 2023 – exceeding 20,000 units in Q1, 30,000 units in Q2, and breaking the 40,000 and 50,000 unit barriers in Q4, with annual sales reaching 376,030 units, making a unique stand among the new players.

The surge in sales was followed by a huge increase in revenue. As a result, LI Auto was able to mobilize ample resources to “take control of its own fate and challenge the limits of growth” and establish a positive cycle.

How to reach 800,000 sales in 2024?

Relying on Pure Electric

LI Auto’s sales target this year is 800,000 units, which is more than double the sales of last year. So the question is, how exactly are we going to achieve 800,000 sales this year? Let’s break down this 800,000 figure.According to the plan, LI Auto’s products this year include the revamped L7/8/9, the newly launched L6, MEGA, and three pure electric models in the second half of the year, totaling 8 models. On average, each model needs to sell about 8,000 units per month.

The challenge, by the data, doesn’t seem great, and judging by the sales record of L7/8/9, they should contribute at least half to the annual sale.

Furthermore, Zou Liangjun, Senior Vice President of Sales and Service at LI Auto, once stated that the sales target for the LI L6 is 30,000 units per month. If the LI L6, which is set to debut in the second quarter, can achieve the “release on delivery, delivery on volume” strategy, then optimistically, the LI L6 might contribute around 200,000 units to the annual sale.

This implies that LI Auto’s pure electric models, including MEGA and the three planned models for the latter part of the year, need to sell at least 200,000 this year. The major uncertainties affecting LI Auto’s goal of 800,000 units in annual sales are primarily focused on their pure electric models.

LI Auto’s involvement in pure electric products is not considered late. In 2018, they had already started working on the super-charging battery. But it wasn’t until 2023 that LI Auto began to ground its pure electric models, focusing on supercharging stations.

Starting with the first supercharging station on April 20, 2023, LI Auto has built and began operating over 330 such stations.

This year, LI Auto plans to build 2,000 supercharging stations, covering 18 major national highways and 60% of core urban areas in third-tier cities and above.

Although the building pace is not slow, the scale is still somewhat lagging behind its peers. In constructing supercharging stations, LI Auto needs to continue to speed up and invest more.

In 2023, another move of LI Auto in pure electric vehicles was the official reveal of MEGA. The MEGA breaks the conventional MPV design pattern in terms of external design, while the interior continues LI Auto’s successful family space design.

So far, whether it’s the level of discussion, attention, or the achievement of over 10,000 orders in 1 hour and 42 minutes, MEGA’s performance should meet LI Auto’s expectations. After its official launch, whether its actual sales can help solve the puzzle of premium MPV sales remains to be seen.

Based on the expansion of supercharging stations and the technological advancements gained from developing MEGA, the competitiveness of the three pure electric models that LI Auto plans to launch in the second half of the year should not be underestimated.It’s noteworthy that although the prices and positioning of the three new electric vehicles in the second half of the year remain unknown, what can be predicted is that the once hard-working trio of small and medium-size cars, namely, Weilai, Xiaopeng, and LI, are set to compete in the pure electric market this year.

In a nutshell, how LI Auto will operate in the pure electric market this year and what outcome will emerge is indeed worth watching.

Nationwide Usability: Let the Money Burn for a While

Intelligence, especially the quality of intelligent driving, is a key factor supporting LI Auto’s annual sales target of 800,000.

LI Auto’s overall performance in intelligent driving in 2023 was not particularly remarkable. In April 2023, LI Auto released AD Max 3.0, but it wasn’t until December that it was officially pushed with OTA 5.0. In the meantime, the infamous ‘broken promise’ incident occurred.

More disconcerting to LI Auto was the emergence of Huawei. Also in April 2023, Huawei released ADS 2.0 and then exploded in September with the launch of a new car, AITO’s M7, increasing the demand and breaking boundaries for intelligent driving.

In contrast, LI Auto’s reputation in the field of intelligent driving is somewhat awkward.

However, it’s fortunate that incidents such as failed promises and the explosion of Huawei’s intelligent driving made LI Auto recognize its own incompetence in intelligent driving. As a result, at the autumn strategy meeting in 2023, LI Auto raised its emphasis on intelligent driving to an unprecedented height.

In fact, LI Auto has been increasing its investment in intelligent driving since the second half of last year.

In terms of talent, by the end of 2023, LI Auto’s intelligent driving team has grown to a size of a thousand people, and this figure is expected to further expand to 2,000 people this year, and to 2,500 people by 2025.

In terms of funding, the research and development costs of LI Auto have been increasing quarter by quarter since 2023 – Q1 was 1.85 billion, Q2 was 2.43 billion, Q3 was 2.82 billion, and Q4 was 3.49 billion.

Entering 2024, for the leading intelligent driving companies, availability is no longer the point of discussion but the number of operational cities is the key to competition.

Currently, Huawei has announced that high-level intelligent driving is available countrywide; Xpeng has covered 243 cities with its city-wise intelligent driving. LI Auto still has a significant gap compared to these two companies.

However, LI Auto, with a sufficient cash reserve, a fleet size exceeding 660,000, and efficient organizational capability, can fully focus resources on a ‘battle of a hundred regiments’, converting its resources efficiently into competitive market strength, and compensate for the short board of intelligent driving.

While the ability to drive intelligently can certainly be compensated for with resources deployed on a ‘battle of a hundred regiments’ scale, Huawei and Xpeng have taken the lead in capturing users’ mentality towards intelligent driving. How LI Auto could adopt a defensive approach to reverse users’ perception of its intelligent driving ability remains a tough challenge.According to LI Auto’s plan, the city NOA without maps will be promoted to all AD Max versions nationwide by the second quarter of this year. LI Auto President Ma Donghui said at the financial report conference that LI Auto’s smart driving products and R&D capabilities will definitely be among the top in the country this year.

What exactly is LI Auto’s top-notch Smart Drive? Don’t worry, let LI Auto burn its money a little bit longer.

In Conclusion

After achieving its first quarterly profit in the fourth quarter of 2022, LI Auto officially escaped from the quagmire of losses, realized profits in each quarter of 2023, becoming the youngest company on the “2023 Hurun Global Top 500” list, transforming from an entrepreneurial company to a growth enterprise.

This means that LI Auto’s past series of business and product strategies have been validated in commercial practice; it has successfully internalized the learning outcomes from companies like Apple, Tesla, Toyota, Huawei and Microsoft; and has built up a solid health bar in the process of increasing sales.

It should be underscored again that, this year LI Auto’s product line will expand to 8 models. Among them, the LI L7/8/9 can secure a sales base of 400,000 units.

In other words, based on its solid business capability, LI Auto can be both enterprising and defensive this year. In the face of burn-money battles such as intelligent-driving into cities and large-scale deployment, LI Auto can perform more assertively and calmly.

What needs cautioning is that LI Auto, a brand that is often high-profile and rebellious in its publicity, is increasingly becoming the target of imitation or attack by more and more companies. LI Auto in 2024 and beyond needs to fight against its competitors relying on its own strength.

Although high profile and defiant in its publicity, it cannot be denied that LI Auto always shows practicality and modesty in its actions, just like the remark from founder Li Xiang at the beginning of the article: “Current scale is important, but learning is the priority.”

On March 1, the remodeled models of LI MEGA and L series officially hit the market. The whistle bellows from all quarters. The annual wrap-up performance of the “seriously studying” LI Auto is about to officially commence in 2024.

Below is the key content of the LI Auto management team at the financial report telephone conference. We’ve edited it without altering its original meaning.

Q: What is the gap between LI Auto, Huawei, Xpeng in terms of smart driving, and when approximately can it surpass them?

A: In Q2, LI Auto will push the city NOA, which does not rely on maps, to AD Max models nationwide. The Pro models will also be upgraded to the BEV model. In short, LI Auto’s smart driving products and R&D capabilities will definitely be among the top in China this year.

Q: How will LI Auto ensure capacity ramp-up and product delivery this year?

A: LI Auto has accumulated replicable experience through previous capacity ramp-ups and product deliveries.

Currently, the progress of LI Auto’s new car models all meets the development plan. On the manufacturing side, planning for the factory and worker training has been completed. LI Auto is confident in ensuring the timeliness of product deliveries this year.Q: Does LI Auto have any plans to lower its product prices in the future?

A: Looking ahead to the next five years, LI Auto will not launch cars under RMB 200,000. By 2030, LI Auto, relying purely on the family user market, might approach the global revenue performance of the iPhone.

Q: What is LI Auto’s plan for pure electric vehicle models in 2024?

A: We will launch three additional pure electric SUVs in the second half of this year, standard equipped with 5C charging. These SUVs have superb product capabilities and will become the prime choice for family users in the same price range.

Q: How does LI Auto view the competition in the industry?

A: LI Auto will adhere to its consistent outlook that future competition will gradually concentrate on top players.

Q: What is LI Auto’s pace in the price war in 2024?

A: This year is a big year for LI Auto’s products, and our investment in products will continue to increase, transforming product capabilities into user value. Currently, all of our teams are fully prepared.

Q: When will the iPhone Moment for intelligent driving come?

A: It may arrive in the next 2-3 years. With mass production of L2/3 level intelligent driving, accumulation of data leading to quantitative changes, and the advancement of AI technology, intelligent driving will undergo a qualitative transformation.

Additionally, LI Auto will always maintain the standard configuration for intelligent driving without any plans for additional charges for now.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.