Author: Song Shuanghui

After the New Year’s Day, the discount promotion of Tesla in China was extremely harmful and insulting. Many new owners of the cars went to defend their rights, and other companies also followed suit and lowered their prices.

However, this is just the beginning. Tesla has not let us down. The price reduction is not only targeted at China. Japan, South Korea, Europe and the United States, both near and far, have all followed suit. It can be said to be a global price reduction wave.

We all know that Tesla did not meet Wall Street’s delivery expectations in 2022, and this round of global price cuts averaging 20%, is regarded as Tesla’s killer move to deal with economic downturn and declining demand for new cars.

Although price reduction means discounted profits, it can also bring a surge in deliveries. I have deep experience of this point. Just last weekend, when I went to the shopping mall near my home, not to mention that the Tesla store was as crowded as a mountain, but the store also had a lot of customers. Ford Mustang and XPeng models on the same floor had considerably fewer customers.

Let’s take a look at the price reductions in other markets.

In Asia, the prices of Model 3 and Model Y in Japan have been reduced by about 10% respectively, while the price range for Model 3 and Model Y in South Korea is between 6 million won and 11.65 million won (about RMB32,500 to RMB63,100).

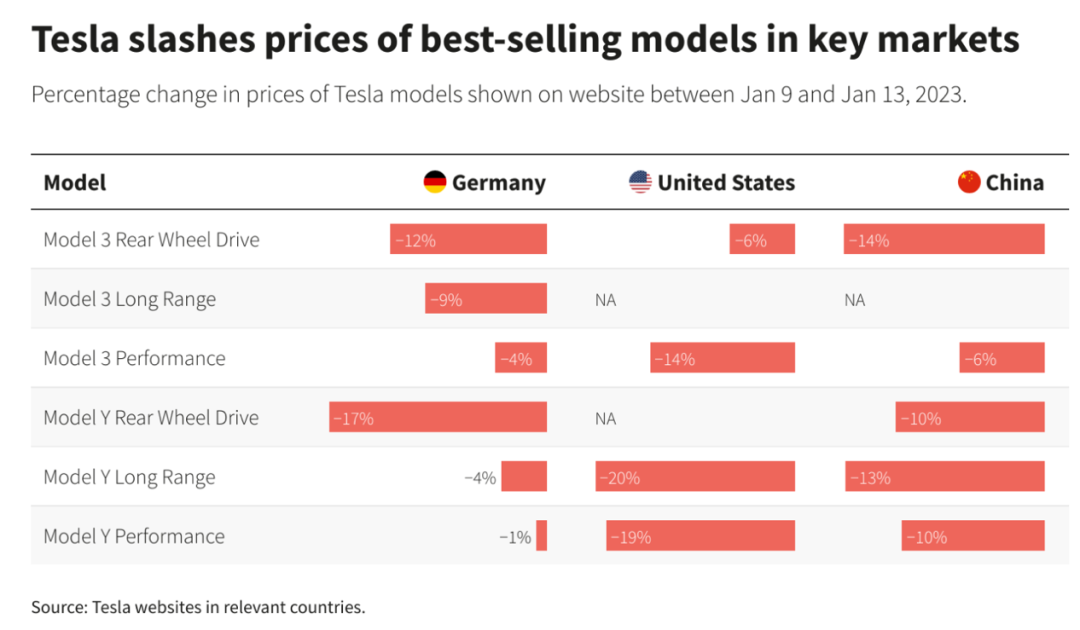

In the United States, the price reductions for Model 3 and Model Y are between 6% and 20%. The Model Y with the largest price cut is 20% cheaper, lowering $13,000, and the 5-seater Model Y is now eligible for a $7,500 tax credit, meaning it is discounted by more than $20,000 all at once.

In Europe, the prices of Model 3 and Model Y in Germany have been reduced by 1% to 17%. The best-selling Model Y is priced at EUR44,890, which is EUR9,100 cheaper. The starting price of Model 3 in France has been reduced to EUR44,990, and additional government subsidies of EUR5,000 are available.The spokesperson of Tesla Germany attributed the cause of this price reduction mainly to the decrease in costs, which is similar to the explanation given by Tesla China before.

If there is anything that can comfort Chinese consumers, it is that the prices of Model 3 and Model Y sold on the Chinese mainland remain the lowest in the world, with starting prices of only 229,900 yuan and 259,900 yuan respectively. The entry-level Model 3 in the United States sells for 36,490 US dollars after subsidies, which is about 245,000 yuan.

Even after this round of global price reductions, Tesla Model 3 and Model Y are still far away from Musk’s original idea of popular pricing, as he initially planned Model 3 to be a model at a price of $35,000, and Model Y at $40,000.

Throughout 2022, Tesla has been increasing prices in the United States. Musk even admitted that the prices are “embarrassing”. A price reduction was only a matter of time. However, even though prices have been rising continuously last year, Tesla still beat BMW and became the best-selling luxury brand in the United States.

Now that this round of price reduction has taken place, analysts believe it will seriously impact small electric car companies that have been selling cars without making a profit, as well as traditional automakers who are actively investing in electrification.

According to data from Deutsche Bank, Model Y is $18,000 cheaper than Ford’s Mustang Mach E after subsidies. Thomas Hayes, chairman of Great Hill Capital, believes that competitors can only follow suit and reduce their prices.

In the eyes of many people, reducing prices is a self-damage strategy. Analysts also predict that Tesla’s gross margin will decrease by 3 percentage points in 2023 compared to 2022. However, this can ensure high growth rates in delivery volume and make competitors struggle.Wedbush analyst Dan Ives predicts that Tesla’s global delivery volume will increase by 12% to 15% this year. Therefore, while Tesla’s stock price is falling, its competitors’ stock prices are hit harder.

After Tesla reduced prices globally, GM and Ford’s stocks fell by 4.5% and 6%, respectively. Stellantis fell by 3.7%, and Volkswagen fell by 3.6%.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.