China’s Auto Industry in 2022: A Review of New Energy Conversion

Author: Zhu Yulong

The main purpose of this article is to summarize and sort out the rapid conversion of China’s auto industry to new energy sources in 2022, with each year being a predictive time point. Of course, predicting 2023 will involve more realistic factors, such as external factors (subsidy decline, vehicle prices, B-end vehicle replacement ratio, oil prices, and local consumption coupons) and internal factors (automaker cost structures, development plans, and new energy vehicle sales network construction). Based on weekly insurance data, I was able to easily pull out all the data from weeks 1-51 of 2022, starting with a review.

China’s Domestic Brands and their Electrification in 2022

The following chart shows the proportion of electrification, which is the ratio of new energy vehicles to total vehicle sales, on the X axis, and total brand sales on the Y axis, with the size of the bubble representing new energy vehicle sales. This chart reflects the actual transformation process of various automakers to new energy sources.

Looking at sales in the millions level in China’s domestic market, only BYD and Changan have approached a 20% rate of conversion to new energy. Among the joint venture brands with over 500,000 units sold, Volkswagen performs the best, with 17% of new energy vehicles out of 2.12 million total vehicles sold.

The challenge of how joint venture brands can make new energy vehicles is a subject for observation and practice in 2023. Volkswagen has gone through a round of ID series attempts, but now feels a bit like its strength is waning, and in 2023 the focus will be on General Motors. The Japanese automakers have not made any significant changes to the situation in 2023.

Growth from 2021 to 2022

In terms of overall growth rate, the 51 weeks of 2022 saw growth from 2.807 million to 5.067 million, an increase of 80% year-on-year. However, the Matthew effect is still very obvious. BYD’s speed of terminal new energy vehicle sales in the 51 weeks of 2022 soared from 508,000 to 1.528 million (estimated to possibly reach 1.6 million in the end). Here, we bring up the challenges that exist.

◎Tesla: Increased from 305,000 in 2021 to 436,000 in 2022, with growth rate lower than the whole industry. Judging by recent performance, this means that around 300,000 cars have entered a standstill.

◎Wuling: Increased from 384,000 in 2021 to 411,000 in 2022, and is also tracking cars below 50,000 one by one. With the decline of the total market share of gasoline cars, this volume is relatively difficult. However, it is observed that Wuling’s passenger cars, excluding electric vehicles, are only 157,000, and the electrification rate has exceeded 70%, and there is no turning back. Therefore, trying to make hybrid cars is a necessary choice for Wuling.

◎Chery: Chery’s growth mainly includes 90,000 Little Ants and 78,000 QQ ice creams.

◎Aiways, Dongfeng and Geometry: In fact, the weekly report also mentioned that there is a good demand for personal and B-side demands this year. Aion S (8.6 million units in total for S and S Plus) of Aiways, Dongfeng’s Fengshen E70 (65,900 units), and Geometry A (40,000 units).

While observing the rapid growth of these companies, from the perspective of car models, there are currently many overlapping parts. If 2022 is about grabbing the market from gasoline cars, in the process of growth in 2023, it is not only necessary to continue to grab the market from gasoline cars, but it is also easier to grab market share directly from competitors.

Due to the base number in 2022, and the addition of approximately 150,000 new insurance policies per week, the new energy vehicle market share will reach 5.2 million in 2022. No matter how low the growth rate is for low base number companies, the growth rate of the entire new energy vehicle brand is unlikely to be as fast as before.

There is also a very important thing, that is, the situation of gasoline cars. When the chip supply is insufficient, the price of gasoline cars is also limited. To transfer the sales of gasoline cars to new energy vehicles on the right-hand side of the chart, it is necessary for joint venture brands to participate deeply. Many companies still try to squeeze out the residual value of their existing gasoline car models, or even promote the last generation of gasoline cars. At present, it seems difficult for these implementation agencies established under the original gasoline car system to transition to electric cars, as the gasoline car system is in a state of making as much profits as possible.I believe the core issue lies in whether the trend can be sustained. Apart from Tesla and BYD, for current automotive enterprises, maintaining a scale of 100,000-200,000 new energy vehicles sold requires special efforts. The market is tough, and the contribution to corporate profitability is hard to evaluate. Without positive incentives for transition, it will always need to be supported by other means. Currently, the demonstration effect is expected to obtain blood transfusions from the secondary capital market. However, with so many new energy vehicle companies going public, and the wave of market value recovery led by Tesla, the supply is far less than the demand.

Changes Brought by Decline of Gasoline Vehicles

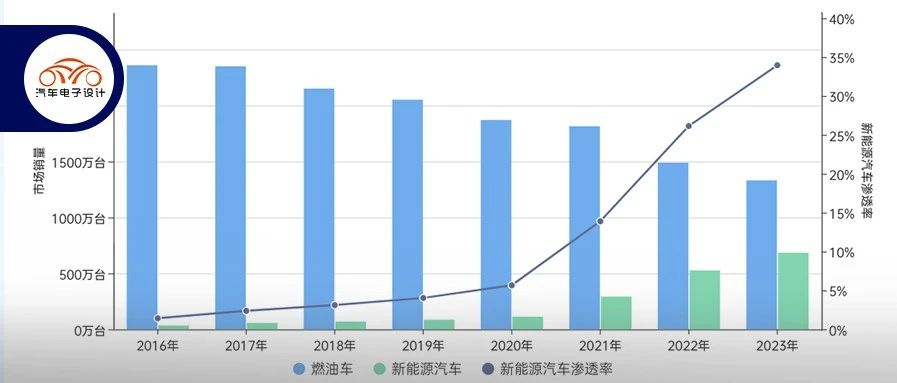

Assuming that next year’s automobile consumption does not increase, 1.5 million gasoline vehicles will continue to be transferred to new energy vehicles. Compared with 2016-2017, China’s gasoline vehicle market has shrunk by 10 million units in about 5-6 years, a decrease of 1.5 million units per year. Especially in 2022, under the conditions of a 5% purchase tax discount, we experienced a reduction of about 3.5 million units.

2022 is a great year for China’s automobile exports. From January to November, automobile companies exported a total of 2.785 million units, a year-on-year increase of 55%. Among them, the export volume of new energy vehicle models was 593,000 units, a growth rate of 100%. For component companies, the biggest support this year is that automobile companies have achieved an export scale of approximately 2.5 million units, offsetting some of the loss in domestic sales. If we exclude exports, the changes brought about by SAIC and Chery’s domestic sales would be even more significant.

This is also a historic change. Behind the appearance of a total reduction of one million in 2022, we must consider the factor that domestic automobile consumption will tend to be weak in the next two years, which is strongly related to our overall domestic consumption.

Reduce the most is still 100,000-150,000 yuan cars aimed at ordinary families, so analyzing and considering the automotive market from 2023-2025, in terms of terminal considerations, we cannot use linear extrapolation assumptions. In the process of structured transition, if we only see the increment, we also need to have sufficient sensitivity to the changes in the consumer market itself.

Reduce the most is still 100,000-150,000 yuan cars aimed at ordinary families, so analyzing and considering the automotive market from 2023-2025, in terms of terminal considerations, we cannot use linear extrapolation assumptions. In the process of structured transition, if we only see the increment, we also need to have sufficient sensitivity to the changes in the consumer market itself.

Summary: Recently I have been thinking about the main focus of 2023, and I think there are some long-term issues that are worth paying attention to and worth discussing with you. In this regard, we are also collaborating with the 42 garage, which is particularly sensitive to observing terminal demand, and hope that we can provide some inspiration to everyone.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.