Writing by Roomy

Edited by Zhou Changxian

Originally, these were two unrelated things. One is the new forces seeking more sales by reducing prices, and the other is whether the exploration of the transformation of traditional luxury brands can be more stable.

In my opinion, new forces such as Tesla, XPeng, and NIO, which directly impact the market, are not yet the first-line luxury brands represented by Mercedes-Benz and BMW, but the second-line luxury brands with a large overlap in price range. This can be seen from the closing sales volume of the latter in 2022. Of course, NIO would not agree with this view, as it is already fighting against BBA in some markets.

Li Bin, the head of NIO, said previously, “We can’t simply look at the data. We need to see how many cities are lost by fuel-burning cars and who they belong to?” Some trends can also be seen from the data shared by NIO, where new energy vehicles and traditional fuel-burning vehicles have begun to confront each other in the high-end market.

The first line of defense that should be more worried about this head-on confrontation is second-line luxury brands, mainly represented by Lexus and Volvo. In fact, Lexus has already been regarded by NIO as a target to be surpassed in sales volume in 2023. In other words, Li Bin believes that this trend has mercilessly blown onto many traditional luxury brands.

As representatives of the deep-water area being impacted, the perception of Volvo, the representative of second-line luxury brands, is very clear.

Qin Peiji, the President of Volvo China Sales Company, said at the 2022 year-end performance communication meeting, “Although it says ‘Volvo is doing well in 2022’ in the PPT, it’s actually just ‘alive.’ I think ‘alive and well’ is more appropriate to describe it.”

What he said about “being alive and well” mainly means two things: “Volvo’s market share has increased slightly” and “the confidence of the dealership system is still there,” implying that even in a year of fluctuations like 2022, Volvo can still maintain a steady pace.

Of course, being alive is not Volvo’s main task. The long-term goal is to build a “Volvo of electrification.”

Back to the old question again, “What is the difficulty of transformation?” After exploring for several years, Volvo has gradually found some answers.

“The popular saying now is that we still hope to speak the truth, we don’t tell lies, and we should tell the truth,” Qin Peiji said. In my opinion, telling the truth is the beginning of a complete transformation for traditional car companies.

Living is good

Why connect Tesla’s price reduction with Volvo’s transformation and transformation?

In fact, as Qin Peiji said, “traditional and new forces should not be separated, it is just a circle. The market has changed, and whoever turns around quickly”. It is all about the same thing. The big waves washed away the stable brand framework for so many years. Some brands were slowly eliminated, and some brands turned around like elephants.

Whoever turns around quickly and who has a perfect system, who will win in the future. “Waiting for all brands to use all their power, it will definitely be washed more severely in 2023.” In Qin Peiji’s view, without doing the job well, any car company will face an impact.

The new forces that once caused huge shocks to traditional fuel vehicles have encountered more and more “systematic problems” when they have crossed the threshold of selling more than two hundred thousand or three hundred thousand vehicles, and they have begun to mention “systematic strength” more frequently.

On the first day of this year, Li Bin listed the areas that need to be optimized in an internal letter, covering sales, supply chains, services, etc., including “the quality of software and hardware before and after the launch of new cars has affected product reputation and reputation. The test car accident and data theft events exposed the need for internal management to be strengthened” … It can be foreseen that Li Bin may make major adjustments to NIO’s system.

After the listing of XPeng G9, a variety of problems encountered by XPeng founder He XPeng made him distressed. This reflects a fundamental problem, that the new forces lack experience in the operation of the automotive industry system and need more experienced automotive professionals to plan and operate product matrices.

Recently, it was reported that Wang Fengying, the former general manager of Great Wall Motors, will take over as CEO of XPeng Motors. Currently, XPeng has not admitted it internally, only saying that “it will resolutely continue to promote organizational changes” and “continue to open and welcome outstanding talents in the industry to join.”

It is unknown whether Wang Fengying’s joining of XPeng’s message is true or not, but Tesla’s price reduction has really caused many waves and speculation. At the beginning of the year, Tesla models experienced large price reductions ranging from 6% to 13.5%, of which the Model 3 was reduced by as much as RMB 36,000.

Tesla’s significant price reduction was due to the expanding production and sales gap. In the first quarter of last year, Tesla’s production and sales gap was 5,000 vehicles, which expanded to 34,000 vehicles in the fourth quarter. In other words, the order volume is drying up rapidly. In November, there were still 25,000 orders backlog, but in the first week of December, there were less than 6,000 orders.# This Marketing Crisis in the Automobile Industry Makes Musk Uneasy

In order to recover from the sales shortfall, Musk had to invest heavily and reduce prices. During a public event, Musk stated, “If we want to maintain sales growth, we have to reduce prices. Otherwise, the growth rate will slow down. This is a choice.” The media has written a headline for Tesla’s price drop, “Tesla lowers prices just to survive.”

Yes, “just to survive” is once again mentioned.

The major new automakers all struggled to get through 2022. Jim Chenevy said, “Everyone is asking if the 2022 market is good. Actually, it’s not good at all. Although there are policies such as purchase tax, the overall market is still bad, and the overall market volume has decreased by 8\%.”

He referred to the market capacity of luxury fuel vehicles, which fell from the expected 3 million to 2.5 million. The luxury market, once known as “the peaceful years here,” is now a glimpse of the grim reality, and the market is indeed bad.

In this bad market, there is also the impact of electrification. Jim Chenevy is pleased to announce that Volvo had a sales volume of 162,000 in 2022, an increase in market share of 0.1\% reaching 6.4\%.

“Why don’t we panic when the market fluctuates? It’s because it’s always been about the framework.” Jim Chenevy believes that “a system is a framework that, when hit by the market’s big waves, should not be blown away.”

System strength, like the barrel effect, cannot have any shortfalls. And mature system strength, including that of traditional automakers such as Volvo, is an advantage. This is also an important issue in the restructuring of new automakers. For example, what Li Bin has been doing in recent years is paving the way for NIO.

“A structure is a framework. When running, if someone else’s framework falls apart on three of its four sides, but yours is still there, then yours is the winner of the long run. That’s how I see it. Traditional companies should also strengthen their communication, learn when necessary, and revolutionize themselves to change some of their shortcomings.”

Jim Chenevy is very clear about what needs to be done.

Strengthening the “Castle Wall” of Safety

Jim Chenevy knows what he wants, and he’s not satisfied.

Even though Volvo has maintained a steady sales volume, reality cannot be ignored. He joked, “If the world doesn’t change, this system can continue to operate, and I can comfortably be the CEO of a sales company.”However, the reality is different.

All traditional enterprises are facing the process of accelerating transformation. “We want to recreate an electrified Volvo.” Qin Peiji understands that traditional car companies have always faced a very realistic problem: how to transform in the era of new energy?

He gave an example.

“Two years ago, someone used Apple and Nokia as examples. At that time, I said it was absolutely impossible, because if Nokia knew that the trend behind was Apple, it could not have died. All traditional host factories know that electrification is a trend, and there cannot be such a dramatic change as in the mobile phone industry.”

Although the market of traditional car companies has been squeezed, it will never become the next Nokia. The premise of not becoming is that they must act. “They must jump to that blue ocean market and find that it is also a red ocean, where there is a large group of people swimming, but this is reality.”

A bunch of top car companies have jumped in one after another. Qin Peiji believes that the reason why they have not succeeded yet is that they have not figured out what kind of people are for one gas car and one electric car respectively. What are the different characteristics of the audience?

Then, as a member of the traditional car company’s transformation camp, does Volvo understand?

When making cars for the first time, whether it’s Tesla or NIO, they rely on a single prominent point to cut in and quickly capture users. NIO is committed to services, XPeng is committed to autonomous driving, Ideal is committed to range anxiety…With various strategies, they have suddenly disrupted the traditional car companies’ comfort zone.

Is Volvo panicked? To be honest, during the two or three years of exploration and emergency electrification transformation, including Volkswagen, Toyota, Mercedes-Benz, and BMW, they were all panicked. Volvo is no exception.

However, after tossing for several years, many traditional car companies have realized one thing, “From the perspective of the underlying logic, why do you want to buy a car?” Qin Peiji further asked, what is the reason for buying a luxury car in the era of gasoline cars? What is the reason for buying a luxury car in the era of electrification?

Nowadays, the term luxury is very elusive. What is luxury? It is the reason for purchasing in the minds of consumers, but consumers may have more than ten reasons for purchase. Is it appearance? Is it comfort? Is it control? Is it safety? A lot of elements, which one do consumers really care about?

Volvo’s research found that the density of the word “safety” is increasing. In the era of electrification, the demand for safety is unprecedentedly high. Mobile phones can be blacked out, but electric vehicles can’t because it is a matter of life and death.Qin Peiji believes that the sense of security guaranteed by the system is one of the major advantages of the Volvo brand.

It is well known that safety is Volvo’s brand label. To the extent that in the era of fuel-powered cars, people often wondered whether a luxury brand with “safety” as its label had an insufficiently clear brand style.

Qin Peiji also frankly stated that “many years ago when making luxury cars, Volvo did not have much advantage because safety requirements were low on the list of reasons to purchase a luxury car.”

Times have indeed changed. According to internal research data from Volvo CRM, the weight of Volvo’s safety has been continuously rising in the past three years, “this is what we hope to achieve, to strengthen the ‘protective moat’ of safety.”

There is also a question that needs answering. Why can’t fuel-powered car companies do well in electrification? Some people believe that the inheritance of brand assets is a huge problem, and traditional car companies’ brand assets cannot be inherited. But Qin Peiji does not see it that way. “We hope to challenge this pattern, and firmly believe that brand assets can be inherited.”

In the era of fuel-powered cars, Volvo had done a lot of groundwork, but consumer recognition was not high. In the era of electrification, safety is seen as the most important element outside of intelligent technology. BYD founder Wang Chuanfu even said, “safety is always BYD’s highest pursuit.”

As the saying goes, if others have it, we need to have it; if others have it, we need to do it better. In an era where all brands are talking about safety, Volvo is seeking a better fit between safety, luxury, and electrification.

Volvo has been promoting safety for 95 years, and the brand label is now being incorporated into the era of electrification. “The brand is so important to a company.” Qin Peiji is pleased that consumers see brand + safety as the primary factor when purchasing a Volvo.

“The success or failure of a brand does not depend on a particular technical configuration, but on the brand’s attitude towards technology.” Behind the issue of “sense of security” in the era of electrification is, in fact, the reshaping of the value of automotive brands. Volvo is well aware of what value reshaping means.

“In a market downturn and price war, consumers always put you on their list, this is what we have always called the ‘head kill’.” Qin Peiji said.

The Four Tasks and Challenges

With the system providing support and safeguarding, and with safety as its brand label, is Volvo’s electrification transformation worry-free?Qin Peiji knows it isn’t easy.

Because the demands of consumers are real and cannot be satisfied just by slogans. Moreover, the biggest difference between the Chinese market and the global market is that no market has such a high frequency of new car iterations, and the competition is so fierce that the word “involution” is insufficient to describe it.

The first step that Volvo needs to take in the era of electrification is to understand consumers. But Qin Peiji also knows that traditional carmakers like Volvo cannot do “fan service” like new carmakers.

“Traditional companies cannot do fan service like new carmakers. Whether a company is responsible to its employees, shareholders, or customers is not a matter of right or wrong, but a matter of balance.”

In the balancing process, Qin Peiji said the word “tossing,” Volvo needs to toss.

He believes that the impact of new carmakers already exists, which is reasonable. An industry that has not changed for 20 years needs a revolution. In such a revolution, traditional carmakers need to learn to show enough respect for C-end customers. “We need to learn from new carmakers how to serve customers well.”

For example, problems such as products being off-track, poor digital experience, complex online shopping processes, insufficient consumer touchpoints, and weaker purchase funnels compared to new carmakers need to be addressed. “Traditional luxury brands should be aware of this instead of believing that their inherent system will always succeed.”

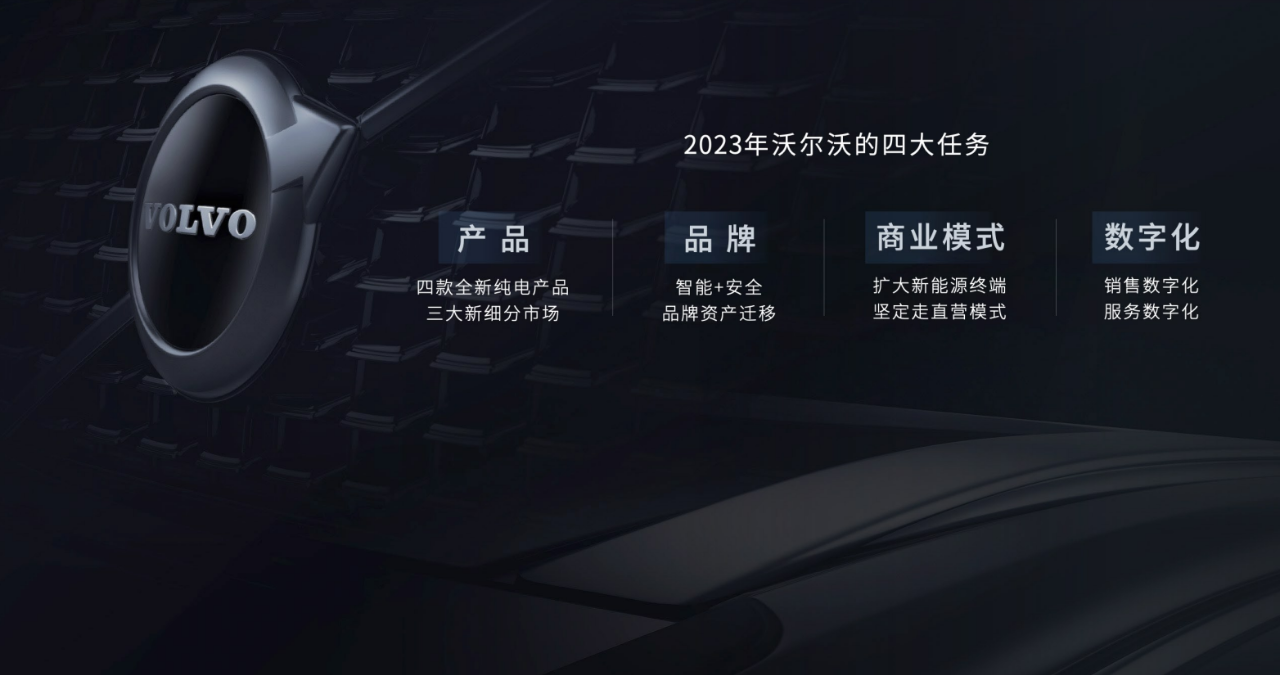

Qin Peiji said that in the three-year exploration of electrification transformation, Volvo has encountered many pitfalls. Now, it has some experience in crossing the river by feeling the stones. At the communication meeting, he shared Volvo’s four tasks for 2023:

The first is products, whether they suit Chinese consumers’ tastes, which is challenging. In fact, whether consumers are always right or can easily be brainwashed is an eternal topic.

Qin Peiji complained that this exploration process was quite painful. Because the consumers have already been educated by new carmakers and are not the same as before. However, some principles remain unchanged, such as anti-labeling, anti-face, and safety.

At the end of 2022, Volvo launched the new pure electric flagship SUV model, Volvo EX90. This is the first electrified model equipped with a laser radar in the traditional luxury camp, “almost all configurations prepared for electrification are implemented in this car.” In 2023, Volvo will release four new pure electric models, further accelerating its electrification transformation.

“The launch of multiple electrified products is a huge challenge to our sales system, but we believe that our strength lies in cultivating the segmented market,” said Håkan Samuelsson. He believes that the reliability, durability, and stability of products made by traditional enterprises using their strong systems require time for verification.

Secondly, branding is something that Volvo has always insisted on. Why can Volvo survive the difficult year of 2022? It is because they have invested a lot of effort into branding, and the brand label can be recognized by consumers.

“The product must be really safe, far beyond that of others, to be able to stand firm in the field of safety,” said Håkan Samuelsson. He believes that a brand cannot truly stand firm in a certain field without 10-20 years of operation, and Volvo’s emphasis on safety for the past 95 years has already been firmly rooted in consumers’ minds.

Thirdly, it is about the business model. This is more about channel issues. For example, should supermarket stores be opened, and should the dealer model exist?

“In the process of transformation, traditional enterprises must first satisfy the customer experience, and then consider the dealers. We cannot abandon the dealers to work alone.” Håkan Samuelsson believes that Volvo must have strong management output capabilities and optimize customer experience with dealers, as well as ensuring the profitability of dealers opening city center stores. “This is what we have always insisted on.”

It is reported that by 2022, Volvo has already laid out over 25 city center stores and is expected to add 29 more in 2023.

Finally, it is digitalization, which Volvo is learning from new car-making forces.

“The reconstruction of digital business processes is a very complex system,” Håkan Samuelsson admits. As a traditional automobile manufacturer, Volvo was once very far from its customers. Moreover, without the internet gene, Volvo has truly spent a lot of internal resources in developing digital systems.

He believes that this is a very difficult process. “As long as one thing is not done well, the whole system may collapse and this system may not be able to run in two years.”

Qin Peiji said that Volvo’s four major tasks for 2023 are also four major challenges. “Of these four things, only the brand has really good experience. For the other three things, we are only halfway there, and we don’t know what difficulties we will encounter when we continue.”

However, he knows full well that if they don’t act, there will never be another cycle.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.