Author: Zhu Yulong

It’s the end of the year again, and we need to prepare for sales forecasts next year. In October, 446,800 units were sold, of which 321,000 were pure electric and 126,000 were plug-in. If we look at the weekly data, as of November 13th, a total of 4.2 million units were sold, estimated to be 120,000-140,000 per week for the remaining 7 weeks. Therefore, the estimated year-end terminal insurance data for 2022 is roughly 5.04-5.18 million.

Note: This data does not include exports of new energy vehicles or vehicles in storage.

Looking at the overall penetration rate, I would like to talk about the breakthroughs in the price range in 2022 and the prospects for 2023:

- In 2022, there will be breakthroughs in the 100,000-150,000 and 150,000-200,000 price ranges. The most obvious example is plug-ins rising from more than 50,000 to 120,000-140,000 per month. As this price range covers three major markets, namely 100,000-150,000, 150,000-200,000, and 200,000-250,000, next year, with the promotion of Changan, Haval, Chery, and Geely, there will be strong substitution capacity.

- There is really no potential for vehicles priced under 100,000, as major companies focus on transitioning to hybrid electric vehicles, and this area is already a transfer payment market, where only 1-2 companies are willing to continue.

- For the Tesla price range of 250,000-350,000, prices will continue to be pushed down next year. In fact, Tesla’s performance this year has been mediocre, waiting for Elon Musk to finish doing Twitter and come back to oversee everything.

- For the 350,000-500,000 price range, it feels a little like the Southern Song Dynasty. Companies can maintain themselves in this relatively high-margin market, but there is no growth rate in the future.

Brutality of Competition

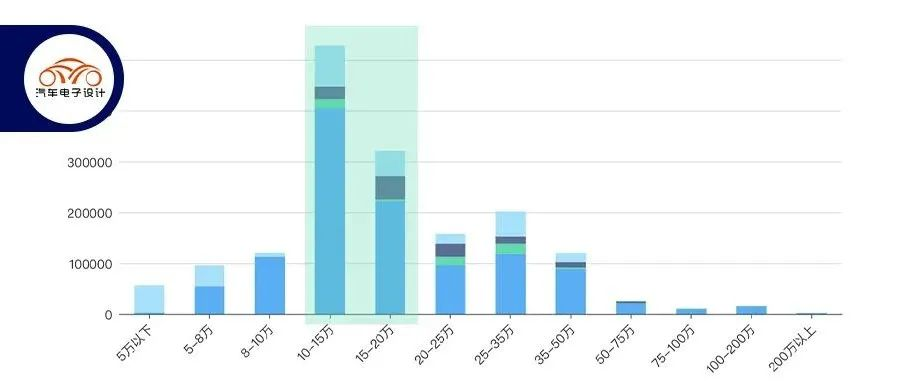

Why is the penetration rate stuck at 30%? It is simple from a logical perspective: Currently, China’s two largest passenger car segments are 100,000-150,000 yuan, accounting for 31.90%, and 150,000-200,000 yuan, accounting for 19.40%, both of which are limited by battery costs. Looking at the next 3 years, it will become increasingly difficult for gasoline-powered cars to make money, but the cost reduction path for new energy vehicles is to make the batteries smaller. From a broad perspective, the penetration rates for HEV, PHEV, and BEV in several price ranges are:

◎ Under 50,000 RMB: 95.33%

◎ 50,000-80,000 RMB: 43.13%

◎ 80,000-100,000 RMB: 6.33%

◎ 100,000-150,000 RMB: 23.28%

◎ 150,000-200,000 RMB: 30.81%

◎ 200,000-250,000 RMB: 39.27%

◎ 250,000-350,000 RMB: 41.48%

◎ 350,000-500,000 RMB: 26.29%

◎ 500,000-750,000 RMB: 20.05%

Our previous growth was driven by the inexpensive A00 cars. In 2022, the electrification rate in all price segments will indeed increase. However, relying solely on pure electric vehicles will be difficult in the future. With nearly 40% penetration in the 200,000-350,000 RMB range, it will be important to consider geography, climate, and different usage scenarios. After a wave of urban market penetration, pure electric vehicles will face challenges in the Northeast, Northwest, and Central regions.

In my personal opinion, this year’s growth still comes from the overall changes in the market (with 31.90% in the 100,000-150,000 RMB range and 19.40% in the 150,000-200,000 RMB range being the main areas of focus in 2023). There are still not many high-penetration low-priced and high-priced cars on the market.

From the standpoint of pure electric and plug-in hybrid vehicles, the current wave of pure electric vehicles is limited due to battery prices, and the emphasis is on low-priced models. Without mastering battery prices and the upstream industry before fully promoting pure electric vehicles, there may be a situation where neither oil cars nor electric vehicles make profits.

In 2022, the market for pure electric vehicles priced below 100,000 RMB has become highly competitive. Despite monthly sales of 102,700 units, only Wuling, Changan, and Chery have exceeded 10,000 units in sales. We cannot expect much progress from the market in China.

Wuling accounts for nearly 40%, Changan for 17.6%, and Chery for 13.8%. However, sales expectations for this market have decreased significantly with the introduction of Wuling's hybrid cars, Changan's extended-range vehicles, and Chery's plug-in hybrids.

## BYD and New Forces

BYD faces a smooth ride in 2022 with their BEVs priced below 150,000 RMB and PHEVs priced between 100,000 and 250,000 RMB. For Great Wall, Changan, Geely, and Chery, it is easy to follow their approach by producing PHEVs priced between 100,000 and 250,000 RMB. It is highly likely that 2023 will become a year of hybrid power surge. Only automakers such as GAC that own their own battery factories may be able to catch up with BEVs priced below 150,000 RMB.

The gap left by joint ventures presents an opportunity for domestic brands to upgrade their gasoline vehicles to plug-in or extended-range models.

An analysis of BYD's current advantages:

- Their market share in 10-15,000 RMB BEV due to lowered battery prices is 65%.

- In the 100-250,000 RMB PHEV market, their market share is 92.96% for the 100-150,000 RMB segment, 75.07% for the 150-200,000 RMB segment, and 88.76% for the 200-250,000 RMB segment.

The core of this issue is whether this advantage can be caught up by other car companies?

Next year, the growth and survival challenges for new energy vehicles will come from all aspects. On the one hand, Tesla’s prices may continue to fall as it adjusts its pricing with the expansion of production capacity, coupled with the “luxury renovation” of its car models. On the other hand, Huawei is also trying to jump into the market by hitting the 250,000-yuan price tag. The common problems are:

- Using high-end materials has less marginal utility for sales growth.

- How to control costs while decreasing prices.

- Tesla and BYD are starting to fight against each other.

In 2023, there will be challenges from all sides for new energy vehicles, making it a tough year!

Conclusion: I think that in 2023, we can judge the overall market and estimate the retail data for different price segments, speculating how high it can go, in comparison to the 5.04-5.18 million (or even higher) from 2022. What do you think?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.