Author: Tao Yanyan

The ZhiNeng Weekly is tracking the on-insurance data of passenger cars in China. This week’s analysis is for the 1st week of March 2023, specifically from February 27, 2023 to March 5, 2023.

Industry Overview

As of March, we saw a large promotion of automobiles in Hubei Province, which may be a turning point for automobile consumption in China. On July 1, 2023, the country’s most stringent emission standard, National VIb, will be officially implemented nationwide. This is a turning point for traditional fuel cars, meaning that compliance costs will further increase. During this time, it is necessary to clean up inventory and old powertrains.

Looking at the overall data of on-insurance passenger cars in China, this week’s sales volume was 345,300 vehicles, a year-on-year decrease of 3.4% and a month-on-month increase of 4.26%.

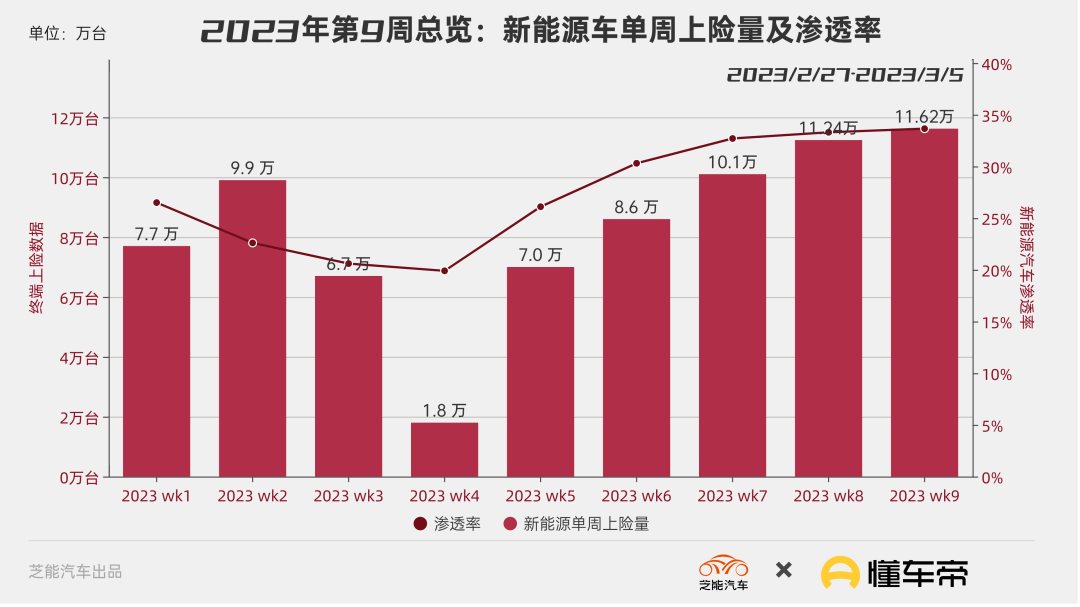

In terms of powertrain, new energy vehicles performed well in the first week of the month, with sales of 116,200 vehicles this week, a year-on-year increase of 24.4% (under the high base effect of last year), and a month-on-month increase of 3.8%.

Traditional fuel cars were relatively poor in the first week of March, with only 229,100 units, a monthly increase of only 4.49% and a year-on-year decrease of 13%, bringing down the overall sales volume.

We believe that after the price war of fuel cars begins with unlimited costs, the entire automobile market will experience irreversible price collapses. This has indeed had a huge impact on consumers’ purchasing psychology. Cars have also become unsellable products. As the largest consumer item outside of housing, consumers have started to buy more but not less.

Key Automotive Company Profile

The following key companies have different paces of recovery during the tracking process.

-

BYD: Sales volume this week was 38,937, a year-on-year increase of 61.2% and a month-on-month decrease of 1.4%;

-

Tesla: Sales volume this week was 13,266, a year-on-year increase of 17.2% and a month-on-month increase of 23.9%;

-

NIO: Sales volume this week was 3,345, a year-on-year increase of 81.1% and a month-on-month decrease of 0.4%;

-

XPENG: Sales volume this week was 1,421, a year-on-year decrease of 51% and a month-on-month decrease of 15.6%.- Ideal: Sales this week were 3,222 vehicles, a year-on-year increase of 250.6% and a month-on-month decrease of 40.2%.

-

Weltmeister: Sales this week were 973 vehicles, and Weltmeister won’t be able to recover in the short term.

Starting in March, we saw that automotive companies have even begun to aggressively adjust their pricing strategies with the support of local governments, and the price war is nerve-wracking.

High-Attention Car Companies

Tesla

Tesla’s domestic deliveries have started to gradually accelerate, and currently, Tesla’s situation is that it has a very affordable model in this price range. Despite the disappointment of price cuts, many consumers have still placed orders, which is the result of comprehensive comparison. The demand for Model Y is even stronger, and it is surrounded by this car in every alley and street in Shanghai.

New Force Brands

NIO, XPeng and Ideal are all relatively stable in the current situation.

◎ NIO: NIO’s performance is the most stable, with ET5 being the best-selling model for NIO. Currently, NIO’s stubbornness in not lowering prices has not yet seen the results of expanding its battery swap stations.

◎ Ideal: Sales of Ideal models have begun to fluctuate, and there are limitations on the mid-to-high-end demand for L9 models. Consumers have given all their enthusiasm to L7, which is a true reflection of the current automobile consumer market.

◎XPeng Motors: With the sales of G9 starting to decline sharply, all the hopes of XPeng Motors are pinned on the revamped P7. Judging from the information currently released, XPeng has focused more on its own improvements, neglecting the status of current competitors. We are looking forward to a very powerful price to impress consumers.

◎XPeng Motors: With the sales of G9 starting to decline sharply, all the hopes of XPeng Motors are pinned on the revamped P7. Judging from the information currently released, XPeng has focused more on its own improvements, neglecting the status of current competitors. We are looking forward to a very powerful price to impress consumers.

Wenjia Motors: Wenjia’s performance is poor, and there are no good measures to boost sales at present.

BYD

Judging from BYD’s sales, the healthiest cars are still the Yuan Plus and the Dolphin. More expensive cars, such as Tang, Han, and the Hippo, have been somewhat suppressed, and consumers have expectations of a price reduction for BYD.

- Yuan Plus: 6,547 units

- Song Plus EV/Song Plus DM-i: 5,010 units

- Tang EV/Tang DM: 1,513 units

- Han EV/Han DM: 2,640 units

- Hippo: 1,136 units

- Dolphin: 6,435 units

Volkswagen Brand

If we combine the sales of the two Volkswagen brands, at the current level, I can only say that Volkswagen really needs to thoroughly review how to sell electric cars in China. This is a very serious matter.

In the first week of March, we also witnessed history. The automotive industry is the pillar of the Chinese economy, and the automotive cluster is also the lifeline of local tax revenue and employment. We have really seen great efforts made by local governments to rescue the automotive industry in the economic cycle.# 欢迎来到我的博客

这是我的个人主页。

我喜欢编程,我的主要编程语言有:

JavaPythonC++

我还喜欢以下技术:

- HTML/CSS

- JavaScript

我最近学习了一些前端框架,包括:

Vue.jsReactAngular

学习是一件非常有趣的事情,我每天都在不断地学习、成长。

现在,我想与您分享我的思想和想法,希望您能从中获得启示和帮助。

<p>请点击<a href="https://www.example.com/contact">联系我</a>,我很期待和您交流。</p>

谢谢您的访问!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.