Author: Tao Yanyan

Chip Inventory Series

-

Preface: “Global Automotive Chip Trends“;

-

Part One: “Traditional Giant Infineon“; today’s second part.

Recently, the core issue in the chip industry remains. In terms of automobiles, apart from Infineon, it is necessary to continuously track the situation of NXP.

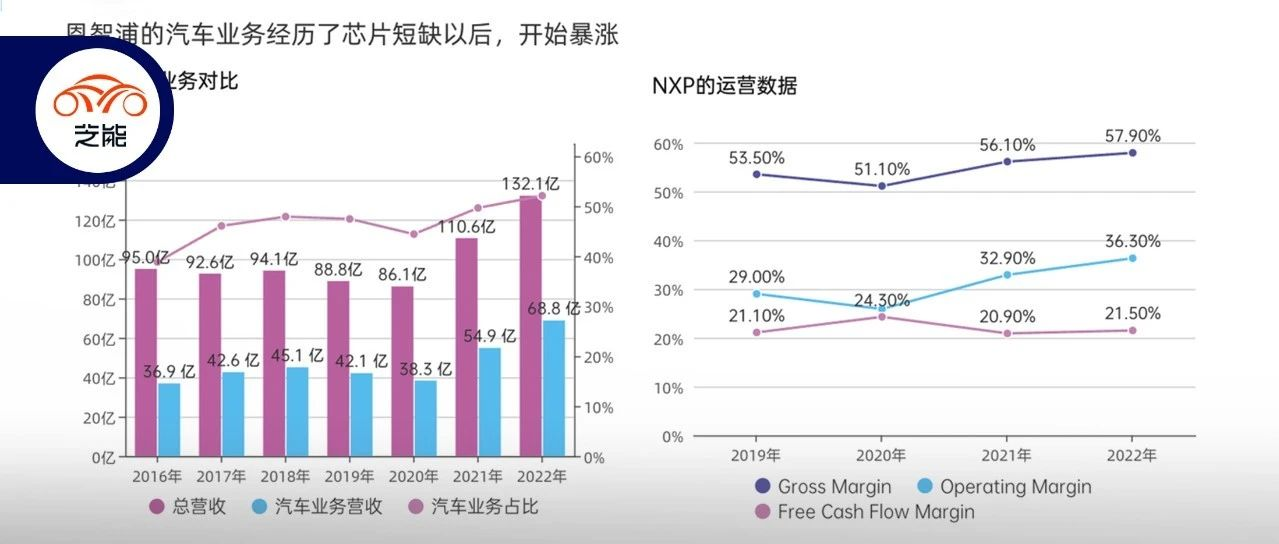

◎ NXP’s total revenue for 2022 was $13.21 billion, an increase of 19.4% YoY; net profit was $2.833 billion, an increase of 48.6% YoY.

◎ The automotive sector’s total revenue was $6.88 billion, an increase of 25% YoY, reflecting the accelerated growth of automotive chips compared to the mobile sector; as global xEV vehicle sales grow, automakers’ chip purchasing strategies have shifted to “stockpiling.”

Looking at historical data, NXP’s automotive chip business climbed from $3.83 billion in 2020 to $6.88 billion in 2022, a truly astonishing increase.

In the automotive field, the main drivers of accelerated growth include:

◎ 77GHz radar (28nm RF CMOS radar single-chip IC series).

◎ Electrification solutions (battery management solutions, inverter control, and other xEV control processors).

◎ S32 domain and regional processors under the EE architecture.

Key Layouts in the Automotive Field

Electrification Business

In automotive electrification applications, NXP covers a wide range of chip solutions, including motor control, battery management systems, and DC/DC converters. Products include MCU microprocessors, analog front-ends, gate drivers, secure power management, in-vehicle networking, and sensors, etc. Of course, the most familiar example to us is the AFE breakthrough, which disrupted the duopoly by ADI (including its acquired Linear) and TI, through its multi-channel acquisition chips.Translate the following Chinese Markdown text to English Markdown text, retaining the HTML tags in Markdown and outputting the results in a professional manner.

Due to the evident convergence trend in the electrification field, NXP’s original BMS product line in the MCU field directly clashes with Infineon’s power MCU.

Control and Processing Chips

In the transition from single-function-oriented MCUs to the next-generation composite MCUs with EE architecture, NXP’s primary focus is on communication, both strengthening communication capabilities and processing capabilities.

◎ For Zonal nodes, it mainly revolves around the S32K3, with storage covering 512KB to 8MB flash memory, four Arm Cortex M7 cores (maximum frequency upgraded to 320MHz), and support for ASIL B/D safety applications in single-core, dual-core, triple-core, and lockstep core configurations.

◎ For Zongal modules, the S32G3 automotive network processor includes ASIL D level safety, high-performance real-time and application processing, and network acceleration features.

Overall, the trends here are to increase unit price and reduce quantity while focusing on software centralization to realize value.

Radar Chips in Perception

Regarding radar, the aim is to meet the needs of automakers and Tier 1 suppliers through radar head design direction and highly integrated 77GHz radar transceiver SoCs. This was also introduced at CES2023, equipped with four high-performance transmitters, four receivers, a multicore radar processor with hardware acceleration, and Gigabit Ethernet communication interfaces and memory.

Of course, there are still many questions about the value of traditional millimeter wave and 4D millimeter wave in automotive perception systems.

## Automotive Chip Competition and Product Line Adjustments

## Automotive Chip Competition and Product Line Adjustments

We previously analyzed the impact of the voltage transition from 12V to 48V in automotive low-voltage systems. Regardless of traditional automakers working on Zonal or Tesla focusing on 48V, significant adjustments will be made in the layout of traditional automotive chips.

◎ Input Circuits: With an increasing number of single-chip nodes, there are fewer genuine input circuits in future Zonal systems.

◎ Output Circuits: Between ECU and actuators, the amplification effect of the MOS transistor in the output loop reduces total driving currents as 48V load voltage increases, leading to evolving demand in this sector.

◎ Microprocessors (MCU): As computing cores become cheaper, simple ones are included in drivers. We can see that all MCU manufacturers are moving towards sophistication, offering multi-core expansion memory, higher functional safety, and accommodating various features.

◎ Power Circuits: Converting from 12V to the required voltage requires matching to a 48V power supply.

Conclusion: My personal opinion is that, in the automotive chip industry, the product categories of established manufacturers will switch from classic matrices to newer products as MCUs decrease and transform. It still presents significant opportunities. However, it appears that major computation players such as Qualcomm and NVIDIA have taken the lead, leaving companies like NXP, Infineon, ST, and Renesas aware that they cannot compete in certain areas.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.