Author: Michelin

When it comes to Tesla, it is not only the focus of attention in the field of electric vehicles, but also comparable to the “wealth code” in the stock market. Every investment in Tesla and every exposure of a new supplier has aroused everyone’s pursuit of a certain enterprise or even a certain industry. The “Tesla sector” in A-shares, composed of suppliers of Tesla’s Shanghai Super Factory, is also regarded as an opportunity for future development and attracts attention. Today we will take a look at a company that has recently been “taken off” by Tesla – Kingmo Technology.

Two months ago, Kingmo Technology’s stock price was less than 1 Hong Kong dollar, and now the market value of the company has increased by nearly 10 times with the launch of the Model Y in China. What does this company do?

Compared with the battery, chip, and automatic driving fields that new energy vehicles are often concerned about, Kingmo Technology’s main business seems to be relatively low-key, which is the die-casting machine business. As a leader in the global die-casting machine industry, although their products are low-key, their contribution to the production of the Model Y is not small.

With the “Tesla Printer”, increasing production capacity is not a dream

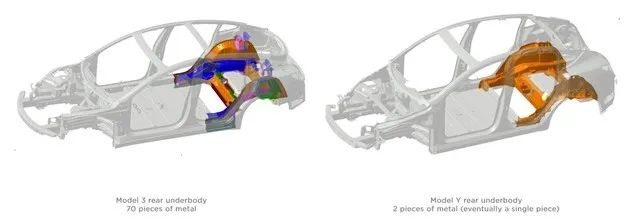

One of the striking reforms in the new Tesla model Model Y is the integrated die-casting process for the rear body.

According to Tesla’s official information, Model Y adopts aluminum casting process, integrating the part of the car body including the anti-collision beam into one piece, reducing 70 parts to 4 parts, and finally to 1 part. What helped Tesla achieve this function is the 6000T die-casting machine jointly developed by Tesla and Kingmo Technology’s sub-company IDRA.

In the traditional white body manufacturing of cars, steel plates of different thicknesses need to be cut into different shapes, stamped into many small parts, and then welded together by manual or robotic equipment to form a complete white body. In Tesla’s integrated die-casting process, high-pressure gas presses the metal solution (usually aluminum alloy solution) into a complex mold, and the final product can be a complex body part at one time after solidifying. The one-time molding of dozens of small parts replaces the steps of cutting, stamping, and welding small parts on the plates, which not only improves the rigidity of the parts, but also naturally improves the automation level and production efficiency of the production line.

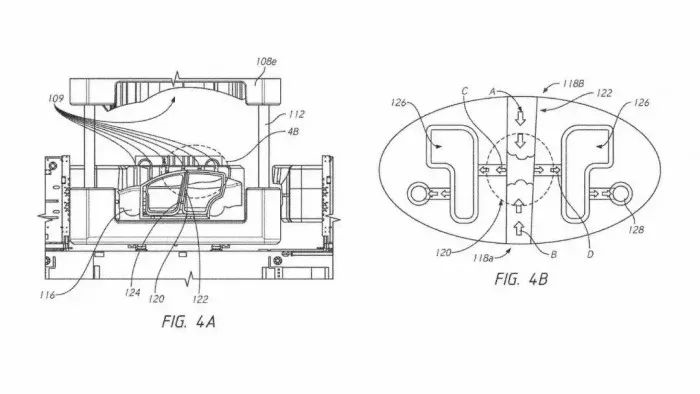

Currently, Tesla’s Fremont factory, Shanghai Super Factory, and the under-construction Berlin Super Factory have all purchased this kind of giant super die-casting equipment from IDRA. According to a die-casting machine patent applied for by Tesla earlier, Tesla plans to have only 5 die-casting pieces for the final body, and only 3 for the chassis. Imagine that a car body + chassis is composed of only 8 die-casting pieces. No wonder many people call IDRA’s die-casting machine “Tesla Printer”.

Currently, the use of a giant die casting machine on the Model Y production line has replaced 300 robots used for stamping and welding, enabling the production of a Model Y vehicle every 2 minutes in the Tesla Gigafactory in Shanghai. Tesla claims that its production capacity has reached 1.05 million vehicles per year in 2021, and this is in no small part helped by its “secret weapon” of increasing production efficiency, such as its giant die casting machine.

Aluminum casting has been an old friend of the automotive industry

Although Tesla’s integrated die-cast body has brought surprises to everyone, aluminum castings and die-casting processes are not new in the automotive industry. With the increasing demand for lightweight vehicles, the use of aluminum alloy castings has been increasing year by year. In 1990, only 50 kg of aluminum alloy materials were used per vehicle, but in 2020, the amount of aluminum used per vehicle has increased nearly fourfold to 190 kg. From the partners of IDRA, it can also be seen that aluminum castings are widely used in automobiles: General Motors, BMW, Chrysler, Mercedes-Benz, Audi, as well as domestic companies such as First Vehicle Group and Second Vehicle Group, all use IDRA’s die-casting machines. The automotive business accounts for 65% of LK Group’s total revenue.

However, unlike Tesla’s die-cast body, aluminum castings are generally used in gearbox housings, engine covers, oil pans and wheel hubs, with smaller component sizes and lower complexity, making aftermarket repairs and replacements relatively easy.

It’s no surprise that Tesla is the “first to eat crabs” with the use of such large castings, comprising 70 parts into 1 or 2 components.

Therefore, there are concerns about the repair costs of the castings after the vehicle has been manufactured.

For example, what if the body is dented or scratched after its integration? Does the entire body have to be replaced?

Although Tesla’s vision is bold, the company has only tried to integrate the rear floor of the Model Y, which is also for safety reasons. This area is located inside the body, usually where the engine or power battery pack is placed, and is rarely involved in direct collisions. Imagine if the battery pack of a car is damaged, even a traditional stamped body will require major repairs and must be sent back to the factory.

It may still be too early for the popularization of the “automotive printer”.Tesla’s ability to deliver quality products is beyond doubt, for example, the minimalist large screen and physical button-free design introduced in 2012, which is now almost a standard feature in the cabin. Will the integrated cast body lead the trend of future body manufacturing?

Musk’s vision for the future is to “produce Tesla products like toy cars”. However, the realization of an “automobile printer” is still far away from reality.

While aluminum castings obtained through giant die-casting machines can undoubtedly improve the automation level of automobile production, increase production efficiency, and achieve lightweight body, the corresponding body rigidity will also be improved. However, the problems that may be faced in actual production are almost more than advantages.

Compared with the failure rate of automobile parts per million (PPM), the control of consistency in cast products has always been a difficult point. How to solve the problem of residual high-pressure gas required to inject molten metal in the die-casting machine, avoid bubbles in alloys, ensure the consistency of the wall thickness of the alloy at various locations, and avoid defects caused by cold shrinkage of the alloy, all make the scrap rate of high-pressure die-castings high and the consistency poor.

For a “carefree” car company like Tesla, consumers seem to be more tolerant, and technological innovation may be more important than polishing details. But for more traditional car companies, under the standardization and homogenization of automobiles, mature and controllable details, relatively stable choices may be more important than the pioneering use of “integrated body”.

In 2019, Tesla applied for a patent for “new aluminum alloy materials”, which showed that the Model Y will use a new type of aluminum alloy material shared with SpaceX, which has higher strength and conductivity. Maybe this is Tesla’s “secret weapon” to solve the quality control of die-castings?

Compared with quality control, the promotion of large die-casting machines also has to consider cost issues. The IDRA6000T die-casting machine currently used by Tesla costs about 6 million euros per unit, and about 8 million euros for a set of peripheral equipment. When producing different castings, the new mold opening requires additional costs and time.

In 2020, global sales of Model 3 exceeded 360,000 units, and it seems that Model Y is also targeting an annual sales volume of hundreds of thousands. Such a large output for a single model provides space for giant die-casting machines to play their advantages, optimize production efficiency and costs to the extreme without the need to open new molds.For traditional car companies, it is obviously not cost-effective to introduce immature giant die-casting machines hastily and abandon the existing production lines; for new car-making forces, they cannot achieve cost reduction and efficiency improvement by investing heavily in giant die-casting machines when demand and output are not up. Instead, it may be dragged into the abyss.

When Tesla masters the road of integrated casting body, more and more car companies will choose the road of integrated casting body, after the quality control, cost control and after-sales maintenance solutions of large-scale casting parts are verified.

Finally

In the era of Industry 4.0, the intelligent factories created by highly integrated and automated production lines are the pursuit of automobile manufacturers and even the manufacturing industry. The car body integrated die casting machine jointly created by LK Technology and Tesla undoubtedly brings a new choice for the revolution of automobile production.

Similarly, Tesla’s attempt on die-casting car bodies also enables capital to see more possibilities of LK Technology and the die-casting machine industry. Currently, Tesla has purchased 15 IDRA 6000T giant die-casting machines. With the improvement of production capacity and the promotion of die-casting car bodies in Tesla models, the die-casting machine may face an industry space of up to tens of billions.

However, this expectation has been reflected in the valuation of LK Technology, and the future direction still needs more popularization of “automotive printers” to support it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.