This article is reposted from the autocarweekly official account.

Author: Karakush

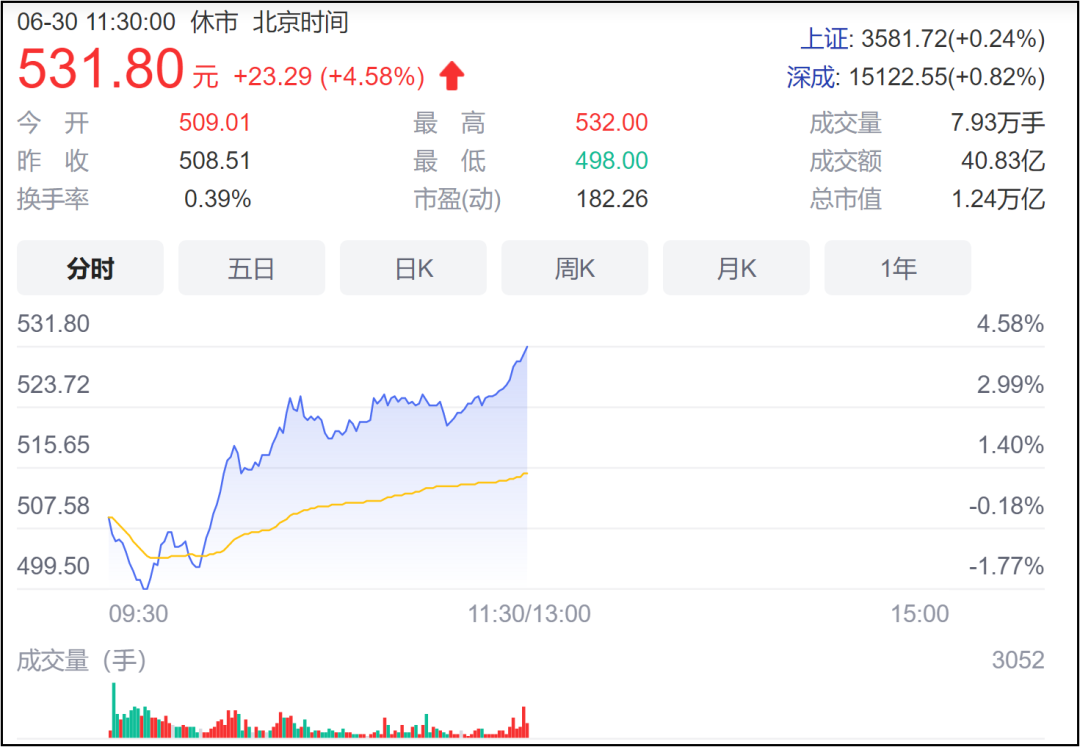

CATL’s stock price is rising again.

Today, after a slight shock in the opening, CATL’s stock price has been rising all the way. As of the morning closing, the increase has reached 4.58%, and the stock price has risen to 531.8 yuan.

The reason on the news side is that on the evening of June 28th, CATL issued an announcement that it has signed a framework agreement with Tesla to supply lithium-ion batteries to Tesla from January 2022 to December 2025.

This agreement is actually an extension of the supply agreement from last year. The supply time in the old agreement was from July 2020 to June 2022, a total of two years; and now it has been extended to about five and a half years.

The joy in the secondary market is understandable.

This extension is a decision made after a “trial” for a year, indicating that the user experience is quite good. After domestic Model 3 began to be equipped with CATL’s lithium iron phosphate batteries last year, the cost was greatly reduced, providing the model with ruthless price reduction space, which can be said to be the key reason for Tesla’s sales growth. Experience and rationality that have been tested are the most lethal: cheap, safe, and stable, buy it.

In addition, five years is a long-term contract. If a club or brokerage firm extends a long-term contract with a certain celebrity athlete, it will go to the hot search, and the time is a risk that both parties have to bear. The fleeting years are ridiculous, and the window will not wait for me, just like in the battery market. The five-year contract not only indicates that you are a stock with excellent performance, but also expects you to be a stock with potential.

It is also worth noting that the renewed contract no longer includes the word “China,” perhaps indicating that the cooperation will go global beyond China.

Just like what the announcement said, this is Tesla’s further recognition of CATL’s product quality and production capacity.

However, the surge in stock prices may be unexpected for some friends.

Since the beginning of this year, CATL’s stock price has accumulated an increase of more than 44%. Especially since the end of May, its market value has reached one trillion yuan for the first time, becoming the only technology trillion dollar stock in China’s new energy concept and A-share market, leading other peers by a large margin; and CATL is still growing in the meantime, with a cumulative increase of 17%.

Technical adjustments are harmless. In general, in this kind of situation, the big leader usually callback slightly, and funds are more actively pouring into the second and third lines, after all, there are many good targets, and raising the ceiling is also beneficial for emerging players to have a more clear judgment of the stock price.

But if you read more industry news, you may get confused: isn’t CATL (Contemporary Amperex Technology Co. Limited) going to fail? There are plenty of skeptics in the industry, some of whom argue that there is too much hype in the sector, while others say that the growth momentum is not strong enough. And they have good reasons: as more and more automobile companies build their own battery factories, the redress of battery dividends brought about by electric vehicle growth is no longer monopolized by battery companies.

CATL will be abandoned by the times.

This still deserves some debate

The phenomenon is that most of the powerful automobile companies are demonstrating their plans to produce their own batteries. They are vigorously building battery factories, increasing GWh production, and investing in battery companies.

For example, in March of this year, Volkswagen Group announced plans to build six super battery factories in Europe with a total annual production capacity of 240GWh by 2030. In the Chinese market, Volkswagen Group has invested in battery company Guoxuan High-tech.

The more radical the giants are in the transition to electrification, the faster their pace is in China.

For example, since 2012, Mercedes-Benz has established nine battery factories in seven cities on three continents globally, which are used to support the production of 500,000 new energy vehicles per year in the future. One of the factories is located at Yizhuang, Beijing, and has been producing batteries for EQC since 2019. Mercedes-Benz also invested in battery company Funeng Technology through its subsidiary last year.

BMW’s power battery center Phase II in Shenyang was also opened last year. This is the first fifth-generation power battery factory put into operation in BMW’s global production network, providing support for iX3.

Domestic automakers, such as Geely, started building a battery project in Ganzhou in May, with an annual capacity of 42GWh. The group has set up two Varejo companies to make battery packs and directly holds shares in Shandong Hengyuan New Energy (which has existing on-site production capacity for its own supply) and indirectly holds shares in Funeng Technology.

Great Wall Motor also has its own incubation of the battery energy company, Fulaide Energy, which has now been spun off and operates independently. They began their first battery factory in Changzhou at the end of 2019, with overall annual production capacity planned to reach 100GWh in several factories in China and Europe by 2025.

If space permits, I can explain several more examples. The self-built carnival has excited many friends in the industry and is seen as an inevitable trend for automakers. Producing and selling batteries in-house forms a comprehensive commercial loop which looks like an eternal machine of perpetual motion. In contrast, specialized power battery suppliers like CATL will have difficulty maintaining their growth momentum and their long-term prospects are not optimistic.

- – – It is probably not what friends in the automotive industry would say.

Amidst the trend of building self-owned battery factories, there are some characteristics that make people believe: expertise will not die.One way that many auto companies have chosen to pursue “self-building” in the electric vehicle industry is by collaborating with professional battery companies through joint ventures. For instance, projects for power batteries from SAIC, GAC, and Dongfeng have been established and built in collaboration with CATL. This approach is more cost-effective than direct procurement once economies of scale are reached, as long as the initial investment costs can be sustained, although establishing a joint venture factory is still quite expensive – even though the investment and risk are much smaller compared to solo efforts.

However, those who are determined to go solo are not excluded. For example, Great Wall signed a ten-year strategic framework agreement with CATL in early June. Last year, Geely and CATL’s joint venture, TAGE, also announced plans to invest in a power battery project in Yibin.

Auto companies are pursuing multiple options to ensure a secure battery supply chain. Volkswagen has explained, for example, that it maintains a large amount of cooperation with CATL in addition to its relationship with Guoxuan High-tech. The first batch of electric vehicle products launched in the Chinese market by Volkswagen, from the Volkswagen ID.4 to the ID.6, use CATL batteries. Compatibility, therefore, is key to securing a sufficient battery supply.

While a grand energy vision may be enticing, the top priority for auto companies is to swiftly address their own battery supply. Currently, the main concern is that the increasingly expanding production demands of auto companies are not able to be met by the growing battery production capacity. Elon Musk has forecast that even if its battery suppliers develop at maximum pace, a severe battery shortage is anticipated to continue after 2022. Delivery of Tesla’s Semi electric truck has been delayed due to battery shortages.

This year, the influx of new car startups and the vigorous transformation of veteran automakers in China have contributed to the upstream production woes that some battery producers, such as CATL, have been experiencing due to lack of quality production capacity. Li Bin stated in March that NIO’s monthly deliveries were limited to 7,500 vehicles due to battery supply constraints, and even more crucially, the 100 kWh battery will not meet expectations until July.

Supply chain security has become a dilemma for auto companies and one of the reasons why they are urgently pursuing self-building options. Some established auto companies may still strive to prioritize certain product lines by their own efforts when facing supply chain pressures.

Similarly, some powerful auto companies may opt to buy critical raw materials such as lithium and cobalt from mining companies to further ensure the security of their supply. It is unlikely that mining companies will have difficulty finding customers to do business with.Even without considering battery shortage, car companies can still be relatively calm in the daily game with the supply chain. Electric vehicle batteries account for over 40% of the total vehicle cost and are a key component for determining product pricing. However, at present, safety requirements for timely/priority delivery are greater than bargaining power. Technically, batteries have a hard cost. Battery companies are not omnipotent players like Cindy, but rather survivors who maneuver within their own competitive and supply/demand situations. Therefore, there is not much bargaining space in the short term, but sensitivity to first-mover advantage in launching high-quality batteries into the market is higher.

No matter whether battery shortage will evolve into a long-term issue, it is indicative of a market that is too large, and cooperation is diverse.

Professionalism is the Key

In the medium to long term, my personal opinion is that car companies have the necessity to layout for batteries, but not the necessity to recreate another CATL.

There is a view that battery threshold is extremely high, and not something that car companies can just become proficient in. I personally do not agree with this simplistic argument.

After all, there are companies like Tesla that have announced the creation of a brand new “super battery factory,” taking on the design, production, and even electrode materials (of course, they will continue to purchase from cooperative battery companies). The key is that it is not impossible based on acquisition and R&D. It is a requirement of their mission and business logic.

It is precisely from the perspective of business logic that most car companies have their own tasks to do.

Its “necessity” lies in understanding battery R&D, production, processes, and technology through building your own battery factory, so as to better demand from battery factories. For car companies, a component that accounts for 40% of the total vehicle cost cannot be a black box component. Just as in the past when making fuel cars, not mastering engine technology, there are very few friends who are too lazy to even copy it.

The “non-necessity” lies in respecting the division of the industry and the laws of the industry. In more than 100 years of industrial history, it is not the first time that new technologies have emerged. Car companies have not developed into all-encompassing trusts. The industry still differentiates into the roles of host factories and suppliers. They participate in research and development designs with each other but maintain a clear dividing line. Supplier groups such as Bosch, Continental, and ZF are responsible for technology and components, while the value of car companies lies in the integration of the entire industry chain.

A point in maintaining mutual respect in the chain lies in professionals undertaking the trial and error cost of the technology.The power battery technology is still in a rapidly developing stage with various technical routes, despite its development to this day. A few years ago, graphene was rumored to be the hope of the whole industry, while solid-state batteries have become the trend this year. You might have thought that ternary lithium batteries are the sole solution for long-range driving in the market, but lithium iron phosphate, which has been beaten by ternary lithium batteries, is making a comeback.

The iteration is fast and nonlinear, and nobody dares to bet on which direction will be the future development. Even CATL chooses to invest in all possible solutions instead of betting on one. For automakers, the priority of R&D cost is also a big issue. The two corresponding basic disciplines for batteries and vehicles are quite different – one is electrochemistry, and the other is mechanical engineering, which will become electrical engineering and computer engineering in the future. In any case, it cannot be said that it is impossible, but it will inevitably require extra tuition.

Even if one chooses to develop one particular route for energy density and cost breakthrough, the material science is currently the biggest challenge in the industry. For example, negative electrode materials used by the industry are mostly graphite, which can only produce battery energy density of 270Wh/kg, but cannot meet the expectations for driving range. Silicon-based materials are considered a substitute, and the energy density of batteries produced by mass production is expected to reach 300 Wh/kg in 2-5 years. Currently, CATL is focusing on solving the technical bottleneck of using lithium metal as the negative electrode, and it is expected that solid-state lithium-metal batteries with energy density of 350 Wh/kg can be produced in 5-10 years, with liquid-state lithium-metal batteries reaching an energy density of 400 Wh/kg in 10 years.

This prediction is based on R&D capability. According to the 2020 annual report, CATL has 5,592 R&D personnel, and some have even exaggeratedly described that it has almost all the battery-related Ph.D.s in China. As of the end of last year, CATL had a total of 2,969 domestic patents and 348 foreign patents, and a total of 3,454 domestic and foreign patents were being applied for.

If automakers want to catch up with such accumulation, it is not impossible to attract talented individuals with high salaries. However, in recent years, they have often found themselves in a state of cutting costs and increasing efficiency due to transformation needs. Money is not enough, and they have many other things to spend on. Basically, the automotive industry believes that intelligence is the key to competition. Automakers need to set up their own technical teams, including autonomous driving. Compared with the battery sector, which has already formed a preliminary division of labor, intelligence may be the short board that traditional automakers need to fill urgently.

At the same time, this is also based on the consideration of optimizing overall resource allocation. If a resource, including manpower, rare metals, land, money, etc., can produce more energy output in one company, then there is no need to force oneself to generate power out of love. Let professionals do their job. Under such policies, we have successfully reduced the cost of batteries by nearly 90% in ten years.

In the long run, automakers will gradually calm down from capital and battery fever and concentrate resources on more efficient areas. The problem facing CATL is not insufficient demand, but rather the inability to keep up with production capacity. Currently, they already have a production capacity of 69.1 GWh and are constructing an additional 77.5 GWh capacity. In early June, Reuters reported that CATL may also construct an 80 GWh factory in Shanghai, which is estimated to be able to supply power to approximately 800,000 electric cars.

It is believed that the market value will rise again.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.