Author: Feng Jingang

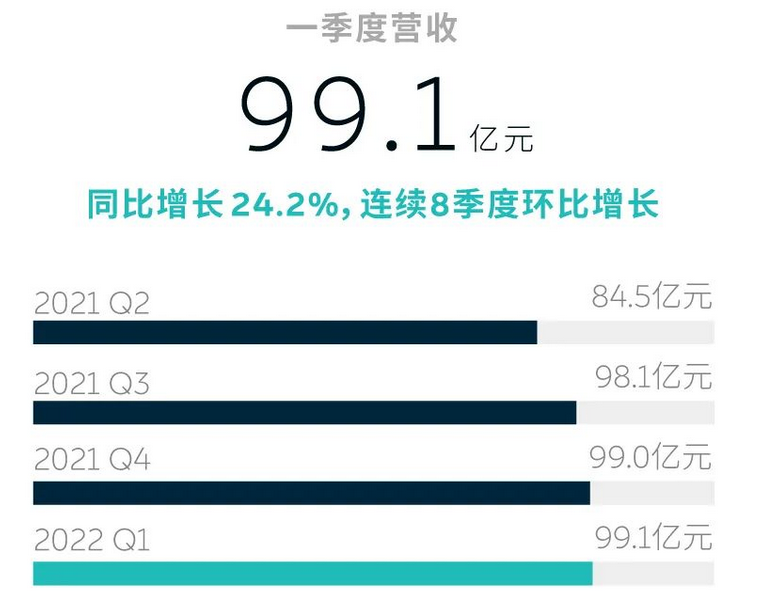

On June 9, NIO released its unaudited Q1 2022 performance report.

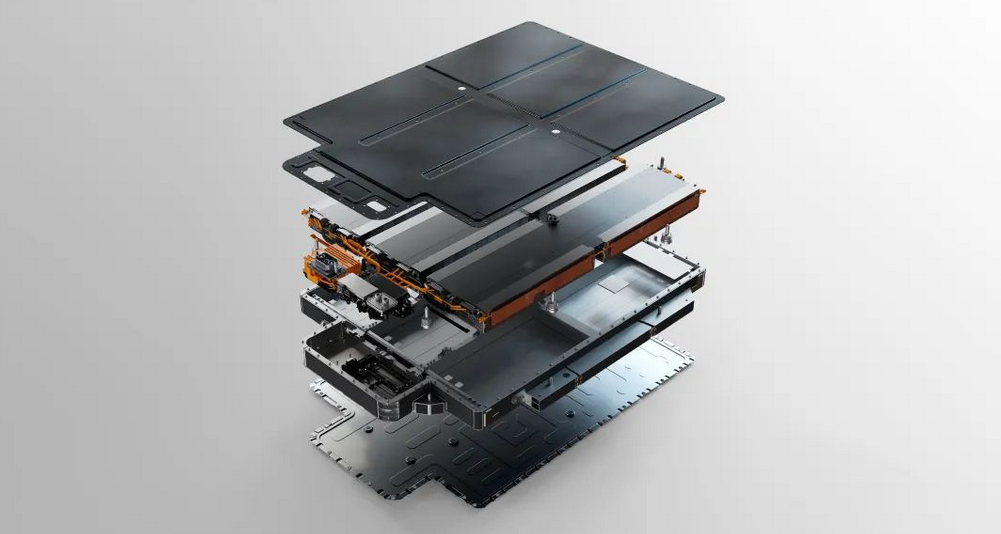

At the same time, NIO disclosed some information about its batteries, which has attracted significant attention in the industry.

Pressure on NIO from Batteries

On November 10, 2021, at the NIO Q3 2021 earnings call, NIO CEO William Bin Li stated that NIO’s long-term vehicle gross margin target is 25%.

To achieve this strategic goal, strengthening cost reduction and efficiency has become NIO’s essential choice in operation. One of the most important points is to strengthen the research and development of battery technology to further control the battery.

Regarding battery R&D, there is a significant misunderstanding, and even some editors cannot distinguish between battery core R&D and battery pack R&D. The former is more difficult, and the latter is slightly less difficult. After the development of the battery core, it also involves complex battery manufacturing.

At present, there are only a few OEMs who can manufacture electric cores, and the vast majority of them purchase battery packs or electric cores from battery factories and then develop battery packs themselves. Although OEMs can self-assemble battery packs, their technologies vary, resulting in inconsistent performance such as spontaneous combustion.

At present, NIO belongs to the category that directly purchases battery packs from battery factories (CATL).

In terms of quality, except for the spontaneous combustion of NIO’s ES8 in the early stage of switching from Samsung batteries to CATL batteries (the reason is unknown whether it is due to NIO’s battery pack design problem or CATL’s electric core problem), NIO has not had many spontaneous combustion incidents. This shows that the quality of directly purchasing battery packs from CATL is highly guaranteed.

According to “Electric Motion” analysis, the so-called NIO self-developed battery publicly disclosed before 2024 (this time point comes from the following text) refers to self-developed battery packs.

Return to Gross Margin

The Q1 report shows that NIO’s automotive sales revenue was 9.244 billion yuan, an increase of 24.8% compared with Q1 2021 and an increase of 0.3% compared with Q4 2021; the vehicle gross margin was 18.1%. In contrast, the vehicle gross margin was 21.2% in Q1 2021 and 20.9% in Q4 2021.

The report explains that NIO’s vehicle gross margin has decreased compared to the first quarter of 2021, mainly due to changes in the product mix resulting in a decrease in the average selling price; the vehicle gross margin has decreased compared to the fourth quarter of 2021, mainly due to the increased cost of single-car batteries.

Regarding the pressure on NIO’s gross margin in Q1 2022, Li Bin stated at the earnings call that the entire electric vehicle industry is facing rising prices of materials such as batteries and chips and that NIO cannot be spared.Li Bin revealed that NIO’s battery costs significantly increased in the second quarter and reached a peak in April, which poses a challenge to the gross profit margin for the quarter.

Despite the fact that NIO’s gross profit margin for the first quarter is further away from the long-term goal of 25%, the fact of industry mutation can’t be ignored.

Since the beginning of this year, the prices of battery raw materials such as lithium carbonate and lithium hydroxide have surged. Among them, the highest price of lithium carbonate has soared to more than 500,000 yuan per ton, and then the price transmission chain has spread to various battery factories and terminal factories.

According to the industry’s judgment, the prices of battery raw materials have reached their peak, and the trend of decline will be followed. This also means that the decrease in NIO’s gross profit margin caused by the rise in battery raw material prices is also a periodic fluctuation.

Li Bin said that with the delivery of new products, the increase in single-car revenue, and the increase in production volume, the gross profit margin is expected to rebound from the third quarter, and the battery materials will be linked to the raw material prices. The cost of the battery pack is basically determined by the raw material prices of the previous month, and the orders with higher prices can only be delivered in the third quarter.

Nevertheless, this sudden mutation in the battery industry has still increased NIO’s determination to research and develop its own batteries.

Li Bin said that NIO’s investment in battery research and development has significantly increased in the past period.

I checked the financial report and did not see any financial data related to battery research and development, but there are some overall research and development data for everyone to refer to.

The financial report shows that NIO’s R&D expenses for Q1 were RMB 1.7617 billion ($277.9 million), an increase of 156.6% year-on-year for Q1 2021 and a decrease of 3.7% sequentially for Q4 2021.

Based on the R&D expenses for Q4 2021, if the R&D expenses for battery research and development have increased, it means that the R&D expenses for other technologies have been cut accordingly.

Li Bin also disclosed that NIO currently has a battery-related team of more than 400 people, deeply involved in research and development work such as battery materials, battery cell and pack design, battery management system, and manufacturing processes, comprehensively establishing and enhancing battery systematized research and development and industrialization capabilities. I believe that these investments will improve the long-term competitiveness and profitability of NIO’s products.

This paragraph has received a lot of quotations in the industry, and there are many speculations in it, such as whether NIO will abandon CATL and develop its own batteries, etc.

I think it may be too much to worry about, as car companies with certain strength will all research and develop their own battery packs or battery cells, such as BMW, which has repeatedly emphasized that it has mastered battery cell research and development technology, and Tesla. However, mastering it and manufacturing it are two different things.

Regarding multiple battery cell suppliers, at least for now, it is also the norm in the industry, and there is no issue of whether to abandon it or not.

Traditional automakers rely mainly on battery suppliers for battery cells and participate more in battery pack design and manufacturing, according to their actions, such as BMW and Mercedes-Benz.

In contrast, Tesla, which is more powerful, has more options, but still relies on battery manufacturers for battery cell manufacturing.

Therefore, regarding the information disclosed by Li Bin, I think it is normal. NIO did not do it before, and now it is just filling this gap.

As for whether NIO will develop its own battery cells and even produce them in the future, I think the possibility is not high. Even if it does, it will only be a small-scale trial production, and mass production of battery cells has great uncertainty.

In the future, the core of smart electric vehicles will definitely be in intelligence, including software, chips, and operating systems. From another perspective, has Apple developed its own battery cells? Has Xiaomi developed its own battery cells?

As for the claim that battery cells account for a high proportion of costs, chip costs are not low now, and even exceed battery cells?

Recently, Yu Chengdong said, “Let’s do the math. Originally, a chip cost 10 yuan, and 9 chips are used for one car, which is about 100 yuan. Now it has risen to 2500 yuan. If you use 9 chips, it will be 22,500 yuan, and the cost will directly increase by 22,000 yuan.”

Compared with the speculation from the outside world, Li Bin’s statement may be more worthy of scrutiny.

Li Bin revealed that NIO will launch a brand new 800V high-voltage platform battery pack in 2024.

Li Bin said that this battery pack will redefine batteries in terms of cost, performance, and safety. In the long run, it will adopt a “self-made+external procurement” manufacturing strategy, which can effectively improve future profitability.

To put it simply, self-made means that NIO makes its own battery pack, and external procurement means that NIO buys battery pack from battery factories. As for whether the battery factory is CATL or other battery factories, it is not easy to say now. Generally, it mainly depends on NIO’s own brand and product requirements, as well as technical requirements for battery packs.

I think NIO’s battery strategy is still lagging behind the industry as a whole, whether it is self-developed battery packs, multi-supply of battery cells, or even launching an 800V high-voltage platform until 2024.

From the catalog information of the XPeng G9, it not only uses XPeng’s self-made battery pack but also is the first domestically produced 800V high-voltage platform mass-produced car. The benefits of 800V are self-evident, which can further accelerate the charging speed of car owners and alleviate charging anxiety.

The 800V high-voltage platform is the key for XPeng and IDEAL to challenge NIO swap stations. Once other brands’ 800V fast charging systems are established, NIO’s reliance on swap stations will be further weakened.

Finally, let’s discuss a bit.In order to achieve a gross profit margin of 25%, NIO must tackle the battery issue. However, developing proprietary battery cell technology is too difficult, let alone manufacturing cells. Thus, developing proprietary battery packs and adopting cells from multiple suppliers is a more practical path.

By leveraging multiple cell suppliers with NIO as the core, NIO theoretically gains the initiative to reduce costs. However, this decision is not without cost.

Firstly, there is feedback from users.

For example, considering the already-proven CATL battery packs and the developing but quality-unknown NIO battery packs, which do you think consumers would choose? Additionally, for the same model of car, when comparing CATL cells with cells from other brands, which do you think consumers would choose?

These are all very real problems, especially for a high-end user-oriented brand like NIO.

Secondly, there are consequences to breaking a binding relationship.

In the past, by having a deep relationship with CATL, NIO could obtain the best battery packs, such as ternary lithium-ion batteries, and even later semi-solid and solid-state batteries, thereby creating NIO’s high-tech brand image.

However, if NIO adopts multiple cell suppliers and decreases the importance of CATL, will CATL still be willing to provide the best batteries to NIO first?

It’s hard to say for sure, as CATL’s customer base also includes Tesla, and even BMW, Mercedes-Benz, Ideal, and so on.

In short, each decision is a double-edged sword. It depends on how to choose and think about its hidden risks.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.