Introduction

“Life is short, and many people waste their time on meaningless travel by car. I want to help people reclaim their time.” With the goal of changing people’s ways of travel, Kyle Vogt founded Cruise, which was later acquired by General Motors for $1 billion, a microcosm in the global wave of autonomous driving development.

On March 3, Haozhun Intelligent Mobility held its first brand open day event at its Beijing headquarters. Zhang Kai, Chairman of Haozhun Intelligent Mobility, and newly appointed CEO Gu Weihao respectively presented the development strategy, product technology, and future goals of Haozhun Intelligent Mobility to industry professionals with the themes “The Next Decade of Autonomous Driving is Here” and “Intelligent Travel, Starting with Haozhun.”

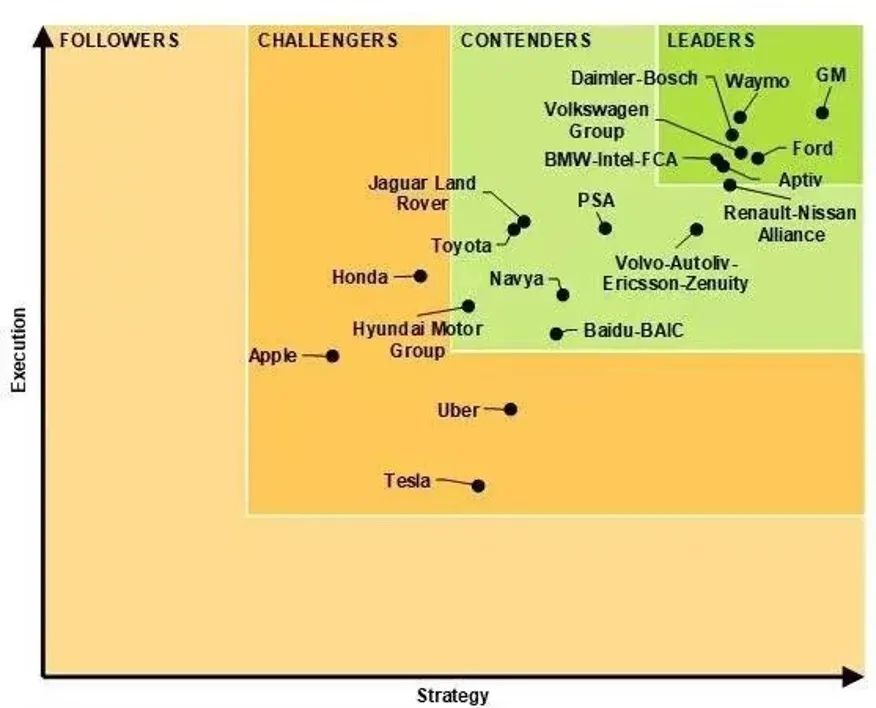

The Development Paths of Global Autonomous Driving Companies

As the commercialization of autonomous driving accelerates, the different development paths in the industry are also beginning to diverge. Waymo, with its Google background, hopes to integrate autonomous driving hardware and software through its own technology. Cruise, with its General Motors background, chose the car as the core of its technology application from the beginning.

In 2009, Google officially established its unmanned vehicle department in its X laboratory, focusing on the research and development of autonomous vehicle technology. In 2016, it became Waymo. In its first year of independence, Waymo began to set up operation and testing centers to establish a testing foundation for its formal operation on city roads.

In 2019, Waymo announced the launch of unmanned taxi services without safety drivers in Phoenix. Waymo’s innovation in autonomous driving technology and commercial exploration is radical, but it has also attracted the attention of global technology capital, with a current market value of $30 billion.

Facing the technological advantages of technology companies, the hardware manufacturing advantages that traditional automobile manufacturers have formed over many years are being constantly weakened, and they are beginning to seek further cooperation with technology companies to consolidate their market dominance.

Whether automobile manufacturers can have research and development capabilities in autonomous driving technology is related to their competitiveness in the future automobile market. If they have only the “right to use” and not the “ownership,” they may also become contract manufacturers for autonomous driving technology companies.

Automobile manufacturers have begun to actively contact technology companies, and the GM Cruise model was born as a result.

Backed by General Motors, Cruise and Waymo have completely different choices. Cruise’s research and development focuses more on the vehicle itself, integrating technology better into the vehicle through coordinated vehicle manufacturing and autonomous driving teams.

In 2017, General Motors produced 130 test version Chevrolet Bolt electric cars equipped with Cruise self-driving technology for public road testing. By the end of 2020, Cruise was granted permission to test fully autonomous vehicles on city streets in California. The Cruise AV model, which is currently in development, will not include a steering wheel, accelerator or brake pedal, creating a mobile space that reflects Cruise’s vision of the future of transportation. In agreement with Cruise’s vision, Zhang Kai, the CEO of Momenta, said at a brand open day that with the gradual unification of intelligent interaction and intelligent driving, the functions of travel tools will be defined by software, and these tools will become a third living space for people, providing entertainment, business meetings, nighttime rest, shopping, child care and customer spaces. In the coming decade, it is believed that the greatest change for humanity will come from intelligent travel tools. Cruise has plans to expand into the low-speed autonomous delivery market, partnering with Walmart in 2021 to deliver some of its products to consumers via Cruise’s self-driving fleet.

In 2017, General Motors produced 130 test version Chevrolet Bolt electric cars equipped with Cruise self-driving technology for public road testing. By the end of 2020, Cruise was granted permission to test fully autonomous vehicles on city streets in California. The Cruise AV model, which is currently in development, will not include a steering wheel, accelerator or brake pedal, creating a mobile space that reflects Cruise’s vision of the future of transportation. In agreement with Cruise’s vision, Zhang Kai, the CEO of Momenta, said at a brand open day that with the gradual unification of intelligent interaction and intelligent driving, the functions of travel tools will be defined by software, and these tools will become a third living space for people, providing entertainment, business meetings, nighttime rest, shopping, child care and customer spaces. In the coming decade, it is believed that the greatest change for humanity will come from intelligent travel tools. Cruise has plans to expand into the low-speed autonomous delivery market, partnering with Walmart in 2021 to deliver some of its products to consumers via Cruise’s self-driving fleet.

Before this, partnerships between car manufacturers and start-ups had received criticism as car manufacturers were seen to be lacking innovation and start-ups lacked experience in efficient planning. General Motors emphasized that they would treat Cruise as an independent company and maintain its business autonomy, without stifling its innovation culture through technical control and corporate integration after acquiring the company. While Waymo is accelerating its commercialization process, Cruise is improving its vehicles themselves, thanks to its early integration of self-driving systems into the vehicles and its coordination between hardware and software teams.

In the “car-making” field, Chinese internet companies, including Alibaba and Baidu, have shown great enthusiasm and prioritized its development on a strategic level for the future.Ali teams up with SAIC, Baidu teams up with Geely, Huawei and Xiaomi rumored to be advancing their car-making strategies comprehensively, Tencent and Meituan have also invested in new car-making forces such as NIO and Ideal, and car-making is becoming another hot industry after smartphones.

As a core technology of new energy vehicles, autonomous driving has also gained the support of various capital. Among the three development models of autonomous driving, Waymo and Cruise represent two types and the third type is represented by new energy vehicle manufacturers such as Tesla, NIO, XPeng and Ideal.

Relatively speaking, because the development model of new energy vehicle manufacturers is more difficult, the technology of mass production of cars is more complex and difficult than that of smartphones, and the vehicle implantation and data collection of each autonomous driving system are more difficult.

Autonomous driving technology started relatively late in China, and it needs deep cooperation between autonomous driving companies and automobile manufacturers, using the industrial chain advantages, quality management advantages, and cost control advantages of the automobile manufacturers. Autonomous driving technology will accelerate its development in both vehicle application and data collection.

However, more and more automobile manufacturers have become “original equipment manufacturers” of technology companies. The emergence of the GM Cruise model provides the possibility for automobile manufacturers to compete for the “ownership” of autonomous driving. In China, Gu Weihao, CEO of Momenta, believes: “Momenta adopts a development model similar to GM Cruise. We rely on the huge user base of Great Wall Motors to exceed the data scale of domestic technology companies and new car-making forces in terms of operating data. Finally, the software system engineering team will process the data to achieve industry-leading cognitive intelligence.“

Momenta has already formed a “dual product line strategy” in the passenger car and low-speed unmanned vehicle ecological platform markets. According to Gu Weihao, both product lines have formed the minimum commercial closed loop, and in the future, they will further enhance AI performance and product capabilities through the commercial closed loop. “Currently, the strategic cooperation agreements reached with Momenta are all the most well-known Internet top-tier customers in China, and customers have evaluated us as a team with comprehensive capabilities, outstanding work capabilities, able to think and solve problems from the perspective of customers, and trustworthy products.”

Cognitive intelligence is the “answer” to autonomous driving technology.

As an important application of artificial intelligence, autonomous driving requires a large amount of data resources to help AI train algorithms and establish models. Domestic and foreign autonomous driving vehicles collect data while driving, and then transmit the data back to the system. The system restores the data to objects consistent with human cognition based on algorithms and models, which is used for vehicle driving decisions.Currently, mainstream autonomous driving can achieve perceptual intelligence, which uses a large amount of data to establish models and identify various objects on the road, and now requires cognitive intelligence. Cognitive intelligence has high requirements for data volume, acquisition costs and data quality.

According to Gu Weihao, “autonomous driving systems are based on deep learning AI, and training a highly adaptable autonomous driving system is mainly dependent on two abilities – data collection speed and data processing power. The ability to collect large amounts of real data quickly and use it for algorithm training is crucial to maintaining a sustained competitive advantage.”

Moovita, which adopts Cruise mode, has advantages in both data collection and processing. After the autonomous driving system is installed on the first batch of Great Wall cars, it will obtain a large and complex urban road data set. In terms of data acquisition, Moovita will surpass domestic technology companies and new car forces in terms of data volume, and the software engineering team will process the data to achieve cognitive intelligence.

In Gu Weihao’s view, pure technology companies need to use special data collection vehicles to collect data, but efficiency is low and costs are high. As for new car forces, they need to sell cars to obtain data, so the amount of data that can be collected is limited by the sales of electric cars.

“The close relationship between Moovita and Great Wall Motors can quickly install the autonomous driving system in more vehicles. Great Wall’s sales alone are much larger than the total sales of all new car forces, and we will cooperate with more automakers in the future. In the low-speed unmanned vehicle ecosystem, Moovita is also cooperating with brands such as Wumart, Duodian, and SF to obtain more data.” Gu Weihao and his team will also leverage their capabilities in automated data annotation, algorithm problem mining, training, and evaluation to obtain leading data processing and AI algorithm training capabilities.

If traditional automotive manufacturers and autonomous driving technology companies can efficiently combine their strengths, the efficiency and innovation brought to the entire industry is unpredictable. With the enhancement of data collection and processing capabilities, the “cognitive intelligence” of Moovita’s autonomous driving technology has a bright future. The road ahead for Gu Weihao and Moovita is still not a smooth one, but the future is undoubtedly promising. We will also see a new era of autonomous driving start.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.