This morning, NIO officially announced its financial results for the first quarter of 2021, with several data points reaching new highs.

Deliveries

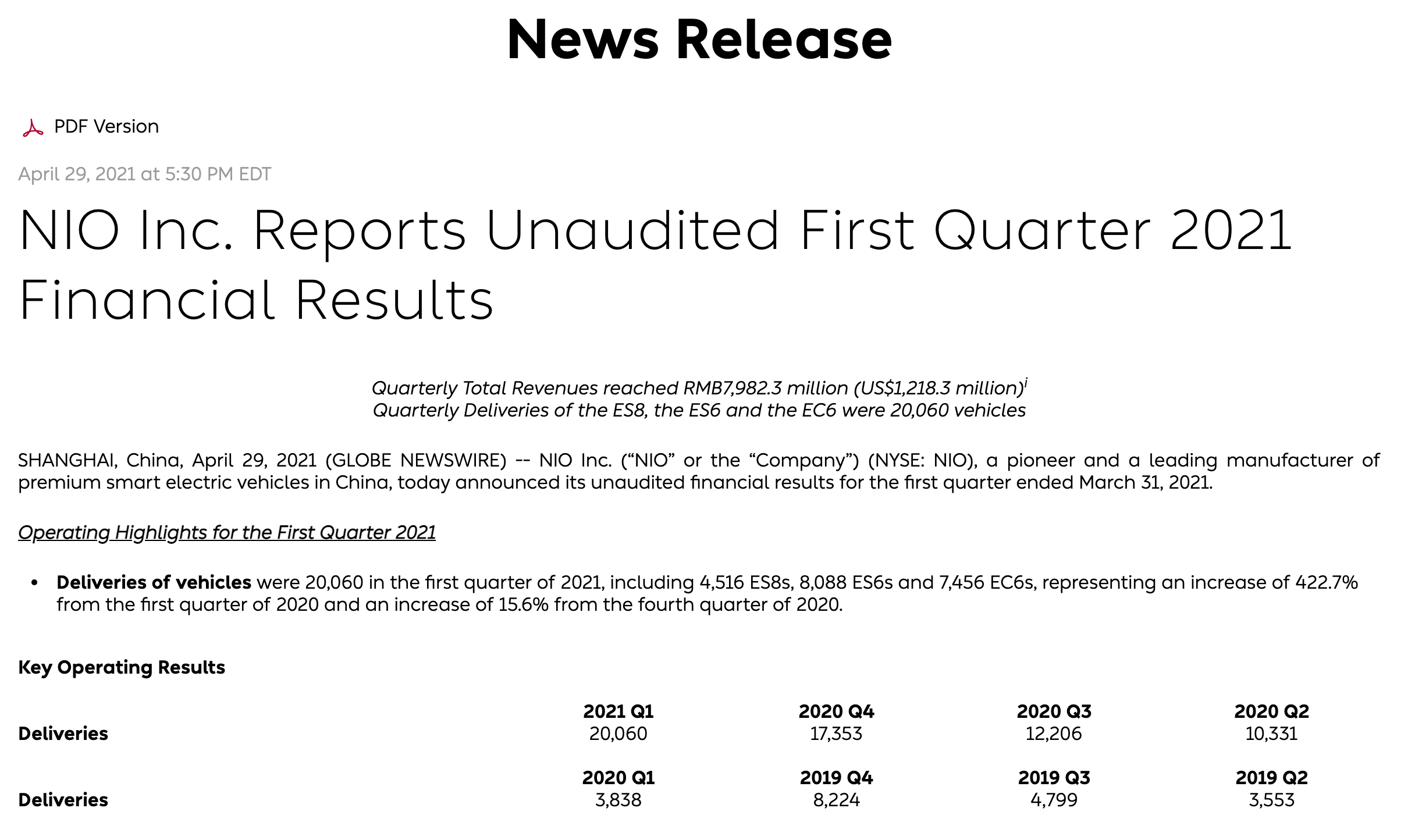

In the first quarter of 2021, a grand total of 20,060 vehicles were delivered. Among them were 8,088 ES6, 7,456 EC6, and 4,516 ES8.

Not only did these deliveries set a new record for any quarter in the history of NIO, with a month-over-month growth rate of 15.6% and a year-over-year increase of 422.7%, they also surpassed the previously declared forecast of 20,000 to 20,500 vehicles in the 2020Q4 financial statement.

Despite the entire industry facing a chip shortage, NIO achieved a record high in vehicle deliveries even after announcing on March 26th that it would suspend production for five days and reduce estimated delivery volume to 19,500 vehicles.

In addition, on April 7th of this year, NIO celebrated a milestone with the official production of its 100,000th vehicle.

作为比较,去年四个季度的交付数据在此公布:

- 2020年Q4,共交付了17,353辆车

- 2020年Q3,共交付了12,206辆车

- 2020年Q2,共交付了10,331辆车

- 2020年Q1,共交付了3,838辆车

在财报中,李斌表示:“我们产品的总体需求仍然持续强劲,但由于芯片短缺问题,供应链仍然面临着巨大挑战。在不稳定的宏观环境下,鉴于强劲的势头,我们预计在2021年Q2交付2.1万到2.2万辆车。”

财务数据

2021年Q1,车辆销售收入为74.058亿元人民币,比上一季度增长20%,比去年同期增长489.8%(总收入为79.823亿元人民币,同比增长20.2%)。In 2021Q1, NIO achieved a gross margin of 19.5% and a vehicle margin of 21.2%, both of which reached new highs. In 2020Q4, the gross margin was 17.2% and the vehicle margin was 17.2%. (For comparison, Tesla’s gross margin was 21.3%, and the vehicle margin was 26.5% in 2021Q1.)

The net loss in 2021Q1 was RMB 451 million, which decreased by 73.3% from the first quarter of 2020 and 67.5% from the fourth quarter of 2020.

The increase in vehicle margin was mainly due to the higher take-rate of NIO Pilot and the 100 kWh battery package.

Other Data

NIO expects total revenue for 2021Q2 to range from RMB 8,146.1 million to RMB 8,504.5 million, which represents an increase of 2.1% to 6.5% from the first quarter of 2021.

Research and development expenses in 2021Q1 were RMB 686.5 million, which represents a 17.2% decrease from the same quarter of 2020 and a 31.4% increase from the previous quarter.Selling and management expenses of 2021Q1 were RMB 1,197.2 million, an increase of 41.1% over the same period last year and a decrease of 0.8% from the fourth quarter of 2020.

NIO’s cash reserve has reached RMB 47.5 billion.

🔗Source: NIO

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.