Author: Dayan

Recently, NIO released its first quarterly report after listing in Singapore.

According to the report, NIO achieved a revenue of 9.91 billion yuan in the first quarter of 2022, a year-on-year growth of 24.2%, and has achieved eight consecutive quarters of positive growth. NIO’s vehicle sales gross profit margin reached 18.1%. The net loss in this quarter was 1.78 billion yuan, a decrease of 16.8% compared to the previous quarter.

It is worth mentioning that among the three new power enterprises represented by NIO in China, NIO is the only new power enterprise that did not decline in revenue compared with the previous quarter. Under the influence of many unfavorable factors such as the repeated recurrence of the epidemic, frequent lockdowns, continued chip shortages, and significant increases in the prices of battery raw materials, NIO’s achievements are not easy.

Record-high deliveries in June

Behind the sustained revenue growth is the continuous increase in NIO’s new vehicle deliveries. In the first quarter of 2022, NIO delivered 26,000 new vehicles, a year-on-year increase of 37.6%.

Although NIO’s delivery data is not as eye-catching as its competitors in the new energy vehicle market, it has two advantages:

First, in the market for high-end pure electric passenger cars priced above 300,000 yuan, NIO’s market share has reached 5%, ranking second. Therefore, compared with those brands that are seeking to move upward, NIO, which is promoting product sinking, still holds considerable initiative.

Second, as NIO’s flagship sedan, the delivery volume of ET7 began to rise continuously. In May, the delivery volume of ET7 reached 1,707 units. For a model with a price of 4.5 million yuan, NIO’s achievement is of great value.

In addition, according to NIO, the company set a new record of new orders in May. Therefore, it is expected that the delivery volume in June will also hit a historical high. According to NIO’s forecast, its delivery guidance for the second quarter is 23,000 to 25,000 units.

Considering that NIO’s delivery volume in April and May were 5,074 and 7,024 units, respectively, it is estimated that the delivery volume in June will be between 11,000 and 13,000 units, dispelling the shadow of the epidemic.Previously, the lockdown in Shanghai put pressure on the supply chain of the national automakers. However, with the resumption of work and production, JAC-NIO’s first factory has fully restored its production capacity to the level before the epidemic, laying a solid foundation for the production of NIO’s new models.

Meanwhile, NIO’s second factory located in Hefei Xinqiao Intelligent Electric Vehicle Industrial Park has achieved full line integration of its production line and entered the car production validation phase. It is expected to officially commence production in the third quarter of this year.

Continuous delivery of new models, bright prospect for NIO’s sales in 2022

2022 is a big year for NIO’s product launch. In addition to the NIO’s first pure electric sedan, the ET7, which has already been delivered, there are two other heavyweight products based on the NT2.0 platform: the mid-sized intelligent electric coupe, the ET5, and the all-new mid-to-large five-seat SUV, the ES7.

The former will begin delivery in September, while the latter is expected to be delivered in late August. Currently, the domestic auto market is still a market driven by new models, which means that the launch of these two models will not only further improve NIO’s product matrix but also greatly stimulate NIO’s terminal delivery to a new level. Especially after the ET5, which targets Tesla Model 3 and BMW 3 Series, is launched, it will become NIO’s new sales backbone.

In addition, Li Bin also revealed more information about NIO’s new brand for the mass market during the financial report conference.

The models of this new brand will be launched in the second half of 2024, based on NIO’s NT3.0 platform. The main products will be priced between RMB 200,000 and 300,000. The biggest highlight of this new car is that it will use NIO’s self-produced battery, which supports a replaceable battery architecture and 800V high-voltage fast charging technology.

In addition to the self-developed new battery, NIO will also release the NOP+ enhanced navigation system in the third quarter of this year. The deployment of this function is based on NIO’s self-developed high-precision map that NIO and its partners jointly developed.

In the future, NIO will continue to optimize its full-stack self-developed algorithms and end-to-end data closed-loop and operational capabilities through the integration of hardware and software platforms, in order to enable the development of NAD services that can cover more scenarios.Actually, regardless of the market environment, NIO has always maintained a relatively high investment in the R&D field. From financial report data, in the first quarter of 2022, NIO’s non-GAAP R&D total investment exceeded RMB 15.141 billion (approximately USD 2.388 billion), which is at a leading position among new domestic EV startups. To ensure that NIO can maintain a high-intensity R&D investment, as of March 31, NIO’s cash reserve was RMB 53.3 billion.

NIO Adjusts Battery Strategy – Self-Research and Procurement

In NIO’s first-quarter financial report, the gross profit margin decreased slightly to 14.6%, while in the same period last year and the previous quarter, the gross profit margin was 19.5% and 17.2%, respectively.

The biggest reason for the decline in gross profit margin is the factors of the Russian-Ukrainian conflict, as well as the significant increase in demand for EVs worldwide, which caused raw material prices for power batteries, especially ternary lithium batteries, to rise sharply, resulting in battery costs reaching a high point in April this year. Although battery costs have decreased in May, it is estimated that battery prices will remain high for some time to come.

For EVs, battery costs often affect the entire vehicle. If battery costs continue to rise, it will inevitably affect the profit situation of EV companies like NIO. Like other EV companies, NIO has increased the terminal retail price of products this year, but continuous price increases are not a long-term solution.

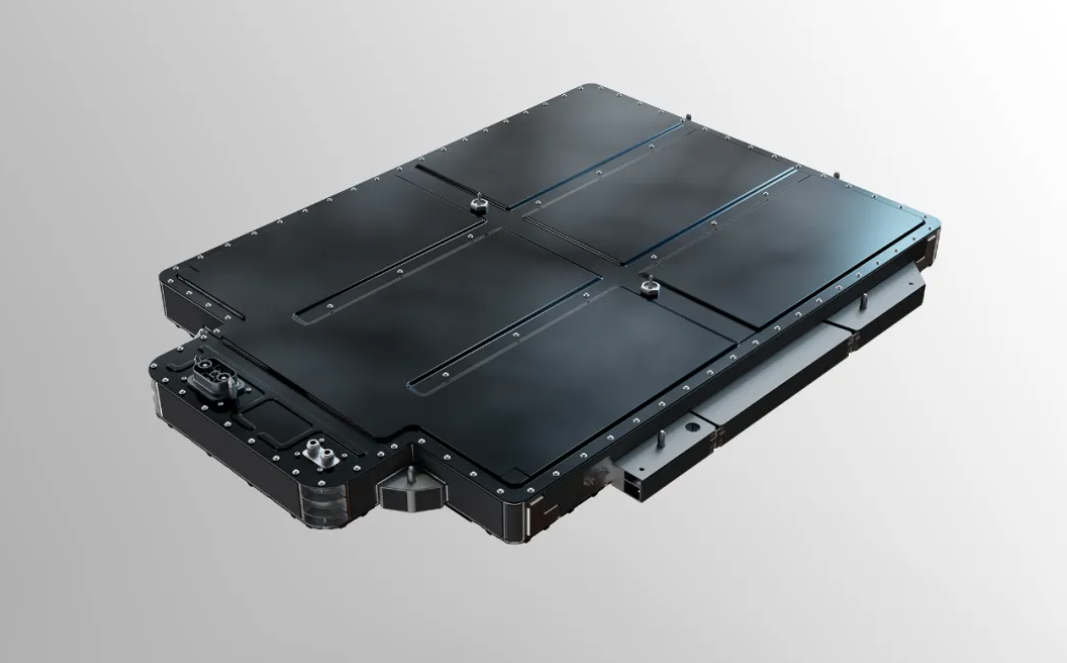

Therefore, NIO has assembled a team of more than 400 people to participate deeply in R&D work in battery materials, cell and pack design, battery management system, manufacturing process, and so on.

In addition to the self-developed batteries that NIO will soon use on its new brand, NIO’s battery team has also made a small innovation. In 2021, they officially released the 75-degree ternary lithium-ion battery, which is a cost-effective innovative battery product with excellent endurance performance, which offsets the cost risk of the current raw material price increase to some extent. Therefore, we have reason to expect NIO’s new low-cost batteries.

For EVs, power battery costs often account for more than 1/3 of the entire vehicle’s material costs, and the phenomenon of the delicate balance of domestic power batteries has not been completely improved. Therefore, it is not an exaggeration to say that self-researching and self-producing batteries have become NIO’s biggest confidence to launch new brands for the mass market.

By producing its own batteries, NIO will be able to effectively control the cost of batteries and vehicles and become more adept at delivery. With the advancement of self-developed battery pack projects, NIO will gradually transition to a manufacturing strategy of “self-made + outside procurement” for battery packs.

Finally

This year has been the most difficult year for the automotive industry in the past decade, due to the impact of the pandemic on supply chains and the potential weakening of consumer demand. For new players in the market like NIO, continuous delivery is crucial to their upward development.

Fortunately, governments at all levels, from central to local, are providing unprecedented subsidies to stimulate terminal consumption, so the recovery of the domestic auto market in the short term is highly likely. What’s even more pleasing is that even in a difficult environment, NIO’s delivery is still on the rise, and NIO’s investment in areas such as batteries and autonomous driving has not slowed down.

We believe that after a period of accumulation, with more core technologies mastered, NIO can not only widen the gap between itself and competitors technologically, but also create more value for the company.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.