Author: Zhu Yulong

Recently, we have been sorting out some information on Tesla, mainly referring to Troy Teslike and some information from the United States.

Based on the current data:

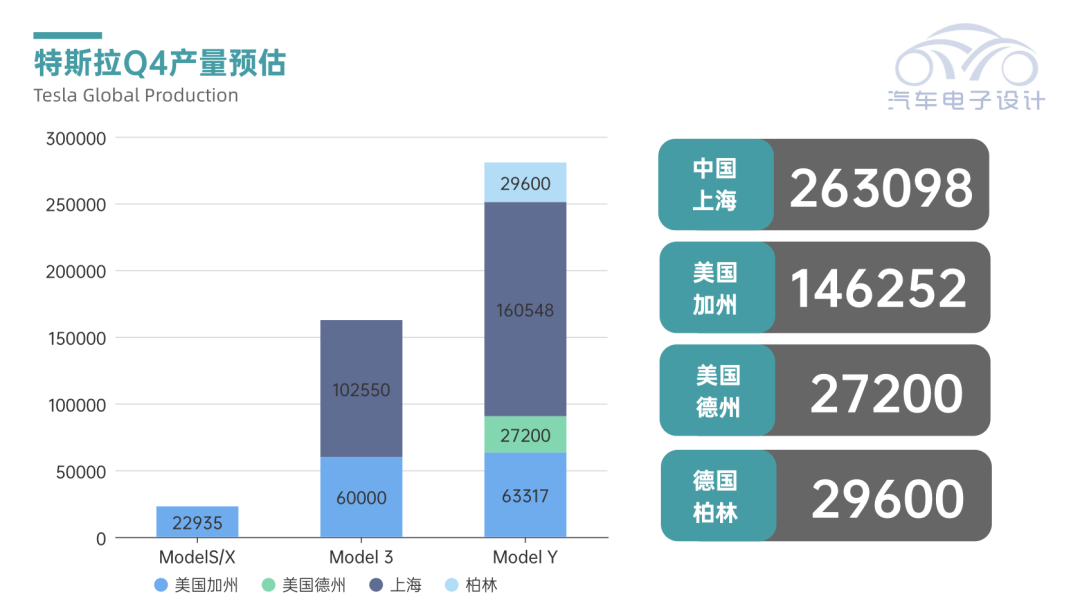

◎Q4 Tesla’s production volume is estimated to be 466,165 units, and the estimated production volume for the whole year of 2022 is 1.396 million units.

◎Q4 Tesla’s delivery estimate is 420,000, of which the main delivery destinations are divided into the United States and Canada (165,000), China (120,000), Europe (101,000), and other regions (33,000).

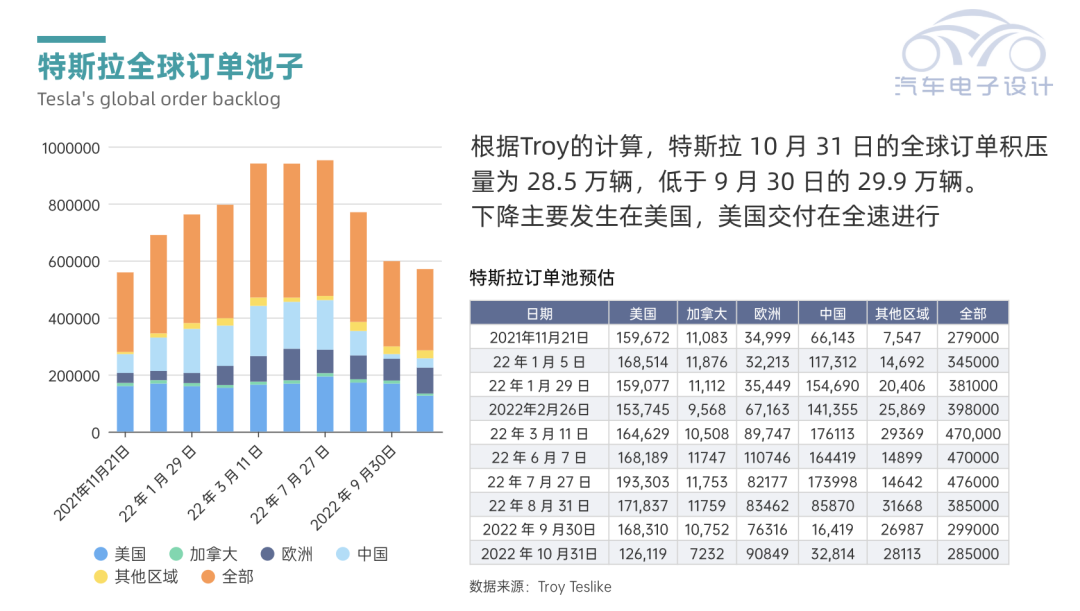

◎Looking at the order backlog, there are currently 285,000 orders worldwide, with China’s estimate at the end of October being 32,000 (after the price reduction, the order volume has increased).

◎From the distribution of battery demand, LFP supply this year has relieved the demand in the United States, but IRA will change the supply of the US market next.

◎Next year, the 4680 and 2170 batteries will be the main supply in the US market.

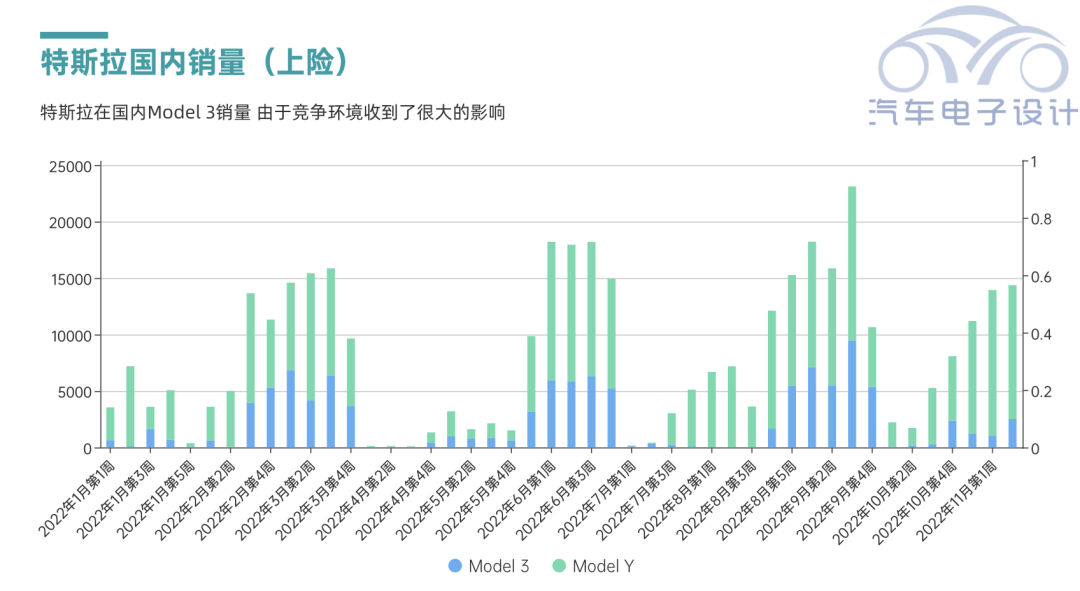

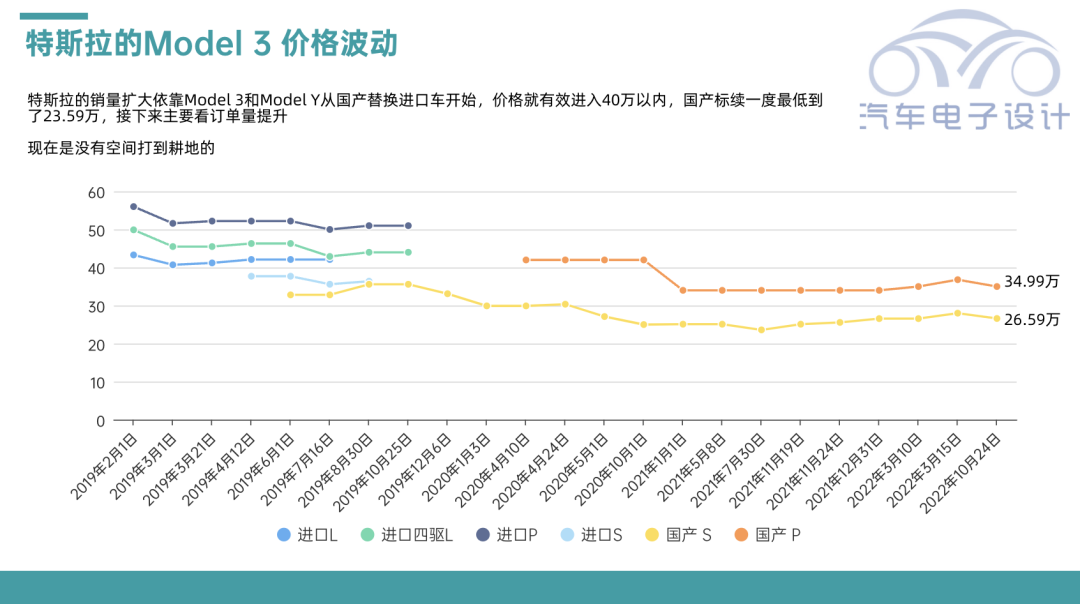

Looking at Tesla’s performance this year, we see that focusing on developing autonomous driving technology has not resulted in direct changes in orders. This order backlog is quickly being consumed in a highly competitive market. In China, the biggest problem is the fluctuation of the data of Model 3.

Order Backlog and Delivery Estimates

According to Troy’s calculations, Tesla’s global backlog of orders on October 31 was 285,000 vehicles, down from 299,000 on September 30. The decline was mainly in the United States, where deliveries are proceeding at full speed.

My understanding is that, in the current situation, the goal is to boost deliveries in December and quickly fulfill orders in first-tier and second-tier cities, which is a daunting task. Traditional methods such as insurance and price reductions may not be effective, so we are discussing special preferential offerings, and we are looking forward to changes in the final price.

Battery Supply

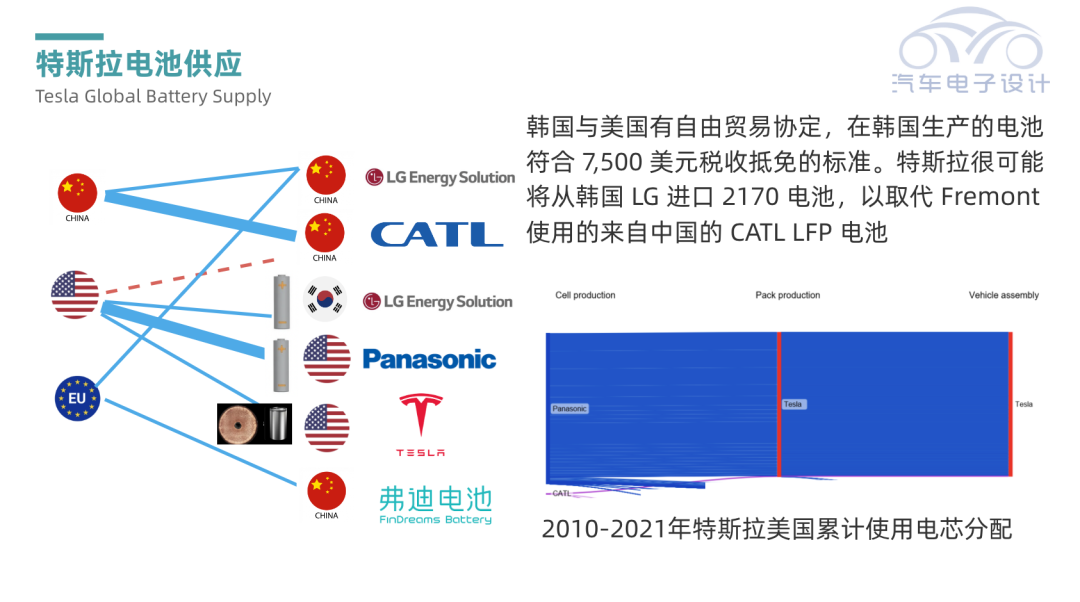

According to Troy’s intelligence, there is a free trade agreement between South Korea and the United States. This means that batteries produced in South Korea meet the standards of a $7,500 tax deduction. Tesla is likely to import 2170 batteries from LG in South Korea to replace the CATL LFP batteries used in Fremont.

As I understand it, Tesla is currently Ningde Times’ largest automotive customer. Nearly 80% of Tesla’s batteries in China are provided by Ningde, with exports accounting for roughly half of the company’s 21.6 GWh of demand for power batteries from January to September.

◎26.2 million vehicles are insured domestically, with 15.75 GWh used.

◎104,000 vehicles are exported, with 5.89 GWh used.

Of course, the LFP batteries exported to the United States are not included in this calculation. Therefore, in 2022, Ningde Times helped Tesla achieve a relatively low price and sufficient supply. Under IRA restrictions, Tesla’s preferred strategy is to procure batteries from South Korea for delivery to the United States, and to use Chinese batteries for Europe, meaning that the United States will only use cylindrical batteries (2170+4680), while China and Europe will adopt a purchasing and comparison strategy.

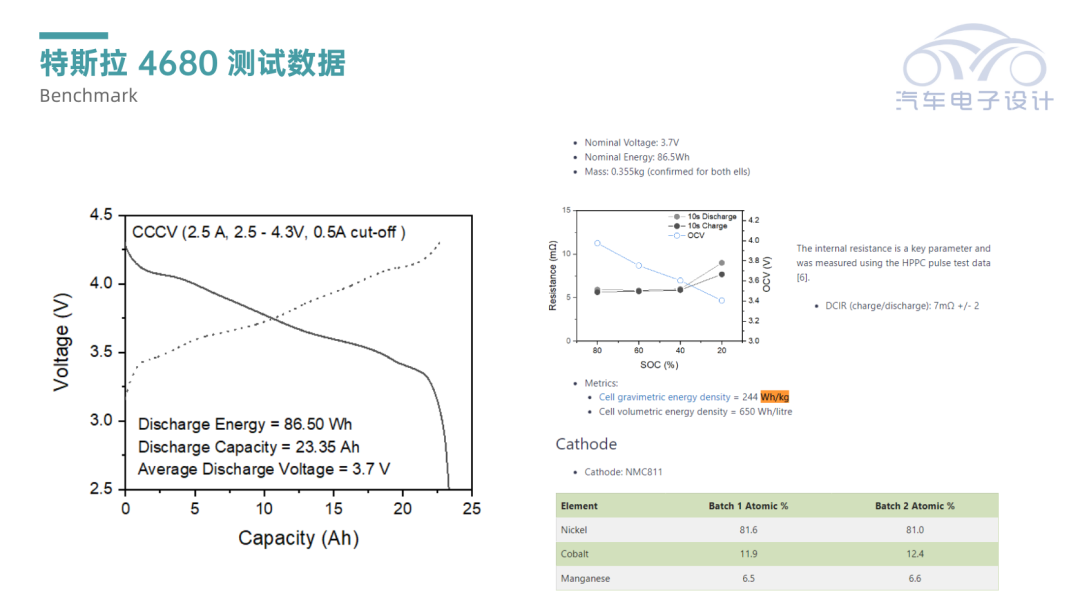

Based on the current situation, the test data for first-generation 4680 cells is far from the expected results of Battery Day in terms of capacity, fast charging speed, energy density, production efficiency, chemical systems, and production processes. The progress of battery development and implementation is truly below expectations, but the IRA prevents Tesla from turning back on this road.I understand that the Tesla 4680 can only crawl slowly in the US within 2 years, and it will not be able to land in Europe until after 2025. It is difficult to compare with Chinese battery companies in China.

Summary: Tesla is the strongest fortress in the global electric vehicle industry, and half of the credit goes to Elon Musk for pumping it up. After no new cars or changes in 2022, I feel that the entire industry is beginning to be in a state of confusion, unable to lead consumers to continue buying.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.