Author: Tao Yanyan

Recently, we reviewed the electrification transformation process of several traditional global car companies, with a total of ten planned, including German, American, and Japanese companies. Please stay tuned. Today is the first article, featuring the representative with a very aggressive transformation – Volkswagen Group.

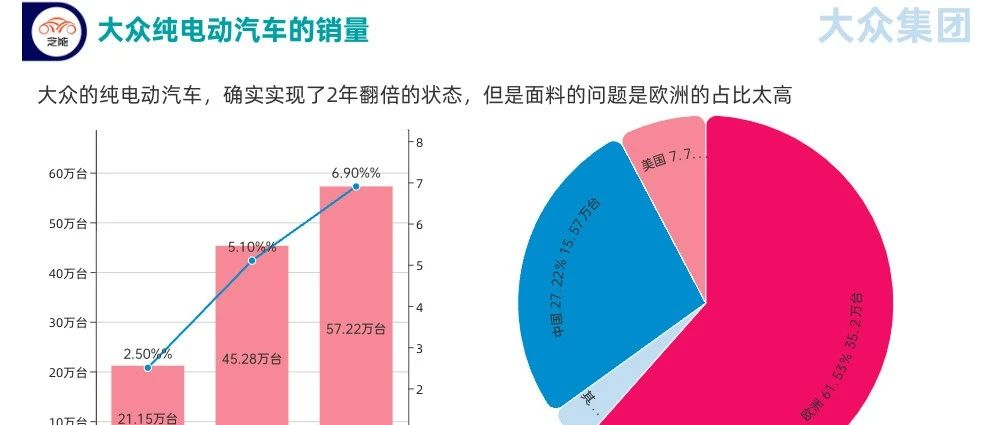

In 2022, Volkswagen delivered 572,100 pure electric vehicles to global customers, a YoY growth of 26%, with the share of pure electric vehicles in total delivery reaching 6.9%, higher than 5.1% a year ago. Volkswagen also has a significant order backlog – with a total of 1.8 million units, including 310,000 pure electric vehicles.

From a market perspective:

- Europe: 352,000 units (up 13.4%)

- USA: 44,200 units (up 18.8%)

- China: 157,000 units (up 68.2%; the fastest growth but lower market share)

- Others: 20,200 units (up 59.2%)

The total is 572,000 units (a YoY growth of 26.3%).

Currently, Volkswagen ranks first in pure electric vehicle delivery in Europe; it has risen to the fourth place in the US market (but the total number is relatively low); and China has witnessed the largest increase, with a YoY growth of 68% in pure electric vehicle deliveries. We know that, in 2022, Volkswagen was striving to sell ID-series products, but at the beginning of this year, it adopted a price hike strategy (SAIC-Volkswagen ID.3, low-end version, increased by 13,000 yuan, high-end version increased by 6,600 yuan; Volkswagen ID.4X and Volkswagen ID.6X increased by 6,600 yuan; the price hikes of FAW-Volkswagen ID.4 CROZZ and ID.6 CROZZ were 6,600 yuan). In the second part of this article, we will continue to see from the data how prices affect the sales of Volkswagen models.

## Volkswagen’s model situation

## Volkswagen’s model situation

In 2022, the best-selling pure electric vehicles of the Volkswagen Group were:

-

Volkswagen ID.4/ID.5 with a total of 193,200 units sold, of which about 170,000 were ID.4 and 23,000 were ID.5.

-

Volkswagen ID.3 with a total of 76,600 units sold.

-

Skoda Enyaq iV (including Coupé) with a total of 53,700 units sold.

-

Audi Q4 e-tron (including Sportback) with a total of 52,800 units sold.

-

Audi e-tron (including Sportback) with a total of 51,200 units sold.

-

Volkswagen ID.6 with a total of 37,400 units sold. However, this car model is only sold in China.

-

Porsche Taycan (including Touring) with a total of 34,800 units sold.

-

CUPRA with a total of 31,400 units sold.

From these sales figures, we can also see some issues:

◎ ID.3 does not seem to be as popular in Europe as before, with SAIC Volkswagen only selling 20,000 units in China in a year, and only more than 50,000 units in Europe. This lower sales number compared to other models is not ideal.

◎ Taycan had a total of 34,800 units sold due to the chip supply issue. Other car models, except for ID4 and ID3, could not even match this number. The multi-brand strategy of “having more babies good for fighting” on MEB did not achieve the desired effect.

◎ Volkswagen’s main brand has sold more than 580,000 MEB electric vehicles over the past three years, with a total of 330,000 units sold in 2022. The growth rate is good, but when compared with the growth rate and absolute speed of China as a whole, it is not that encouraging.

Volkswagen’s Future Prospects in 2023

The core question now is: What will be the ultimate growth rate of the ID series? With the arrival of the new platform PPE, software has truly become a core issue for the public.

We can see that the sales area of Volkswagen’s pure electric vehicles is still relatively concentrated, mainly in cities with purchase restrictions and coastal cities. From the perspective of penetration, it has not yet transitioned to cities below the second-tier. Currently, external pressure from Tesla’s price war strategy has had a significant impact on regions with key sales; internal pressure comes from the poor reputation of the ID series of infotainment systems, which suppresses subsequent growth.

Now, Volkswagen’s software has become a black hole. From a planning perspective, the software platform developed by CARIAD for the Volkswagen Group is divided into three stages:

● The first stage is software applicable to mass-produced models on the MEB platform. The Chinese team is leading the effort to implement remote online updates (OTA) on ID series products in China. In other words, what can be done now is still around this infotainment system itself.

● The second stage is software for the PPE platform. It supports information and entertainment systems and advanced driver assistance systems based on the Android open-source system and enables remote online updates on some Audi and Porsche brand models. This can be expected around 2024, but it cannot support the MEB system.

● The third stage is unified and scalable (Unified & Scalable) software on the SSP platform, which is suitable for all brands owned by the group. It supports Volkswagen’s self-developed operating system VW.OS and connects to the Volkswagen Automotive Cloud VW.AC. This technology stack is planned to be launched around 2025 and pre-installed with L4 level autonomous driving technology.Based on this, we can predict the situation in 2023:

◎ MEB remains the same as before, with higher prices and unsolved software problems, and Volkswagen will continue with its original strategy;

◎ Due to software problems, it is expected that PPE will be launched in Europe by the end of 2023, and if lucky, it can also be launched in China;

I am still worried about the reliability of Volkswagen’s self-developed operating system, VW.OS, and it does not help with the sales of short-term MEB models.

In conclusion: for Volkswagen at present, either it chooses to start lowering prices across the board like Tesla, but this decision requires a comprehensive switch from ternary-high-nickel to lithium-iron-phosphate, and repair relationships with major domestic battery companies, which currently seems quite difficult; or it relies on its own product strength and continues to struggle for another two years, but the battle for market share will already be over in these two years, putting greater pressure on the need for a comeback. The path of Volkswagen’s electrification transformation is very difficult.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.