Author: Dayan

On March 1, NIO disclosed its performance for the fourth quarter and the full year of 2022.

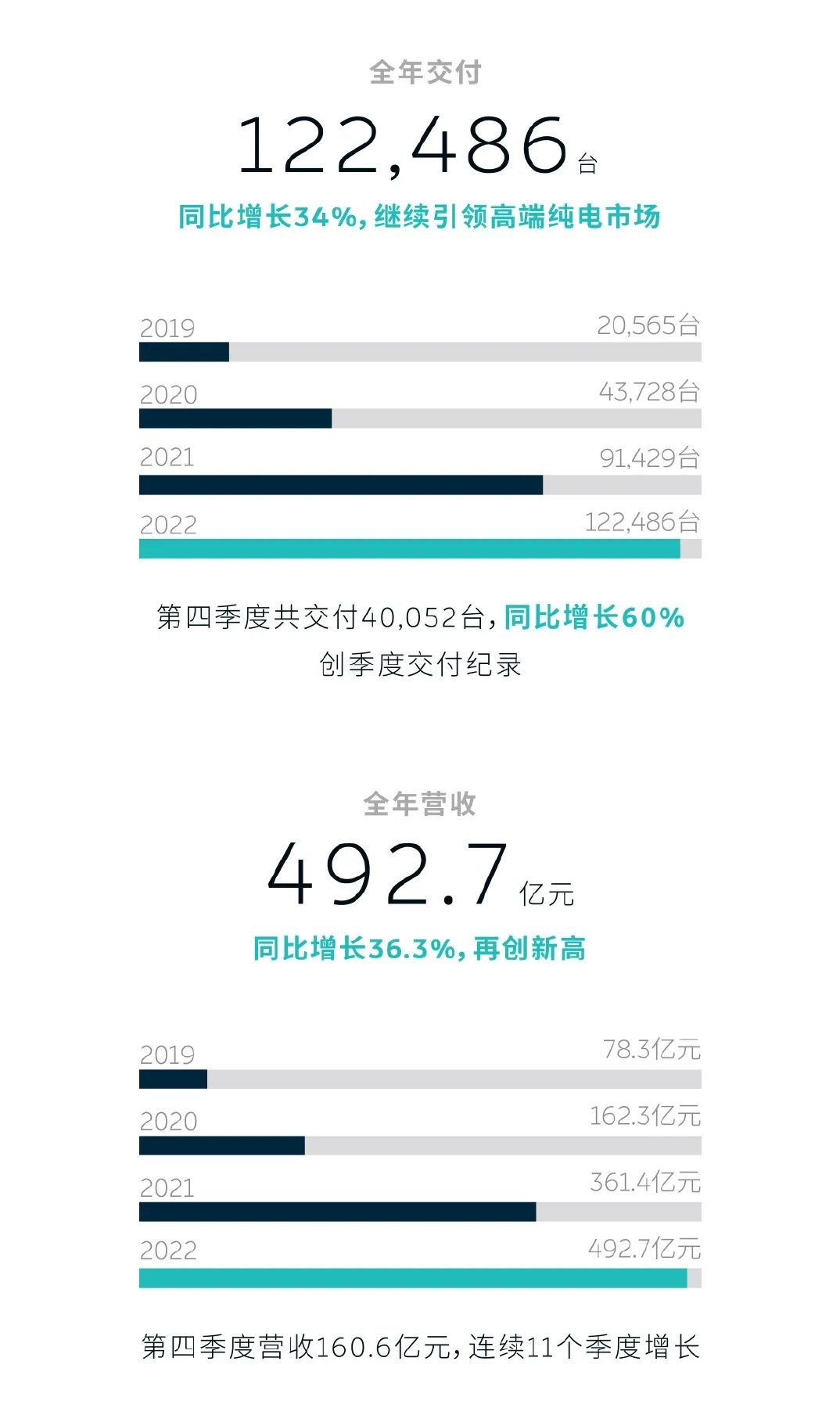

In 2022, NIO delivered a total of 122,486 new vehicles, a year-on-year increase of 34%. The revenue growth rate also kept pace with the sales growth rate. NIO’s total revenue reached 49.2686 billion yuan last year, a year-on-year increase of 36.3%. However, unlike the growth in sales and revenue, NIO’s net loss attributable to shareholders in the full year of last year was 14.5594 billion yuan, an increase of 37.7% compared with the same period of the previous year.

Does NIO need to slow down?

NIO’s loss in 2022 reached 14.5 billion yuan. Despite the continuously expanding loss, Li Bin and NIO did not slow down their pace. In addition to the routine launch of new models and updates to existing ones, NIO also has great ambitions in the overall layout:

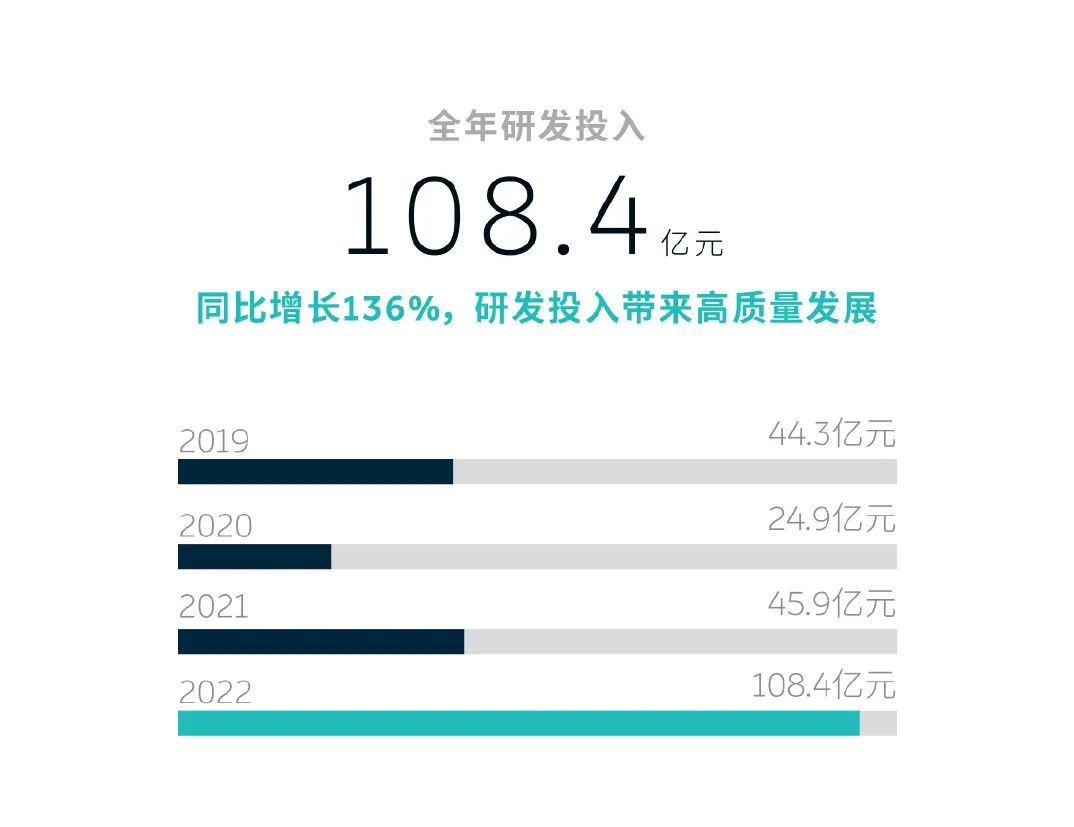

Continuous high R&D expenses

In terms of R&D, NIO has always maintained a higher level of investment. In 2022, NIO’s total R&D expenditure reached as high as 10.84 billion yuan for the entire year, a year-on-year increase of 136%. Li Bin has also stated that NIO’s future expenditure on R&D will remain at 3 billion yuan per quarter.

After all, whether it is a brand new vehicle platform, three-electric system, intelligent cockpit, or autonomous driving, they all require continuous R&D investment. Only by keeping investment at a high level can NIO ensure that it does not fall behind in forward-looking technology.

Second brand yet to come, third brand emerges

NIO’s second brand has been officially confirmed, but before it is officially launched, NIO’s third brand “Firefly” has already been revealed on various channels. From a technical point of view, it is not too difficult for NIO to create a lower-positioned brand.However, the challenges faced by NIO in improving brand awareness, expanding sales channels and network, and controlling overall vehicle costs are not insignificant.

As a seasoned veteran in the business world, Li Bin knows that NIO’s brand positioning is its most valuable asset. If NIO were to allow its brand to be diluted by lower-end vehicle models, although it may lead to short-term sales growth, it would ultimately cause significant harm to NIO’s brand value in the long run. Instead of that, it would be better to create a completely new sub-brand. However, NIO has to establish two sub-brands simultaneously, and it goes without saying that a substantial investment is required. In addition to investing a significant amount of money, NIO also needs to balance its own services and its golden signboards while not harming its loyal customer’s benefits.

Adding 1000 charging piles

As a fast way to replenish energy, battery swapping can effectively solve users’ mileage anxiety. NIO is about to start mass production and deployment of its latest third-generation battery swap station. Therefore, NIO plans to add an additional 1000 battery swap stations by 2023. NIO will have a total of 2300 battery swap stations built by the end of 2023.

However, the battery swapping business will also bring a considerable burden to NIO. On the one hand, battery swapping is a heavy asset operating mode for manufacturers. The cost of a large number of batteries needs to be gradually recovered over the next six to seven years. On the other hand, the construction and operation of battery swapping stations are all significant capital expenditures. Without accurate calculations, it is inevitable for these stations to suffer losses in the initial period. Thus, speeding up the battery swapping sector’s layout is also a significant challenge for NIO’s operational capacity.

Delving deeper into the European market

The difficulty that NIO faces in operating in an entirely new overseas market can be imagined. In the initial stage, a considerable amount of resources is required, regardless of brand appeal or customer experience services, before any results can be achieved.Therefore, in the short term, the European market will also be a burden for NIO. However, the good news is that the European Parliament has already passed a comprehensive ban on the sale of fuel-powered cars by 2035.

For NIO, this is a good opportunity. If they can bring their advanced ideas on battery swap mode and customer operation to the European market and gain recognition from European customers, then NIO’s prospects in Europe are limitless.

As of the end of 2022, NIO’s cash reserve was 45.5 billion yuan. This amount is not small, but considering NIO’s investment everywhere, the 45.5 billion yuan cash reserve actually needs to be carefully managed. Currently, NIO does need to quickly reduce the amount of losses and build a solid foundation for the sustainable operation of the company. On the other hand, NIO also needs to seize investment opportunities to ensure their competitive position in technology and even in the entire system.

20% Gross Margin Has the Potential to Return

Nowadays, the gross margin of new energy vehicle companies is very much in focus. As we all know, new energy vehicle companies have not yet achieved profitability. A higher gross margin not only means that they have the capital to engage in price wars in the future, but also helps them achieve comprehensive profitability as soon as possible.

In 2022, NIO’s gross margin performance was not outstanding. In the fourth quarter of 2022, under the influence of related inventory provisions, accelerated depreciation of production facilities, and losses from purchasing commitments related to ES8, ES6, and EC6 models, NIO’s gross margin was only 6.8%. Compared with the fourth quarter of 2021, which was 20.9%, it can be said that it has declined significantly. However, this gross margin level is clearly abnormal and has been affected by external factors.

In 2023, the global lithium ore price is expected to drop significantly, which would directly reflect on the gross profit margin per vehicle for electric vehicle companies such as NIO. In the battery sector, NIO also has big moves. Previously, NIO’s battery business was mainly supplied by CATL. Starting from 2023, NIO’s second battery supplier, CITIC Guoan, will begin delivery. Having two battery suppliers means that NIO has a greater say in bargaining for better battery prices.

In 2023, the global lithium ore price is expected to drop significantly, which would directly reflect on the gross profit margin per vehicle for electric vehicle companies such as NIO. In the battery sector, NIO also has big moves. Previously, NIO’s battery business was mainly supplied by CATL. Starting from 2023, NIO’s second battery supplier, CITIC Guoan, will begin delivery. Having two battery suppliers means that NIO has a greater say in bargaining for better battery prices.

Beyond batteries, the full launch of NIO’s NT2.0 model will also play a considerable role in enhancing the gross profit margin. According to NIO’s plan, with the decline in battery and chip prices and the launch of a new vehicle model in 2023, NIO’s gross profit margin is expected to return to the level of 18% to 20%.

Will NIO lower its prices?

Tesla’s large-scale price cuts at the beginning of the year had a significant impact on the entire Chinese new energy vehicle industry, especially the electric vehicle market. In comparison with Tesla, most domestic automakers have relatively low gross profit margins and therefore do not have the confidence and strength to engage in price wars with Tesla. Tesla’s price cut in January did indeed drive a considerable amount of terminal demand.

Tesla’s price cut has led to follow-ups from manufacturers, such as XPeng, WM Motor, and BYD. Although NIO appeared to stand outside this price war, it sold its inventory vehicles as display vehicles, resulting in significant discounts that garnered much media attention.

Nevertheless, during the financial report meeting, NIO reiterated its commitment to a stable pricing strategy for the NIO brand and does not have a plan to lower prices through downgrading. For NIO, the emergence of the second and third brands means that a NIO price cut would undoubtedly greatly compress the living space of the two brands yet to be born.In addition, as mentioned above, Li Bin and NIO are well aware of the value of the NIO brand, so NIO will not easily open the door to price cuts. As long as they persist a little longer, there will be no motivation for the low-cost NIO models to reduce their prices.

Summary

NIO has expanded aggressively in various areas, which requires large amounts of capital investment. However, NIO faces increasing pressure from the slowdown in the growth of new energy vehicles in China and the pricing competition among various brands.

While it is necessary to consider NIO’s series of layouts in technology research and development, energy supplement, and sub-brands, it is also essential for NIO to carry these burdens and maximize investment efficiency while sprinting to success. Only in this way can NIO face challenges and drift smoothly around the corners.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.