Continuous efforts in electrification are a “must-do” for all traditional car companies, and faced with this innovative problem, each car company has come up with different problem-solving ideas.

Domestic new electric vehicle manufacturers such as NIO, XPeng, and Li Auto have made significant achievements with “smart and technological” approaches, while traditional independent brand car companies have taken a different path by launching new brands. For example, Guangzhou Automobile Group (GAC) has launched the Aion series, and GAC has also indicated that Aion will be developed independently. Dongfeng has introduced a brand new electric vehicle brand, the Voyah, and SAIC first launched the R brand, and in the future there will be a brand, L, that will compete directly with BBA.

From the current problem-solving approaches of car companies, high-end development has become a new focus of independent brand electric vehicles and the domestic new energy market.

Beijing Automotive Group (BAIC) is no exception, and ARCFox is the answer. During the Beijing Auto Show, the ARCFox brand officially released its Chinese name – ARCFOX. At the same time, its first mass-produced model, ARCFox αT, has started pre-sales.

The final price of the ARCFox αT has now been announced, with a total of 5 versions priced between 241,900-319,900 yuan. The detailed prices for the five models are:

- ARCFOX αT 480 S version, NEDC range of 480 km, with a suggested retail price of RMB 241,900;

- ARCFOX αT 480 S+ version, NEDC range of 480 km, with a suggested retail price of RMB 256,900;

- ARCFOX αT 653 S version, NEDC range of 653 km, with a suggested retail price of RMB 261,900;

- ARCFOX αT 653 S+ version, NEDC range of 653 km, with a suggested retail price of RMB 276,900;

- ARCFOX αT H version, NEDC range of 600 km, with a suggested retail price of RMB 319,900.

As a medium-sized pure electric SUV, this pricing obviously positions it in the mid-to-high-end pure electric vehicle market.

“Practical work” Is the Solution

“Establishing new brands, turning towards high-end development” is not a gimmick, but a determination for traditional independent brand car companies transitioning to electric vehicle manufacturing. The image of traditional independent brands in marketing, manufacturing, and user operation has been established through long-term precipitation in the market, and has formed many inherent impressions in the minds of consumers, such as “cheap, low-end, and not luxurious”.Breaking free from this phenomenon is what domestic brands have been striving for, and removing such labels has become inevitable as domestic brands improve themselves.

By creating new products and establishing a user-oriented marketing system, “high-endization” is actually a way for BAIC to break through itself.

BAIC Group has not had much successful experience in breaking through its own brand, and is not even known for its quality. Therefore, the positioning of ARCFOX as a high-end brand has been questioned from the start.

In response to these doubts, BAIC has given three simple answers:

-

Insisting on product quality first;

-

Self-revolution, innovation in all aspects such as system and technology;

-

Breaking through user circles and strengthening user services.

In the words of Liu Yu, the General Manager of BAIC New Energy, “To gain recognition, a brand can’t just talk the talk. A brand isn’t created out of thin air, it’s established through experience, and the key is still to rely on hard work.”

The First Step of Hard Work: “Products”

What kind of car has a range of 653 km and can accelerate from 0 to 100 km/h in 4.6 seconds?

A muscle car? An electric super car? BAIC’s answer is the ARCFOX αT.

This car comes with two battery capacities: 67 kWh and 93.6 kWh, with corresponding NEDC mileage of 480 km and 653 km, respectively. The flexible selection caters to the need of commuting between cities, and the car’s battery suppliers include SKI from South Korea, and Rongsheng Mengguli, among others. These mature battery suppliers can maximize the safety of the batteries and the supply chain.

Furthermore, ARCFOX has announced plans to launch one to two new models every year in the future. The next model is a large C-class coupe model with a length of about 5 meters and a range of 710 km.

Today, the selection of pure electric vehicles in the market is much richer than a few years ago. But the two core issues of a pure electric car’s “range and intelligence” still need continuous improvement. Achieving a range of over 600 km is already considered a good level in the industry due to the difficult breakthroughs in battery technology, and intelligence has become an important direction in creating differentiation.As a high-end brand, intelligent features are indispensable for automobiles, and BAIC has chosen Huawei as its partner in intelligent and connected technology.

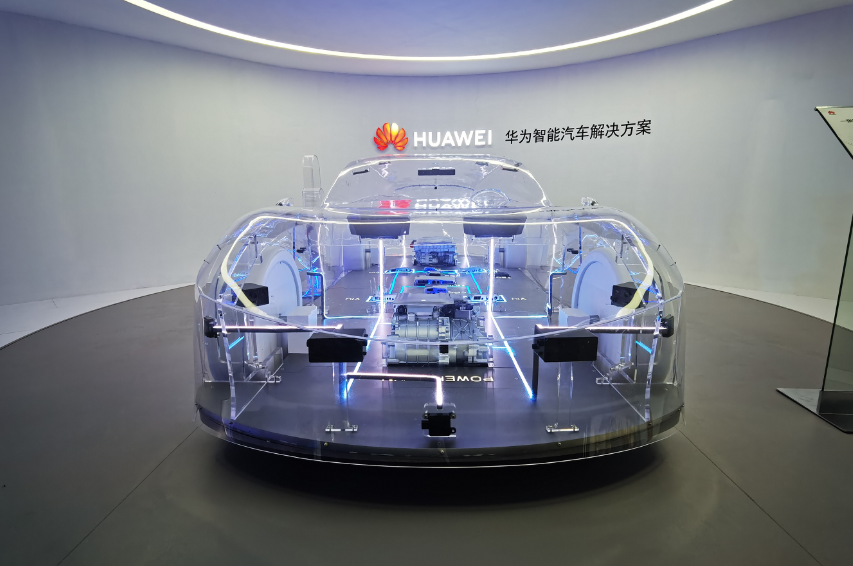

The collaboration between ARCFOX and Huawei goes beyond 5G and also involves communication, autonomous driving, chips, software, cloud, artificial intelligence, intelligent cockpit, and human-machine interaction.

ARCFOX αT is equipped with Huawei’s MH5000 5G chip T – BOX. According to the official statement, relying on powerful computing power and data communication bandwidth, the vehicle can achieve L2.5 level of assisted driving and multi-screen interaction intelligent vehicle system.

In terms of assisted driving, ARCFOX αT is equipped with a system called “α – Pilot”. This system was jointly developed with Bosch and consists of 1 domain controller, 1 third-generation 2 million high-pixel multifunctional camera, 4 second-generation panoramic cameras, 5 fifth-generation millimeter-wave radars and 12 sixth-generation ultrasonic sensors.

The cameras can collect image information within a 540° range around the vehicle, and the 5 fifth-generation millimeter-wave radars can provide a detection distance of up to 210m. In addition, the 12 ultrasonic radars on the vehicle body can make the response speed of the assisted driving function faster, and the detection range wider.

For example, the 540° holographic image assisted driving system combines real-time and virtual images through algorithms and displays the vehicle’s surroundings in the AR scene on the in-car display screen after collecting, correcting, transforming and stitching the images through ECU. Also, the algorithm can combine the previous and current frame images to display the road conditions under the vehicle, providing the driver with a clearer and more comprehensive understanding of current road information.

Hardware is only the foundation, and optimizing the functions is the challenge for the ARCFOX team. Therefore, it is still necessary to experience the vehicle further to know how specific the capabilities are.

However, more importantly, the ARCFOX vehicle has the hardware foundation to upgrade to L3 and L4, which means that ARCFOX will gradually open up assisted driving functions through software OTA. However, with such hardware configuration, ARCFOX faces additional cost pressures and needs to be scaled down. Moreover, another important purpose of software pre-installation is that ARCFOX may open software through paid services in the future.Today, the new energy vehicle market has already passed the period of barbaric growth, and both consumers and automakers tend towards rationality. The market is also shifting towards brand, product strength, product personality, services, and other aspects.

In the competition of the second half, apart from the core elements of the three-electrics and the range, more reliable intelligent driving functions and networking, better interactive experience, and better user experience are all the core points of competition. In these aspects, BAIC still has a long way to go.

The Second Step of Practical Action: Technology

We say that products are the embodiment of technology, and the word “practical” must be returned to technology itself. From production and manufacturing to vehicle development, all rely on reliable technology.

“Collaboration” is the most typical logic in the automobile industry. In this mass-production industry, having a luxurious “circle of friends” can often be a shortcut.

In terms of hardware, ARCFOX has chosen the world’s most high-end suppliers. “SKI batteries, Siemens motors, Bosch chassis, Magna’s steel-aluminum hybrid body, and Harman’s large screen are all chosen from the top 100 global parts suppliers. 70 of those are ARCFOX’s friends.”

The birth of the ARCFOX αT is the result of a three-party cooperation between BAIC Group, Magna, and Huawei, but this three-party cooperation is different from the original equipment manufacturer (OEM) centered vertical supply model. Circle-based car manufacturing has innovatively broken the inherent centralized logic of the original equipment manufacturer.

The benefit is that suppliers no longer just meet the needs of the original equipment manufacturer. Instead, they will deeply consider how their own technology can bring a better user experience. In addition, it can mobilize the enthusiasm of all cooperation partners and accelerate technological iterations.

BAIC new energy chose to cooperate with Magna based on the latter’s engineering experience. Magna is the world’s most diversified parts supplier, ranking third globally and first in North America. Many people think that Magna is the “Foxconn” of the automotive industry. In fact, Magna has not only made achievements in manufacturing but also has unparalleled achievements in whole-vehicle system engineering and vehicle platform tuning.

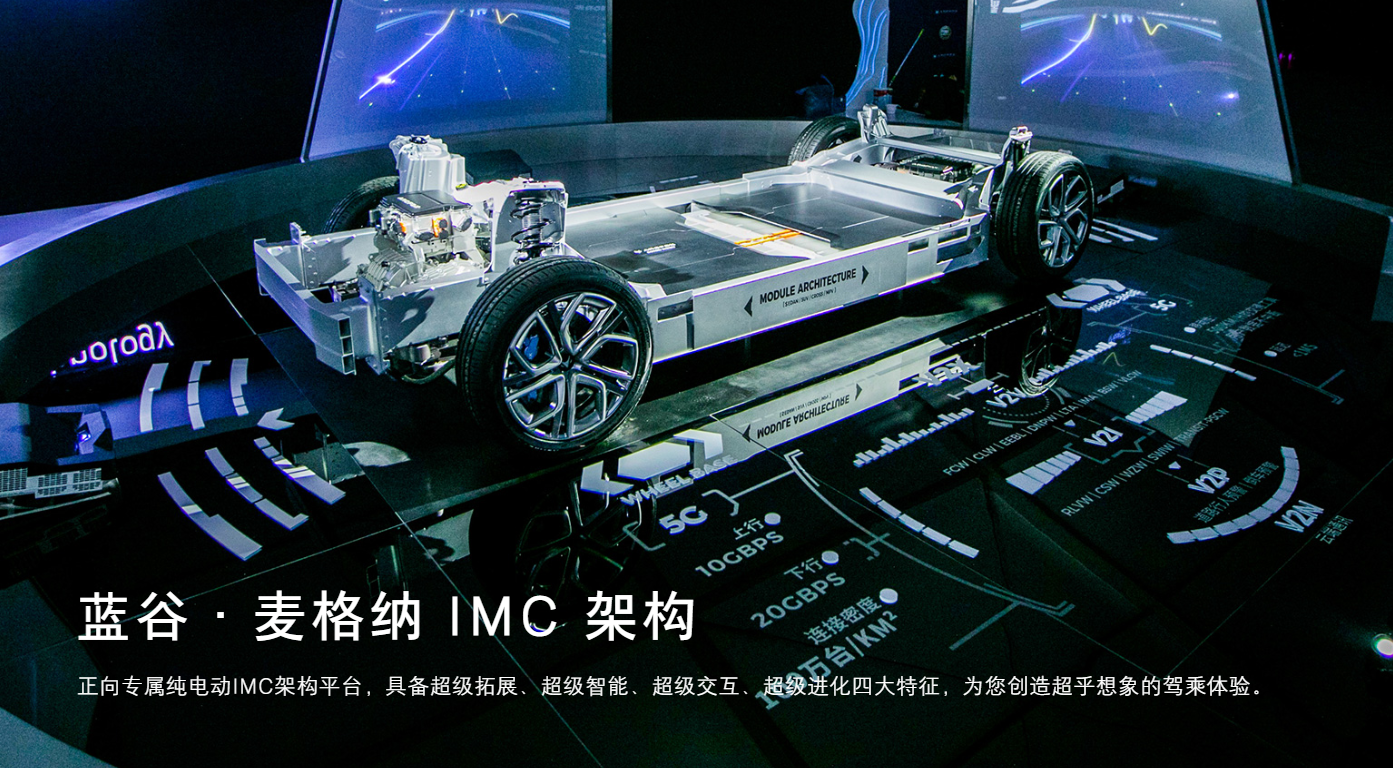

In terms of electric products, Magna is also a supplier of electric transmissions, electric rear-drive, and rear axles. These involve the driving experience that high-end pure electric vehicles value most. We all know that the biggest challenge of transforming from traditional fuel vehicles to pure electric vehicles is that due to the relocation of the center of gravity, the experience in chassis tuning cannot be applied to pure electric vehicles.And Magna is just good at this. The birth of the IMC platform fully demonstrates Magna’s strength, and the IMC architecture will be the core architecture of ARCFOX in the next few years. The IMC has 42 core modules and 127 functional modules, forming different car products through the combination of different functional modules.

It looks familiar, and yes, this is also a highly integrated modular platform. Like Volkswagen’s MEB pure electric platform, the advantage of modularity is its strong scalability.

Overall, Magna’s joining will help Beiqi take a lot less detour in technology. For car manufacturers, it’s definitely not just about buying and selling. Although the supplier’s supply model is changing, the supplier’s role has not diminished. Next, how ARCFOX can accurately grasp user needs and continue to build good products will be the key.

The Cold Sales of Beiqi New Energy

Beiqi has been in the new energy field for many years and has won the pure electric market sales championship for several consecutive years. However, most of the models are low-end models mainly for operation, and Beiqi is almost invisible in the high-end market.

Moreover, the sales decline caused by the subsidy decline is a key issue that Beiqi has to pay attention to.

In 2020, Beiqi’s new energy sales continued to plummet. According to data from the China Passenger Car Association, since the beginning of the year, Beiqi’s new energy sales have seen a discontinuous decline, with a cumulative sales of only 20,186 vehicles in the first 9 months, a year-on-year decrease of 78.57%.

This data is even less than the monthly sales in June 2019. At the same time, according to the sales data released by Beiqi New Energy, the sales volume in September was 2,245 vehicles, a year-on-year decrease of 77.57%. What is even more noticeable is that its production in September was only 221 vehicles.

In the sales ranking, the Tesla Model 3 is still leading, and models such as the Wuling Hongguang MINIEV and Aion S have performed well. The top 10 list also includes models from Changan orai, BYD, and NIO’s Ideal, but there is no sign of Beiqi New Energy.

This is not a good sign for Beiqi Group. Under the situation of continuous low sales, new energy needs to open up the situation again at the Beiqi Group level. Whether ARCFOX can bear this great responsibility still depends on its specific market performance. However, we can see from ARCFOX that Beiqi’s determination in the field of new energy is firm.

In Conclusion:# ARCFOX αT: The Virgin Work of BAIC Group in High-end Pure Electric Market with Significance

ARCFOX αT is the virgin work of BAIC Group in the high-end pure electric market with great significance. It can be said to be crucial, as self-owned brands such as Geely, GAC and BYD are making large layouts in the new energy market. Despite having no major weaknesses in its products, ARCFOX αT is still facing significant pressure and requires an established recognition of the ARCFOX brand from consumers. This pressure is particularly significant for a new brand entering the market.

I hope that all self-owned brands can win this competition in the new energy market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.