Shortage of Chips: Most Wanted is MCU

Cars can be equipped with as little as 70 to more than 300 MCUs, the tiny components that seem to be in extremely short supply. The shortage has forced some Chinese customers to use non-functioning safety MCUs in their Electric Power Steering (EPS) systems. In effect, using non-functioning safety MCUs is like not wearing a bulletproof vest in a battlefield.

The lack of chips has caused reduced production and even shutdowns for various companies. For example, NIO had to suspend production for three days, while other brands such as Great Wall Ora Black Cat and WM Motor have also been affected.

The scarcity of critical chips has also affected the wider automotive production chain, with shortages of EPS chips, tire pressure monitoring system chips, and current sensors for battery packs. This has led to a significant impact on non-chip related components.

According to a report by consulting firm IHS Markit, the global auto industry will see a loss of 3.9 million units and $110 billion this year due to the chip shortage. The problem is expected to ease in the fourth quarter of the year.

Even companies like Tesla, led by Iron Man Elon Musk, have not been immune to the chip shortage. In a tweet, Musk disclosed that the semiconductor”shortage is a huge challenge for Tesla, particularly for MCU chips, and the situation is being exacerbated by competitors hoarding chips like people hoarded toilet paper at the start of the COVID-19 pandemic.”

Electric Vehicle Observer interviewed several insiders to learn more about the industry’s current state: the Integrated Circuits (ICs) chips per new energy vehicle are still in massive shortage, specifically MCUs and System-on-Chips. MCUs, being the core component of any electronic device, have seen the most significant increase in prices, rising to 10 to 20 times the standard cost.

So what are MCUs all about, and what does the chip industry in China look like? Numerous industry experts and company executives weighed in on this issue, aiming to address these concerns.

State of Chinese MCU Adoption

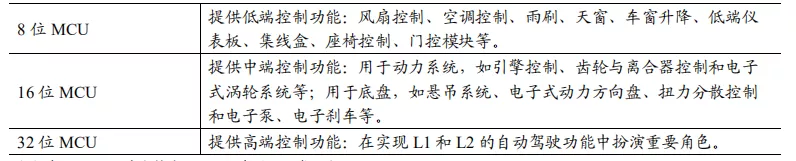

Before we enter the nitty-gritty of Chinese MCU adoption, let’s define what MCUs are. MCUs, also known as Microcontroller Units, are the core components of embedded electronics that act as the “central nervous system” of various devices. MCUs integrate CPU, memory units (RAM/ROM/Flash), counters, A/D converters, interfaces and other peripherals in single chips, providing a powerful and flexible computing platform. They are widely used in IoT applications such as wearable devices, home appliances, automotive electronics, and wireless networks, thanks to their high-performance, low-power consumption, programmability, and flexibility.The MCU on a car can control the car’s power, entertainment, air conditioning system, etc. The demand for it in a single car is very high. The average usage of traditional cars per car is more than 70, while the usage of smart cars per car is expected to exceed 300.

(1) Lack of design and production companies in China

Firstly, corresponding to this is that the number of Chinese self-owned brands that can design car-grade MCUs is very few, with low market share that can even be ignored.

Wind data shows that the self-developed rate for car chips in the domestic auto industry is only 10%, with 90% of car chips depending on importation. Among them, 95% of the front-loading chips are imports, and over 80% of the after-loading chips are imports. Chinese chip companies lack the right of discourse in the automotive industry chain.

An insider told the “Electric Vehicle Observer” that due to the long R&D cycle and high certification requirements for car-grade MCUs, only a few Chinese enterprises can achieve mass production of mid- to low-end categories, and the penetration rate of domestic brands is very low. Moreover, they are mainly concentrated in the body field and almost none of them involve chassis functional safety.

According to data from IHS Markit, the market share of the top 7 car-grade MCU markets worldwide reached 98% in 2020, with Renesas Electronics accounting for 30%, NXP 26%, Infineon 14%, Cypress (acquired by Infineon in 2019) 9%, and both Texas Instruments and Microchip Technology accounting for 7%, while STMicroelectronics accounted for 5%. No Chinese companies made the list.

After the chip is manufactured, it needs to be cut off from the wafer, connected to a wire, packaged, and tested. This process is called packaging and testing.

In the field of chip packaging and testing, the Chinese mainland has already grown three giants: Changdian Technology, Huatian Technology, and Tongfu Microelectronics. However, as an end-node link, the technological content is slightly lower.

(2) Chinese car-grade MCU chip companies are working hard to catch up

2018 was the first year of Chinese car-grade MCUs – Jeppiaar Technologies under Siwei Map and BYD both launched car-grade MCU chips.

At this stage, Chinese car-grade MCUs are still in the initial stage, with a few enterprises capable of designing and even fewer contract foundries that can produce car-grade chips.The head of the Four-Dimensional Top New MCU product line, Tong Qianghua, told “Electric Vehicle Observer” that their designed products are all 55nm, which belongs to a mature process and does not have high production technology barriers. However, mainland Chinese wafer factories do not have mature and stable 55nm automotive-grade production lines, so they can only be produced by external wafer giants such as TSMC.

Not only Four-Dimensional Top New, but also 70% of the world’s automotive-grade MCU capacity is at TSMC.

The development process of automotive-grade MCUs from research and development to mass production is arduous and lengthy, and requires huge capital investment.

“The period from chip layout to mass production is about 2-3 years. Our first-generation MCU took more than 2 years from research and development to mass production. The investment for the first-generation MCU is at least in the tens of millions of yuan.”

In Tong Qianghua’s opinion, the most lacking thing in the development process of automotive-grade chips is talent.

“This is not something that can be done by someone who has just graduated with a major in integrated circuits for 2-3 years.” Tong Qianghua said that Jiesai Technology has more than ten years of experience in the field of automotive chip design, which makes them capable of designing China’s first automotive-grade MCU.

Of course, Chinese companies are also striving to catch up. In addition to the AC781x/AC7801x series launched by Jiesai Technology mentioned earlier, there are also BYD Semiconductor BF711x/BF7106 series, Xinyang Microelectronics KF8A/KF32A series, Sitronix ASM87/ASM30 series, Qipuwei Semiconductor XL6600 series, Huada Beidou HD80xx/HD9xxx series, and National Chip Technology CCM3310/CFCC2002/CFCC2003 series, and also Megi, Zhongying Electronics, ZhiXin Semiconductor, Fenyi Gaoxin, Yuntu Semiconductor, etc. are also involved in automotive-grade chip production.

Among them, BYD Semiconductor’s performance is also outstanding. Its main business covers the research and development, production and sales of power semiconductors, intelligent control ICs, intelligent sensors, and optoelectronic semiconductors, and has an integrated business chain including chip design, wafer manufacturing, packaging testing, and downstream applications. As of May, its produced MCUs have been installed in 10 million vehicles.

(3) Due to the US blockade, the industrial chain is incomplete.

Even if China has design and production capabilities, there are still many bottleneck points in the upstream of the chip production process.

For example, photolithography machines and photoresists.

The core reason why China cannot produce high-end chips is that it does not have high-end photolithography equipment – photolithography machines.

ASML in the Netherlands is currently the world’s most advanced EUV photolithography machine manufacturer, and is the only one, an absolute monopoly.However, due to the early “Wassenaar Arrangement,” high-end lithography machines have always been a prohibited product for China.

Currently, companies such as Shanghai Microelectronics are independently researching and developing new generations of lithography machines, but there is still a certain gap in technology compared with ASML.

In addition to high-end lithography machines, another bottleneck product is lithography photoresist.

On May 27th, foreign media revealed that Japan’s leading photoresist company, Shin-Etsu Chemical, restricted the supply of KrF-level lithography photoresist to multiple first-line wafer factories in China, and Chinese wafer factories are facing a shortage of photoresist.

The lithography photoresist market in mainland China started relatively late, and the current technology level is relatively backward. The production capacity is mainly concentrated in mid-to-low-end products such as PCB lithography photoresist and TN/STN-LCD lithography photoresist, while high-tech barrier products such as TFT-LCD and semiconductor lithography photoresist have extremely low production capacity.

According to data from reports by Founder Securities, mainland China’s share of the global lithography photoresist market is less than 13%, and the domestication rate of high-end semiconductor lithography photoresist is less than 5%.

Currently, major global lithography photoresist companies are mainly concentrated in Japan and the United States, such as Japan Synthetic Rubber (JSR), Tokyo Ohka Kogyo (TOK), Sumitomo Chemical, Shin-Etsu Chemical, and Dow Chemical.

In Tong Qianghua’s view, China’s upstream in the chip industry needs to catch up with these bottleneck links, which may require ten or even decades of efforts.

(3) Independent controllability is difficult

Can China achieve independent controllability in these bottleneck links?

Jin Weihua, a venture partner at Huadeng International, a venture capital company with many years of investment experience in the Chinese chip industry, told “Electric Vehicle Observer” that the semiconductor device industry chain must be globalized.

“The entire industry chain cannot be concentrated in one country or region.” Jin Weihua said, “Its industrial chain has a very high technological content and requires the cooperation of top global resources.”

The semiconductor manufacturing industry uses as many as 300 different inputs, many of which also require advanced production technology. The production of EUV lithography machines alone relies on a global supply chain: the EUV lithography equipment developed by ASML contains approximately 100,000 parts provided by more than 5,000 suppliers and requires the collaboration of suppliers from the UK, the US, Germany, Japan, and other countries.

According to the White House’s supply chain assessment report, semiconductor devices involve many countries and regions in the production process, and their products may cross 70 international borders. The entire process may take up to 100 days, of which about 12 days are intermediary transfer steps between supply chain steps.Recently, the Semiconductor Industry Association (SIA) and Boston Consulting Group (BCG) released a report titled “Government Incentives and US Semiconductor Manufacturing Competitiveness”, which showed that in order to establish a complete domestic supply of semiconductors in each major region, an upfront investment of $900 billion to $1.225 trillion and incremental annual operating costs of $45 billion to $125 billion (excluding depreciation of new upfront investment) would be required, which would only offset the profits of the industry.

According to statistics, the entire semiconductor supply chain only made a profit of $126 billion in 2019.

What Causes the Shortage

Although China’s design and production capabilities are insufficient, and MCU production capacity is relatively concentrated, such a severe chip shortage has never occurred before.

Yang Dongsheng, the head of BYD’s product planning and automotive new technology research institute, called this chip shortage a “once in a century” event.

There have been many industry analyses of the causes of the shortage.

The main reason is the impact of the epidemic last year, with orders from main engine manufacturers and Tier1 companies being cut, ultimately leading to wafer fabs. The wafer fabs have switched their production capacity to consumer electronics. At the end of last year, the automotive market rebounded unexpectedly, and chip production capacity couldn’t keep up.

In addition, black swan events have occurred frequently: the snowstorm in Austin, Texas in February 2021, the fire at Renesas Electronics in Japan, which affected the production of several wafer fabs, and the strike at STMicroelectronics, all had a certain impact on the supply.

However, the fundamental reason is probably that the procurement cycle does not match and the wafer fabs lack a strong production willingness.

(1) Automakers’ procurement methods are not suitable for chip manufacturing

Chen Gang, general manager of BYD Semiconductor Co., Ltd., believes that this is a problem with the transmission of supply and demand information in the information chain. Due to the epidemic, industry companies did not transmit enough information to the supply and demand side.

Or it can be said that the procurement cycle of automakers does not match the chip production rhythm.

For example, the representative of the entire vehicle enterprise, Toyota, adopts the “Just-in-time” management method, which tries to minimize inventory levels.

Generally, the specific process is that OEM places an order with Tier1 company first; Tier1 company places an order with IC manufacturer based on the order demand; then IC manufacturer arranges capacity with upstream wafer foundries and packaging and testing links.

Regarding semiconductor production, from the wafer entering the factory, it will undergo about 500 processes (about 1,000 processes are required for cutting-edge products), and the entire process takes about 2-3 months. That is to say, at least half a year ago, automakers had to issue orders for the required vehicle-mounted semiconductors.

This sudden epidemic disrupted automakers’ production plans. As they could not produce new vehicles, suppliers would gradually reduce their orders, and the amount of orders issued to TSMC would also be drastically reduced.The market for home computers and game consoles has seen a significant increase under the impact of the pandemic, leading to a surge in communication data globally due to the influence of remote work. This has resulted in a substantial increase in the demand for data centers, which in turn require large amounts of high-performance processors. Therefore, High Performance Computing (HPC) has seen a significant increase in market share, squeezing the production line for automotive semiconductors.

Since May last year, the recovery of the Chinese automotive market has exceeded expectations, causing IC manufacturers’ orders to skyrocket 1-2 times, and further increasing to 3-4 times from October to December. However, the production capacity of wafer factories has not kept up with demand. As of May 2021, the delivery cycle for chips has reached one year.

Hassane El-Khoury, CEO of ON Semiconductor, pointed out the mismatch between procurement and supply rhythm, “My customers can cancel orders within 30 days, but it takes me two years to establish production capacity. Clearly, this is not a wise investment.”

Chip manufacturers are thus more inclined to accept long-term and stable orders.

Additionally, wafer factories have weak production intention. If not for various pressures, TSMC would probably not be willing to produce more automotive semiconductors. HPC products have high profits and demand with lower requirements, so TSMC will naturally prioritize producing these products. After all, according to last year’s sales, automotive chips accounted for only 3% of TSMC’s revenue, but their process requirements were close to military standards.

From the data, the requirements of automotive-grade MCUs are significantly higher than industrial-grade ones. In terms of temperature, commercial-grade MCUs only need to meet the working temperature of 0~70 degrees, while industrial-grade MCUs require -40~85 degrees. However, automotive-grade MCUs must meet -40~125+ degrees, with a defect rate no greater than 1 DPPM.

Tong Qianghua told the Electric Vehicle Observer that production of automotive-grade chips also requires “production line certification,” which has a long cycle. “Production line certification” refers to the inspection and verification of the production line for automotive chips in semiconductor factories by automotive manufacturers to achieve “zero defect rate.” Only when a certain type of automotive chip is produced continuously for six months to a year, and it can stably produce normal working products, will the automotive enterprise certify the chip production line. This certification process typically takes 1-2 years. The certified production line process consists of fixed procedures, and production equipment and process conditions cannot be changed.

The experts mentioned that to meet the automotive standards, a series of comprehensive certifications are required, such as obtaining either the reliability standard AEC-Q series, the quality management standard ISO/TS16949 certification, as well as passing the functional safety standard ISO26262 ASIL certification. In general, only semiconductor devices that meet the above conditions can pass the automotive grade certification.

The experts mentioned that to meet the automotive standards, a series of comprehensive certifications are required, such as obtaining either the reliability standard AEC-Q series, the quality management standard ISO/TS16949 certification, as well as passing the functional safety standard ISO26262 ASIL certification. In general, only semiconductor devices that meet the above conditions can pass the automotive grade certification.

In terms of ASIL level, level A is generally used for skylights, level B for instrument panels, level C for engines, and level D mainly for autonomous driving and EPS (Electronic Power Steering).

Although the process is cumbersome and demanding, the price of such chips is very cheap. As Ding Rongjun, an academician of the Chinese Academy of Engineering, said, “The automotive industry expects chips to perform to aerospace standards, but sells them at cabbage prices.”

Tong Qianghua also believes that the serious mismatch between investment and output in the automotive chip industry has led to a lack of enthusiasm from wafer factories to invest in the production of automotive grade product lines.

In addition, there is also the panic-order placed by car manufacturers, which has resulted in excessive hoarding of chips and further exacerbating the chip supply.

According to a report on the Sci-tech Innovation Board Daily on June 21, international giants including Infineon, NXP, and STMicroelectronics are currently experiencing extended lead times, with lead times increasing up to four times. Due to the shortage, MCU channel market prices have skyrocketed. As an example, the channel price of a best-selling model from STMicroelectronics has risen nearly 12 times from 2019 to the present.

In the spot market, the price surge is even more insane. According to Chip Superman’s spot price display, the prices of two models of MCU chips, FS32K133HFT0VLLT and FS32K144HAT0KLHT, from NXP Automotive in November last year were around RMB 24, while the prices in April this year were RMB 380 and RMB 585 respectively, an increase of 15 and 24 times.

Major changes may occur in the automotive chip industry structure

As a leading chip manufacturer, TSMC is actively increasing its production capacity and plans to increase its MCU capacity by 60% in 2021. TSMC has also stated that it will promote the establishment of modern “Just-In-Time” supply chain management in the complex supply chain to increase demand visibility, which should help to avoid the shortage of similar supply in the future to a certain extent.

However, this additional production capacity plan will not begin mass production until the second half of 2022, and will only supply 40,000 pieces to global customers by mid-2023.

This year’s gap is difficult to fill. Previously, Bernstein Consulting estimated that the chip shortage in 2021 will cause a loss of 2-4.5 million vehicles in production worldwide; IHS estimates that due to the chip shortage, there will be a loss of $61 billion in 2021, including approximately $25 billion in China and $14 billion in Europe.

This chip shortage will have a profound impact on the automotive industry.In the short term, the impact mainly includes car production halts and chip price increases.

In the long term, the entire automotive industry will reexamine its procurement methods and the layout of each country in the chip field.

Industry experts predict that there will likely be three changes in the future industrial structure.

Firstly, car manufacturers will likely communicate directly with IC manufacturers and wafer foundries to ensure supply through methods such as advance locking of orders/prices/volumes, and the Tier 1 status may be weakened.

Secondly, car manufacturers will directly participate in the chip production capacity layout, such as SAIC Motors and Infineon’s joint venture to construct an IGBT factory, and this trend may extend to MCUs, such as Tesla’s rumored acquisition of a wafer factory.

Thirdly, the domestic foundry supporting process will be accelerated. Due to the impact of the pandemic and supply tension, domestic related wafer foundries are expected to enter the list of major chip manufacturers. The development of Chinese chip companies has ushered in an opportunity.

Although the difficulty of achieving self-sufficiency and controllability in the chip industry chain is very high, under the severe situations of the COVID-19 pandemic and international trade disputes, countries around the world have begun to examine the feasibility of self-sufficiency and controllability.

In the United States, it plans to invest 52 billion U.S. dollars to implement the “Semiconductor Incentive Plan”. In South Korea, it will invest 510 trillion won in the semiconductor field by 2030. Europe plans to invest approximately 50 billion euros (386 billion yuan) in the chip industry.

In China, there have also been reports from foreign media that China is launching a “chip confrontation” plan, led by Vice Premier Liu He, which includes a huge investment portfolio covering trade, finance, and technology, and has already reserved 1 trillion US dollars in government funds.

The long-term blockade of China by Europe and the United States has made China the only country with a complete industrial system in the world. This large-scale chip shortage will also accelerate China’s progress in fields such as lithography machines, photoresists, and chip foundries. If the 1 trillion US dollars investment is true, it may indeed create a self-sufficient and controllable chip supply chain, but this remains to be seen.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.