Analysis of Monthly Data Report

Author: Tao Yanyan

Our monthly data report has been well-received lately, so after the release of the quarterly data, we started analyzing and examining the data, mainly with the goal of reflecting the overall market situation.

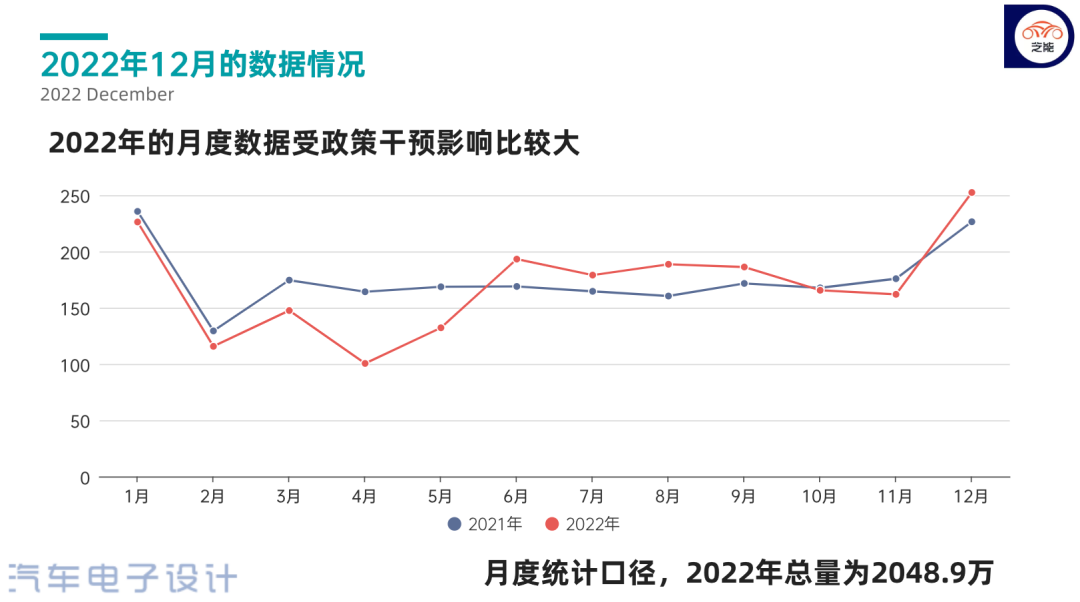

In terms of monthly data, the insured data for December 2022 was 2,524,000, a year-on-year increase of 11.5%. This is a very high number compared with the -1.3% year-on-year decrease in October and the -7.9% year-on-year decrease in November. In December, there was a sudden double-digit growth in insured data.

Looking at the whole year, insured data for domestic passenger cars was 20,489,000, a year-on-year decrease of 2.8%.

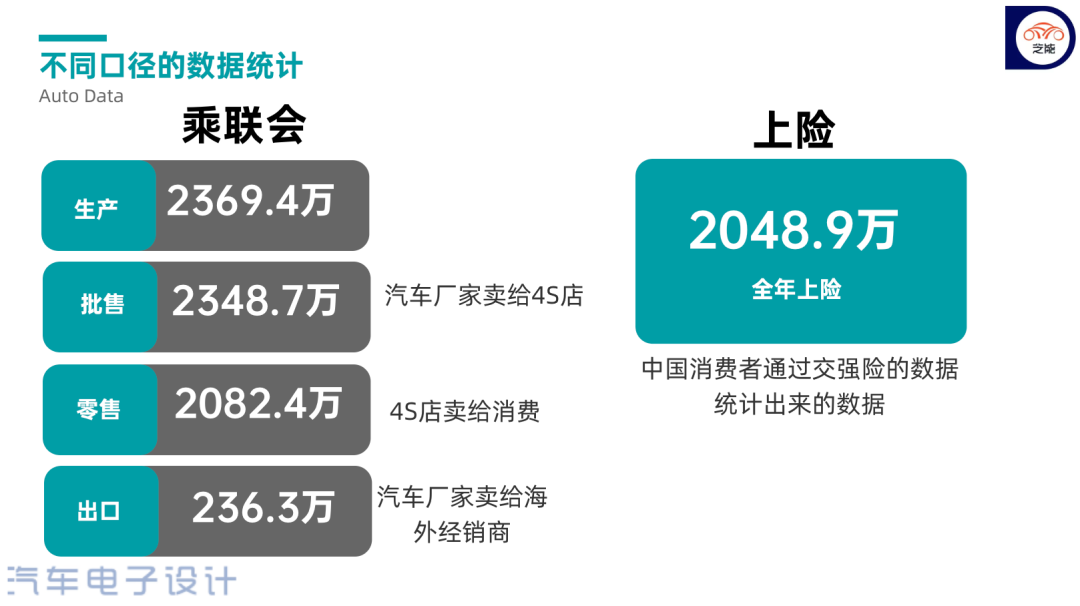

This data can be compared with that released by the China Association of Automobile Manufacturers:

●Automobile Production for Companies: In December, the production of passenger cars was 2,095,000, a year-on-year decrease of 15.0%. The annual production in 2022 was 23,367,000, a year-on-year increase of 11.6%.

●Automobile Wholesale for Companies: In December, the wholesale volume for companies to 4S stores was 2,222,000, a year-on-year decrease of 6.1%. The wholesale sales for passenger car manufacturers in 2022 were 23,154,000, a year-on-year increase of 9.8%, an increase of 2,060,000 over 2021.

●Automobile Exports for Companies: In December, passenger car exports were 260,000, a year-on-year increase of 50%. The total number of passenger cars exported for the whole year was 2,363,000, an increase of 55%.

●Automobile Retail for Companies: In December, the passenger car market retail was 2,169,000, a year-on-year increase of 3.0%. The total retail volume in 2022 was 20,543,000, a year-on-year increase of 1.9%.

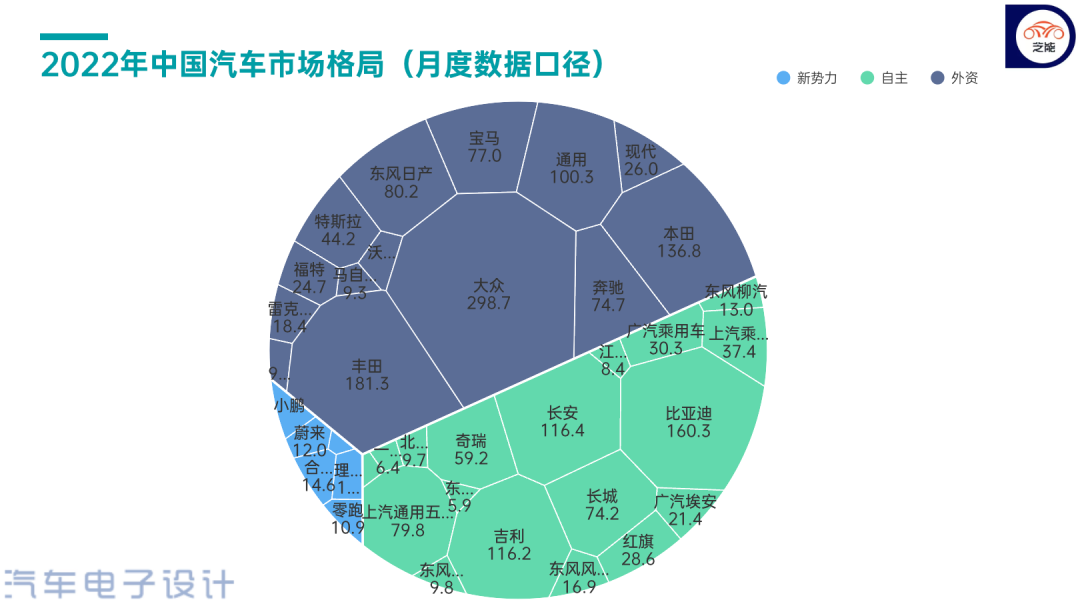

Analysis of Different Company Data.Firstly, update the competitive landscape by analyzing monthly data for different companies.

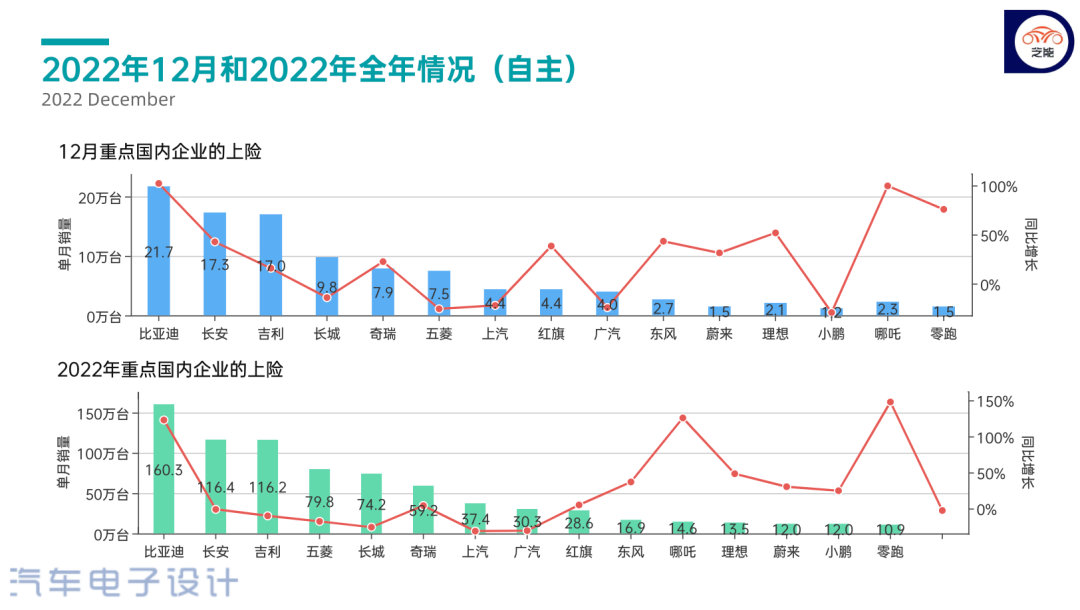

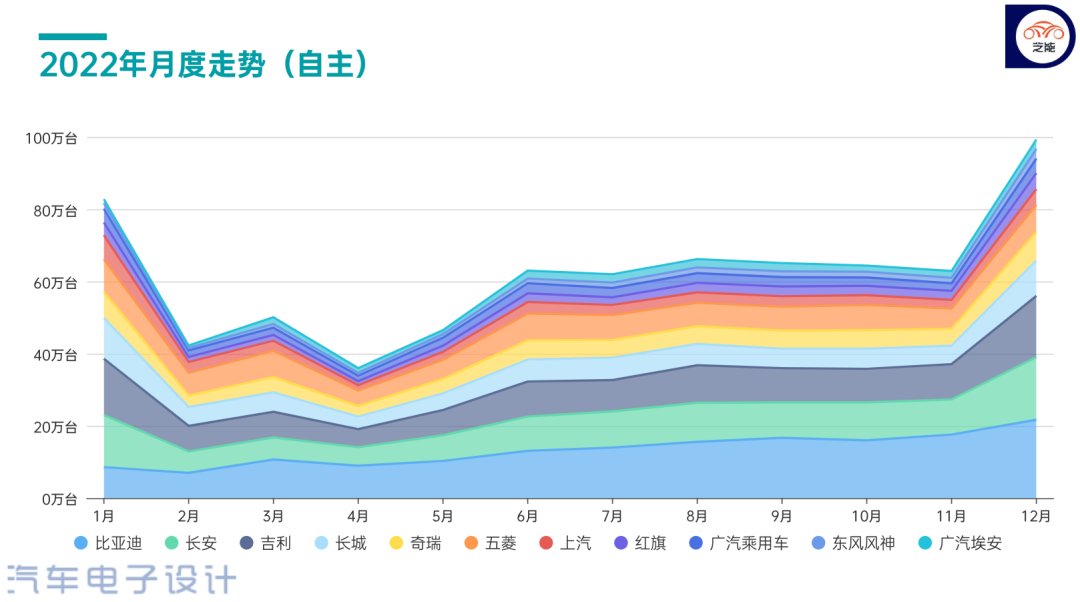

Domestic Enterprises

According to the monthly statistical caliber, the top three rankings are small in December, including all brands.

◎ BYD: 217,000.

◎ Changan Group: 173,000.

◎ Geely Group: 170,000.

In 2022, the top five domestic enterprises include:

◎ BYD: 1,603,000.

◎ Changan Group: 1,164,000.

◎ Geely Group: 1,162,000.

◎ SAIC-GM-Wuling: 798,000.

◎ Great Wall Motors: 742,000 (excluding pickup trucks).

Followed by Chery with 592,000, SAIC with 374,000, GAC with 303,000, and Hongqi with 286,000.

Monthly fluctuations suggest that the Matthew effect is still evident, and 2023 could truly be the beginning of a deep reshuffle of the domestic passenger car market.

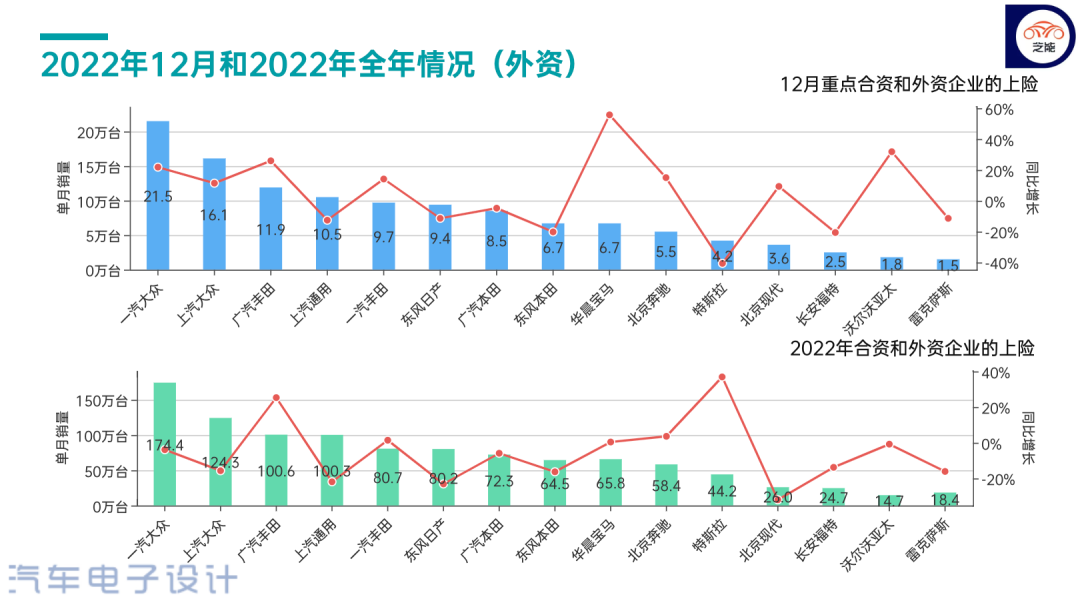

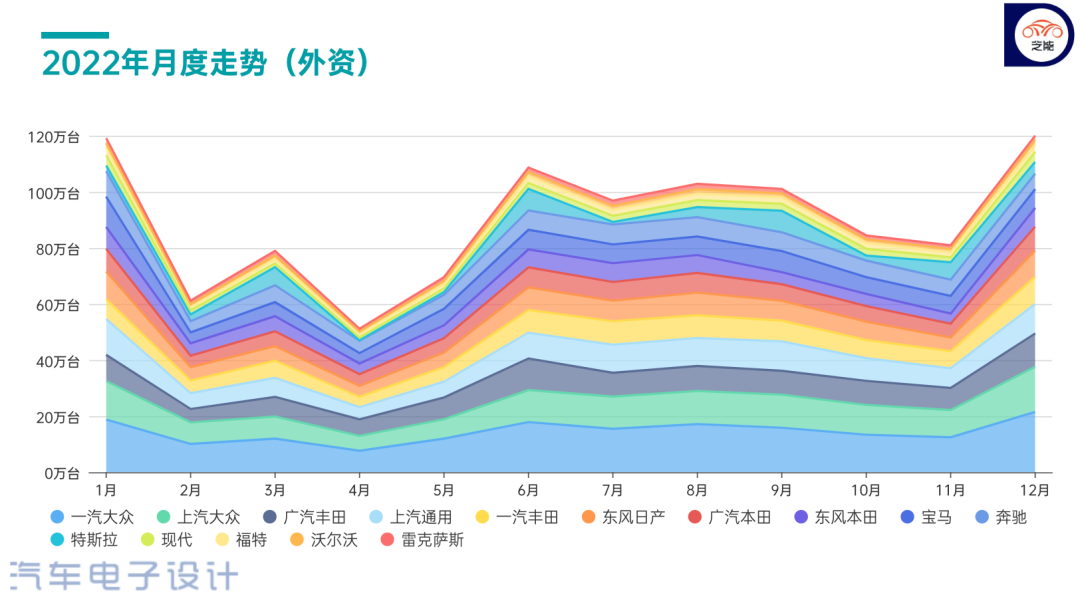

Joint Venture Car Companies

From the perspective of joint venture and foreign-funded enterprises’ statistics, enterprises that rank among the top are still working hard to gain momentum.

◎ FAW-Volkswagen: 215,000 per month, increasing by 21.8% year-on-year.

◎ SAIC-Volkswagen: 161,000 per month, increasing by 11.4% year-on-year.

◎ GAC Toyota: 119,000 units per month, increasing 25.9% year-on-year.◎SAIC GM: 105,000 units in a single month, a year-on-year decrease of -12.6%.

Looking ahead to 2022, there are only four companies with annual sales of over one million.

◎FAW Volkswagen: 1.744 million units, a slight year-on-year decrease of -3.9%, with a relatively small impact.

◎SAIC Volkswagen: 1.243 million units, a year-on-year decrease of -15.7%. It is still unclear what to do in the medium and long term as product competitiveness declines.

◎GAC Toyota: 1.006 million units, a year-on-year increase of 25.3%, still growing against the trend, as Toyota’s hybrid is recognized.

◎SAIC GM: 1.003 million units, a year-on-year decrease of -21.9%, transformation is still necessary.

◎FAW Toyota: 807,000 units, a year-on-year increase of 1.4%, attributed to the layout of the hybrid.

◎Dongfeng Nissan: 802,000 units, a year-on-year decrease of -23.1%, still need to promote the large-scale application of hybrids, otherwise it will be difficult to rely solely on gasoline vehicles.

Foreign brands in China’s market are full of challenges, and there is indeed a possibility that foreign shareholders will continue to withdraw in 2023. The pressure on foreign brands was previously downward pressure from luxury brands, but now with the challenge of new energy vehicles, the uncertainty of business operations is increasing.

New Energy Vehicles

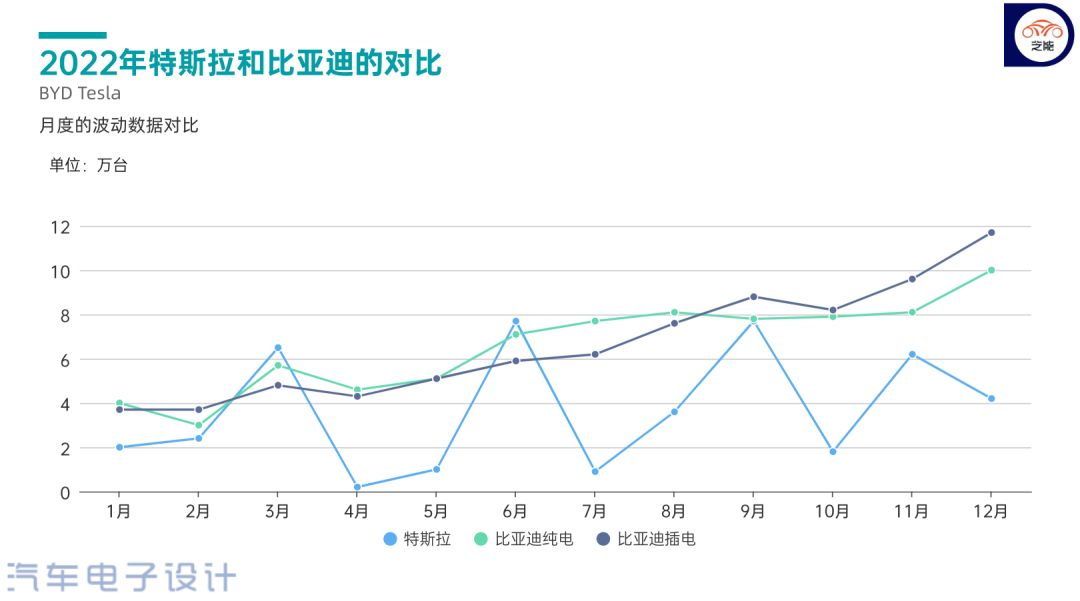

BYD and Tesla

We can compare the two companies’ data from the monthly data, which objectively reflects the changes in demand. With the price of Tesla decreasing and its repositioning, it has a great impact on consumers’ price expectations.

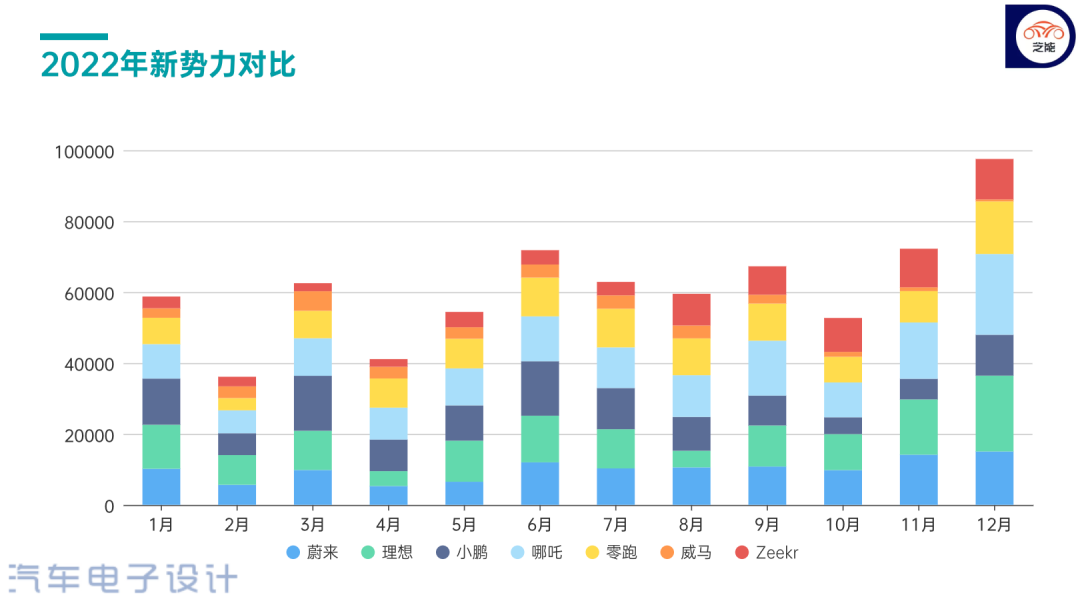

### Monthly Data on New Forces

### Monthly Data on New Forces

From the perspective of new forces, the strength from October to December can be attributed to the accumulation of orders from new car sales. Some new force enterprises that focus on B-end sales have also taken measures to adjust. Therefore, by December, several companies’ cumulative data had approached nearly 100,000 units.

Commentary: When Zhu and I looked at the data together, the prominent feeling was that the competition in the domestic automobile industry among fuel vehicles has already been very fierce, and the high growth of new energy vehicles still masks many problems. This makes it difficult to judge the future direction of the automobile industry. If the country also relies on the automobile market to support consumption, similar to real estate, the long-term effects brought by consumption taxes and local consumption vouchers will also be discounted. We also see the anomaly in the December data, which is a result of car companies over-exploiting the market based on policy timelines.

Conclusion: The human factors that were artificially adjusted in the December data are indeed relatively significant. Therefore, tracking weekly data in 2023 is a good method. We will post it on Weibo as soon as possible, and then send it here on the public account the next day. Thank you for your attention.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.