As a top performer among new automotive forces, Li Auto has once again proven itself.

According to Li Auto’s recently released Q1 2023 financial results, the company’s revenue scale reached a record high. At the same time, with the expansion of their revenue scale, Li Auto’s gross profit exceeded 20%, and both operating profit and net profit performance were quite impressive.

This suggests that under the backdrop of Q1 price wars, Li Auto, focusing on the extended-range vehicle market priced above 300,000 yuan, seems to have remained largely unaffected.

More importantly, Li Auto is currently in the “1 to 10” growth stage, aiming to secure a market share of over 20% in the passenger vehicle segment priced between 200,000 and 500,000 yuan, thereby providing a strong foundation for its subsequent “pure electric+extended-range” strategy. Achieving this goal is no easy feat for Li Auto, given the competitive landscape.

Fortunately, this year’s steps taken by Li Auto appear to be quite steady.

A record-breaking financial report

From various aspects, Li Auto delivered an impressive financial result.

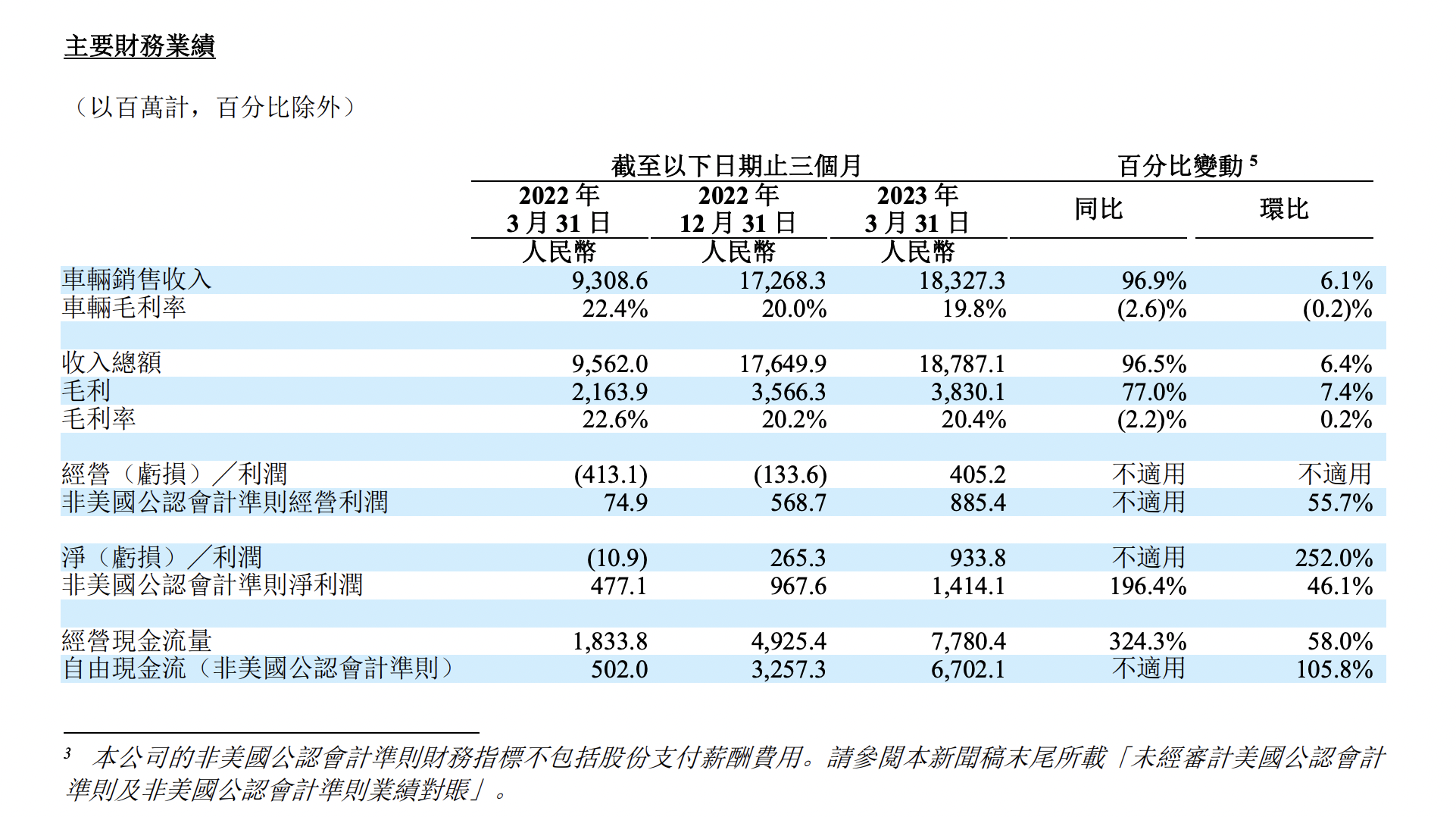

In terms of revenue, Li Auto’s total Q1 revenue was 18.79 billion yuan, a 96.5% increase compared to the same period last year (95.62 billion yuan) and close to doubling. Compared to Q4 2022, it is a 6.1% increase.

Of this, revenues from car sales amounted to 18.327 billion yuan, an increase of 96.9% year-on-year and 6.1% quarter-on-quarter.

Li Auto stated that the increase in vehicle sales revenue for Q1 2023 compared to Q1 2022 was mainly due to the increase in vehicle deliveries and the rise in average selling price contributed by the Li L series models, while the 6.1% increase compared to Q4 2022 (17.27 billion yuan) was primarily driven by the increase in vehicle deliveries, offset by the decline in average selling price due to the difference in product mix between the two quarters.Now let’s look at the gross margin situation.

In terms of gross margin, Ideal Motors has a gross margin of 20.4%, which is a 2.2% decrease from the 22.6% in the same period in 2022, and a 0.2% increase from 20.2% in Q4 last year.

Specifically, in Q1 2023, Ideal Motors’ per vehicle gross margin was 19.8%, 2.6% lower than the 22.4% in the same period last year.

It should be noted that, during the same period last year, Ideal Motors only had the Ideal ONE model on sale, while this year there are three models on sale concurrently: the Ideal L9, L8, and L7. This has undoubtedly increased the complexity of Ideal Motors’ investment in production, configuration, delivery, promotion, personnel organization, and more, thereby raising various aspects of investment.

Given this premise, the 19.8% per-vehicle profit margin is still considerable. Moreover, it should be emphasized that Ideal Motors’ performance in both gross margin and per-vehicle profit margin in Q1 2023 surpasses Tesla’s.

In its earnings report, Ideal Motors stated that the decrease in vehicle gross margin compared to Q1 2022 was mainly due to differences in product mix between the two quarters.

In terms of profit, Ideal Motors’ operating profit (non-GAAP) in Q1 was RMB 8.9 billion, with a net profit (non-GAAP) of RMB 14.14 billion. Based on the net profit (non-GAAP) data, Ideal Motors experienced a year-on-year growth of 196.4% in Q1 compared to the same period last year and a 46.1% growth rate compared to Q4 last year.

Additionally, in terms of cash flow, Ideal Motors had a free cash flow of RMB 67 billion in the first quarter, a 105.8% increase from the RMB 32.6 billion in Q4 last year. In comparison, Ideal Motors’ free cash flow in Q1 of last year was only RMB 5.02 billion.

It’s worth mentioning that Ideal Motors’ R&D expenses in Q1 2023 were RMB 18.5 billion, an increase of 34.8% from RMB 13.7 billion in Q1 2022, and a decrease of 10.5% from RMB 20.7 billion in Q4 2022.

Regarding this data, Ideal Motors stated that the increase in R&D expenses compared to Q1 2022 was mainly due to the increased costs to support its expanding product portfolio and an increase in employee compensation resulting from an increase in staff. The decrease in R&D expenses compared to Q4 2022 was mainly due to the cycle and progress of new car projects.Translate the following Chinese Markdown text into English Markdown text in a professional manner, retaining the HTML tags in Markdown, and only outputting the results.

In addition, as of March 31, 2023, Li Auto has cash, cash equivalents, restricted cash, fixed deposits, and short-term investments totaling RMB 65 billion — peace of mind with ample resources on hand.

Regarding the financial performance, Li Auto’s CFO Li Tie commented:

We achieved a healthy gross margin of 20.4% in the first quarter, as well as a record positive adjusted operating profit margin and free cash flow, thanks to our strong product offerings and outstanding operational efficiency. Our robust cash flow and healthy balance sheet position us well for continued investment in product, platform, and system R&D innovation and business expansion, creating value for our users and shareholders.

Li Xiang’s delivery volume forecast is realized

It is not surprising that Li Auto achieved such results in the first quarter.

From the perspective of vehicle sales, compared to the same period last year, whether it is product richness or price range, Li Auto’s L series has completed a qualitative change in product layout compared to the single model, Li ONE, of last year.

Therefore, Li Auto performed well in Q1 vehicle sales:

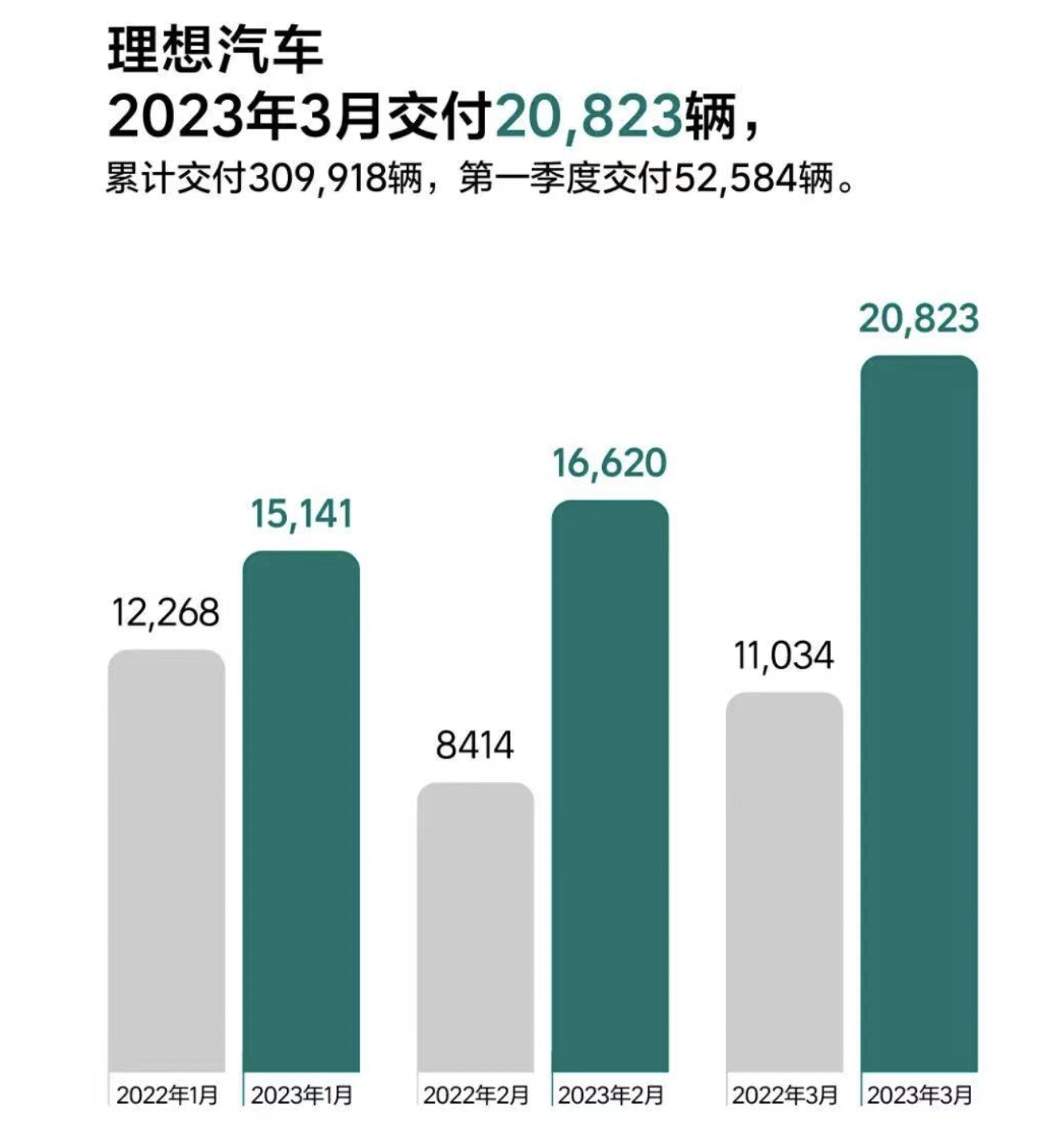

In January, 15,141 new vehicles were delivered, a year-on-year increase of 23.4%, achieving growth against the market trend, as overall vehicle sales declined due to demand overspill.

In February, with the L9 and L8 two models, 16,620 new vehicles were delivered, a year-on-year increase of 97.5%.

In March, boosted by the quick delivery of the L7 just a month after its launch, 20,823 new vehicles were delivered, achieving a monthly delivery volume exceeding 20,000 units for the second time (the first time was in December 2022), a year-on-year increase of 88.7%.

Based on this excellent monthly performance, Li Auto delivered a total of 52,584 new vehicles in Q1, a year-on-year increase of 65.8%. If we extend the timeline to March 31, 2023, Li Auto’s cumulative delivery volume reaches 309,918 units.

Translate the following Chinese Markdown text into English Markdown text in a professional manner, retaining the HTML tags in Markdown and outputting only the results.

Translate the following Chinese Markdown text into English Markdown text in a professional manner, retaining the HTML tags in Markdown and outputting only the results.

It should be noted that Li Xiang had previously given an expectation of 52,000 to 55,000 deliveries in the first quarter of 2023 in a conference call. Therefore, judging from the results, Ideal Auto did achieve its initial sales forecast, which is certainly worth praising.

It’s worth emphasizing that in the already concluded month of April, Ideal Auto’s single-month deliveries reached a new historical high—25,681 units in April, a YoY increase of 516.3%, surpassing the 25,000 units that Li Xiang himself had predicted in an earnings conference call (Ideal Auto had previously stated that after L7 deliveries, monthly supply could reach a minimum of 25,000 units).

Such achievements are indeed enviable in the industry (as a stark contrast, both NIO and XPeng’s April deliveries fell short of 10,000 units).

Along with the announcement of April deliveries, Ideal Auto also disclosed in its financial report that as of April 30, 2023, it had 302 retail centers covering 123 cities and operated 318 after-sales service centers and Ideal Auto-authorized sheet-metal centers in 222 cities.

Regarding Ideal Auto’s overall performance in Q1 2023, CEO Li Xiang said:

In the first quarter of this year, amid an intensifying competitive environment in the new energy vehicle market, Ideal Auto ranked among the top three new energy brands in China with sales of over 200,000 units, thanks to the continued recognition of Ideal L9 and L8 and the strong order volume and rapid production ramp-up of Ideal L7. This once again proves our ability to design and create popular models, as well as the advantages and synergies of our supply chain, manufacturing, sales, and service network.

Notably, in the earnings report, Ideal Auto also provided expectations for the next quarter. Specifically:

- Vehicle deliveries for Q2 are expected to be 76,000 to 81,000 units, an increase of 164.9% to 182.4% compared to Q2 2022.

- Total revenue for Q2 is projected to be RMB 242.2 billion to RMB 258.6 billion, an increase of 177.4% to 196.1% compared to Q2 2022.

Clearly, based on such data combined with the already announced April results, Ideal Auto’s average delivery level for May and June needs to exceed 25,000 units (also April’s performance) to achieve the expected base delivery volume.In terms of product planning for 2023, Ideal Auto will launch its first pure electric vehicle model. However, the first pure electric model will not be delivered this year, which means that for the further growth in sales and revenue, Ideal Auto will have to rely entirely on the existing L9 + L8 + L7 product lineup.

At present, what Ideal Auto is doing is to further increase sales based on the existing product lineup by improving the efficiency of its sales network. For this purpose, Ideal Auto is also putting in great efforts to optimize its sales organization system and incentive measures, such as adjusting matrix structure or decentralizing provincial management rights.

The battle for a 100 billion scale has begun

Ideal Auto has indeed achieved good results so far, but it must not be complacent.

Currently, Ideal Auto is in the midst of transformation from “1 to 10.” From the financial report, it has preliminarily completed the systemization of products and supply chain through the successive launch of the three Ideal L series models and has initially been verified in the market. It should be noted that this process has not yet been completed.

However, at this point, Ideal Auto has already embarked on the next stage.

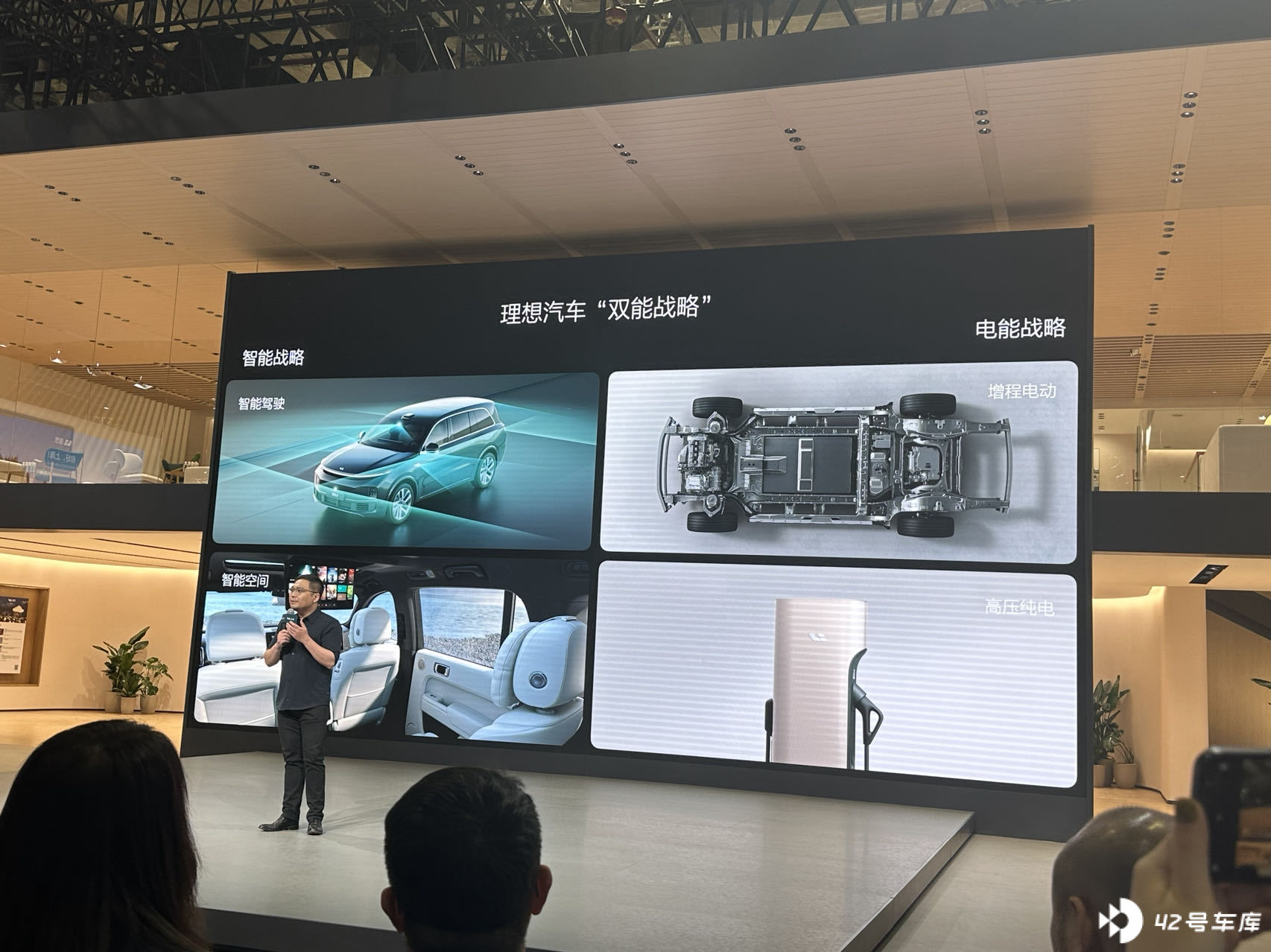

Specifically, on April 18th, Ideal Auto announced its “Dual Energy Strategy.” On the “electric energy” level, Ideal Auto has shifted from a single range extender route to a range extender + pure electric “two-legged walking” strategy, a change in its product lineup. This means that the change in Ideal Auto’s product lineup this time is more profound, and it will have a significant impact on its entire supply chain system, organizational system, and technology system.

Of course, the “Dual Energy Strategy” has another connotation—intelligence, that is, creating “Intelligent Driving” and “Intelligent Space” technology platforms based on software 2.0 capabilities, providing AI intelligent car experiences.

Regarding the “Dual Energy Strategy,” Li Xiang himself is full of confidence, stating in the financial report that:> We believe that electrification and intelligence will bring continuous growth and greater scale effects to the business. Combined with our constantly improving operational capabilities, we will create greater value for users while achieving profitability. Our healthy profit margins and cash flow will continue to support our investment in R&D and the enhancement of business capabilities, further strengthening the flywheel effect of the company’s development.

However, implementing Ideal Automotive’s layout in the pure electric market is not an easy task. After all, compared to its unparalleled success in the extended-range market, Ideal Automotive will face more powerful and outstanding competitors in the same price range of the pure electric market. Whether it can achieve its desired share in this market remains uncertain.

Moreover, Ideal Automotive has set an even higher goal for revenue. The goal is to achieve a revenue of 100 billion by 2023. In 2022, Ideal Automotive’s total revenue was 45.29 billion – this means that to achieve the goal of 100 billion in revenue, Ideal Automotive must at least achieve a year-on-year revenue growth of 120% in 2023.

Clearly, this is a substantial challenge.

All the past is the prelude – before attaining the goal of “securing 20% market share in the 300,000 to 500,000 RMB SUV price range,” Ideal Automotive will need sufficient prudence and effort. Nonetheless, with the impressive results of the first quarter, Ideal Automotive has garnered enough confidence to launch an attack on 100 billion in revenue.

And the clarion call has sounded.

Here are the main contents of the Ideal Automotive management team during the earnings call, edited without altering the original meaning.

Q: How will Ideal Automotive’s gross profit margin change in the future? What is the plan for the urban NOA push?

A1: We are very confident in improving the gross margin per car.

A2: The urban NOA test is going well, and we expect to push early bird user tests in June. Early bird users will be determined according to their frequency of using the highway NOA and their usage habits. We hope that users will be willing to use the urban NOA, and that early bird users will have a higher degree of tolerance for us. We expect to promote the urban NOA function to 100 cities by the end of the year. Our urban NOA architecture does not rely on high-precision maps, so theoretically, it can be experienced with any navigation map. Of course, in practice, the experience of the urban NOA function also depends on the locally prevailing Ideal Automotive population – the higher the number, the better the effect.Translate the following Chinese Markdown text into English Markdown text in a professional manner, keeping the HTML tags in the Markdown, and only output the result.

Q: When can the previous monthly sales target of 30,000 vehicles proposed by Ideal Auto be achieved? What is the delivery plan for pure electric vehicles?

A: The second quarter will be a climbing process, and we expect to achieve the delivery target of 30,000 vehicles in June. The pure electric model is expected to be released this year, followed by test drives and subsequent deliveries.

Q: How does Ideal view the introduction of more competing models like the Ideal L8 by other automakers?

A: Orders for Ideal L8 will continue to grow. The more brands involved, the better it is for us. The biggest competitor for Ideal L8 is actually Tesla’s Model Y.

Q: For Ideal Auto, is profitability more important, or is market share more important? What is the outlook for price competition this year?

A: We believe market share is important. Our goal is to increase the market share in the 200,000 to 500,000 market from 11% in the first quarter to 13% in the second quarter. However, Ideal Auto has no consideration for price reductions, as our pricing is already the best competitiveness in the price range and product segment we have determined.

Q: What is Ideal Auto’s pricing strategy for pure electric vehicles?

A: In order to develop high-voltage pure electric models, we have made preparations in R&D and supply chain qualifications, hoping to achieve the same price for pure electric and extended-range vehicles. The purpose of our extended-range vehicles or high-voltage pure electric vehicles is to replace fuel vehicles on a large scale. Therefore, we need to ensure unimpeded access by building a large number of supercharging stations on highways, and not pass on the cost to consumers, allowing them to buy our pure electric vehicles at competitive prices.

Q: As more models are launched, how will we layout consumption and services to increase market share?

A: One is to upgrade the stores for multiple models; the other is that we will open joint-venture stores in cities with increased market share. In the future, our stores will cover almost all fourth-tier cities and will have joint-venture stores in large-scale auto cities. Our overall coverage and scale will be more similar to Mercedes-Benz or BMW.

Q: Do current order and delivery performance support the goal of achieving 30,000 units in Q2 monthly sales? How are the sales of Air versions? How will the layout be in the third and fourth tiers?

A: In fact, May is a traditionally slow season for car sales, but we found Ideal Auto’s order and delivery performance in May was better than in April. L7 Air and L8 Air brought in a 20% increase. Currently, our best-performing tier is the new first-tier cities, and looking ahead, expansion in third and fourth tiers will be the core focus.Q: How will the management respond to the challenges of the sinking market?

A: In our current approach, we have delegated the original regional management system to provincial headquarters, distributing authority to each province and even each store.

This way, our stores’ growth remains unchanged, but the per-store and per-person outputs have increased, leading to better conversion rates. In the future, tier 3 and 4 cities will determine the best strategy according to new circumstances after implementing upgrades to their management processes.

Q: What is the current production capacity of Ideal Motors?

A: We currently have two production lines at our Changzhou factory. The first line produces L9 and L8 models, with a capacity of approximately 25,000 units per month; the second line manufactures L7 and L8 models, with a monthly capacity of around 10,000 to 12,000 units.

The Beijing factory primarily produces electric vehicle models, with a Phase I annual capacity of 100,000 units.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.