What’s it like to buy a NIO electric car when it is about to go bankrupt?

I happen to know how it feels.

During the gloomy days of NIO, I bought a NIO ES6 in just 3 days, despite concerns from my family and mockery from my friends.

As a brand that has gone from infinite glory to “ICU admission” and onto the normal ward after receiving Tencent financing, and finally to “discharged from the hospital basically cured” against all odds in the cruel automotive market competition, NIO’s survival is an uncommon phenomenon, especially for a brand at the cutting edge. Yet, none of this is surprising to me.

On December 22nd, I attended an unexpected but highly informative “chat” between NIO’s co-founder and CEO Qin Lihong and the media, which I plan to share my views on.

NIO makes money this year

A high-end brand in our eyes

According to Qin Lihong, being a high-end brand is not just about selling expensive cars. “We have our own definition of luxury, and defining whether a car is luxurious or not is not based on how the door opens, but on the brand’s culture.”

Yes, luxury brands have stories to tell, and what sets NIO apart is their story, which begins with the EP9 breaking records at the Nurburgring and peaks with their journey through hardship with their users.

Qin Lihong also revealed that NIO’s current average invoiced price is RMB 440,000, with the ES8 above RMB 500,000, and the ES6 and EC6 between RMB 400-410,000. Our average invoiced price of RMB 440,000 is higher than Mercedes-Benz by RMB 8,000, BMW by RMB 20,000, Audi by RMB 60,000, and Tesla by RMB 140,000. Excluding supercar brands like Ferrari, it is currently lower than Porsche.

At the same time, he also mentioned that NIO has indeed invested heavily in user services and lifestyles, which makes their financial statements not so pleasing to the eye.

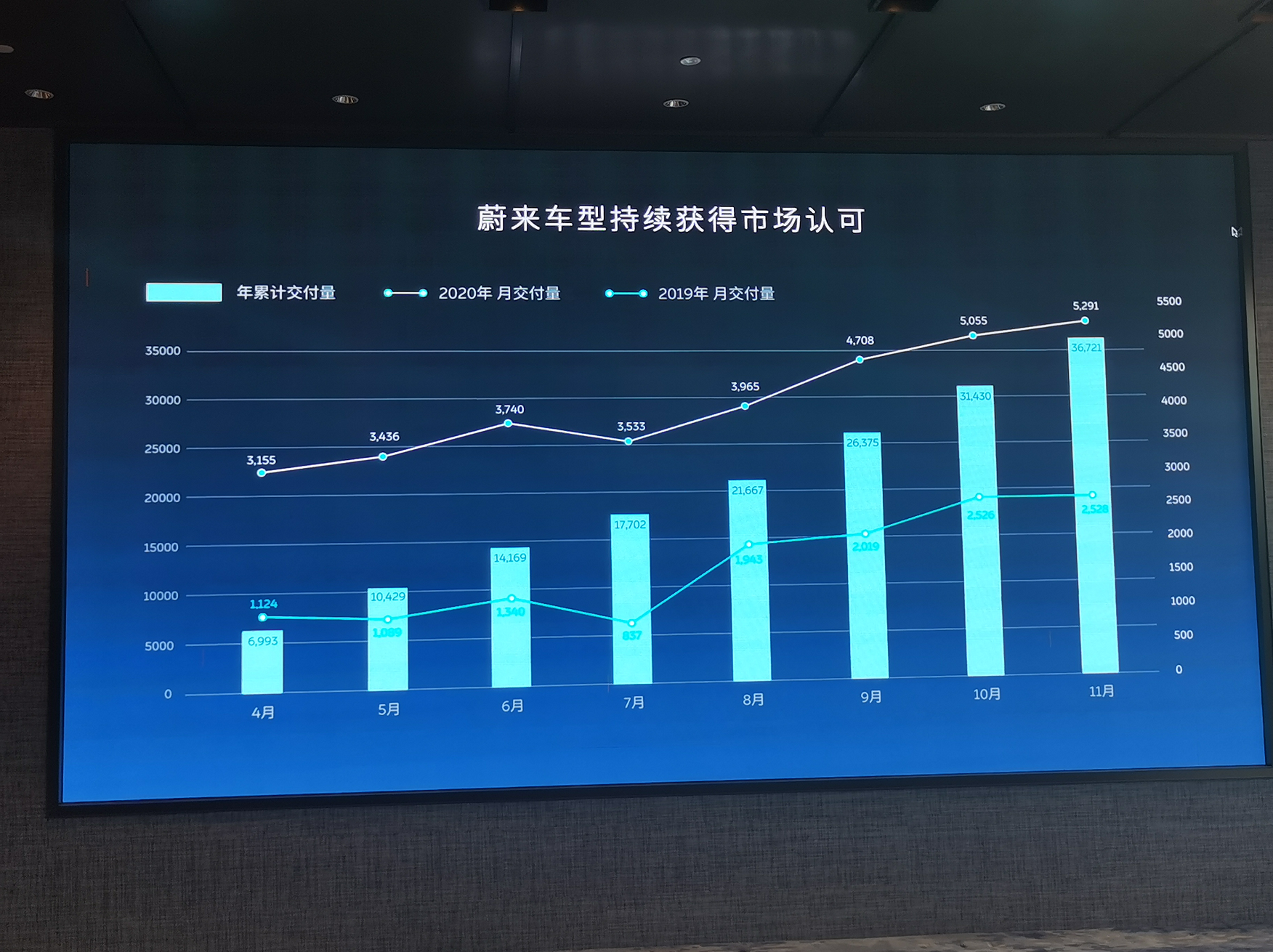

But starting from the third quarter of this year, NIO’s car sales have been making more than ten percent gross profit, with a gross profit of RMB 40-50,000 per car after excluding taxes. Although the predicted sales volume for this year is only slightly over 40,000, the profitability would be understood if calculated based on the sales volume of 200,000 cars per year.It has to be said that this is the first domestic independent brand to break out. Before this, in the price range above 400,000 yuan, NIO had such shipment volume, which was truly the first. And all of this was based on the seemingly stupid NIO vehicle owners who sold cars hard when everyone was pessimistic about NIO’s future, and took on 69% of the sales task. This bears emotions that cannot be described with just 12,000 recommended car purchase points.

As for NIO’s production capacity issue, it remains the same as before, currently maintained at around 5,000 units, and will be increased to around 7,500 units in January.

Surprise Mall Revenue of CNY 200 Million

NIO Points are patented globally and adopt blockchain technology.

In NIO’s financial system, NIO Points have the same status as RMB and USD and have clear project subdivisions.

For example, the points red envelopes issued by NIO executives on any occasion are counted as “marketing expenses”, while the points compensation for users who delay delivery is counted as “vehicle price discounts”. And this business sector allowed NIO to ship one million items in 2019 and earn CNY 200 million in revenue.

The core point for this business sector’s profitability, apart from having a relatively high net worth user group and investing a lot of effort in developing 500-800 products every year, is using “NIO Points” to connect various scenes and forming a set of “points circulation” system.

That is, many NIO App gameplays, such as daily check-ins, scan code charging, battery swapping, user evaluations, and quality content tipping, can all receive certain point rewards. And these accumulated points can not only support the purchase demand of “Surprise Mall”, but also drive the hotness of NIO House offline activities.

If these are not enough to motivate users, then “points can be exchanged for large batteries” is NIO’s ace in the hole. As for whether the results are good or not, you can refer to the ranking of NIO’s user App in the mobile phone battery consumption list.

NIO spends money to inject into user fragmented time and penetrate into daily scenes, enhancing user stickiness, which is a “chain attack” that NIO hopes to improve brand reputation and word-of-mouth publicity. Wait a minute, I smell a bit of an Internet company here. Judging from the results, NIO’s plan is very successful.

Selling Cars is the Top Priority

NIO House, as the main place for NIO Points “offline consumption,” directly affects the user group that can be served.From the opening of NIO House in Wenzhou Mixc on December 8, 2019 to the NIO House in Chengdu Mixc on December 20, 2020, NIO went through 378 days of dormancy before welcoming its 23rd NIO House.

During this year of suspended expansion for NIO House, NIO’s focus was on both controlling costs to seek better gross margin in its financial report and realizing the importance of expanding sales channels nationwide.

Compared to NIO House, which requires greater investment, NIO Space became the major force this year. This cost-effective and high-value sales channel network has rapidly expanded nationwide from 22 locations as of January 16, 2020 to 177 locations as of December 22. As of November, it has covered over 111 cities. This large-scale expansion of the sales network is the prerequisite for the delivery of 40,000 vehicles this year.

It should be noted that although NIO Space is a dealer system co-built by NIO and its users, it is still directly managed by NIO. If buying a car is a NIO user’s first silly move, then investing in building NIO Space is their second.

In addition, on January 3, NIO will release their last puzzle piece of the business model, the second-hand car system.

Cannot stop charging

I provide both battery swapping and supercharging

Since NIO deployed the first battery swapping station in Nanshan, Shenzhen on May 20, 2018, NIO had built over 100 battery swapping stations in 21 cities within half a year, including the battery swapping networks along the G4 and G2 expressways.

However, negative information in the market and sluggish terminal sales put NIO in a difficult position, until NIO deployed a battery swapping station at the WeiLong service area in Chongqing a few days before the Spring Festival on January 31, 2019. In the entire year of 2019, NIO only deployed a battery swapping station in Harbin International Automobile City on November 8, 2019.

This was the year when NIO only left the ICU for a regular ward. Although financially tight, NIO was not idle during this year.On April 21, 2019, NIO’s first supercharging pile was born. On July 9, the first direct-operated supercharging pile was launched in Suzhou. After the “charging partner” project was launched in September and a cooperative supercharging station was built in Xi’an on September 24, NIO built 21 supercharging stations in the remaining three months of 2019, reaching a total of 92 stations as of the date of writing.

At this time, the power of NIO users not only accelerated the expansion of NIO’s sales channels, but also supported the layout of NIO’s charging network.

In April 2020, after setting up three battery swapping stations in Guiyang, Baoding, and Shanghai Haoyu, NIO decided to listen to user opinions on the layout of battery swapping stations. Therefore, on April 26th, an “user face-to-face” discussion on the layout of battery swapping stations was held online through the NIO App, and after this meeting, the deployment strategy for NIO’s battery swapping stations this year changed to covering more cities.

The result of this change is the uneven increase in sales volume across the country, which has led to relatively serious queuing for battery swapping in cities with high car owner densities. Although NIO adjusted its strategy in the second half of the year, it still faced the cold winter, and the queuing for battery swapping in cities with high car owner densities still did not improve.

According to the information displayed by NIO’s charging app, on April 5, the 124th battery swapping station landed in Guiyang, and on December 17, the 167th battery swapping station went online, so during this period, NIO added 43 battery swapping stations.

Today, according to Qin Lihong, in April 2021, NIO plans to invest in 200 second-generation battery swapping stations, maintaining the pace of one station per day, and the efficiency of the second-generation station can be three times that of the first-generation station. The site selection work for the battery swapping stations is almost completed, but the specific deployment strategy is yet to be determined.

Connecting the first Sichuan-Tibet Line Fast-Charging Network

In September of this year, NIO announced the Power Up charging incentive plan, which plans to deploy 20,000 20 kW destination DC charging piles to form a nationwide destination charging network.

The Sichuan-Tibet Line is just one of the boutique routes, with a total of 14 NIO 20 kW fast charging stations set up in various hotels along the way, covering more than 2,900 kilometers. Don’t rush to make fun of whether 20 kW can also be considered fast charging? Because the most shocking thing is that the charging network along the Sichuan-Tibet Line was also invested and built by a NIO car owner who is a doctor and took one month to complete.

## NIO Day has surprises in store

## NIO Day has surprises in store

The NIO Day on January 9, 2021, held in Chengdu, which is a city selected by all NIO App users, will not only involve NIO users in planning stages, such as reception, warm-up, and other program arrangements but also has some surprises in store. As Qin Lihong said, we are more like a producer and our users play a significant role in defining the company as a user-centric enterprise.

Of course, Bin’s presentation during NIO Day will focus on four highlights, which include the NT 2.0 autonomous driving platform, 150 kWh battery pack, the second-generation power-swap station, and a brand-new sedan.

All four aspects are worth anticipating. They may enable NIO to produce a sophisticated, mass-produced autonomous driving solution using NT 2.0, increase power-swap efficiency by triple levels with the second generation, or alternatively directly introduce the 150 kWh battery pack when the 100 kWh ones are not yet universally adopted. The all-new sedan is simply another focal point of the event. Additionally, Qin Lihong reveals two small but notable details about the new sedan:

Firstly, he stated, “now everyone is talking about lidars, so let’s see our lidar on January 9. They’re nothing compared to ours,” Qin Lihong said it himself.

Secondly, he emphasized that “our new sedan can begin delivery from next year’s fourth quarter because some suppliers will not be able to supply until the third quarter of next year.”

Frankly speaking, following NIO’s rather bold style of spending money without flinching, one might be tempted to guess whether it will adopt the 300-line lidar using the 1550 nm wavelength from Luminar.

Proudly a user-driven company

“Many companies claim to be user-centric, but what they offer does not measure up to what we offer. The idea is not to involve users in product development and internal testing; that alone doesn’t separate us from the pack,” as Qin Lihong said. This seemingly haughty statement reflects his deep-rooted confidence.

But who gave him that confidence? I believe that it comes from two primary sources: users and Li Bin.

The user resources and information under NIO’s direct-sales model belong to the manufacturer, whereas under the traditional dealer model, the manufacturer must go through a middleman to reach end-users, and that involves considerable time and expense. Moreover, Li Bin – dubbed the father of travel by many – leaves an indelible mark on NIO with his vision and leadership.Who still remembers the phrase “e-commerce as a service”? It is probably only known to former colleagues of Li Bin from Lao Yi Che. All along, I have believed that NIO has made up for all the regrets of Li Bin’s first half of life, whether it is in the field of automotive e-commerce, C-end services, or user operations. What many people don’t know is that NIO’s user-centric thinking is not simply an imitation or plagiarism of anyone else, nor is it a business model conceived on a whim. It comes from years of accumulation of thinking. I also believe that without this accumulation of more than ten years, it is difficult to grasp the core of it. If you are interested, I will analyze Li Bin more deeply in the future.

Qin Lihong also brought us a system planning diagram that NIO has built around users, which is also a rare core of its user thinking that is conveyed to the outside world.

In addition, I would like to mention the little-known user trust fund. It was created by Li Bin selling one-third of his NIO shares, and experienced many difficulties in a one-year legal process before being successfully registered in the first half of this year. During the epidemic, the user trust fund played its role for the first time and set up a special fund of 5 million yuan, of which 3 million was used for car owner care. This is also the reason why every NIO car owner received a mask protection pack during the epidemic, and 1 million was donated directly to Wuhan’s epidemic prevention efforts. The remaining 1 million yuan was used to cooperate with the car owner’s public welfare donation activities, including a 1:1 cash matching donation and the provision of 50% of the material costs.

About software iteration

Qin Lihong said that our software progress was slow last year, mainly because of our management, not our software engineers, but after adjustments this year, our R&D efficiency has improved. We invested 15 billion yuan in R&D before, but it was not efficient enough, to be frank, R&D is a process of trial and error. But we will continue to increase investment in the future. We now have 40 billion yuan in cash, and we will mainly focus on two aspects of investment: one is automatic driving and human-machine interaction, and the other is the infrastructure of user services.

As I mentioned in my previous article about NIO car machines, the frequent personnel changes in the NIO software team last year had a significant impact on the progress of software development. But Qin Lihong’s initiative to take the blame himself this time was unexpected.

I also want to mention the overseas layout of NIO.As for the overseas market that I am most concerned about, Qin Lihong has explained that due to the epidemic, NIO has postponed its actions in the European market this year. Moreover, NIO does not want to conduct one-time business in Europe. They will insist on direct sales and move everything operated domestically to overseas, such as point system, battery swap stations, and road services. More information will be announced by Li Bin and Qin Lihong at the Shanghai Auto Show.

This is consistent with the information revealed by Li Bin at the EP CLUB party for car owners at the end of October that NIO has already completed the selection of NIO Houses in Norway to serve as its first overseas market.

Choosing Norway as the first stop for its overseas market is not only because Norway’s fuel price per gallon is twice that of the United States, but also because the government policies there provide excellent support, making it the country with the highest penetration rate of electric vehicles. Whether NIO’s models will be favored by overseas customers is also worth looking forward to.

Conclusion

As Qin Lihong said, we should all make a final judgement on cars, each person will have their own judgement, and he does not want to judge whose technical route is better.

For NIO, its judgement on the end game is intelligent electric vehicles, and it wants to play in the high-end field because only high-end models have the ability to command a premium. From the current perspective, NIO’s ability to command a premium has been achieved, although its gross profit margin is not high enough, it is only a problem of scale. After making a good judgement on the end game, the next step is to design a road to achieve it, and resolutely follow it. What we can do is to grow with the market along with time.

As for me, my family and friends have gradually begun to understand my choice to purchase a NIO model, and for the foreseeable future, the news that “NIO will go bankrupt” will finally no longer be mentioned.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.