Annual Performance Review of China’s Top 10 Automakers

Author: Tao Yanyan

(1) NIO, Adhering to Long-termism;

(2) Xpeng, Technology-oriented;

(3) Leading in the Segmented Markets, Li Auto;

(4) Zero Run, Self-developed Worldwide;

(5) The Best-selling New Force in 2022, Hozon Auto;

(6) GAC, Which Divided and Transitioned Smoothly to Pure Electric;

(7) BYD, Focusing on Mainstream Demands.

In the last article, we mentioned that BYD has currently put great pressure on Geely and Great Wall. In this article, we will review the situation of Great Wall, which everyone cares about.

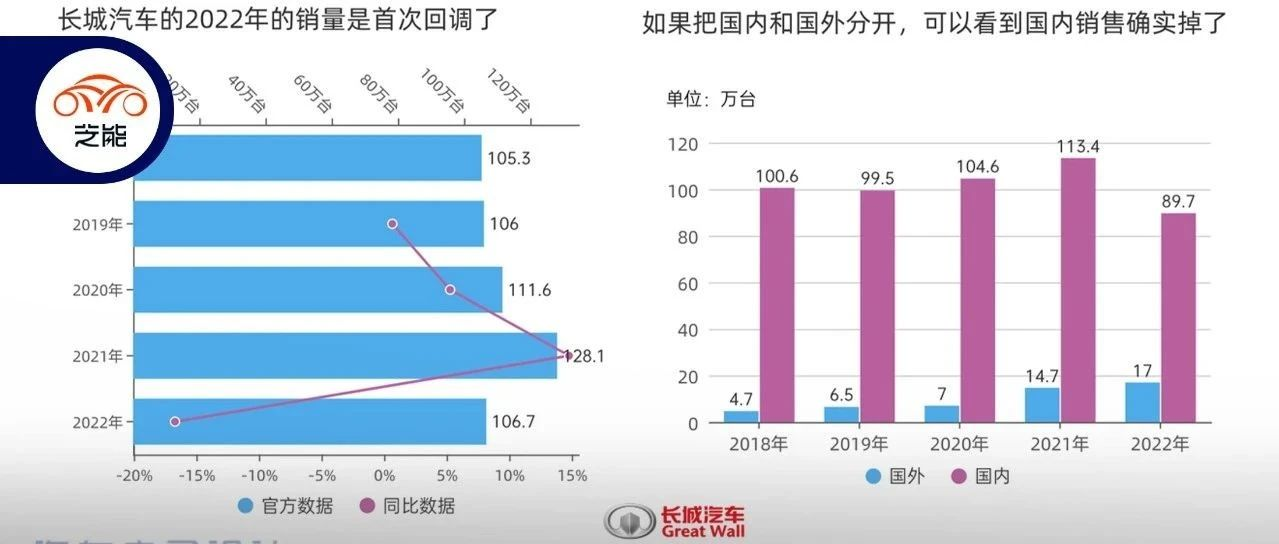

◎ In 2022, Great Wall sold 1,067,523 vehicles, with cumulative overseas sales of 173,180 vehicles, an increase of 21.28% year-on-year.

◎ The total operating revenue of Great Wall in 2022 was 137.351 billion yuan, an increase of 0.69% year-on-year, and the net profit was 8.279 billion yuan, an increase of 23.09% year-on-year.

Looking at the overseas sales, it has expanded from 47,000 in 2018 to 170,000 in 2022. Domestic sales decreased from 1.006 million in 2018 to 897,000, especially the decline rate in domestic sales from 2021 to 2022 was relatively fast.

Overall, under the impact of chip shortage and market changes, Great Wall Motors adopted a mode of maintaining pricing and profit, which had a certain effect from the results perspective. However, it is facing deep-seated problems. With BYD’s use of DM-i to enter the fuel vehicle market, it has not only taken away the share of joint venture automakers, but also had a significant impact on SUV products such as Haval. Great Wall’s transformation into new energy vehicles in 2022 is unsatisfactory.

Great Wall’s brand strategy

In 2022, Great Wall Motors’ electrification of its Haval brand was challenged, and plug-in hybrid SUVs became the most popular products under fluctuating oil prices.

◎Haval: 616,550 units.

◎WEY: 3,381 units.

◎ORA: 103,996 units.

◎Tank: 123,881 units, an increase of 46.45% YoY.

The problem that Great Wall is currently facing is how to plan the market structure of specific models. We can see some clues from the terminal data.

Looking at the entire vehicle model spectrum (Figure 3), it is clear that the Haval SUV series has increased its unit price and segmented market premiums to the Tank series. The biggest problem now is the sustainable development of ORA and the electrification of Haval itself.

According to the domestic insurance data, in 2022:

◎M6 and H6S derived from Haval H6: 316,700 units.

◎Haval big dog: 89,500 units.

◎Haval divine beast: 41,000 units.

◎Haval red rabbit: 25,000 units.

In 2022, the sales of the WEY series were under great pressure, while the Tank series was a relatively bright spot. It is also difficult to further expand with the continuous increase in oil prices and the penetration rate of new energy.

The Development of New Energy at Great Wall: Achievements and Prospects

Euler’s product positioning is as follows, from abandoning black cat and white cat, then transitioning to good cat, lightning cat and ballet cat. Great Wall’s exploration has achieved some results, but it has also confined itself with the label of women’s cars. In this price range, tags and cost-effectiveness go hand in hand, and as the prices increase, the competitiveness of Euler’s models does face some challenges.

If we review the year 2022, removing the discontinued black cat and white cat products, good cat accounted for the vast majority, while the lightning cat and ballet cat both need a process of entry.

The problem that Great Wall needs to solve is how to implement the transition from the release of Lemon Hybrid to the next step. Whether it is the oscillation between HEV and PHEV, it is the root cause of the problem. Therefore, starting from the later period of 2022, there will be adjustments in the execution strategy, and the focus will be on low fuel consumption SUVs. In fact, this is a long-term strategy for the sustained development of the company. In the insight that the SUV market is quickly turning towards hybridization, Great Wall is limited to minor moves with the WEY brand, which has delayed the overall transition of Haval. With the adjustments made in the second half of last year, Haval’s hybridization process has accelerated this year.

Summary: We believe that Great Wall is a company worth paying attention to and tracking. In the past few years, it has developed a series of component systems including Haomo, Xiandou, and Fhcn energy in the technical and incubation fields. Great Wall has been actively exploring and trying. However, how can future automotive companies survive? Is vertical integration like BYD the only correct answer? We need to do some in-depth tracking and thinking.

Summary: We believe that Great Wall is a company worth paying attention to and tracking. In the past few years, it has developed a series of component systems including Haomo, Xiandou, and Fhcn energy in the technical and incubation fields. Great Wall has been actively exploring and trying. However, how can future automotive companies survive? Is vertical integration like BYD the only correct answer? We need to do some in-depth tracking and thinking.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.