Overview

万博 发自 副驾寺

智能车参考 | 公众号 AI4Auto

Nio has launched the first domestically developed full-stack self-developed intelligent chassis domain control unit ICC, which has caused a lot of discussion. Apart from the technology itself, the core of the discussion is also curiosity about Nio: When did Nio, known for its user service “Car Circle Haidilao,” become so hardcore in technology? Moreover, it is in the field of chassis technology, which is a traditional strength of traditional automakers.

So today, let’s take a look at what is different about Nio’s ICC intelligent chassis domain controller.

And with the two major labels of high-end and service, is Nio really a company that values R&D capabilities, as Li Bin has emphasized countless times but has been diluted by the public?

What’s different about the intelligent chassis controller?

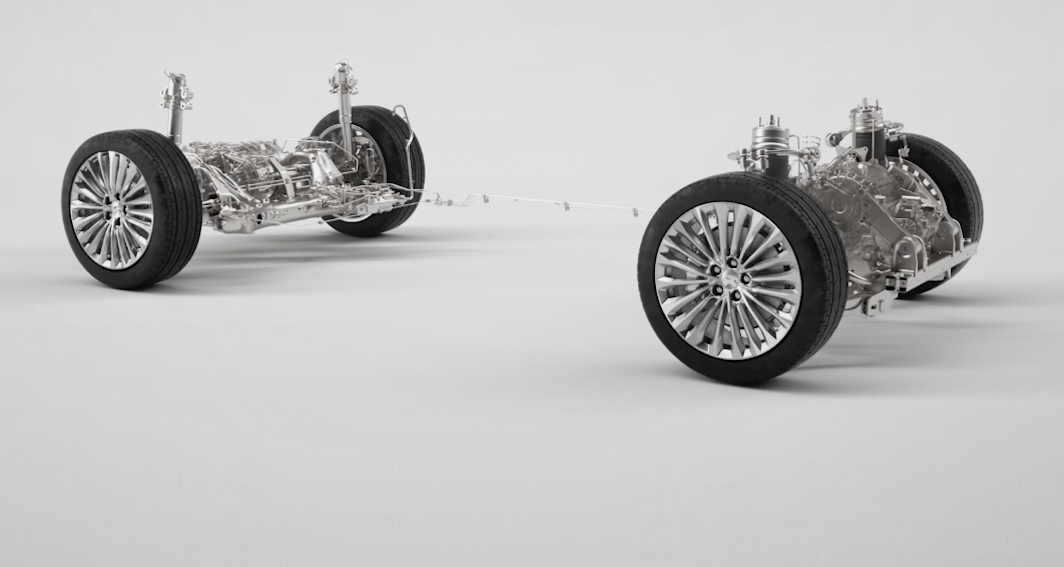

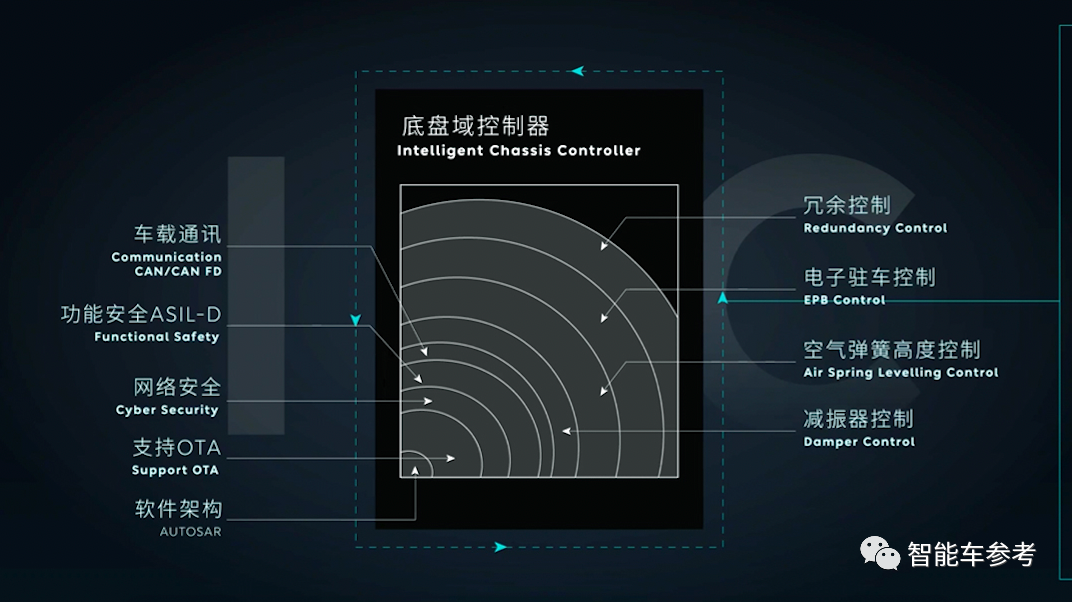

From the information disclosed by Nio officials, the biggest difference between the intelligent chassis launched this time and traditional mechanical chassis is centralized control.

Specifically, it is to concentrate more than 100 component controllers including suspension, shock absorbers, and electronic brake systems (EBP) in traditional chassis into a domain controller at the perception and decision-making levels, intelligently allocated and controlled by software algorithms.

That’s Nio’s ICC intelligent chassis domain controller.

The role of component controllers is only at the decision-making level.

This technological evolution is also a miniature of the current electronic and electrical architecture revolution in the intelligent car field – centralized architecture. A similar chassis control design philosophy is also reflected in Tesla’s models. Although other manufacturers are also moving towards a domain-centric architecture in electronic and electrical architecture, they are mainly in the transitional stage from distributed architecture to centralized architecture for chassis controllers.

For example, XPeng provides coordination for multiple chassis components through the vehicle control unit (VCU) without a dedicated domain controller for the chassis.

So, what are the advantages of domain-centralized chassis control, which can become the unanimous choice of mainstream intelligent car manufacturers?

Nio officials disclosed that there are mainly three core advantages:

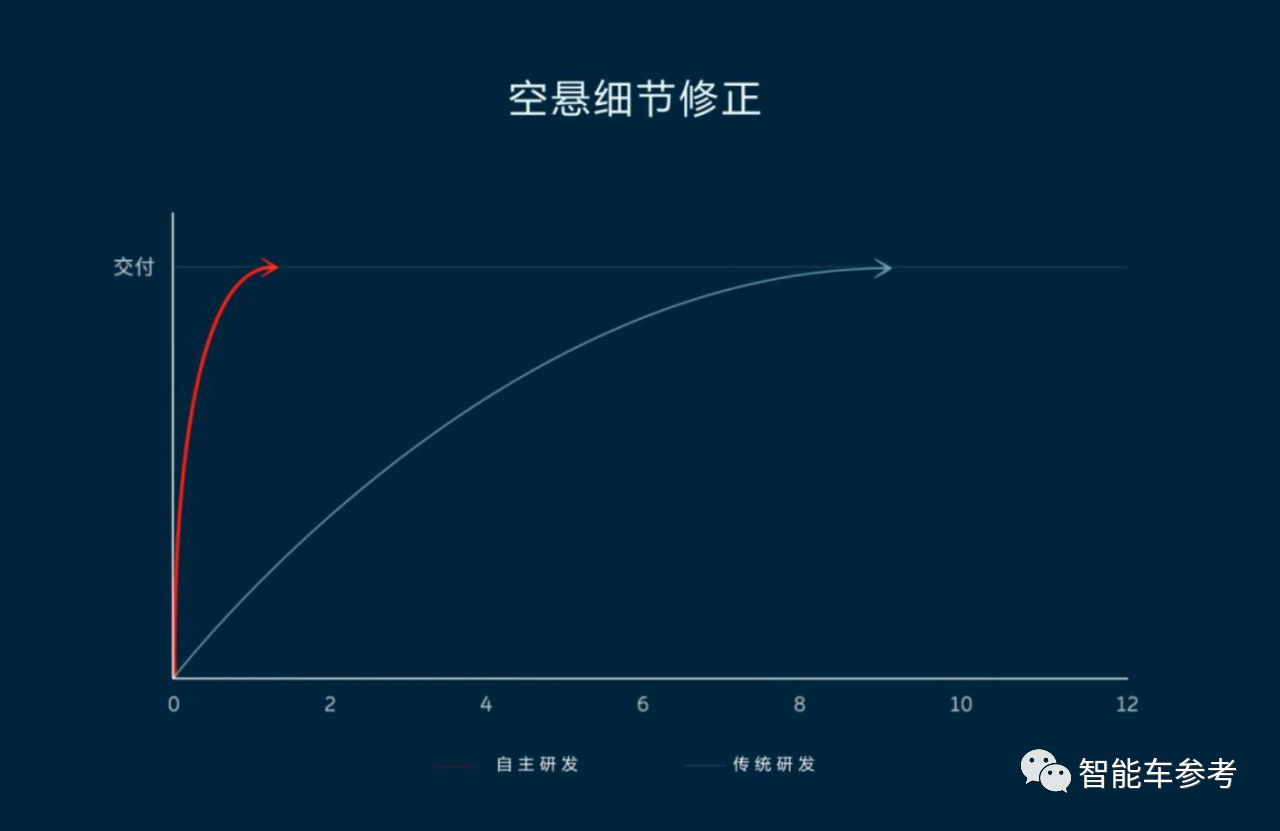

First, rapid iteration of the chassis becomes possible.

Traditionally, chassis solutions are of various suppliers involving multiple parties in the supply chain, and the design and calibration of a chassis for a car company often require customization and adjustment of requirements and parameters with many partners.“`

The development cycle of the chassis also needs to cooperate with the upstream suppliers. Moreover, when it comes to chassis iteration, often a modification of a component can affect the whole system, which takes a lot of time and effort.

On the other hand, centralized domain chassis control only needs to upgrade the domain controller software through FOTA, which can greatly reduce the iteration time.

Specifically, how much can it be optimized?

Taking the example of the adjustment of the air suspension and dynamic suspension damping control parameters for correcting a performance detail of a road surface, after NIO’s independent research and development of ICC, it can usually be quickly upgraded via FOTA after 1.5 months, whereas traditionally it normally takes at least 8 months.

Secondly, the chassis experience can continue to evolve.

The iteration of an intelligent chassis is mainly data-driven. Real-time road information can be collected through the interaction of vehicle signals and sensor signals under various driving scenarios.

Test engineers will find the optimal chassis setting parameters for different scenarios based on practical situations.

For example, suspension stiffness settings for aggressive driving, urban road conditions, and energy-saving modes can all be continuously optimized and pushed based on constant learning.

Finally, it is the adaptation of the chassis to autonomous driving.

It should be noted that there is a big difference in the predictability of vehicle status between traditional and intelligent driving.

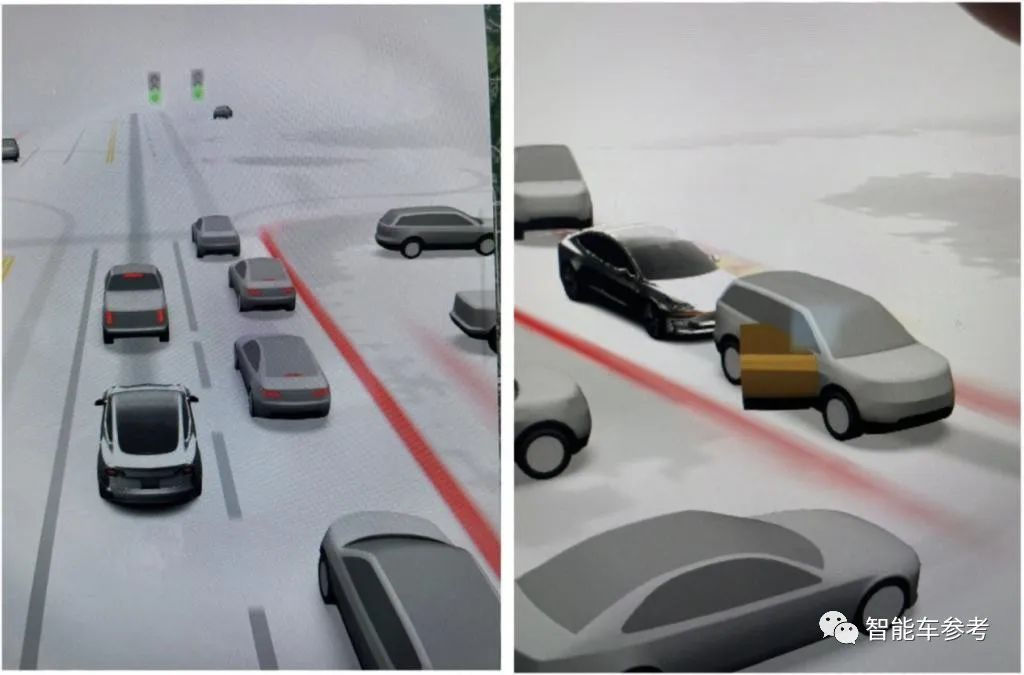

For example, in intelligent driving mode, the vehicle sensors can perceive and process road conditions hundreds of meters away, and different roads require different vehicle responses.

The centralized domain chassis can quickly respond to the prediction and decision-making of the intelligent driving system, improving vehicle comfort.

In contrast, traditional chassis, due to its distributed architecture, needs the intelligent driving system to simultaneously control hundreds of controllers, which is far slower than the centralized domain chassis.

In addition, an intelligent driving system can make targeted settings for the response of the chassis in different scenarios.

For example, in the high-speed NOA state, utilizing negative torque generated by the motor as a backup for braking can systemically decrease the failure probability of key functions, greatly improving driving safety.

Finally, has NIO’s independently developed ICC, the first intelligent chassis domain controller in China, been put into mass production yet?

“`NIO announced that ICC has been put into mass production on NIO’s second-generation technology platform, NIO Technology 2.0, including the recently delivered ET7.

In addition, two new models, ET5 and ES7, which are about to be delivered and released, will also be equipped with ICC.

Why does NIO self-develop ICC?

One of the core reasons is that in the intelligent era of automobiles, the intelligent chassis gives automakers more power over chassis development.

Why?

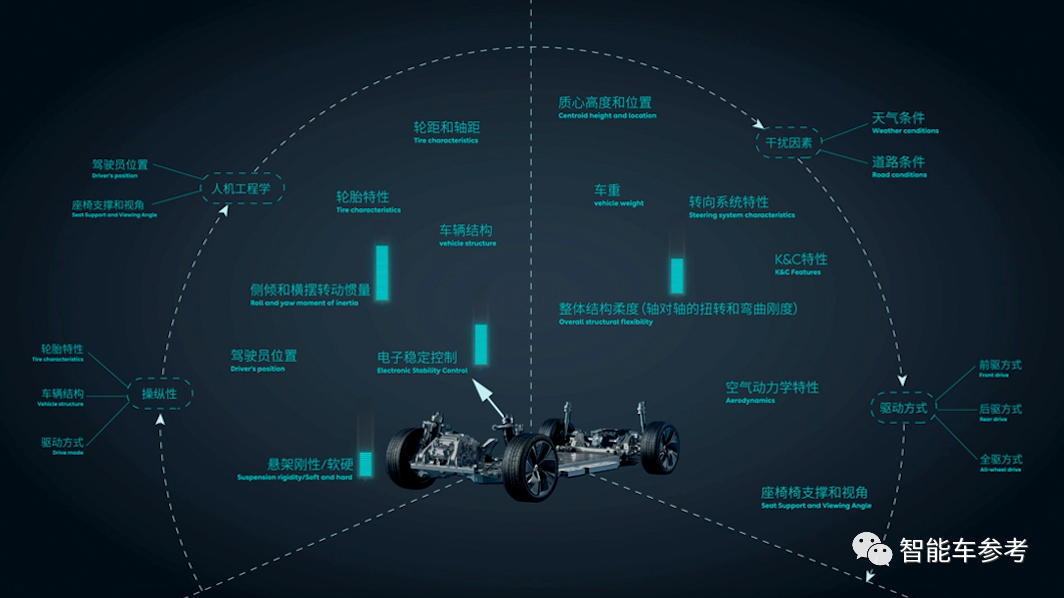

To understand this, we need to understand a question: what kind of chassis do we need in the era of intelligent automobiles?

According to the “Smart Chassis Technology Roadmap” published by the China Association of Automobile Engineers, the requirements for intelligent car’s chassis are as follows:

Through the global integrated control of the wired control system, from the distributed functional development of traditional chassis control to the performance and quality development of customer perception and experience, to achieve more secure, comfortable, and low-carbon system performance requirements.

From the definition and requirements given above, it is clear that at least two major requirements should be met:

To meet the needs of automatic driving safety redundancy and rapid iteration.

The best way to meet these two requirements is through a distributed control architecture that moves towards centralized control. Now in the centralized stage, the entire chassis system is controlled by domain-centralized architecture.

The NIO ICC chassis domain controller is designed and developed based on such ideas.

Under such requirements, the need for automakers to have power over chassis development has become more urgent.

As mentioned earlier, the traditional chassis design solution is for automakers to cooperate and customize from different Tier 1 or Tier 2 suppliers, tuning parameters separately, and finally integrating them.

This type of development and procurement method means that the initiative for chassis upgrades and iterations by automakers is always in the hands of suppliers such as Bosch and Continental. The chassis style of a car is almost impossible to change from the moment it comes off the production line to the hands of consumers.

This is why different car companies and series have fixed chassis feels, such as some people like BMW, while others love Audi…

However, in the era of intelligent automobiles, the requirements are that vehicles can continuously learn and improve, whether it is intelligent driving, cockpit interaction, or riding experience.Therefore, with the self-developed chassis domain controller, we have taken the initiative in the development iteration of the chassis, making rapid development iteration possible based on the characteristics of our own vehicles and user groups. As a result, upstream players have become mere hardware suppliers. This is why mainstream manufacturers, including Tesla and NIO, have also opted to self-develop their own chassis domain controllers.

Is NIO technology-oriented?

Compared to XPeng Motors, NIO’s distinct label has always been service and high-end. Although NIO’s founder and CEO, Li Bin, frequently emphasizes NIO’s research and development capabilities at various occasions, the fact that their technology strength is often overlooked remains unchanged.

On the one hand, people always classify NIO as a new force in automobile manufacturing, but on the other hand, no one seems able to explain where exactly NIO is “new.” At least NIO wants to prove themselves to be more technologically advanced than other after-sales services through the NIO Intelligent Connected Car (ICC).

However, intelligent vehicles are a complex engineering system that includes software, algorithms, controllers, network connections, etc. The ICC is at the bottom of the intelligent vehicle technology stack but is not the core.

Therefore, to determine whether NIO is like Haidilao in the automotive industry or a hardcore technology leading manufacturer, we need to re-examine NIO’s technological capabilities.

In the intelligent vehicle field, the most fundamental areas where technological capabilities are reflected are the two major parts: the electric powertrain system and intelligent driving.

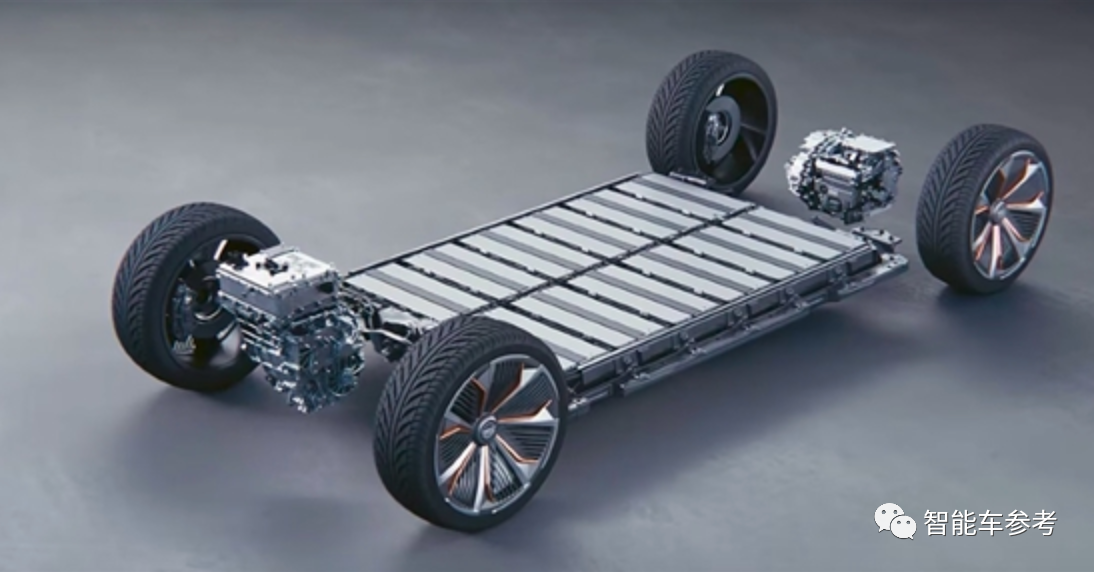

NIO’s R&D areas in the electric powertrain system cover almost the entire industry chain.

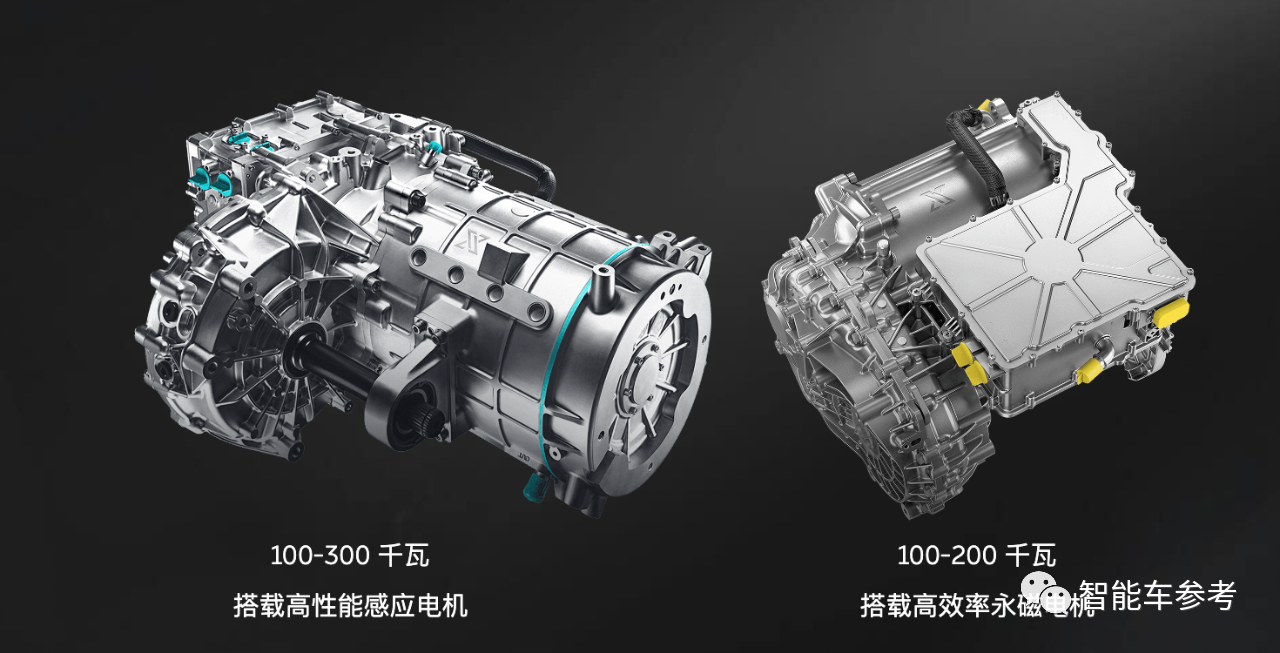

As early as 2015, soon after its establishment, NIO invested in XPT NIO Drive Technologies in Nanjing, focusing on research and development of motors and motor control hardware. This includes NIO’s 866 series vehicle models and the motor control of later models such as the ET7 and ET5, all of which are produced in NIO’s Nanjing factory.

NIO’s self-developed three-in-one EDS electric drive system, which uses the first domestically developed copper rotor technology, is a core technological achievement.

In the battery field, NIO’s layout and achievements are rather prominent among new automakers, with their swapping battery technology as a distinctive label.

In September 2021, NIO launched the world’s first production hybrid battery pack consisting of ternary lithium and lithium iron phosphate batteries.

In addition, NIO released a hybrid solid-state battery in January last year, with a battery pack capacity of 150 degrees and an energy density of 360Wh/kg. When installed in the ET7, a single charge can reach 1000 kilometers.

In addition, NIO released a hybrid solid-state battery in January last year, with a battery pack capacity of 150 degrees and an energy density of 360Wh/kg. When installed in the ET7, a single charge can reach 1000 kilometers.

Previously, NIO’s battery cells were supplied by external suppliers, but recently, NIO has a new layout in battery cells:

According to Li Bin’s disclosure at an analyst conference not long ago, NIO has formed a battery R&D team of over 400 people, with battery cells being one of the main research areas.

NIO’s self-developed battery will be mounted on its high-end new brand car priced at CNY 200,000 to 300,000 in 2024.

Therefore, in the three electric fields of motor, electronic control, and battery, NIO has already achieved self-development and manufacturing capabilities. Compared with other mainstream automakers, only Tesla, BYD and NIO have reached this standard.

In the first half of the game, NIO led the way in electric races. However, in terms of self-development in autonomous driving, NIO’s progress and achievements are not as prominent as in the electric field.

NIO’s earliest autonomous driving R&D team had to shrink in 2019 due to heavy resource investment, and many experts left. The “self-research” work also encountered difficulties.

Subsequently, NIO joined the Mobileye camp and purchased the entire set of solutions.

In 2020, NIO expanded its team with the addition of former Momenta algorithm head Ren Shaoqing and Xiaomi Surging Chip General Manager Bai Jian.

However, in the first half of this year, NIO’s autonomous driving team was hit again by personnel changes. First, Huang Xin, the product director of XPeng’s autonomous driving, joined. Shortly thereafter, NIO’s autonomous driving head Zhang Jianyong resigned.

The reason for the frequent personnel changes, as reported by 36 Kr, is that NIO’s autonomous driving teams responsible for different fields had overlaps in responsibilities and competition for resources, which must be integrated to improve efficiency.

Regardless of the reasons, NIO has fallen behind in the autonomous driving field.NIO’s NAD intelligent driving system is currently still focused on its highway-oriented NOP Navigate on Pilot driving assistance. Compared to other players in China, such as XPeng, Baidu’s Apollo, Huawei, and Momenta, mass-produced passenger car intelligent driving systems are already undergoing intensive testing on urban roads and their release dates are mostly determined.

In contrast, NIO seems to have been quiet.

NIO’s technical label has been downplayed by the public, largely due to the company’s emphasis on the service industry. After all, in the era of intelligent cars, autonomous driving has become an explicit threshold for measuring technical capabilities.

As such, as a company dubbed a “new force” in the automotive industry, NIO does have some technological innovations, but their core intelligent driving technology at least currently appears to be lagging behind.

Nonetheless, it seems that NIO’s level of technological sophistication has not affected the loyalty of its customers, nor has it hindered the company’s ability to sell cars.

So, do you think that for NIO, whether their competitiveness lies in manufacturing or in services?

Welcome to discuss in the comments section below~

— End —

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.