*Author: Bernice

As early as a few years ago, there were similar comments in the automotive industry, saying that in addition to relying on manufacturing and selling cars to achieve profitability in the future, car companies will also obtain revenue from software services and user operations.

In 2018, there was a very optimistic viewpoint: in five years, the operating profit of automakers will be on par with traditional vehicle profits.

Although this prediction has not yet been realized today, we have already seen some clues from the industry. Today we will discuss how software-defined functions and user operations can become the next profit model in the automotive industry.

Which software-defined functions have paid prospects?

First, let’s clarify the range we are discussing today, which functions are defined by software.

These functions are not just functions that require software cooperation, but functions that are brought by the “soul” of software. You can refer to two extreme cases: seat massage and automatic driving. The former only requires software to move the seat, while the latter can create countless possibilities.

Now, some car companies are able to continuously develop creativity through defined software, but there are few car companies that can profit from software. Tesla, as the “first crab eater”, has also broadened the industry’s imagination in commercialization.

Currently, Tesla has three major software-defined profit-making functions: 1. optional installation of autopilot suite; 2. OTA paid upgrade; 3. advanced car networking functions.

Let’s talk about the first one. Tesla’s various levels of assisted driving have always been optional pay-as-you-go functions.

Among them, the Full Self-Driving suite (FSD for short) has become more and more expensive as its functions continue to increase. In May 2019, it rose from $5,000 to $6,000, and in August, it rose from $6,000 to $7,000. In July 2020, it rose from $7,000 to $8,000, with a domestic option price of 64,000 yuan.

In addition, according to reports by foreign technology media electrek, Tesla is expected to launch FSD subscription service by the end of this year, with a price of about $100 per month. Compared to the “buyout” model, this model will bring Tesla a continuous cash flow.

The second one mainly changes the performance and configuration of the vehicle itself through OTA, such as acceleration, endurance, and seat heating. For example:

In 2017, Model S 60 can be upgraded to the same endurance as Model S 75 through paid upgrades, with a domestic price of 19,800 yuan.In 2019, Tesla launched the “Acceleration Boost” upgrade package for Model 3 Long Range Dual Motor with further redundancy performance release available via OTA, reducing the acceleration time from 0 to 100 km/h from 4.4 seconds to 3.9 seconds, costing users $2,000.

In 2020, Tesla introduced the OTA paid function “Heated Rear Seats,” with foreign users paying $300 and domestic users paying CNY 2,400.

The third function is the advanced in-car internet service. MCU1.0 users can upgrade to MCU2.0 for a fee (hardware replacement requiring about RMB 20,000 in China) to obtain smoother and more abundant in-car applications, including Sentry Mode, Karaoke Mode, and Theater Mode.

In December 2019, Tesla divided its in-car applications into Standard and Premium versions. The Standard version is basically a brick, while the Premium version includes map navigation, video, audio, browser, as well as Sentry Mode and Dog Mode and other functions.

Owners who ordered a car on or after July 1, 2018, and want to use the Premium features need to subscribe for $9.99/month (approximately RMB 70.13) per month. Tesla has officially adopted a monthly subscription charging software profit model.

What’s Behind Tesla’s Soaring Market Value?

In the traditional automotive industry profit model, after a car is sold, most of the profit is earned by the dealers. Although there are still maintenance and upkeep costs, the profit margin is much smaller compared to the initial sale.

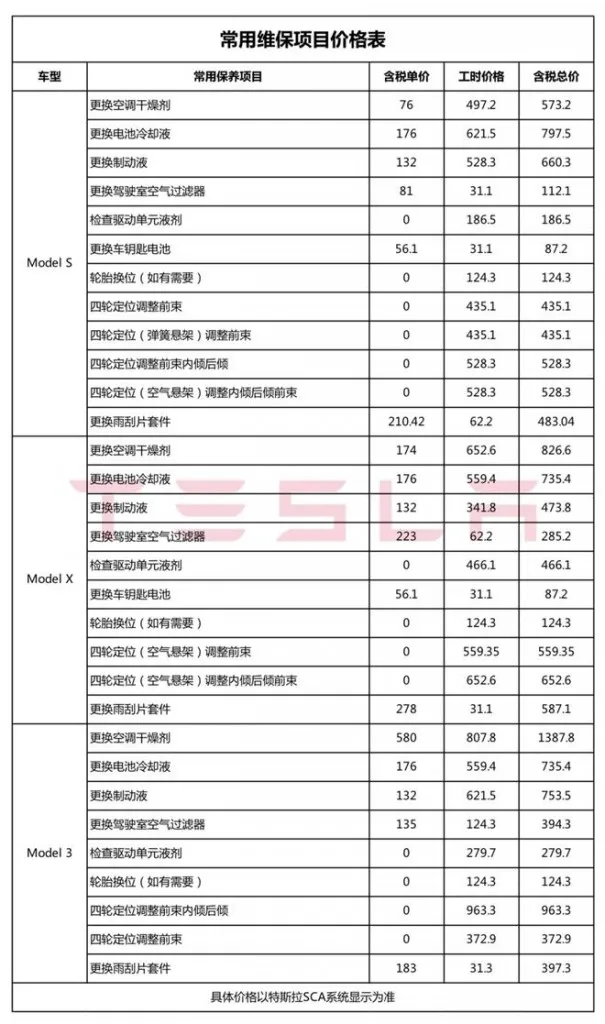

Tesla’s direct-sales model allows for direct contact with users, however, it does not seem to focus its profit model on “after-sales services.” Due to the nature of electric vehicles themselves, the maintenance cost is significantly lower than that of traditional fossil fuel vehicles. According to Tesla’s publicly available nationwide unified maintenance price list, multiple items are only half the price of those from famous German car brands.

Tesla stores have stated in interviews that they will never consider maintenance services as a profit center. Meanwhile, Musk has repeatedly emphasized that Tesla’s future profits will come from “software.” It seems that Tesla is determined to make money from software.

Tesla stores have stated in interviews that they will never consider maintenance services as a profit center. Meanwhile, Musk has repeatedly emphasized that Tesla’s future profits will come from “software.” It seems that Tesla is determined to make money from software.

There are three factors that affect Tesla’s software profitability: car sales volume, activation rate, and unit price.

Starting in 2018, Model 3 orders skyrocketed, and Tesla was plunged into production hell. This process lasted for over a year. With the construction of the Chinese factory, Musk was finally able to climb out of the production hell, dragging his exhausted body out with him. It was during this time that Tesla and its stock price were elevated to a god-like status, and started to increase multiple times.

Today, Tesla has over one million cars globally, so only on this large base can they discuss software profitability. Because no matter how high the software development cost is, it is still an acceptable price when spread out over every car.

In terms of development, Musk is embarking on a more extreme route. The continuous decline in Tesla’s prices actually represents the fact that it is getting closer to the “selling cars at cost and relying on software for profits” path.

In fact, Tesla’s costs can still be further reduced because the Chinese factory is working to achieve 100% localization of parts. Tesla’s factories around the world are “production machines.”

Let’s talk about some numbers.

According to Deutsche Bank’s report in 2020, the overall activation rate of Tesla FSD is roughly between 25%-30%, and is mainly concentrated in the US market. China’s activation rate is less than 10%, which is due to policy and insufficient domestic road testing data, so the experience is far from the US market.

This ratio still has a lot of room for improvement. China is the most tolerant country in the world for electric cars, and with a large user base, the profitability space brought by future software activation can be imagined.

Another aspect is the unit price. FSD has continued to increase over the past two years, and Tesla’s technology is indeed leading. Therefore, relevant authoritative institutions believe that FSD’s future “strong pricing power” is a high probability event. If the unit price increases at a rate of 5% per year, it is estimated that FSD will exceed $10,000 by 2025.

In short, the increasing number of cars, the higher software activation rate, the growing software unit price, and the increasing number of subscribable services make Tesla’s aspiration to profit from software no longer empty talk. As a result, Tesla’s self-proclaimed label as a tech company is recognized by the public and the capital market.

When traditional car companies engaged in industry are also labeled as tech companies, their market value will naturally be closer to tech companies. This is where Tesla’s market value rise comes from.

What capabilities do car companies need to profit from software?

OEMs that aim to profit from software as Tesla does need to possess many qualities, the most important of which is to achieve “software-defined cars”. Only in this way can products have more imagination and more commercial possibilities based on changes in software.

Specifically, the following capabilities are generally required: 1. Whole vehicle OTA; 2. Embedded hardware; 3. Product creation ability; 4. Rapid response ability.

Whole vehicle OTA can continuously bring fresh experiences to users. Based on the current hardware, it can maximally increase the freshness cycle of automotive products through software, making them capable of continuous improvement. Of course, the complete OTA process also needs to be matched with advanced vehicle electronic and electrical architecture.

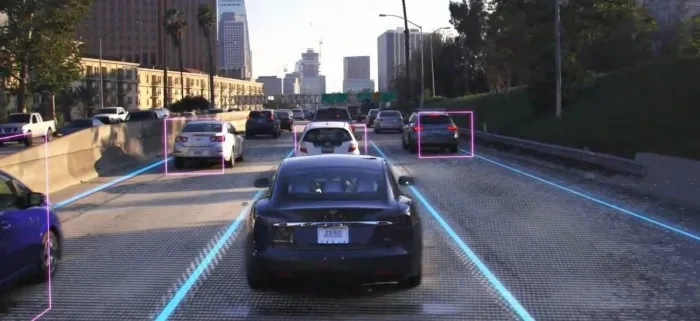

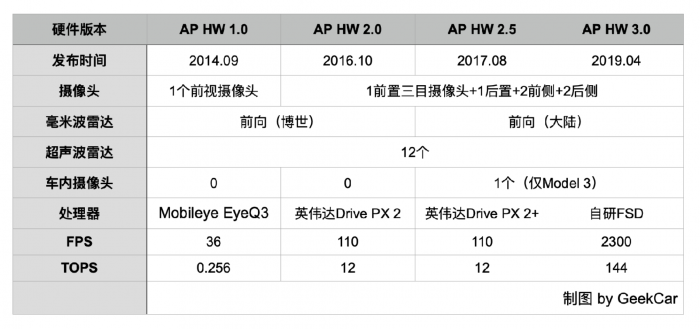

Equally important is the embedded hardware with sufficient capabilities. Take Tesla as an example. Although the vehicle model is equipped with version 2.0 hardware upon delivery, the functions cannot be used, and AP HW 2.5 and AP HW 3.0 have gradually been introduced later with the iteration of software. Not only automatic driving, but other functions can also be similarly achieved through unlocking by software backend, such as battery and seat heating.

When both the software and hardware are ready, what really gives them soul is “product creation ability”. Of course, it can be as complex as FSD, as simple as a Christmas egg, and it may also save people from the danger at a critical moment:

# OTA Operations are Critical for Smart Mobility

# OTA Operations are Critical for Smart Mobility

In 2017, Hurricane Irma hit Florida, and Tesla unlocked additional battery capacity via Over-The-Air (OTA) updates for the 60 kWh car model, extending the vehicle range by 30 miles (about 48 kilometers) to help car owners escape from the storm. Tesla also did the same thing when Typhoon Mangkhut hit China in 2018. This showcases the importance of efficient OTA operations for smart mobility.

This reminds us of what He XPeng said in 2018 at Guangzhou Tower, “Smart mobility is all about operations, not just manufacturing”. He seems to be ahead of his time.

This is also a wake-up call for carmakers who are still focused on traditional vehicle manufacturing. In reality, as tech companies set their sights on the auto industry and Foxconn intending to manufacture cars, it’s becoming evident that car production and manufacturing won’t be sufficient to generate premium value in the future. Instead, software will be a key area where there’s potential to add considerable value.

Conclusion

Historically, profit margins on the cars sold were always limited. Whereas, in the future, profits from a vehicle could be generated over its lifecycle via software and value creation.

In an era where the entire industry recognizes that software is key to defining smart mobility, the automotive industry must move beyond the fundamental tasks of vehicle development and production to focus on “software capability” and “creation capability.” We believe that the next ten years will bring more exciting and enriching experiences for us in the field of transportation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.