Article | Zheng Wen

Editor | Zhou Changxian

On February 22, Volkswagen Group announced that it had reached a framework agreement with Porsche SE’s Board of Directors to clarify that Porsche AG will be listed independently.

On that day, affected by the intensification of the Ukrainian conflict, major European stock indexes and corporate stock prices, including the German DAX index, fell sharply across the board, but Volkswagen’s stock rose against the trend by nearly 10% in a few hours, which is considered a miracle.

I don’t know whether it was a coincidence or a pre-planned event, but Porsche China media communication meeting was also held on the same day, and Porsche handed in a beautiful result list for 2021 in China.

Two days later, the news became clearer.

Arno Antlitz, Chief Financial Officer of Volkswagen, stated that Volkswagen will provide the latest progress and timetable for the listing to the market in late summer. This means that Porsche may complete its IPO as soon as the fourth quarter of 2022.

Crazy “cash cow”

Porsche is undoubtedly a profitable cash cow.

Among traditional automakers, Porsche is almost the only brand that can maintain a profit margin above 15%, and it is also a “high-quality asset” in the Volkswagen Group.

Volkswagen Group sells about 9 million new cars every year, and Porsche’s global delivery volume exceeded 300,000 units last year. Its delivery volume accounts for 3.33% of the group, but its profit ratio reaches 25%.

Porsche China Vice President and CFO Hong claimed: “As you can see, Porsche has always adhered to the commitment of maintaining high profitability in financial data. In recent years, the financial performance in China and the global market has been very stable, and the sales return rate has reached 15%.”

In order to split and go public, Volkswagen Group has established a dual shareholder structure for Porsche. Porsche’s shares will be evenly divided into common shares and non-voting preferred shares, and a maximum of 25% of preferred shares will be publicly offered.

According to Bloomberg’s forecast, if Porsche’s independent listing is successful, its valuation may be as high as 60 billion to 85 billion euros (approximately RMB 400 billion to 600 billion yuan), which is tantamount to creating another Volkswagen.

Unlike its parent company Volkswagen Group, Porsche’s direction towards electrification is particularly radical under the new leader, Dr. Oliver Blume, who took office in 2015. Among the 12 brands in the entire group, Porsche has indeed taken a very unique path.

Porsche can be said to be the most dynamic in terms of reform. As early as June 2018, it announced that it would launch its first pure electric vehicle Taycan the following year.At that time, the consumer market had far less acceptance for pure electric vehicles than it does today, let alone a super luxury performance car – isn’t this a betrayal of the roaring engine? For a time, there were many doubts.

In 2019, the appearance of the Porsche Taycan turbo S at the last Frankfurt Auto Show received a great deal of attention. A senior industry insider even spoke highly of Taycan as the first pure electric vehicle that impressed him. Many foreign media also believe that Taycan has the potential to replace the 911 as a classic sports car series.

In 2020, Taycan was launched in multiple countries/regions around the world and achieved good market performance in the first year of release just like the Cayenne and Panamera did.

According to official data, in 2020, Porsche Taycan delivered a total of 20,015 new vehicles worldwide. Keep in mind that in the first incomplete sales year, Taycan contributed more than 7% of the brand’s sales.

The continued increase in sales volume caught even the Porsche management team off guard. In 2021, Taycan’s annual production capacity was planned at 20,000 units, but this number had already sold out in the first half of the year.

Porsche China’s Vice President and Chief Operating Officer Xiao Da revealed, “By 2025, we plan to have 50% of global new deliveries be electrified models, and by 2030, 80% of models will be electrified.” Porsche also promised to achieve carbon neutrality throughout the entire value chain by 2030 – an ambitious goal.

At the same time, the parent company Volkswagen is facing a relatively awkward situation.

The heavy burden of the transformation of traditional car companies is unprecedented. Volkswagen’s goal is for pure electric vehicles to account for more than 70% of new car sales in the European market by 2030, and for the penetration rate of pure electric vehicles in the Chinese and US markets to also reach 50%.

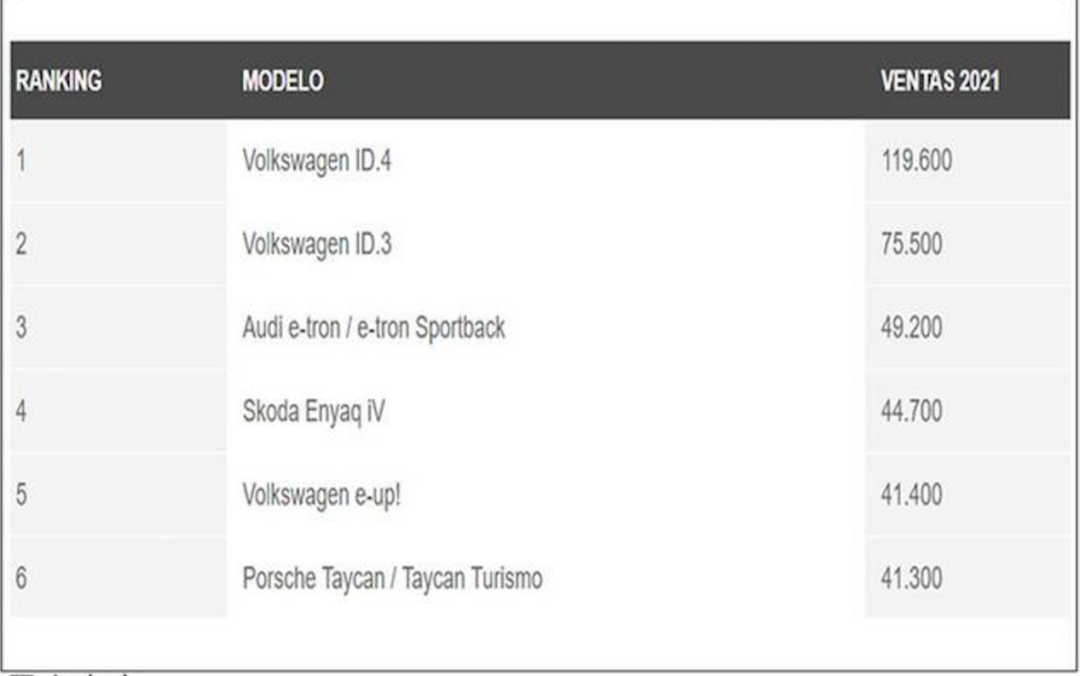

According to data released by overseas media, Volkswagen’s two core pure electric models, ID.4 and ID.3, sold 119,600 and 75,500 units respectively in 2021. In China, only 70,625 units of the ID series were sold, failing to achieve the target of 80,000 to 100,000 units. With this sales data in mind, the road ahead is still long.

How to achieve the goal? Continuous investment is still needed.

Previously, Volkswagen planned to invest 35 billion euros in electrification and 27 billion euros in digitalization by 2025.According to the estimates of major investment banks in Europe, Volkswagen is expected to raise between 15 billion and 25 billion euros through the IPO of Porsche.

Although Volkswagen CEO Herbert Diess has repeatedly conveyed confidence in having enough funds to complete the electrification transformation, shareholders are still concerned that the company’s annual 15 billion euros in free cash flow may not be enough to support the plan. It is also believed that Diess underestimated the rise in battery raw material prices and the cost of building battery plants.

Financial data is also worrying. In 2020, Volkswagen’s marketing revenue fell by 12% year-on-year to 222.9 billion euros, and net profit fell by 37% to 8.82 billion euros. The company’s performance continued to decline in the first three quarters of 2021.

In short, the independent listing of Porsche is indeed very important for Volkswagen’s cash flow.

Who is the hero?

There is no doubt that Porsche has achieved great success in the new electric vehicle market, with impressive sales returns and progress in electrification compared to traditional car manufacturers.

So, who is the hero?

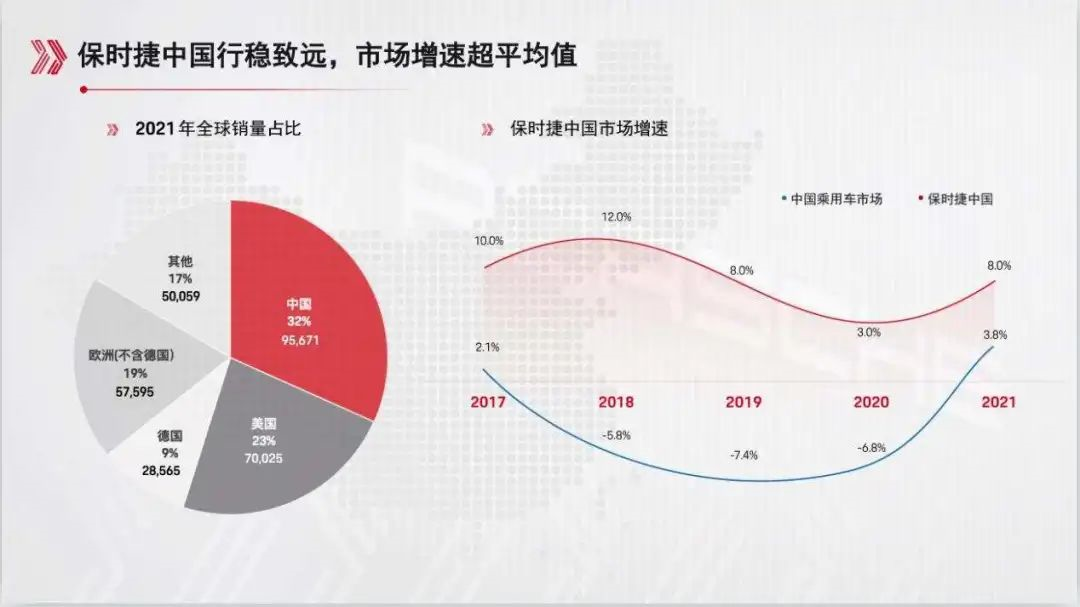

On February 22, Dr. Yan Buyu, President and CEO of Porsche China, revealed the answer. In 2021, Porsche delivered 95,671 new vehicles in the Chinese market, a year-on-year increase of 8%. “32% of Porsche’s global sales come from China, which has become Porsche’s largest single market for the seventh consecutive year.”

Among them, SUV models continue to dominate the Chinese market, with Cayenne and Macan performing equally well, both exceeding 30,000 units sold. Panamera’s market demand remains strong, with a year-on-year increase of 26%, and sales in China account for more than half of global Panamera sales.

It is worth mentioning that the influence of two-door sports cars among young consumers is also increasing. 911 increased by 67% year-on-year and achieved high double-digit growth for two consecutive years. The 718 continued to maintain its leadership position in the niche market with a 74% market share.

In addition, the feedback on Porsche’s first pure electric sports car, Taycan, has also been very positive. At present, four derivative models have been launched in China, and a delivery record of 7,315 units was set in 2021. “2021 is the first full sales year for the Taycan, with a total of four electric sports cars delivered, totaling 7,315 units, more than twice the order volume of 2020.”# The Structural Changes in The Global Automotive Industry Enable Porsche to Speed up Electrification

Porsche is striving to accelerate electrification around product and car-life ecology facing a structural change in the global automotive industry. Currently, Porsche introduced 16 pure electric and plug-in hybrid models to China. In 2021, the delivery volume of Porsche electric vehicles accounted for 18% and increased 8% compared to the previous year, staying ahead of traditional luxury car brands.

Interestingly, Taycan helped Porsche’s brand to expand its customer base. 72% of Taycan users buy a Porsche for the first time.

“In 2021, under many uncertain factors such as the COVID-19 pandemic and the shortage of chip supply worldwide, Porsche has ended the brand’s 20th anniversary in mainland China successfully with a new record year. We are pleased to have created history again and proud of the many milestone breakthroughs we have achieved in the past year.” said Boyu Yan.

The average age of Porsche owners in China is 35 years old, even the same as Mercedes-Benz. However, in North America and Europe, the average age of Porsche owners is about 53 years old. Porsche’s success in the rejuvenation of customers in China is impressive.

Boyu Yan believes that under the wave of digitization and intelligentization in the automotive industry, the Chinese market is very dynamic and full of vitality.

“We have found that many automotive research and development businesses cannot be developed in Germany or cannot be fully understood in Germany, it is more important that they cannot be tested, because Germany does not have the corresponding ecosystem and technical foundation.”

Therefore, after in-depth research and discussion, Porsche China team reached an agreement with the German headquarters to establish a branch of the German R&D center in Shanghai.

“In fact, the first batch of German colleagues of the R&D branch has come to China to start building the architecture. More and more German colleagues will come to China in the next few weeks. Of course, we are still solving some difficulties such as flight and quarantine.” Yan revealed that the first batch of colleagues of the R&D branch will officially start working in April or May.

In the future, the Chinese R&D branch will maintain close contact with Germany, provide important information to the headquarters, and work with colleagues from the Porsche Engineering Department, the Digital Department, and Beijing to find specific solutions for future autonomous driving, connectivity, electric driving, and charging for the Chinese market.

It’s worth mentioning that these solutions are designed by Porsche for the Chinese market and will be integrated into cars developed in Germany.

Porsche’s moves in China are still accelerating.

Conclusion

In the past few years, Porsche has continuously achieved record delivery volumes in China, which belongs to Boyu Yan’s team.

Unfortunately, after three months, he will return to the German headquarters having another important task.

At the media communication meeting, Yan expressed his personal feelings, which is rare for him.

“I am very impressed by the spirit I have seen from the Porsche China team and the Chinese people. They always focus on the future, take strong actions and are not complacent. They respond to the future development with very efficient work.”

He admits that he wants to bring this kind of spirit and efficient way back to Germany, and bring confidence in the future and a positive attitude back to Germany.

“I have never had a month that is the same during my time in China. Every month there are new challenges and changes.”

Yan Boyu exclaimed that in the Chinese market, one must be very flexible, able to quickly adapt to sudden changes, and take advantage of the situation in a timely manner.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.