Weekly Index

Weekly major news

Tesla released Q2 financial report, gross profit reached a three-year low

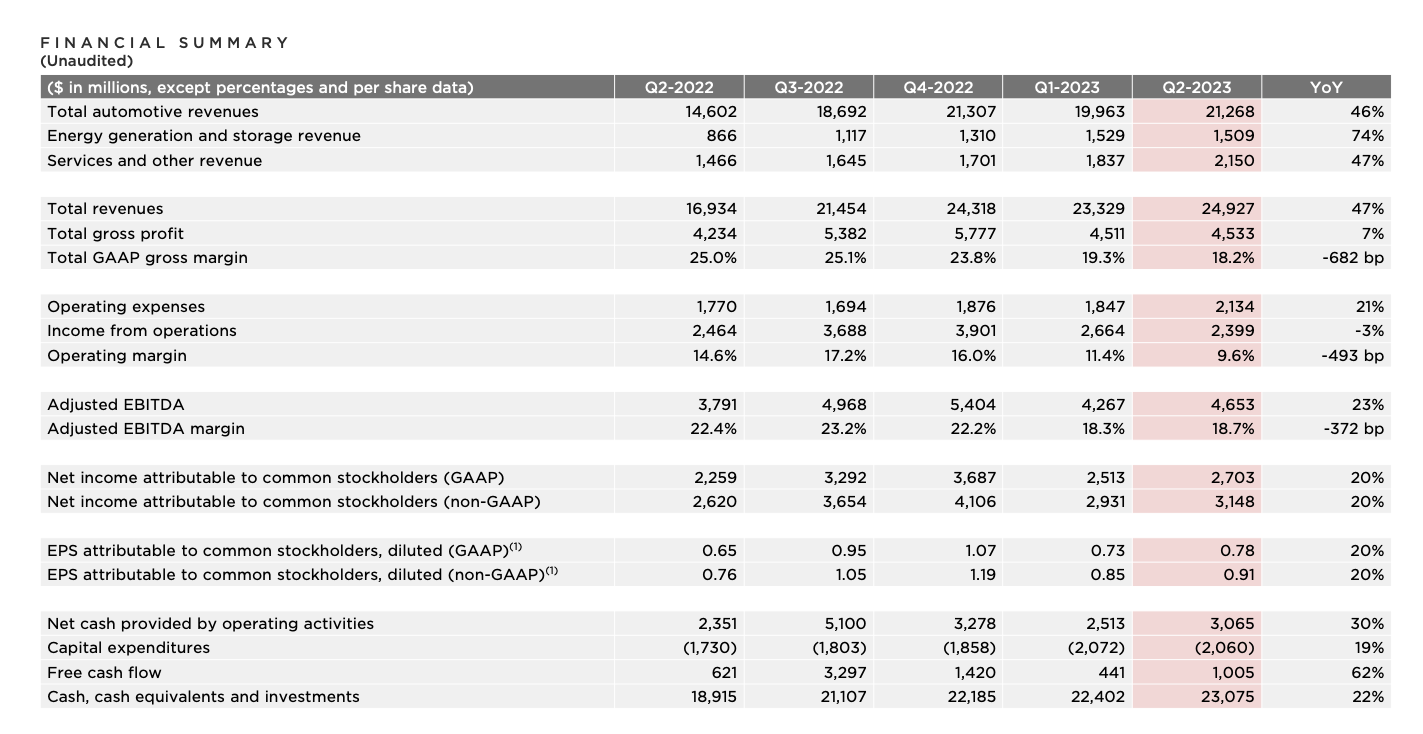

On July 19, Tesla released its Q2 financial report, with revenue reaching a historical high of $24.927 billion. However, the gross profit margin has dropped to a near two-year low of 18.2%.

Let’s first look at the main financial information about profits and revenue:

- Total revenue of $24.927 billion, an increase of 47% year on year and 7% quarter on quarter;

- Revenues from automotive business were $21.268 billion, an increase of 46% year on year and 6.5% quarter on quarter;

- Energy and storage business revenue $1.509 billion, an increase of 74% year on year and a decrease of 1.3% quarter on quarter;

- Services and other revenue $2.150 billion, an increase of 47% year on year and 17% quarter on quarter;

- Gross profit margin 18.2%, decrease of 27% year on year and 5.7% quarter on quarter;- Net profit stands at 9.6%, dropping 34% year on year and falling 16% quarter on quarter.

In overall terms, the financial performance of Tesla in Q2 remains at a healthy level. Revenue from energy and storage businesses may have declined, but total revenue has returned to the level of Q4, 2022. Meanwhile, profit margin continues to shrink, which is the more negative news.

There are several reasons behind this, according to Tesla:

- Falling average car selling price;

- The cost of producing 4680 batteries and other related expenses;

- Cybertruck, AI, and other large projects boosting operation management costs;

- Negative effect of foreign exchange.

The price reduction and effects of foreign exchange go without saying. Amidst the uncertain economic climate, all rivals are cutting prices to compete for market shares.

The other two reasons indicate that Tesla exerted much effort on projects with high cost but also high return, such as the 4680 battery, Cybertruck and AI.

Consequently, it comes as no surprise that profit margin is shrinking. Although it seems in constant decline, it actually heralds a rebound.

As Musk stated in a fiscal report conference call: “In order to lay the foundation for the future, we will keep making meaningful capital expenditures.”

Delivery Volume Keeps Breaking Records

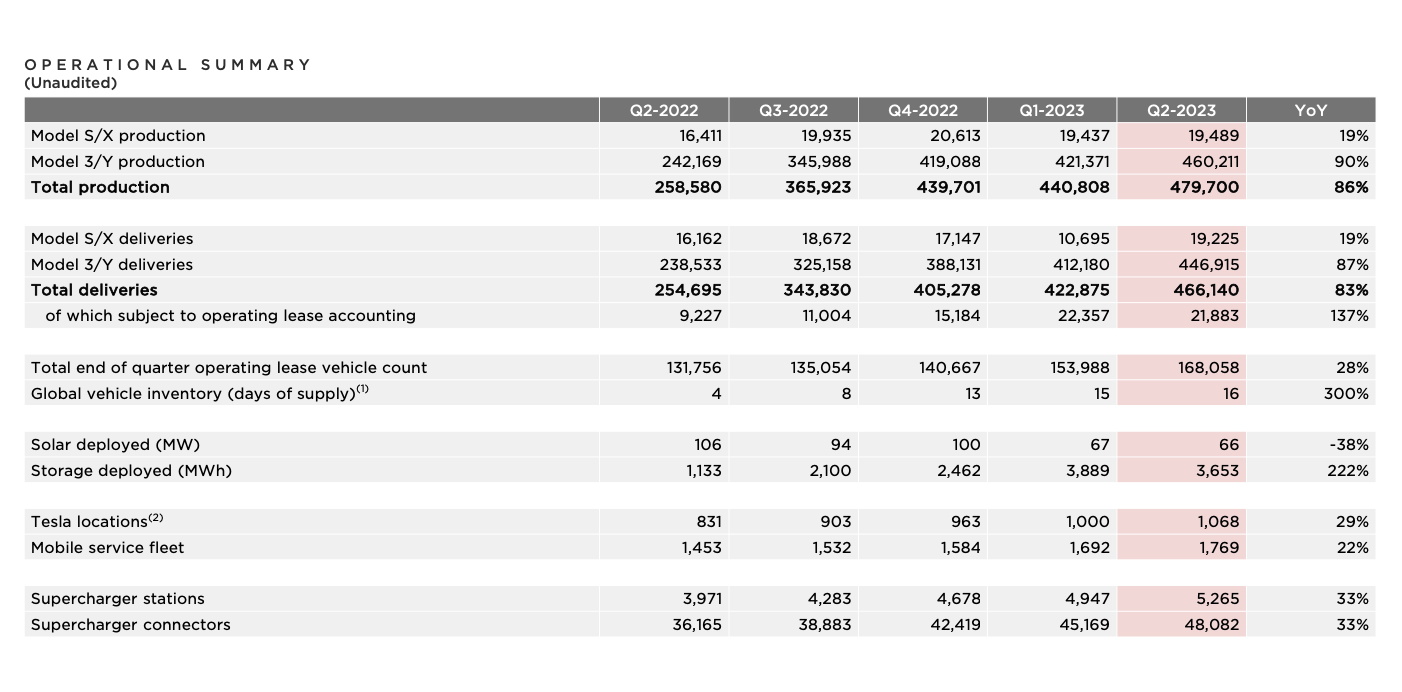

Breaking records in delivery volume is one way to lay a foundation for the future. Tesla achieved a new high in Q2 delivery volume:

- Model S/X delivered 19,225 units, a 20% YoY increase and about a 80% quarter on quarter rise;

- Model 3/Y delivered 446,915 units, a 87% YoY increase and about a 8% quarter on quarter rise;

- Total delivery volume stands at 455,140 units, a 83% YoY increase and a 10% quarter on quarter rise.

Reaching a record high quarterly delivery, Model 3/Y remains the primary contributor to robust Tesla sales. Meanwhile, Model S/X achieved an 80% surge in comparison with last quarter.

Delivery volume made a new high due to increased production capacity:

- Model S/X production stands at 19,489 units, a 19% YoY growth and about a 0.2% quarter on quarter rise;

- Model 3/Y production stands at 460,211 units, a 90% YoY growth and about a 9% quarter on quarter rise;

- Vehicle production capacity in total makes a 85% YoY leap and a 9% quarter on quarter leap.According to Tesla’s financial report, the Shanghai Gigafactory and the Fremont Gigafactory in California have played significant roles in capacity improvement, particularly in Shanghai, which has been operating at nearly full capacity for several months.

The phenomenal role of the Shanghai Gigafactory has been instrumental in Tesla’s venture into the Southeast Asian market. In February this year, Tesla commenced delivery in Thailand and by July, the Model Y was launched in Malaysia. Tesla’s market expansion is ever increasing with 455.1K units marking just a phase of its achievements.

However, Musk states that a factory upgrade will occur in Q3, leading to a temporary halt in production. Although Q3 capacity will slightly drop, it will resume and intensify after the upgrade.

Significant Growth in Service Revenue Expected

With the development of the charging network, Tesla’s service of replenishing energy has steadily grown. According to the latest data from the official website, there are currently over 45,000 supercharging stations available worldwide for Tesla.

At present, this revenue mainly comes from Tesla users, with sources appearing rather monotonous. However, with Tesla’s NACS securing more partners in Q2, service revenues are expected to skyrocket.

NACS (North American Charging Standard) is a Tesla charging specification, which is half the size and twice the power of the US official CCS (Combined Charging System).

In Q2, Tesla signed agreements with FORD, General Motors, Benz, Nissan, Polestar, Rivan, VOLVO and Volkswagen’s US subsidiary, Electrify America, availing Tesla’s charging network to these partners.

It seems Tesla is on track to dominate North America’s charging sector.

Slowdown in Energy Storage Business

The revenue from energy and storage business faced its first drop in nearly a year, where deployment of energy storage also experienced a decline. In Q2, total storage deployment was 3.7 GWHh, down 6% from the previous quarter.

The report explained this as “a result of postponing solar energy purchases in the high-interest-rate environment.”

Musk stated that “as the interest rate rises, the affordability of anything will decrease.” Tesla’s energy storage business seems to be improving steadily amidst this adversity.

In April, Tesla’s energy storage Gigafactory landed in Shanghai, potentially commencing MegaPack production by Q2 next year. Tesla’s Lathrop power storage Gigafactory has also begun production, working towards operating at full capacity.

Musk stated that the MegaPack continues to show strong demand globally, with several large projects lined up for Tesla in 2024.

During the earnings call, Musk also revealed some information about Cybertruck:- Four-door design;

- Approximately 1.8 meters in cargo box length and around 5.8 meters in body length;

- Delivery within the year.

Cybertruck was officially launched in 2019, and after several delays, it’s finally “here after being eagerly awaited”.

According to relevant statistics, with an order cost of 100 dollars, Cybertruck has accumulated 1.94 million orders. Although the final conversion rate is uncertain, it’s foreseeable that with a sufficient base of orders, the sales of Cybertruck will be substantial, likely becoming another significant pillar for Tesla’s sales.

One of the current pillars of sales, the Model 3, amidst the chaos of scattered spy photos and configuration information online, is finally about to receive a complete revamp.

Worth mentioning is that Musk stated that in Q3, the FSD will support account transfer and no longer be confined to a single vehicle, but this feature will only be supported in Q3.

If the revamped Model 3 indeed launches in Q3, the function of FSD supporting account transfer might stimulate the sales of Model 3. Tesla might have another winning streak.

Quick Review

This year, with the impending launch of the revamped Model 3 and the Cybertruck beginning its delivery within the year, could potentially mark a turning point in Tesla’s vehicle model expansion. At the same time, the updated Model Y, new Model Q, and others are all queued up in the near future. With the enrichment of the vehicle models and market expansion, Tesla’s business profit layout might become more rational, and their profitability could improve to a certain extent.

For the entire year of 2023, Tesla’s forecasted target remains unchanged: to maintain a 50% compound annual growth rate with a delivery volume of 1.8 million vehicles.

2024 HOZON S officially launched at a price between 159,800 – 269,800 Yuan

On July 20, the 2024 HOZON S was officially launched with 6 different versions on offer:

Extended range versions:

-

1060 Lite Rear-wheel-drive version, 159,800 Yuan, pure electric range of 200 km, combined range of 1,060 km;

-

1060 Rear-wheel-drive version, 179,800 Yuan, pure electric range of 200 km, combined range of 1,060 km;

-

1160 Rear-wheel-drive version, 189,800 Yuan, pure electric range of 310 km, combined range of 1,160 km.Electric Version:

-

715 Rear-drive version, priced at CNY 229,800, CLTC pure electric range 715 km, 0-100km/h acceleration 6.9 s;

-

650 AWD All-wheel-drive version, priced at CNY 259,800, CLTC pure electric range 650 km, 0-100km/h acceleration 3.9 s;

-

715 LIDAR Rear-drive version, priced at CNY 269,800, CLTC pure electric range 715 km, 0-100km/h acceleration 6.9 s.

The most obvious change with the range-extended version is the addition of a version with a pure electric range of 200 km under the CLTC standard, powered by a 31.7 kWh lithium iron phosphate battery. By reducing battery costs, the price can be lowered to cater to users with shorter daily commuting distances and good charging conditions.

In the range-extended version, the price of the rear-drive 1160 version has reduced by CNY 38,000 compared to the 2022 model. And for the electric versions, there are different degrees of price reductions compared to 2022 models, the 715 LIDAR rear-drive version having the highest price drop of CNY 38,000.

In terms of configuration, except for the Lite version, 650 AWD all-wheel-drive version and 715 LIDAR rear-drive version, all models come standard with 2 Horizon Journey 3 chips with a total computing power of 10 Tops, capable of providing features such as lane keeping, automatic parking, and others that can be used as soon as the vehicle is delivered, without waiting for subsequent OTA upgrades.

The 650 AWD all-wheel-drive version comes standard with 2 Texas Instruments TD4 chips, the 715 LIDAR rear-drive version runs on ADC high-performance platform, which can achieve NCP urban navigation assist driving function in the future.

In terms of the cabin, all models except the Lite version come standard with front seat ventilation and heating, double-layer laminated glass for all four doors, and a 12.3-inch co-driver display. The 650 AWD all-wheel-drive version and the 715 LIDAR rear-drive version also come standard with front seat massage and rear sleep pillow.

The new model has 4 optional packages:

- Performance package: includes 4 Michelin PS4 tires, priced at CNY 1,500;

- Cool select package: includes gull-wing doors and carbon fiber spoiler, priced at CNY 15,000;

- Tech package: includes AR-HUD, priced at CNY 4,500;

- Luxury select package: includes deluxe genuine leather seats with ventilation, massage, and sleep pillow, 21-speaker 720 degree sky sound audio system, deluxe suede interior decoration, priced at CNY 9,900.

The benefits of the new model include:

- CNY 8,000 finance discount or additional purchase subsidy.* Existing HOZON owners can take advantage of a $5,000 bonus towards an upgrade;

- All models come with a free factory game controller. 650 AWD and 715 LIDAR versions come with a free panoramic thermal insulation changing-color skylight;

- Enjoy a free 5 G/month data package for 3 years;

- Non-commercial owners, whose annual mileage does not exceed 30,000 kilometers, will receive free lifelong warranty for three-electric system;

- Free roadside assistance;

- Free OTA upgrades.

Quick Review

The launch of the 2024 HOZON S model seems more like a strategy to reduce price under the guise of an annual edition. After all, as the prices in the new energy market are continuously rolling up, HOZON can’t just sit back and do nothing. Therefore, we are seeing a version with a larger battery for increased range, and a significant amount of downgraded and standard features, along with a lower price. HOZON S still has good competitiveness in its class.

Huawei Cloud releases self-driving development platform

At the Huawei Cloud Intelligent Driving Innovation Summit, Huawei Cloud unveiled the Ulanqab Automotive Region and self-driving development platform. This indicates Huawei’s further investment in providing safe, compliant, full-stack self-innovative, high-computing power cloud infrastructure and efficient full-process development platforms to accelerate the intelligence of the automotive industry.

The Ulanqab Automotive Region, serving as the cloud infrastructure, employs a 3-zone compliance framework and 7-layer security protection. This means it will provide end-to-end secure and compliant safeguards for autonomous driving data. A single cluster capable of reaching 2000P Flops of Ascend AI Cloud Services has been deployed for powerful computing to aid in self-driving development.

Huawei Cloud’s self-driving development platform, with the help of Huawei’s partnership with the auto industry and new tech like the Pangu Large model, makes the full-process development of self-driving more agile and efficient. The Pangu Large Model 3.0 can quickly adapt to various industry requirements and has been applied in various scenarios by many autonomous driving algorithm companies, significantly improving data processing efficiency.

Shi Jilin, Global Marketing and Sales Service President at Huawei Cloud, believes that China’s auto industry is undergoing digital and networked transformation and looks forward to Huawei Cloud partnering with customers to promote innovation in the automotive industry.

Gao Jianghai, President of Huawei Cloud Public Cloud Business, also stated that Huawei Cloud aims to provide safe, compliant, powerful, and globally distributed automotive industry cloud infrastructure in order to support steady growth of auto enterprises, accelerate intelligent realization and global business layout.

Quick Review

The automatic driving development platform released by Huawei Cloud is a good solution for auto enterprises or autonomous driving development companies who lack the technology or financial strength to build large models. It can efficiently assist these businesses in speeding up the development, verification, and optimization iterations of autonomous driving algorithms, reducing costs and risks and increasing efficiency and safety.### avatr Tech Plans to Establish 350 Channel Touchpoints by the end of the year

The new energy vehicle company avatr Tech held a partner recruitment conference at its headquarters in Chongqing on July 21, 2023. At this conference, avatr Tech announced its goal of achieving 350 channel touchpoints by the end of the year to provide better services to its users. The plan attracted a large number of participants, with over 100 leading automotive dealer groups attending the conference, including nearly 30 on-site intention agreements signed with Grand Auto and Jianfa Auto.

Tan Benhong, chairman and CEO of avatr Tech, stated that three new products drive the upgrade of avatr’s diversified channel layout. Chen Zhuo, Executive Senior Vice President of avatr, emphasized that self-operated and other-operated stores will use their own resources, and the touchpoint ratio will be 1:1 by the end of the year.

avatr Tech also promises full empowerment and comprehensive control over service and job quality, providing a “closer, faster, lighter, and more professional” touch experience. Zhu Huarong, Chairman of CCAG, stated that CCAG will empower avatr in strategy, talent and technology, helping avatr to build several heavy-hitting models into market-surprising classic products.

Under the “four years, four vehicles” accelerated landing plan, avatr will continue to stick to joint development with more partners to create distinctive and futuristic travel and life experiences.

Quick review

As avatr, which was born with a golden key, shows a high standard in design, intelligent driving and three-electric system, especially the city navigation auxiliary driving ability is quite eye-catching. With the arrival of avatr 12 and subsequent new cars, avatr indeed urgently needs to expand sales channels, after all, to broaden the audience for individualized models, may be able to capture more consumers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.