The Tesla 2023 Q1 financial report was released during the Shanghai Auto Show.

One of the prerequisites for the release of the financial report was that Tesla had made large-scale price cuts worldwide this quarter, particularly in the Chinese market. The prices of the main models, Model 3 and Model Y, dropped to 230,000 yuan and 260,000 yuan respectively, their lowest historical levels.

On the other hand, amidst the context of major global carmakers shifting towards new energy, Tesla also faces increasingly fierce external competition.

In this context, Tesla’s Q1 results are, in fact, an effective interpretation of the future development strategy for Tesla planned by its founder, Elon Musk.

Profit Decline as a Strategy for Active Response

Overall, Tesla’s Q1 2023 financial report seems somewhat dangerous but still healthy.

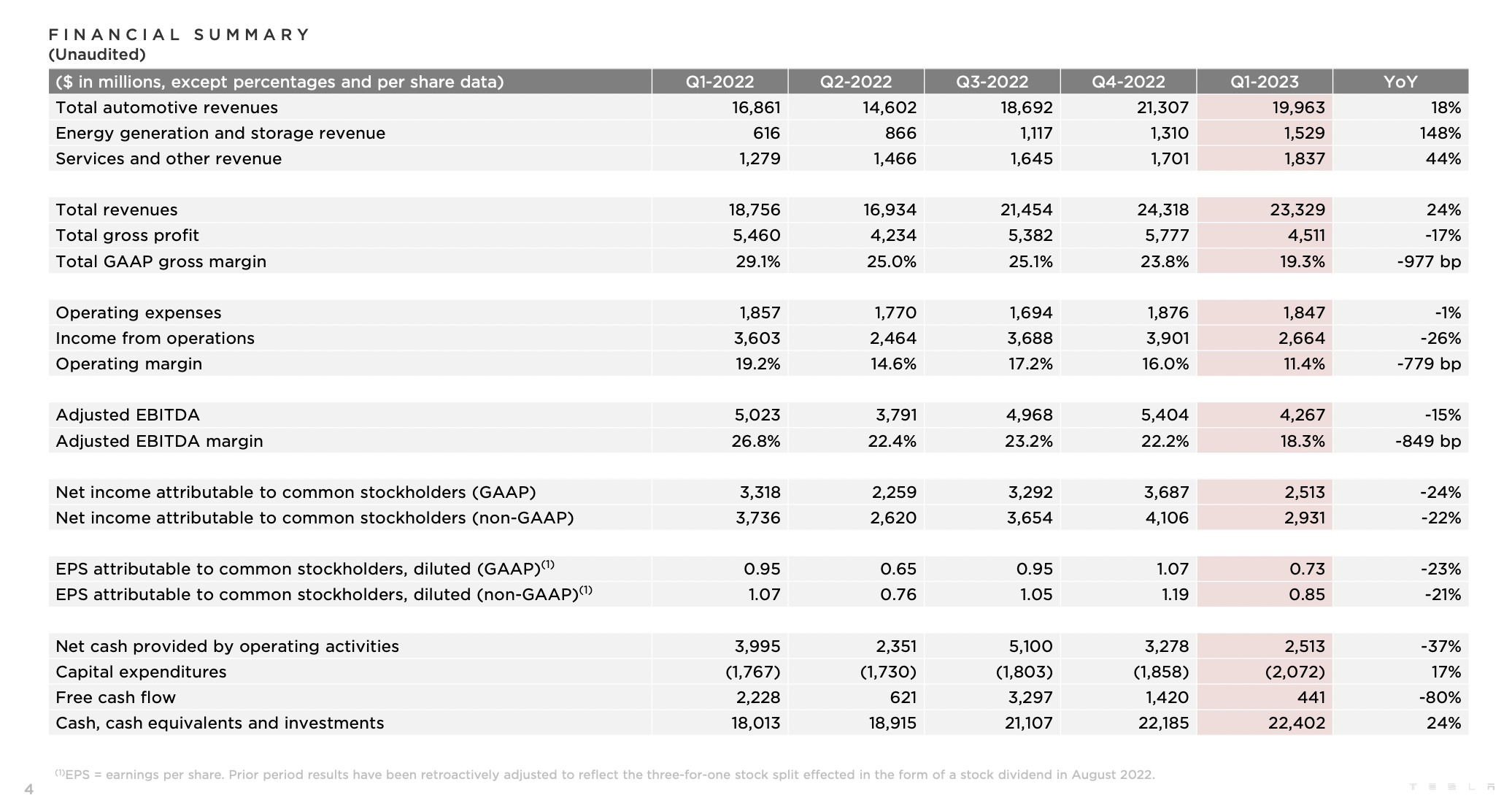

Let’s first take a look at revenue and net profit:

- Total revenue was $23.329 billion, a YoY increase of 24\% and a QoQ decrease of 4\%.

- Automotive revenue was $19.963 billion, a YoY increase of 18\% and a QoQ decrease of 6\%.

- Gross profit was $4.511 billion, a YoY decrease of 17%, and a QoQ decrease of 22%.

- Overall gross margin was 19.3\%, a YoY drop of 9.77\% and a QoQ drop of 3.49%.

- Gross margin per vehicle was 18.9\%, a YoY decrease of 11\%, and a QoQ decrease of 5\%.

- Sales cost was $18.818 billion, a YoY increase of 49\%, and a QoQ increase of 1\%.

- Net income was $2.513 billion, a YoY decrease of 24\%, and a QoQ decrease of 32\%.

- Net profit margin was 10.77\%. By comparison, net profit margin was over 19.2\% in Q1 2022 and 16\% in Q4 2022.

Although Tesla achieved a 24\% YoY revenue growth in the first quarter, important indicators such as gross profit, gross margin, and gross margin per vehicle all showed varying degrees of YoY decreases. The most noteworthy of these was the net profit, which fell by as much as 24\%.

It is evident that this financial performance is a direct result of Tesla’s significant price cuts in the first quarter.

It should be noted that despite Tesla’s significant year-on-year decline in net profit margin in the first quarter, a net profit margin of 10.77\% is still an excellent level in the automotive industry. Regarding this issue, Tesla CEO Musk also stated in the earnings conference call that Tesla’s operating profit margin is still the best in the industry.

Regarding this financial performance, Musk also emphasized in the conference call that this result is the direct result of Tesla’s pursuit of sales volume by giving up some profit. He said:

“We believe that pushing for higher production and larger sales volume, rather than lower production and higher profit margins, is the right choice. As time goes by, we expect our vehicles to generate considerable profits through autonomous driving. Therefore, we believe that what we are doing is laying the foundation for the future, delivering a large number of cars with lower profit margins and finally achieving profits in the future as we perfect autonomous driving.”

Musk emphasized that this strategy is extremely important.

In addition, Musk also pointed out in the conference call that the current macro environment is still unstable, and people will consider this when purchasing bulk items such as cars. The implication is that Tesla’s price-cutting strategy in the first quarter was also based on considerations of the macro environment.

It is worth mentioning that in addition to the automotive business, Tesla’s solar and energy storage business also achieved significant growth, especially the deployment of energy storage in the first quarter, which increased by as much as 360\%.

Therefore, Tesla’s non-automotive business also achieved the highest revenue share in history.

In addition to the above key data, Tesla also had the following important indicators in the first quarter:

- Cash and cash equivalents and investment balance were 22.402 billion U.S. dollars, a year-on-year increase of 24\% and a quarterly increase of 2\%.- R&D expenses were $771 million, a year-on-year decrease of 10\% and a quarter-on-quarter decrease of 5\%.

- Sales and administrative expenses were $1.076 billion, a year-on-year increase of 8\% and a quarter-on-quarter increase of 4\%.

Overall, compared with Tesla’s performance in Q1 of 2022, this quarter’s profit indicator did show a certain downward trend. However, from the perspective of the entire industry, this is still an impressive financial report, especially in terms of revenue and profitability.

In response to this, Tesla CFO Zachary Kirkhorn concluded that Tesla’s financial performance is still healthy.

Musk: The best service is no service

For Tesla, how to achieve this year’s vehicle sales target in economic uncertainty is a key issue.

In fact, in the just-passed first quarter, Tesla’s overall sales performance was very impressive, with many highlights. For example:

- The total delivery volume of all models in the first quarter was 422,875 units, a year-on-year increase of 36\%, reaching a historical high;

- Among them, the global delivery volume of the Model 3/Y was 412,180 units, a year-on-year increase of 40\%;

- The number of Tesla vehicles sold for leasing and operation purposes reached 22,357 units, a year-on-year increase of 84\%;

- The Model Y is the best-selling model in the European market and the best-selling non-pickup model in the United States (which Musk emphasized in his opening remarks at the earnings conference call).

However, to achieve Musk’s already set target of 1.8 million to 2 million car sales, Tesla needs to take some measures on top of its first-quarter sales performance to complete the task.

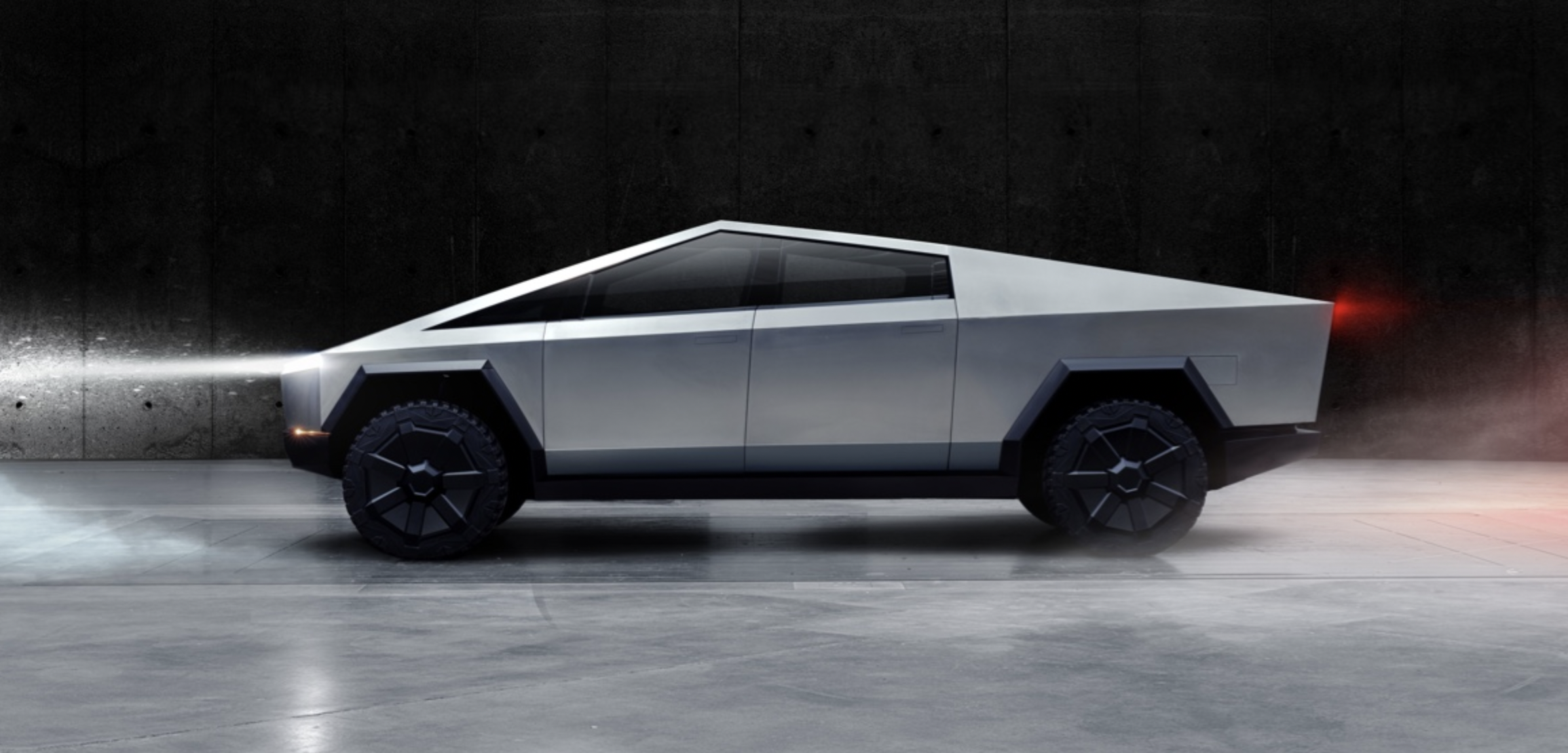

One important measure is undoubtedly new product deliveries.

At the earnings conference call, Musk stated that the Cybertruck will be delivered in the third quarter, and Tesla’s factory in Texas is currently completing its assembly. He also emphasized that the Cybertruck is a good product, and its production will follow an S-shaped curve in terms of output: it will begin very slowly and then accelerate, but overall demand will be very high.

He also specifically stated that Tesla’s car orders have exceeded production.

He also specifically stated that Tesla’s car orders have exceeded production.

In addition to delivering new products, Musk emphasized that Tesla hopes to expand into new markets around the world, although some of these markets may not necessarily be singularly large markets, but there are many similarities. He stated that now is the time for Tesla to operate cars in other parts of the world. It is worth mentioning that Tesla also officially started delivering vehicles to the Thai market in the first quarter of 2023, mainly Model 3 and Model Y vehicles from Tesla’s Shanghai factory.

Of course, despite many measures to increase sales, Musk also talked about the impact of the macro environment on Tesla in the earnings conference call.

He believes that the impact of the macro environment mainly has two factors. One factor is interest rates-every time the Federal Reserve raises interest rates, it is equivalent to raising the price of cars, making cars less affordable.

Another factor is economic uncertainty. He said that when faced with economic uncertainty, people usually postpone large expenses such as buying a new car. This is a natural human response, especially when people read news about layoffs in the media, they may be worried about being laid off and naturally hesitate whether to buy a new car. This is the essence of the automotive industry.

Musk said that under economic uncertainty, many people’s demand for car purchases will be suppressed-but Musk also predicts that this economic storm will last for about a year, but it may start to clear up next spring.

In addition, in the earnings conference call, when asked if Tesla’s sales will continue to adhere to direct sales model, Musk said:

Our direct sales model is currently running smoothly. Of course, we will encounter some pain in the process of increasing sales volume. Tesla’s growth rate is faster than any other company that manufactures large complex products in history, so it will inevitably encounter pain in the process of expanding the scale. But we believe that obtaining feedback from users about services is helpful, which means that we feel the pain points of users and design cars that require less service.

Musk said that the best service is no service-the best thing for consumers is that cars do not need repairs.

Tesla’s opponent is only itself

In the earnings conference call, in addition to the car itself, Musk constantly emphasized autonomous driving.

He said that Tesla has undergone more than 150 million miles of milestone testing on FSD Beta, and this number is growing exponentially, which is a competitive advantage that other players do not have. Musk emphasized that Tesla is also very focused on improving its neural network training capabilities, which is also the key to achieving full autonomous driving.Tesla will continue to purchase a large quantity of NVIDIA GPUs and invest heavily in the Dojo supercomputer, which can increase the cost of model training by an order of magnitude.

It is worth mentioning that Musk mentioned that the Dojo supercomputer may become a service model that can be sold externally, similar to Amazon’s AWS. He stated in a financial call that Dojo is a long-term project, and the return on investment is huge, with a long-term value of potentially hundreds of billions of dollars.

Of course, at a more distant level, what Musk is more persistent and believes in is the realization of autonomous driving and the business model innovation that comes with it.

He stated that FSD is facing a tricky pricing issue because the value of autonomous vehicles is huge. To some extent, the current price of FSD is the option value of autonomous vehicles. Those who are using the FSD Beta can feel that the improvements in autonomous driving are very significant and the trend is clearly moving towards full autonomous driving.

Regarding the next generation of cars, Musk said:

“We are developing the next generation of cars, but now is not the time to discuss product details. We internally call it Robotaxi. However, all vehicles equipped with HW3.0 (most of the vehicles we sell) will achieve full autonomous driving, including Model 3 and Model Y, which can both be Robotaxi— as far as I know, all of our current hardware is capable of full autonomous driving.”

For this reason, Musk even talked about Tesla being able to sell cars at “zero profit” during the conference call.

He said:

“Tesla is in a unique and powerful strategic position. Because we are the only company that produces cars from a technological perspective — we can even achieve zero-profit sales now, and then generate huge economic benefits through autonomous driving in the future, which others cannot do.”“`

I am not sure how many people will understand the profundity of what I just said, but it is incredibly important.

However, Musk also emphasizes that no matter what pricing strategy Tesla takes, it is not intended to attack competitors. He said:

Our pricing behavior is not intentionally weakening our competitors. We are just considering whether users like it, how to make the product better, how to improve the service, and so on.

In fact, we have this unique strategic advantage. We are producing a car: with the support of autonomous driving, the asset obtained by users after purchasing it will be much higher in value in the future – so technologically speaking, selling it at zero profit is possible.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.