Author: Zhu Yulong

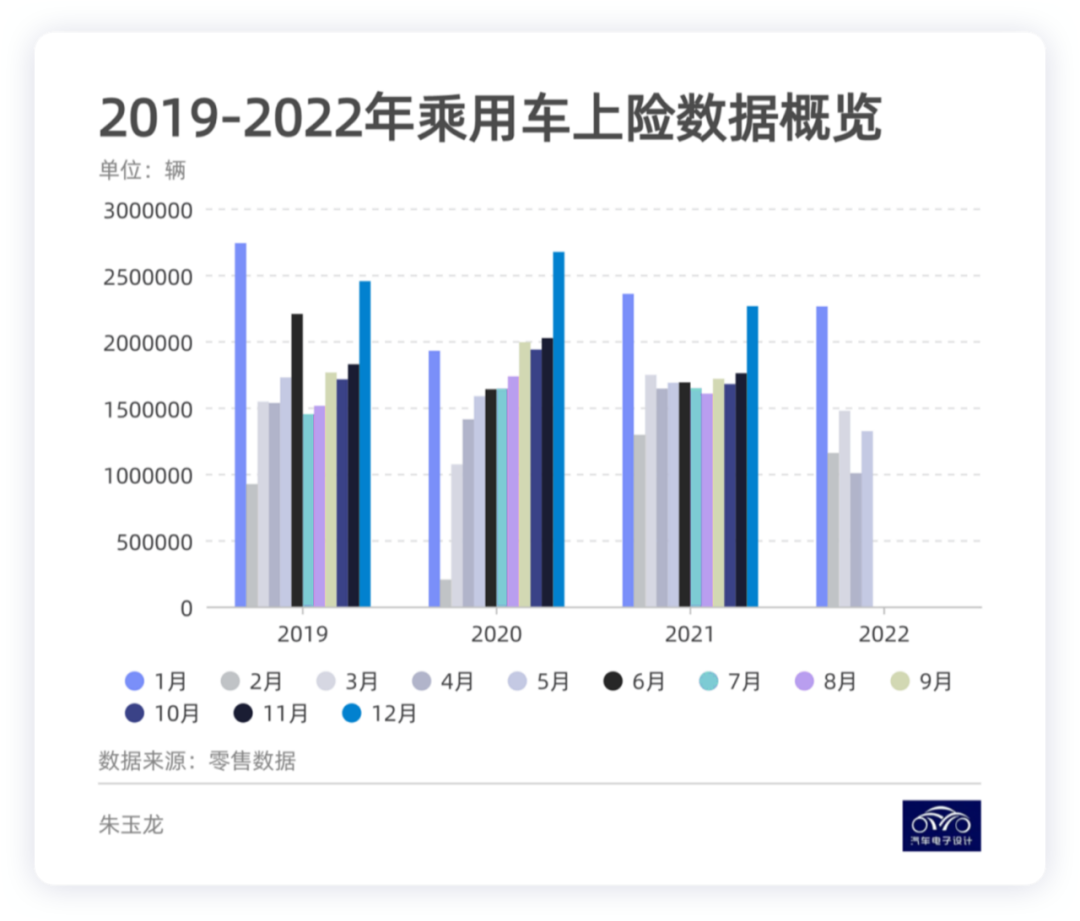

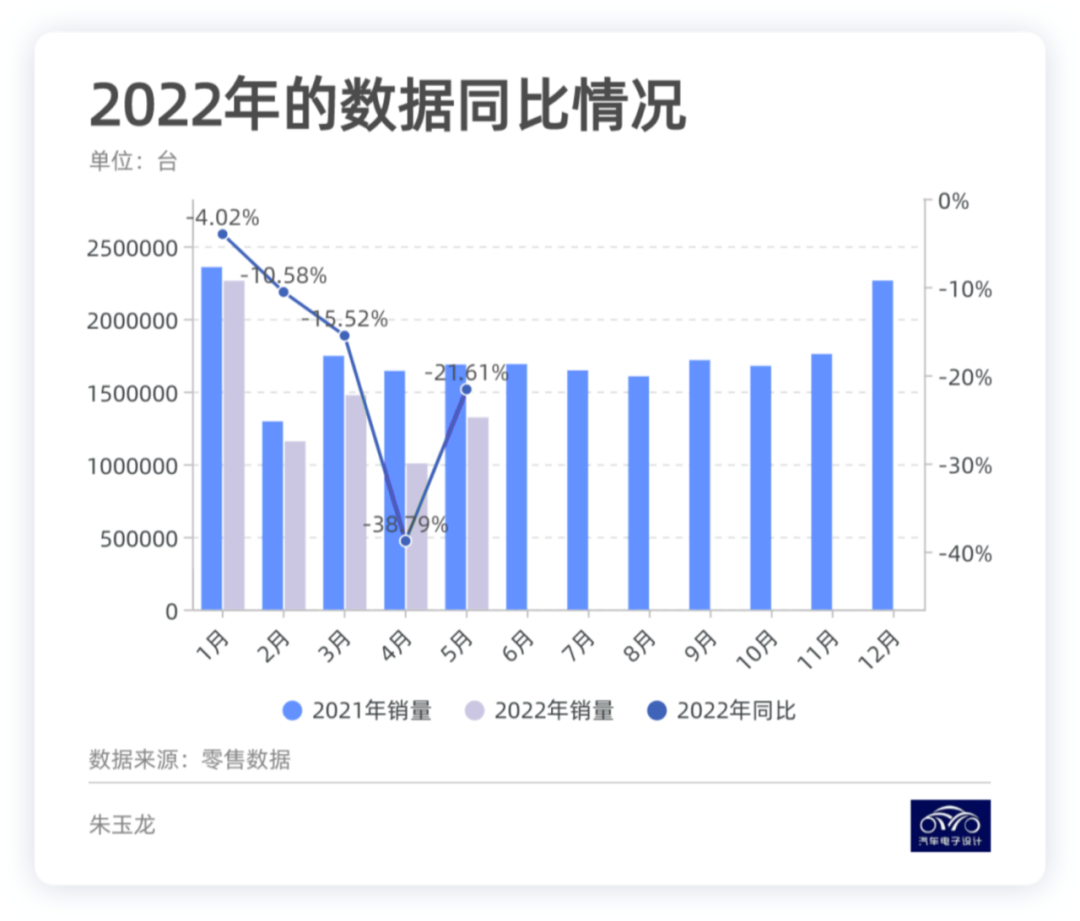

Yesterday, we received the latest retail (insured) data on passenger cars, and let’s take a look together. The total number of passenger cars in May was 1.3216 million, an increase of 317,000 compared to April’s 1.005 million. Overall, under the expectation of halving the purchase tax for eligible vehicle models, the passenger car sales market is gaining momentum and recovering. From the overall data perspective, the total data from January to May 2022 was 7.22 million, a year-on-year decrease of -17.2%.

We can see that the consumption of whole passenger cars has been declining since the beginning of 2022, with the lowest year-on-year decrease in April reaching -38.79%, reaching a trough. In May, with the issuance of policies, passenger car sales began to recover and stabilize. It is estimated that in June, it will return to the normal level of 1.5 million per month. Whether the two traditional off-seasons of July and August can walk out of independent market conditions still depends on high-frequency weekly data.

Independent Brands and Joint Ventures

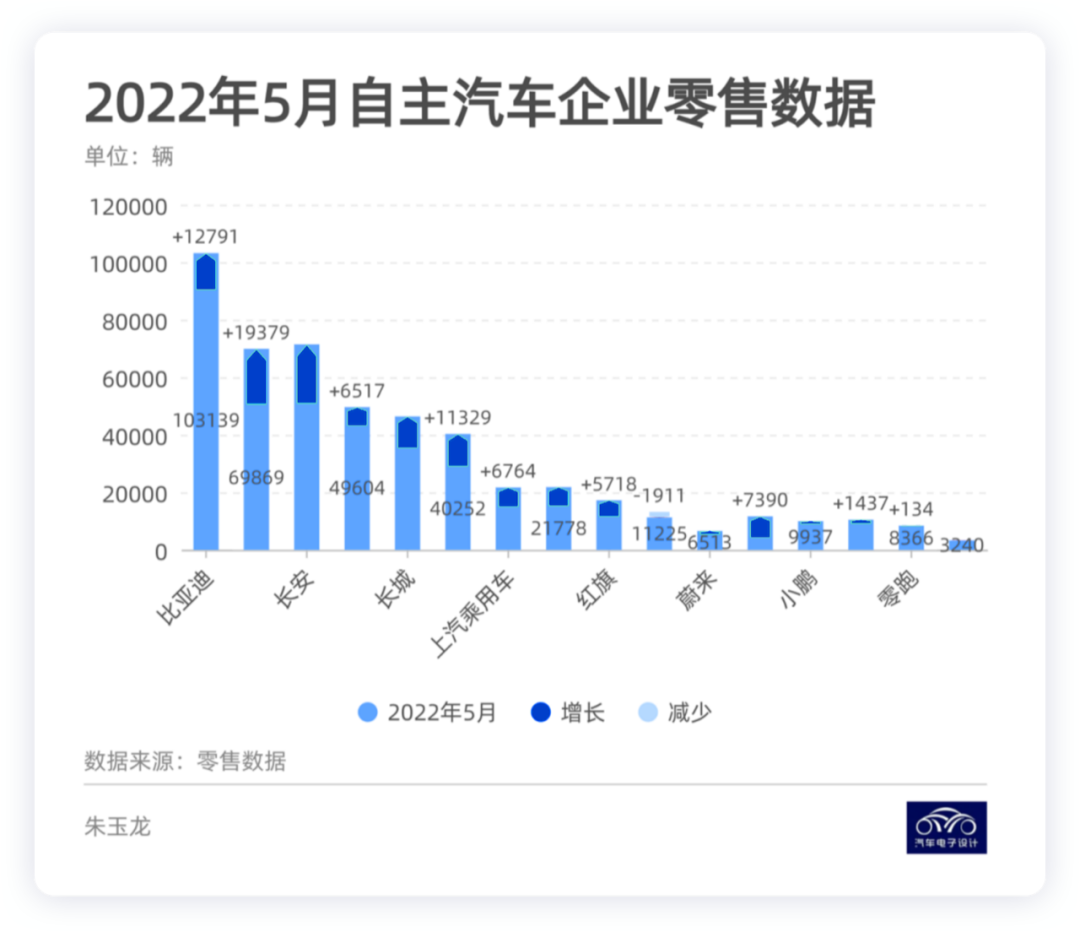

I have pulled out two sets of data, mainly divided into independent brands and foreign-funded brands.

- Independent Brands

Most independent passenger cars have risen compared to the previous period. BYD’s retail sales (registration) were 103,000 units, ranking second is Changan with 71,400 units, and the third is Geely with 69,800 units. The second tier is between 40,000 to 50,000 units, respectively, Wuling, Great Wall, and Chery, and the third tier are GAC, SAIC, Aiways, and Hongqi, all with 10,000 units or more.

In terms of incremental volume, Changan and Geely have recovered relatively quickly.

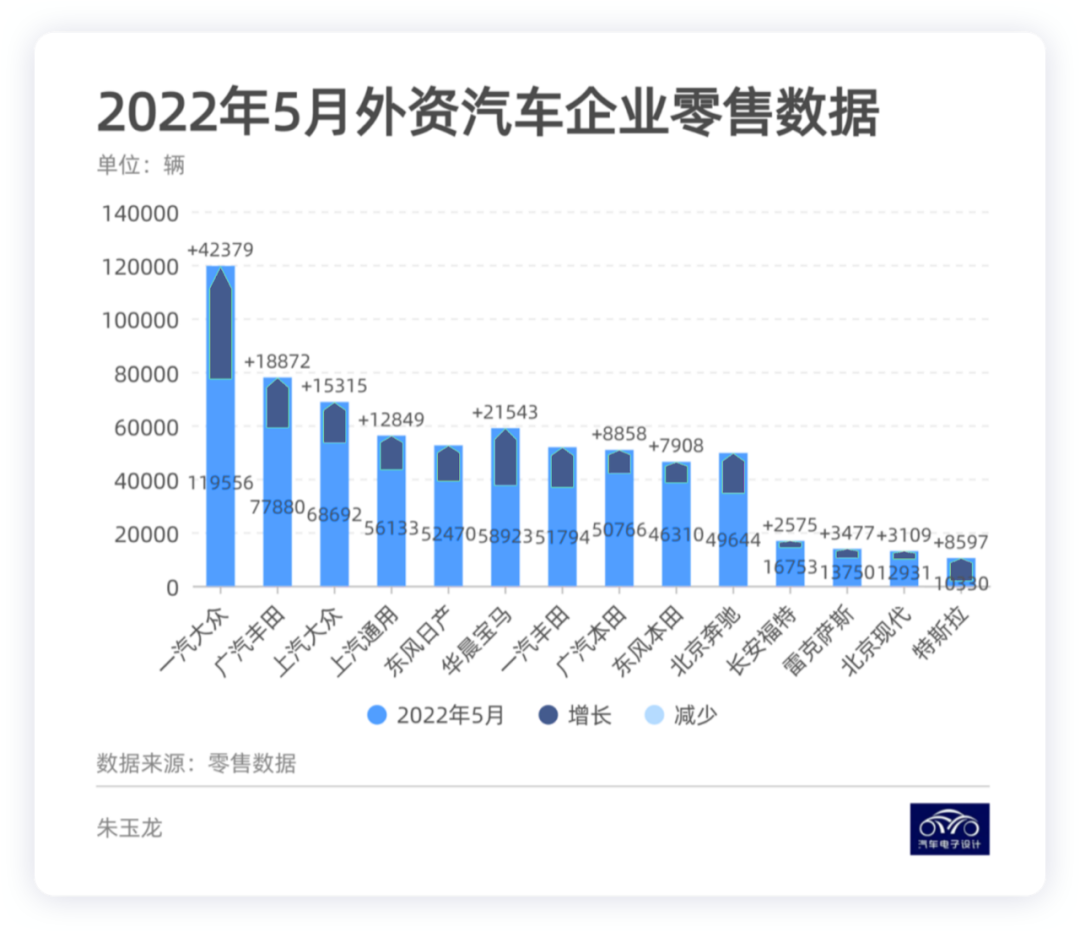

- Foreign-funded Brands

In May, foreign-funded brands have gradually entered the passenger car market. FAW-Volkswagen delivered nearly 120,000 vehicles, a significant increase from the previous month. With the gradual recovery of the epidemic situation, the data of each company looks good. Among them, Tesla’s delivery in China finally exceeded 10,000, achieving significant results under the efforts of resumption of production and work in Shanghai.

Note: In the diagram, the data of BMW and Mercedes-Benz are added to their respective joint ventures. The main focus here is on the recovery of the Chinese luxury car market.

Focus on New Energy Vehicles

- Tesla

The recovery of Tesla’s sales is actually related to the output rate of its Shanghai factory. As the Shanghai factory bears the export mission, part of the recovery in May is due to exports. With the monthly output gradually moving towards double shifts, production is expected to climb from 30,000 to around 50-60,000 by late June, if there are no hiccups.

- BYD

BYD’s strength remains unchanged, with pure electric vehicle sales of 51,000 and plug-in hybrid electric vehicle sales of 50,600, and the entire data climbing process is limited by plant capacity.

Looking at the current data for pure electric vehicles, the main models are the Yuan Plus (11,631 units), the Han (9,330 units), and the Qin Plus (7,423 units). The previously released E1, E2, E3 to E5 and E6 are expected to retire soon. From the dynasty series to the ocean series, we see that the overall sequence of these cars is beginning to focus on creating best-selling models. This is also the inevitable path for future capacity improvements.

The twists and turns in this process are really worth reviewing.

PHEV is the focus of our research and comparison in the next stage, and BYD is still ahead of the market. The delivery of the Song Plus and Qin Plus models is relatively high, which still depends on the prices of high-volume models.

-

New Energy Vehicle Startups# Data for NIO, Li Xiang, XPeng, Hezhong (NETA), Leapmotor, and WM

-

NIO: 6513

-

Li Xiang: 11596

-

XPeng: 9937

-

Hezhong (NETA): 10441

-

Leapmotor: 8366

-

WM: 3240

Summary: The data for the first month of getting back to work after the COVID-19 outbreak shows signs of recovery. Overall, there will be good news for June.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.