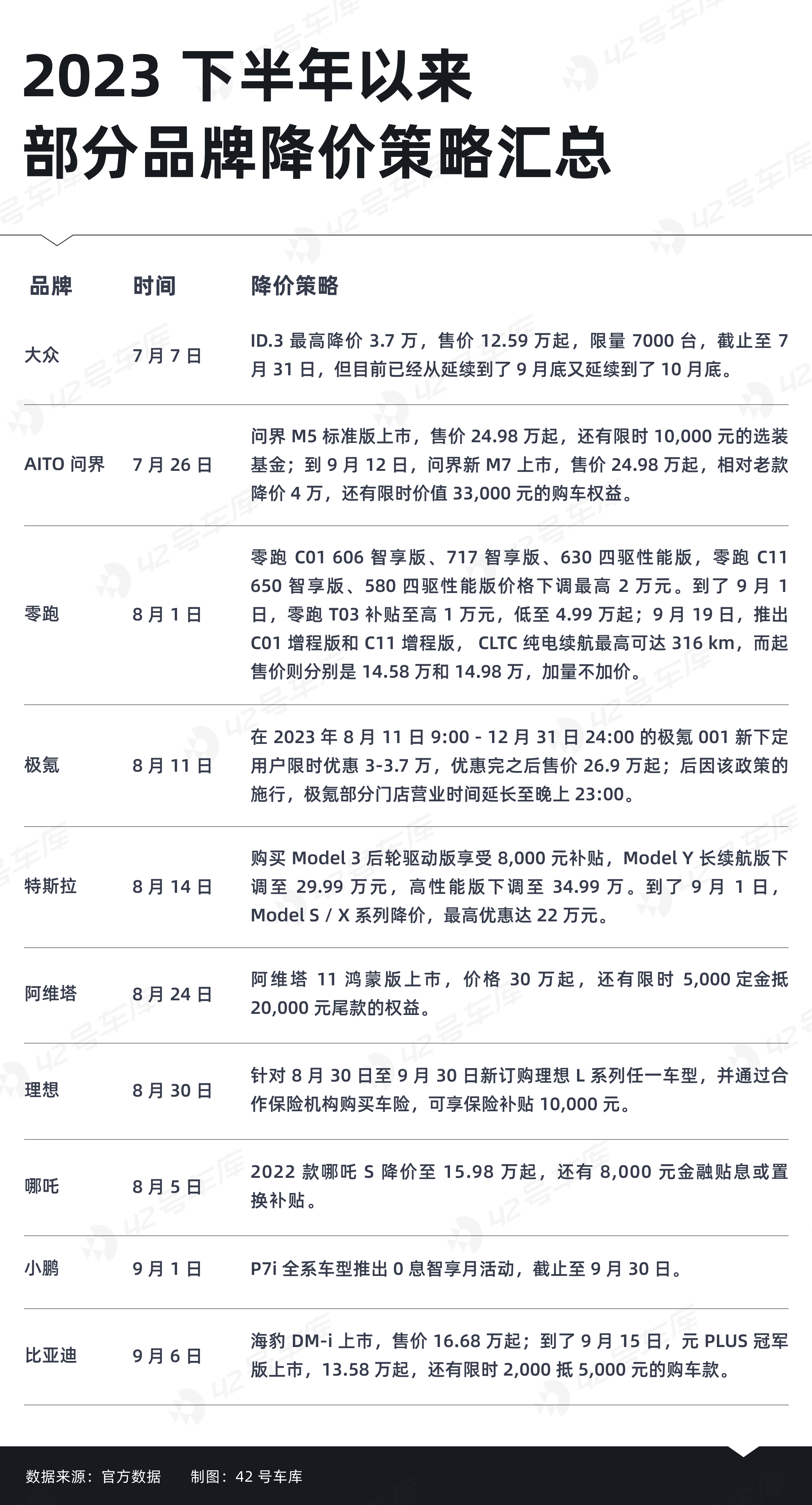

The new M7 by AITO starts at a price of CNY 249,800, marking a decrease of CNY 40,000 from the old model which started at CNY 289,800. The 2024 version of G9 costs at least CNY 263,900, marking a decrease of CNY 46,000 as compared to the old model which costed at least CNY 309,900……

Nobody expected the price war that began at the start of the year to persist this long, with no signs of ending. I’ve even heard talk of it lasting until the end of next year until certain brands drop out altogether.

In this enduring standoff, the price war has evidently evolved from a crude confrontation based solely on price to an all-encompassing war involving traffic, productivity, and financial resources.

No one knows who will introduce a more impactful concession policy or a more lethal move in the coming days. Nobody knows who will be the first to admit defeat in the price war, but everyone hopes it’s not them.

Accompanying the gradual phase-out of national subsidies, the Chinese New Energy Vehicle market is transitioning from policy-driven to market-driven.

During this transition phase, Chinese New Energy Vehicle companies can no longer expect to be ‘nursed’ like infants swaddled in clothes, but rather must learn to ‘fend for themselves’, like grown-up feral children.

Under these ‘self-reliance’ conditions, facing an ongoing price war with no end in sight, Chinese New Energy Vehicle companies have no choice but to gamble everything they’ve got.

Making a Rational but Crazy Decision

What can CNY 250,000 get you in terms of features for a New Energy Vehicle today?

Standard features like front/rear five-link suspension, ventilated/massage/heated seats, a 35.6-inch widescreen, 800V fast charging, and a range of 700 km under CLTC conditions……

In summary, many features that were once unattainable at this price range are now available. All companies seem to be vying for the ‘best value for money’, relentlessly promising more for less.

Of course, every company knows that starting a price war is a desperate measure that hurts the enemy but also eventually harms themselves. However, once a price war begins, all companies must grit their teeth and steadfastly continue reducing prices, regardless of whether it costs them a lot or a little. After all, for these companies, ‘truth’ only resides within sales figures.

At present, companies have mainly used two tactics to deal with this price war:

- Blatantly reducing prices or increasing rights, attracting users through tangible benefits

- Introducing newer versions of existing models, lowering prices while improving product strength.

On the back of these two strategies, companies have on one hand, effectively addressed the traditional off-season for car sales in July and August through incentives; while on the other, prepared for future uncertainties by strategizing for the long term in scenarios where the end of the price war remains ambiguous.However, all of these are not enough. In order to transform the power of tactics into actual sales as much as possible, one important weapon is needed – fast rhythm.

In the current new energy vehicle market, there are countless brands and numerous models. Although the new energy vehicle market seems to be blooming, a closer look reveals that they are almost the same, serious homogenization. The choices for users to buy new energy vehicles are indeed increasing, but the quality options are still limited.

Therefore, for car manufacturers, not only do they need to work on the price, they also need to break away from homogeneity at a relatively faster speed, create their own scarce value, and become the user’s first choice for quality. As Wang Chuanfu said: “This is an era where fast fish eat slow fish, not big fish eat small fish.”

Therefore, we can see that ZEEKR has launched ZEEKR 001 FR, pushing the performance based on pure electric power to the extreme; AITO is the first to announce the opening of national high-precision map-free intelligence at the end of the year, taking the lead in entering users’ vision on the large-scale landing of intelligence; LEAPMOTOR launched the LEAPMOTOR C01 with a maximum range of 316 km under CLTC conditions, making range-extended models unnecessary to use oil…

The efforts made by these car companies to create scarce value have also received immediate returns:

- The limited edition of 99 ZEEKR 001 FRs per month sold out within 15 seconds of opening the reservation;

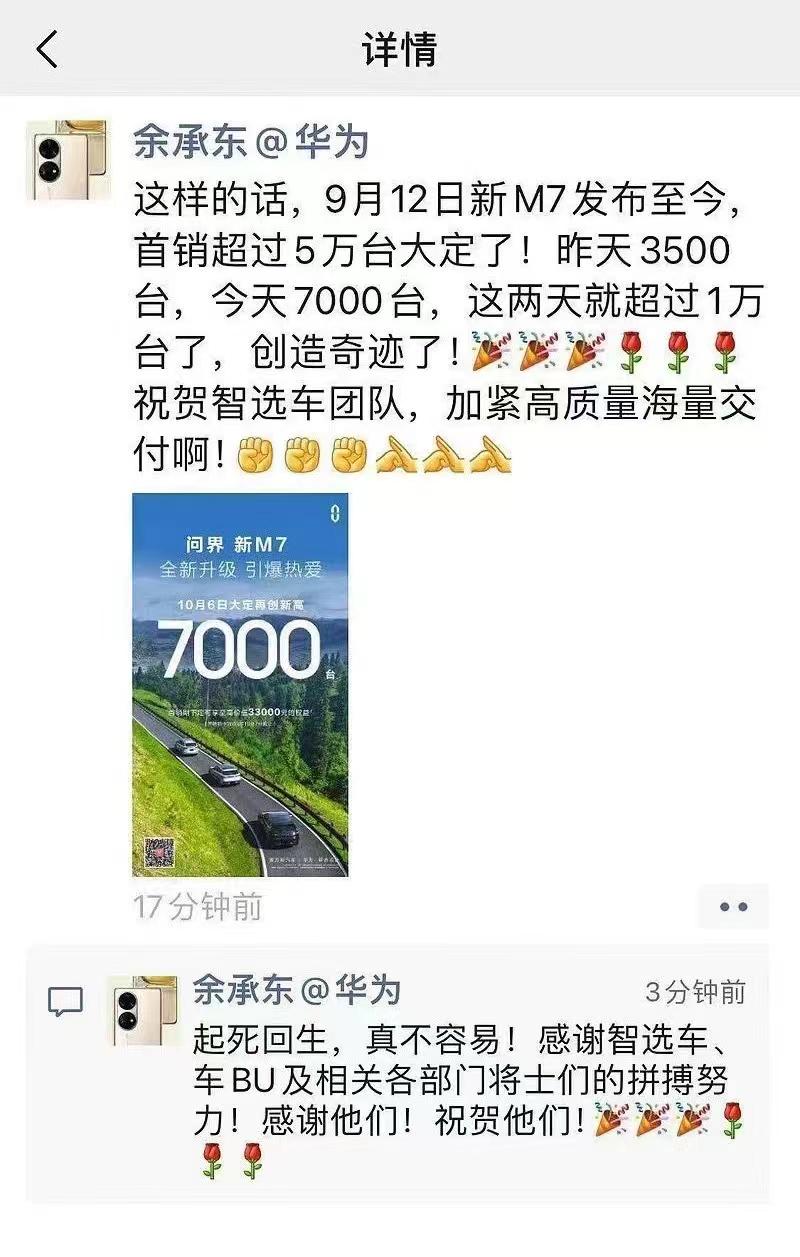

- The new AITO M7 had exceeded 50,000 units in less than a month after its release;

- LEAPMOTOR’s delivery volume in September continued to climb, reaching 15,800 units, an increase of 30% month-on-month.

Actually, once the price drop becomes a trend, it does not have enough attractiveness itself and is more likely to cause users to form a wait-and-see mentality, delaying the time to make a purchase decision.

In order to dispel the user’s wait-and-see mentality, being able to take the lead in providing high-quality products with scarce value is a lethal bullet, and formulating a pricing strategy with enough attractiveness is the trigger pulled when the bullet is fired.

It is worth mentioning that in the price war up to now, many triggers have been pulled to the limit.

Industry insiders told us that the BOM cost of ZEEKR 001 has reached more than 200,000, and the current price of ZEEKR 001 is just starting at 269,000; the BOM cost of Xpeng G6 is relatively high compared to its starting price of 209,900, reaching 170,000 to 180,000.

Additionally, when the LEAPMOTOR C01 Extended Range version was launched, it rarely did not announce the car purchase benefits. Zhu Jiangming stated that the price has come to the bottom.

Like ZEEKR, Xpeng, and LEAPMOTOR, although the market volume is not small, it is very much like the momentum of “Xiaomi’s overall net profit for hardware will not exceed 5%”. Being one step away from losing money is the most realistic state of most new energy car companies in the price war.Judging from the current market competition, it is perhaps the most rational decision that automakers can make based on their own capabilities and market demands, even if it seems crazy.

A foreseeable beginning, an unforeseeable ending

In any industry, price wars are not surprising.

For the new energy vehicle market, Tesla is undoubtedly the initiator of this price war. However, without Tesla, this price war might still be inevitable.

Cost reduction naturally leads to price reduction

Undoubtedly, the current new energy vehicle industry has entered a period of rapid development, taking a big step towards maturity.

According to data from the China Association of Automobile Manufacturers, the penetration rate of new energy vehicles in August this year has reached 32.8%, and the overall penetration rate from January to August has also reached 29.5%. In stark contrast, by the end of 2020, the penetration rate of new energy vehicles was only 5.4%.

In just three years, the penetration rate of new energy vehicles has increased approximately sixfold.

In these three years, from the user’s perspective, users have become more and more accepting of new energy vehicles and are more inclined to choose new energy vehicles when buying cars; from the product’s perspective, the capabilities of new energy vehicles in electrification and intelligence are continuously strengthening, and safety issues, which used to frequently arise, are seldom discussed now; from the perspective of manufacturing, integrated casting, battery chassis integration and other manufacturing technologies are rapidly developing, significantly reducing the production costs of automakers.

At the same time, the battery, as the biggest cost of new energy vehicles, has also seen its raw material prices continuously falling.

According to data from Shanghai Steel Union, as of October 9, the price of battery-grade lithium carbonate has fallen to 178,500 yuan per ton. In early February this year, the price of battery-grade lithium carbonate was still at 469,000 yuan per ton, and in November last year, it was even close to 600,000 yuan per ton.

With the rapid growth of the penetration rate, the scale of new energy vehicles has also reached a new level.

In July, China’s new energy vehicle market officially declared that it had reached a scale of 20 million units. Among them, Tesla China has reached a scale of 2 million units, and BYD has even reached a scale of 5 million units.

The effect of scale is beginning to play a role, and the overall cost is significantly lower than before. Therefore, it is natural for automakers to promote further increases in sales and scale through price reductions.

The Darwinism Game of Automobiles

Survival of the fittest is happening between new energy vehicles and gasoline vehicles – a Darwinian game of automobiles.

As mentioned earlier, the penetration rate of new energy vehicles has increased about sixfold in just three years. Against the backdrop of China’s auto market entering the stock phase, it is undoubtedly that the growth of new energy vehicles mainly depends on devouring the market of gasoline vehicles.Data from the China Association of Automobile Manufacturers shows that the monthly sales of gasoline vehicles have declined compared to last year. The reason for the 65.2% year-on-year growth in a slow-sales month like April is obviously due to the substantial price cuts made by gasoline vehicle companies in March.

This suggests that, despite the emerging trend of new energy vehicles, gasoline vehicles still maintain appeal in the mainstream consumer market as long as prices are sufficiently low. It’s akin to the popular saying, “A 200,000 C6 looks outdated, but a 120,000 C6 is poised.”

However, even though gasoline vehicle prices are being cut by thousands, it seems the trend of price cutting must continue due to oversupply.

According to data released on Cui Dongshu’s personal WeChat official account, the utilization rate of China’s car production capacity is only 72.7% as of the Q2. By international standards, when the capacity utilization rate falls below 75%, it signifies severe oversupply.

When oversupply becomes severe, imbalances within automobile companies occur and dealerships face high inventory pressures. The only end result is more price wars.

For gasoline vehicles, with the emerging trend of new energy vehicles on one hand, and the slow transformation of legacy supply chains on the other, what other options are there, if not price promotion? For new energy vehicles that rely on occupying the gasoline vehicle market to grow, if gasoline vehicles continue to drop prices, they can only follow suit.

Conflict Between Survival and Transformation

The contradictions within the new energy vehicle camp are also a major factor in the outbreak of price wars.

The development of the new energy vehicle market has spawned a large number of new car-making companies. After many fluctuations, only a handful of companies such as NIO, Xpeng, and LI Auto, have a significant market impact. The others have tried resurgence overseas, attempted to find other sources of income abroad or desperately searched for a buyer of the company’s assets.

While new car companies like NIO and Xpeng have survived up to now, most of them are still dealing with survival crises. According to official financial reports, NIO’s Q2 gross profit margin was only 1%, and Xpeng and LeapMotor’s Q2 gross profit margins have become negative.

Adding to the difficulties, these new car companies have no traditional car companies to rely on. Without satisfactory financial report results, they cannot provide a satisfactory result to their ‘money bag’ — the capital market. In isolated circumstances, replacing price with volume appears to be the lifesaving straw for these new car companies.

While these new car makers are burdened with the heavy task of survival, traditional companies also face pressure of transformation.

On the one hand, past achievements in the gasoline vehicle market have become a burden for these car makers during their transformation, hindering their every step and forcing them to helplessly watch as new car makers take the initiative.On the other hand, traditional enterprises have always lagged in terms of popularity in contrast to new car manufacturers. Even though they have explored the new energy vehicle market extensively and have established new series or brands of new energy vehicles, their sales are, on the whole, lukewarm.

For traditional enterprises, to successfully transition and gain ground in the new energy vehicle market, creating a price advantage is undeniably an important way out. After all, compared to new car manufacturers, fuel-efficient vehicles still rake in substantial profits. They can sustain a certain period, but new car manufacturers might not.

The Catfish Isn’t Dead, It’s Just Resting

For a considerable period, the price war cannot escape the influence of Tesla.

Take the domestically produced Model 3 (rear-drive) as an example, since its launch, the price has been frequently adjusted. Each price adjustment triggers significant market fluctuations. Before the release of the updated version, the combined price reduction of the domestically produced Model 3 (rear-drive) amounts to as much as 100,000.

At the same time, Tesla models’ prices have been constantly dropping like the domestically produced Model 3 (rear-drive). However, according to Tesla’s Q2 financial report, Tesla still has a gross profit margin of 18.2%. This indicates that compared to most new energy vehicle companies, Tesla still has substantial room for price reductions.

Moreover, to establish a software and hardware ecosystem and attain a business model that runs profits off software, Musk is inflexible about ramping up production and scales, and even stated that Tesla would rather sell cars at zero profit for sales.

Therefore, before the business goals are achieved, to stimulate the growth of sales and scales, Tesla will inevitably adjust its prices suddenly at some point in history. At that point, even if there isn’t a prolonged price war, short-term battles, lightning wars are unavoidable.

After all, as the absolute titan in the new energy vehicle industry, even if Tesla does not deliberately target anyone, once they cut their prices, most companies cannot escape its influence.

Like Tesla, as another titan in China’s new energy vehicle market, BYD’s every move also impacts the market trends.

At present, new models of BYD champions are continuously being launched. Simultaneously, relying on Denza, FangChengBao, and looking ahead, BYD is also continually cementing their foothold in the medium and high-end markets, covering all price market sectors extensively.

Faced with BYD’s offensive, including Tesla, no new energy vehicle company can rest easy.

In conclusion, the price war is a natural outcome of the development of the new energy vehicle market and it is becoming normalized.

As for when the price war will end, it is currently unclear. Industry insiders told us, in the ongoing price war, some companies do not want to, while some cannot stop. How long it will last needs continued observation of the changes in the third and fourth quarters.## Market Changes under the Normalization of Price Wars

Under the trend of price wars becoming normalized, some changes that are completely different from the traditional automotive market are taking place in the new energy vehicle market.

Continuous Shortening of Product Development / Iteration Cycle

As previously mentioned, car companies are racing to build their own scarce value, one direct effect of which is the continuous shortening of the product development / iteration cycle.

Taking recent events as an example, Xpeng launched the “G9 Battle Again” in less than a year, avoiding some pitfalls that the old G9 stepped on and enhancing the value perception of the 2024 G9 model. In fact, it’s proven that the 2024 G9 model may be another blockbuster for Xpeng after G6 – within half a month, the reservation quantity of the 2024 G9 model exceeded 15,000 units.

Coincidentally, AITO launched its new model, M7, approximately a year later. Within less than a month after its launch, the reservation quantity exceeded 50,000 units, breaking the previous embarrassment of unsaleability. Richard Yu even posted on his social media saying, “Revived from death, it was really not easy”.

However, for some brands, a year is still too long.

IM, launched its LS7 model in February; by October 12th, it’s going to launch LS6. Geely launched the L7 in late May, and four months later, it’s launching the L6. DENZA launched its N7 in July, and just a month later, it has already launched the N8.

The ancient principle of “Only speed can’t be broken” seems to be pursued in the new energy vehicle market.

Interestingly, as car companies rapidly release new products, a phrase that was rarely mentioned before has begun to be frequently mentioned in current product launches: available upon release.

This indicates that car companies are not only competing in product development / iteration cycles, but also in production capacity, delivery, and the capabilities of the entire production, manufacturing, sales, and channel systems.

In this way, car makers can not only provide scarce value to customers in advance to get rid of homogeneity but also find a new breakthrough point in sales and scale, building a more stable profit structure and expanding survival space in the price wars.

Reshaping New Order in the Car Market

With the strong rise of domestic brands in the new energy vehicle market and their constant rolling in the price war, some international brands’ presence is being continuously marginalized. “Lying flat” has gradually become a more historical term in the car market.

Facing their muted presence in the Chinese new energy vehicle market, some international brands have chosen to join if they can’t beat them. The most typical representative of this is the collaboration between Volkswagen and Xpeng.

On July 26th, Volkswagen announced its collaboration with Xpeng. Volkswagen invested 700 million USD to acquire approximately 4.99% of Xpeng at a price of 15 USD per ADS; Xpeng will provide the G9 platform and intelligence technology, and the two will jointly develop two Volkswagen-branded models, planning to launch in 2026.

Through collaboration, Xpeng not only received capital injection from Volkswagen, but also bolstered confidence in the capital market. Upon the official announcement of Xpeng-Volkswagen cooperation, Xpeng stock in the U.S. market soared, once exceeded 37% increase. For Volkswagen, partnering with Xpeng is beneficial for amplifying its voice in the new energy vehicle market, to establish core competitiveness in the trend of automobile intelligence.

Collaboration between Xpeng and Volkswagen undoubtedly creates a win-win situation.

Additionally, FAW Audi also chose to cooperate with SAIC; there seems to be some undisclosed “secrets” between Benz and NIO; and LEAPMOTOR announced it is advancing cooperation with two foreign automakers, but it did not disclose specifically which two they were, stating only that the process is still ongoing.

Regarding the cooperation between traditional brands and new forces, Zhu Jiangming once stated that many companies lack technology but still want to enter the new energy vehicle industry. LEAPMOTOR can provide ODM mode, and achieve mutual success by expanding its circle of friends.

The current reality, as Zhu Jiangming said, is that many companies, especially international ones that want to transition to new energy, lack the technology, while local brands have the technology but limited survival space. Cooperation between the two can thus achieve resource exchange and addition of advantages.

In the short term, cooperation can help both new and old brands get through the difficult price war; in the long term, it is advantageous for both sides to prepare for future competition.

Disruptive Value Rankings

Under the impact of the price war, the value system that was formed in the fuel vehicle system is being disrupted.

In the past, based on 0-100 acceleration, handling performance and other hardware abilities, starting from class A cars, the automobile industry has formed its own set of value system. It was almost impossible for users to buy a sedan like LEAPMOTOR C01 (which is 5m long and 2.93m wheelbase) for 150,000 yuan as it is today.

However, now that power batteries have replaced engines, 5-6 seconds of 0-100 acceleration is no longer a surprise, and even has become quite cheap. The battery itself is not controlled by car companies but is provided by a few suppliers. Compared to fuel vehicles, the hardware capabilities differences between new energy vehicles are narrowing.

Meanwhile, with the push of intelligent technology, software-defined cars become the new trend. Intelligent driving and intelligent cockpit increasingly influence user car buying decisions. This has caused a dramatic shift in user evaluation standards when considering a vehicle compared to the era of fuel vehicles.

In other words, due to the innovation of new energy vehicles, users’ perception of car value is being reshuffled.

The disappearance of brand premium is also disrupting the original value ranking.

The disappearance of brand premium is also disrupting the original value ranking.

The new energy sector is a completely new track, whether it’s emerging or traditional import / independent brands, everyone is starting from scratch, and the brand itself does not carry a high value. Even for brands like BBA, the premium from the fuel car market is repeatedly bruised when coming to the new energy market, and even ridiculed as generic electric cars.

Since there is no brand premium, the vehicle configuration could only be extravagantly assembled regardless of costs.

In order to scale up with cost-effectiveness, new energy vehicle companies are willing to equip an affordably priced new energy vehicle with features that only expensive fuel cars possess. As for whether a premium can be formed or how much can be formed is another story.

Going abroad to release the pressure

Facing the price war pressure in the domestic market, more and more new energy vehicle companies are looking overseas.

Looking at the latest market dynamics, Xpeng announced that it will enter the German market in 2024, and the G9 (international version) and P7i (international version) will enter the Israeli market this Q4; LEAPMOTOR has launched its global strategy at the Munich Auto Show, announcing that it will sell 5 globalized products in Europe, Asia-Pacific, the Middle East, Americas, etc. within the next 2 years; in September, ZEEKR announced a cooperative agreement with the four Gulf countries and is expected to enter 8 major international markets and regions this year.

In general, according to data from the China Association of Automobile Manufacturers, from January to September this year, the total export volume of new energy vehicles reached 727,000, a year-on-year increase of 110%. In April this year, the export volume even recorded a year-on-year increase of 840%.

_20231011164113.png)

Under the trend of globalization, markets such as Southeast Asia, the Middle East, and Europe are all full of the presence of Chinese new energy brands. The latest data from the China Association of Automobile Manufacturers show that Belgium, Thailand, and the United Kingdom have become the top three markets for Chinese new energy vehicle exports from January to August.

Due to the rapid growth of Chinese new energy exports, new pressures have begun to emerge for Chinese new energy vehicle companies abroad.

On October 4th, the European Commission formally launched an anti-subsidy investigation into Chinese electric vehicles, creating an obstacle for Chinese new energy going out to Europe. In this regard, Cui Dongshu, Secretary-General of the Travel Federation, said:

This is an inevitable phenomenon after the strength of China’s new energy vehicles, only after becoming strong will there be attention and some people will feel uncomfortable.

The price war has urged companies to seek new opportunities, but new issues have also emerged with these opportunities. Either domestically or abroad, the journey for new energy vehicle companies is still “long and arduous”.

In closure

September has passed, and the sales of many new energy vehicle companies have increased once again. On the last day of the National Day, Cui Dongshu, Secretary-General of the Travel Federation, also posted on his public account: “Taking up 65% of the world’s new energy vehicles share in August 2023”.In short, the market seems to be a scene of “loud drums and firecrackers”, teeming with celebrations.

But as the saying goes, people only taste in their water whether it’s cold or hot. How much blood they spilled and how much stress they carried in the price war behind the sales increase, only the automakers themselves know best.

Since the boom of the new energy vehicle market, Chinese new energy vehicles have rapidly grown and led the world. It is truly a winning scenario, but Chinese new energy vehicle enterprises have still not matched the celebration of the overall situation in the cycle.

And now, the cycle continues unabated, the price war continues, Chinese new energy car companies seem to be in a state of drinking poison to quench thirst. As Lei Ping, deputy general manager of China First Automobile Group Corporation, said:

The new energy vehicle market is still maintaining a high growth trend, but the vast majority of new energy vehicle companies are facing the embarrassing situation of “increase in volume and revenue but not profit”.

Although reality is not as festive as it seems on the surface, if viewed from a longer-term perspective, new energy is still emerging, and the current situation is just a necessary painful period for the new energy vehicle market to mature.

During this painful period, new energy cars must choose to move forward in pain. After all, the new energy track is crowded with people, and only by breaking through the price war first can they get a ticket to enter the future.

Note: The cover image is from “Saving Private Ryan”.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.