Unexpectedly, the first large-scale merger in the field of LiDAR happened between two listed companies, Velodyne and Ouster.

On November 7th, Velodyne and Ouster announced their official merger, with a combined market capitalization of about $400 million.

The essence of this merger is that Ouster has acquired Velodyne at market price.

Currently, Velodyne’s P/B ratio is less than 1, meaning that its current market value is lower than its net asset value. The merger is equivalent to Velodyne being sold to Ouster at a discount.

The merger will be completed in the first quarter of 2023, and Ouster’s founder and CEO, Angus Pacala, will become the CEO of the new company, while Velodyne CEO, Ted Tewksbury, will become the chairman of the board of the new company.

The most surprising thing about this merger is that Velodyne, which used to be the leader in the field of autonomous driving technology, has ended in this way.

“Metabolism is the norm for the development of the industry,” commented an industry practitioner on Velodyne’s current situation.

Velodyne and Ouster merge, the difficulties of the brothers cuddling for warmth

Since 2020, the LiDAR industry has seen a wave of IPOs.

In October 2020, Velodyne became the “first listed LiDAR stock” through a reverse merger.

Subsequently, Luminar, Innoviz, Ouster, Aeva, AEye, Cepton, Quanergy and other seven LiDAR companies went public in the US one after another.

As of the closing price on November 11th, Velodyne’s stock price reached its peak at $22.82 per share at the end of 2020. Starting from the second half of 2021, Velodyne’s stock price began to slide continuously.“`

Currently, the stock prices of Velodyne have fallen to USD $1, with a cumulative decline of about 78% this year.

Ouster went public in March 2021, and its closing price on the first trading day was USD $11.19. However, as of the closing price on November 11th in the United States, it has also fallen to around USD $1.

The plummet of stock prices is not limited to these two LiDAR companies. The market value of the other six LiDAR companies, including Quanergy, AEye, Aeva, Cepton, Innoviz, and Luminar, have also been halved since this year.

Apart from Velodyne and Ouster announcing a merger, Quanergy has delisted. Currently, only Luminar, Cepton, and Innoviz have received orders from automakers, but it will take one or two more years for them to achieve mass production. The development of the other two companies, AEye and Aeva, is also not optimistic.

The sharp decline in stock prices and difficulty in profits have cast a shadow over the development prospects of the LiDAR field.

Against this backdrop, it is not surprising that Velodyne and Ouster are seeking comfort in sticking together.

Velodyne is the pioneer of mechanical LiDAR.

Ouster, founded in 2015, has always presented itself as “Digital LiDAR.”

“Digital LiDAR” refers to the full semiconductor design of the LiDAR, integrating the thousands of optoelectronic components in the original LiDAR product into a chip, thus achieving a “solid state” form.

On this basis, Ouster adds a rotating device inside the LiDAR, enabling it to scan in a 360-degree direction.

This is the so-called “Rotating Solid-State LiDAR.”

Technologically, Ouster’s product is still a mechanical LiDAR.

“`The convergence of technological routes and strong homogeneity is an important prerequisite for the merger between Velodyne and Ouster. The shortage of cash is another driving force for the merger.

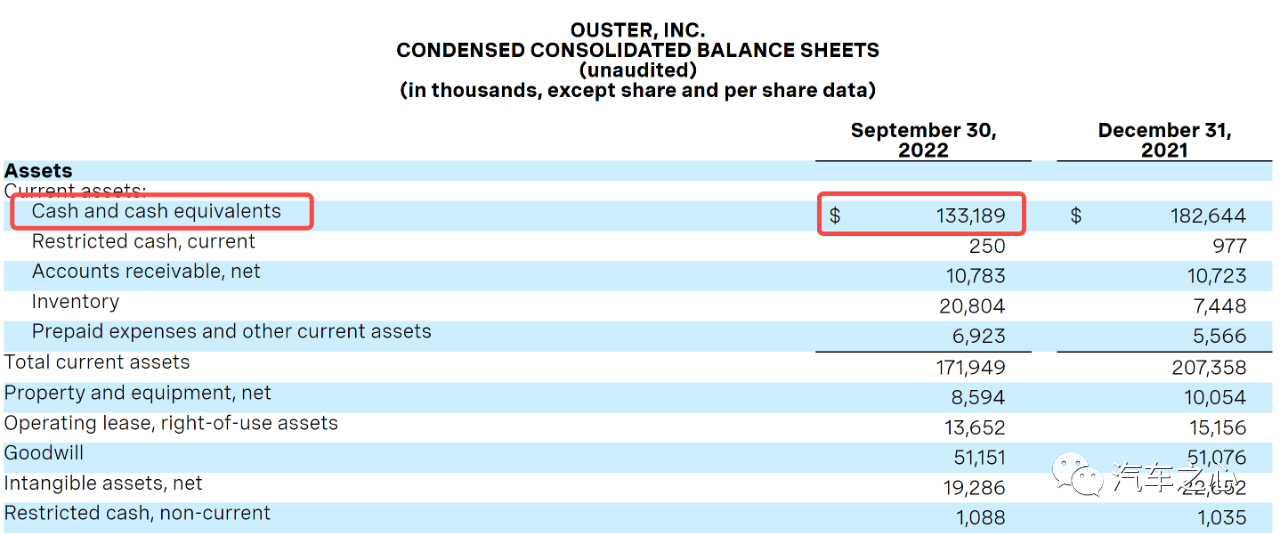

As of the third quarter of this year (September 30), Ouster had a total of $133 million in cash and cash equivalents.

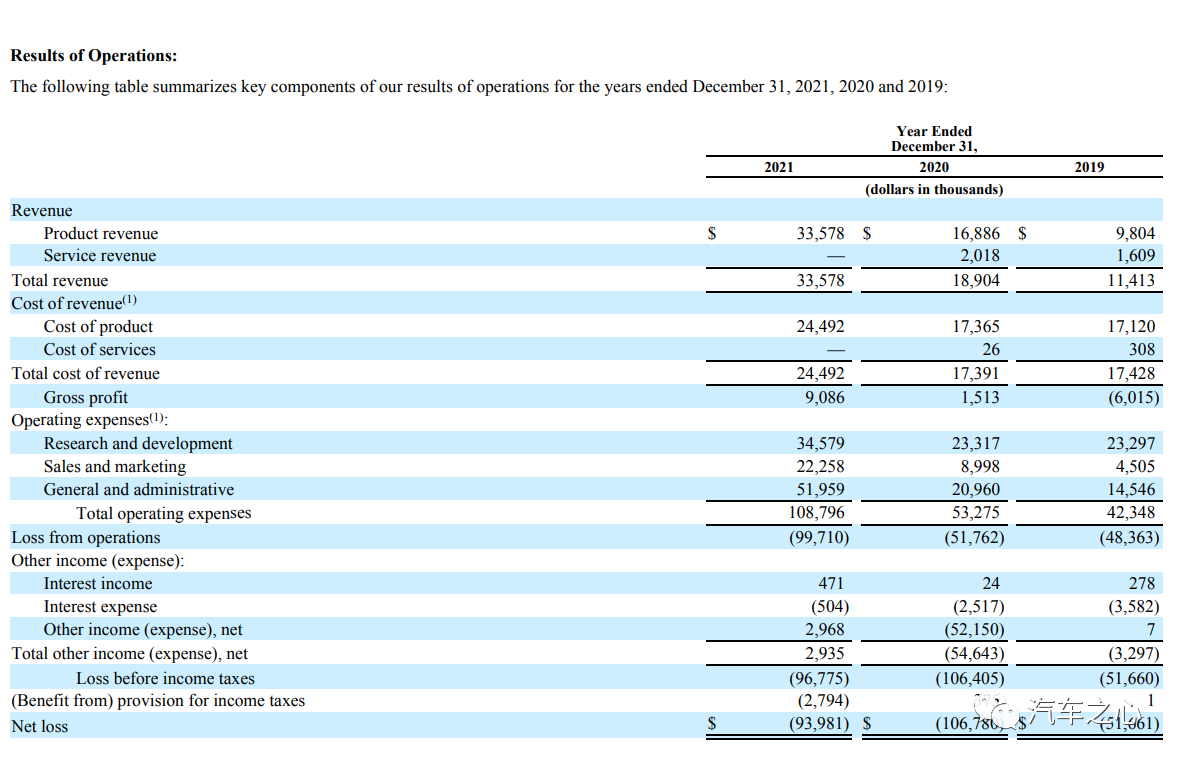

According to Ouster’s financial report, Ouster’s operating expenses in 2021 were $108 million.

At this rate, Ouster’s cash on hand can sustain until the first quarter of 2024.

Velodyne’s operating expenses in the second quarter of this year were $37.5 million, and $31.4 million in the third quarter, slightly more than Ouster.

If the two companies continue to operate independently, a total of over $200 million will be needed annually.

According to Velodyne and Ouster, the two companies can save at least $75 million in a year after the merger.

In other words, the new company’s operating cost after the merger will be $130 million per year.

As the relevant matters of the merger between the two parties will be completed in the first quarter of next year, it is estimated that the two companies will spend more than $50 million each in the fourth quarter of this year and the first quarter of next year.

After the completion of the merger, the cash flow of the new company will be around $250 million, which can sustain the operation of the new company for two years. In contrast, each can only barely sustain for one year if they continue to develop independently.

Another huge explicit value after the merger of the two parties is that the new company will establish a huge patent moat.

According to statistics, the two parties currently have 173 authorized patents and 504 patents applied for but not yet authorized, totaling 677 patents.As a comparison, Lumianar has 98 authorized patents and 110 patents pending authorization.

This merger also resolves the legal disputes between the two parties.

In June of this year, Velodyne sued Ouster for patent infringement.

Then Ouster counter-sued Velodyne in the California Superior Court. The lawsuits between the two companies are actually a kind of “infighting”. After the merger announcement, the lawsuits between the two parties will also be withdrawn.

Reorganization, merger, and acquisition are the normal development trends of every industry. However, the merger of Veldoyne and Ouster did not bring a 1+1>2 effect, but more of a banding together of brothers in arms.

In the mechanical LiDAR market, Velodyne’s products no longer have a competitive advantage.

It is reported that in the Chinese market, Velodyne raised the price of mechanical LiDAR products by 50% at the end of 2021, which undoubtedly accelerated the push of existing and potential customers to domestic LiDAR companies such as Beike, Hesai, etc.

Ouster is more focused on niche markets outside of the automotive industry, such as robotics and industrial fields.

In the passenger car market, there has been no new progress in the cooperation between Velodyne and Hyundai Motor Company. It is expected to start mass production in 2025.

Although Ouster has made some investment in the automotive field, there are still no publicly known auto industry customers.

Therefore, how both parties can survive on the current cash flow until 2025 is still unknown.

The bankruptcy application of Ibeo, the merger of Veldoyne and Ouster, Quanergy’s announcement of delisting, and the poor financial results revealed by eight American LiDAR companies listed on the U.S. stock market all reflect a common problem-inadequate self-generation ability and weak profit prospects, which makes it unable to obtain further financing externally.

This will exacerbate the reshuffle in the LiDAR field.## Why did the former leader of LiDAR fall behind?

In 2007, Velodyne rose to fame in the DARPA Challenge competition in the United States. Since then, the core sensor, which claims to occupy “half of the territory” of autonomous driving, has taken the stage.

At that time, Velodyne founder David Hall applied for US patent 7969558 (patent title “High definition LiDAR System”).

With this patent, Velodyne opened an era of mechanical LiDAR and many L4 autonomous driving companies on the market at that time were queuing up to buy Velodyne’s products.

“At CES in 2016 and 2017, people in the industry flocked to Velodyne’s booth like a pilgrimage.” An autonomous driving practitioner described to “Autohome” how Velodyne was sought after and noticed by the outside world at that time.

Although Velodyne had the first-mover advantage, it did not establish strong technical and commercial barriers.

With more and more players entering the LiDAR market, in the face of fierce competition, Velodyne is no longer the “darling of the times” with unique advantages.

In both the Chinese and American markets, Velodyne’s market share has been eroded by two LiDAR newcomers, RoboSense and Hesai.

Even in Velodyne’s American headquarters, Velodyne has difficulty resisting the momentum of Hesai’s orders from a large number of L4 autonomous driving companies.

Under the attack of RoboSense and Hesai, Velodyne had to resort to wielding its patent stick.

In the passenger car market, Velodyne’s in-car LiDAR did not have the first-mover advantage, and even almost started from scratch with competitors such as RoboSense, Innoviz, HoloMatic and Hesai.

Velodyne’s product for passenger car market, Velaray, was first revealed to the public as early as 2018, but its adoption has been slow.“`markdown

Compared with that, Suteng Juchuang, Hesai and Tudatong have set a new record of shipment through cooperation with automakers.

As of now, Suteng Juchuang holds over 50 models of fixed-point orders. By the end of this year, Suteng Juchuang will have 11 model projects entering SOP.

The Ideal L9 is equipped with Hesai AT128 LiDAR as standard. In the end of September, Hesai announced that its monthly delivery of AT128 exceeded 10,000 units, becoming the first “global” company to deliver more than 10,000 vehicle-mounted LiDARs in a month.

Three models, ET7, ET5 and ES7 based on the Nio NT 2.0 platform, all come with Tudatong’s LiDAR as standard. In July this year, Tudatong’s LiDAR “Falcon” has reached its 10,000th off-line.

Mechanical LiDAR’s share has been eroded, the progress of front-loading production LiDAR has been slow, and the gap has been constantly opened up by newcomers. This is the “external troubles” once faced by Velodyne.

The “internal troubles” come from the internal struggles of Velodyne.

In 2020, the founder and chairman, David Hall, has been dismissed, and in July 2021, Anand Gopalan announced his resignation from the positions of Velodyne CEO and the board of directors.

In the anonymous interview with Automotive News, Velodyne employees expressed that the biggest challenge facing the company is not fierce competition from peers or rapid industry changes, but “internal disharmony” that weakens Velodyne’s industry status.

With the combination of internal and external factors, Velodyne’s proud advantages have disappeared, and it has been crushed by new emerging companies.

Does autonomous driving really need LiDAR?

In 2022, the stock prices of 8 American LiDAR-listed companies fell sharply, and their market values were halved. This made the future of LiDAR uncertain.

A pessimistic view is also spreading: does autonomous driving really no longer need LiDAR?

```

Tesla CEO Musk has always been a strong opponent of lidar and has repeatedly criticized it in public:

- "Lidar is not a necessity for autonomous driving."

- "Lidar is terrible. They will eventually drop lidar, remember my words. This is my prediction."

- "Lidar is expensive, ugly and unnecessary."

- "Lidar is an expensive and unnecessary product, just like a bunch of appendices on a human body. The existence of appendices is basically meaningless."

Musk regards first principles thinking as a guide and believes that people can drive with just a pair of eyes and a brain, and machines can also rely on visual algorithms.

At Tesla's AI DAY this year, Tesla announced a new algorithm: Occupancy Networks.

This algorithm can understand the grid or space occupied by objects in three-dimensional space, effectively avoiding problems such as collision on the edge of objects and blind spots in pure visual solutions.

But this does not mean that the "pure visual" route represented by Tesla will eventually win.

Globally, autonomous driving can be roughly divided into three technical paths:

1. **Pure vision**.

The visual perception and cognitive decision-making of the camera bet that AI technology can enable cars to achieve the perception and thinking ability of human eyes, and this intelligent level can meet the requirements of automated driving regulations before the price of lidar drops to that of millimeter-wave radar. This is the core judgment of this faction represented by Tesla;

2. **Vision+millimeter-wave radar**.

Recognizing the inherent shortcomings of vision in distance perception, millimeter-wave radar is introduced to increase distance detection capability. The problem of non-uniqueness of the direction of the detection results of the millimeter-wave radar is solved by visual analysis. It is believed that visual intelligence can solve the problem of positioning, driving scene understanding, and decision-making planning in the future, approaching and reaching the level of human intelligence.

3. **Vision+millimeter-wave radar+lidar**.

In the absence of AI that can```

The difference between the above three lies in whether or not to use Lidar.

Except for Tesla, most domestic and foreign car brands choose the third technology route - “Strong Perception + Strong Intelligence” as an advanced autonomous driving solution, which means choosing Lidar as the core sensor of advanced autonomous driving.

Lidar is an active sensor that emits pulse lasers and detects the scattering characteristics of targets to obtain depth information. This sensor has two distinct advantages:

First, it has high precision, a wide range, and strong anti-interference ability, which can achieve higher accuracy in some extreme weather conditions and at night than cameras, prevent misjudgment of vehicles, and increase the redundancy of safety.

Second, Lidar has the characteristics of long range, high angular resolution, and low susceptibility to ambient light interference. It can directly obtain the distance and orientation information of objects. When used in combination with other sensors, it can help the perception system reduce detection errors.

Industry insiders have a saying that the safety of autonomous driving systems with Lidar can reach up to 99.99%, while cameras, millimeter-wave radars, and other sensors can only guarantee 99.0%.

Therefore, Lidar is considered an essential sensor for advanced autonomous driving by most automakers.

A Lidar practitioner told Automotive Heart:

"Nowadays, the Lidar on the market can only barely qualify, and the performance and cost are not good enough. Lidar companies need to iterate technology quickly, continuously reduce costs, and improve performance."

From the current progress, Lidar is continuously penetrating the advanced autonomous driving market. As prices continue to decrease, its popularity will further increase.

## The other side of Lidar: Rapid Development

Compared with the bad news frequently reported by European and American Lidar companies, Chinese Lidar companies are experiencing a different scene of prosperity.

First, on the financing side, on November 4, Liangdao Intelligence announced the completion of a B1 round of financing of over 100 million yuan.

On November 11, Suteng Juchuang announced that many industrial investment parties such as Geely Holding Group & Lotus Technology, BAIC Group, and GAC Group had invested.

“`

Next is the product level, where the filling-in blind spots lidar has become the second battleground for Chinese lidar companies to compete for.

On November 2nd, Hesai released the FT120, a short-range filling-in blind spots lidar. Hesai claimed that it has already obtained over one million mass production orders from multiple automakers and is expected to start mass production delivery in the second half of 2023.

On November 7th, Suteng Juchuang released the E1, claiming it to be the “best overall performance” lidar. The mass production time is set for the second half of 2023.

Liangdao Intelligence is also closely following, announcing that its filling-in blind spots lidar LDSatellite’s SPAD chip has passed AEC-Q100 certification, with SOP time targeting the third quarter of 2023.

If we look at the global perspective, we will find that there is a very clear difference in the development of smart cars between China and other countries.

In the global lidar market, Chinese car companies have a strong willingness to use lidar. This industry pace has also helped domestic lidar companies to advance all the way.

Divided by region, the global players who have received orders from automakers for lidar roughly fall into these categories:

(1) Europe has an old lidar supplier called Valeo.

According to the Valeo 2021 financial report, as of 2021, Valeo has delivered 16 sets of lidars for vehicles. This data also makes Valeo the lidar supplier with the largest number of deliveries in the world.

Data shows that in 2020, the global ADAS lidar market was dominated by Valeo. In 2021, although a new batch of players emerged in the market, Valeo still firmly occupied 75% market share.

(2) Innoviz, a lidar company from Israel, in addition to the previous BMW order, also announced the acquisition of nearly 4 billion US dollars in orders from Volkswagen Group this year.

(3) Participants in the field of LiDAR in the United States mainly include Luminar and Cepton.

Luminar has established partnerships with car manufacturers such as Volvo, Polestar, and SAIC.

Through in-depth cooperation with the leading car light supplier Koito, Cepton has won orders for multiple models of General Motors.

(4) Chinese players are more diverse, and the competition is more intense.

So-Thinker has publicly announced clients including dozens of car companies: Lucid, BAIC, Lotus, XPeng, SAIC IM, Great Wall, Zeekr, Lynk & Co, GAC Aion, BYD, FAW Hongqi, Chery, Leapmotor, Dongfeng, and WM Motor.

As of this year, So-Thinker's M series products have won orders for more than 50 models from top car companies worldwide. By the end of this year, 11 models of So-Thinker's projects will enter SOP.

Heesai's current car company clients include: Xpeng, GAC, Lotus, Jidu, and Aiways.

In October of this year, Heesai announced a formal partnership with Changan Automobile, and multiple new models under Changan Automobile's SDA architecture will confirm to use Heesai AT128 automotive-grade LiDAR.

In addition, there is news that Xiaomi's first car model will use Heesai's LiDAR.

```

At present, only NIO is known as a customer of Tudoo in the automotive industry.

The three models, ET7, ET5, ES7, based on NIO NT2.0 platform, are equipped with Tudoo's LiDAR as a full-series standard.

During NIO's Q3 earnings call that just ended, NIO CEO Li Bin revealed that NIO will launch five new models in 2023, and these models are expected to also be equipped with Tudoo's LiDAR.

Currently, models equipped with Huawei LiDAR include: Alpha S from Lynk & Co, Avita 11, Neta S, and a high-end model that GAC is about to launch.

Livox, a LiDAR company under DJI, is not only the supplier of the LiDAR for Xpeng P5, but also the B supplier of LiDAR for LI L9.

In late September of this year, Panda Technologies announced that it has obtained designated models for Hechuang Auto, one of which is the production version of the Hechuang Concept-M G08. The main LiDAR of other designated models will also adopt Panda Technologies' vehicle-level solid-state LiDAR.

There is also news that North Star is developing a new generation of vehicle-level LiDAR and has obtained a designated production spot from a domestic new energy vehicle company. It will officially go on cars in the second quarter of next year.

If the first few years of LiDAR's entry into the automotive industry were only related to European LiDAR manufacturers, then in the next few years, Chinese LiDAR manufacturers will dominate.

First of all, China has formed an ecosystem in the field of LiDAR.

The upstream and downstream of the LiDAR industry chain have emerged a large number of excellent Chinese companies.

The upstream laser companies include JPT Opto-Electronics Technology and Raycus Laser; detector and chip companies include Forrinx Technologies and Chipintelli;

Midstream LiDAR manufacturers include SureStar Joint Innovation, Hesai, Tudoo, Livox, Huawei, Atway, Pandar, Beixing Light, Leishen Intelligence, Liangdao Intelligence, etc.;

Downstream car companies such as NIO, Li Auto, Xpeng, Great Wall, SAIC Feiteng, Avita, have begun to equipped LiDAR in their own models. Since 2020, there have been a total of 25 front-loading designated production spots related to Chinese automakers.

Secondly, Chinese LiDAR companies represented by SureStar Joint Innovation and Hesai have successively built LiDAR production lines with large-scale production capabilities. Their own factories will allow these companies to seize the initiative in large-scale production in the future.

“`

Just recently, Volkswagen Junchuang announced the establishment of a joint venture smart manufacturing enterprise Luxsense (Liting Innovation) with Luxshare Precision.

In addition, Volkswagen Junchuang’s smart manufacturing cluster phase one investment exceeded ¥1 billion, with a factory area of over 55,000 square meters, and nearly 20 automated production lines have been built to achieve a production capacity of millions.

Horizon Robotics invested nearly $200 million to build the “Maxwell” smart manufacturing center in Jiading, Shanghai, with an annual production capacity of 1 million units, which will be put into full production in 2023.

According to the “2022 Automotive and Industrial Field LiDAR Application Report” released by the globally renowned market research and strategy consulting company Yole Intelligence, since 2018, there have been about 55 officially announced LiDAR front-loading points worldwide, of which Chinese LiDAR suppliers account for 50%.

Horizon Robotics has won 27% of the global LiDAR front-loading points as of now, ranking first in the world.

Volkswagen Junchuang ranks second in China and third in the world with 16% of the total LiDAR front-loading points.

Chinese LiDAR suppliers, represented by Volkswagen Junchuang, Horizon Robotics, and TudaTong, are changing the global LiDAR industry landscape.

To summarize why Chinese LiDAR companies can stand out and occupy a place in the global LiDAR field:

Firstly, Chinese LiDAR companies have the correct judgment on technology routes, and their products are competitive enough to be quickly put into mass production; Secondly, their business models are clear and their operations are stable; Thirdly, they have a quick response and service ability.

In conclusion

Thanks to its first-mover advantage, Valeo is currently the car-mounted LiDAR supplier with the most deliveries worldwide.

Starting from 2020, five LiDAR companies from China, including DJI Livox, Volkswagen Junchuang, TudaTong, Horizon Robotics, and Huawei, have successively entered the production and delivery cycle for front-end installations.

Entering the second half of 2022, Chinese LiDAR companies are showing their strength in production and delivery and beginning to break some records.

“““

This July, TDT’s “Falcon” LiDAR became the “first batch” of high-performance LiDARs to achieve mass production and installation with the 10,000th unit rolling off the line.

By the end of September, Hesai announced that AT128 had achieved a monthly delivery of over 10,000 units, making it the “first company in the world” to deliver over 10,000 vehicle-mounted LiDARs per month.

10,000 units is just the beginning. LiDAR delivery needs to reach the next level to truly achieve the scale of LiDAR mass production.

Nowadays, Chinese automakers are sprinting ahead. According to statistics, most new car models equipped with LiDAR will be launched before 2025.

According to Moore’s Law, LiDAR is expected to achieve performance growth in multiples while maintaining current costs in the next few years.

“As thousands of sails pass by the sunken boat and countless trees stand in front of the withered tree.”

It can be expected that LiDAR, as a “new force” mounted on intelligent vehicles, will be invincible.

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.