Luoji

Amid the COVID-19 supply chain crisis in Shanghai, many automakers have experienced significant drops in production and sales. However, LI (Zero) Motors, a newcomer in the industry, achieved its 2nd consecutive month of surpassing 10,000 deliveries, with 10,069 units in May. Meanwhile, the recently pre-sold LI C01 has received more than 45,000 orders as of May 27th.

There is no doubt that the LI C01 has attracted a lot of attention and generated interest among consumers who were previously unfamiliar with the brand. Compared to its previous products, the newly released C01 showcases LI’s true strength, potential, and brand story.

Let’s talk about LI’s brand and the C01.

How far is LI from becoming the next “Tesla”?

Compared to Tesla, LI is far less known among the general public, even with the release of the C01. Not many people outside the auto industry have heard of LI. Those who have may have encountered the brand through different events or models, leading to varied perceptions of the company.

LI’s development can be divided into different stages, so people who became acquainted with the brand at different times may have very different impressions.

It is said that founder Liu Jiangming took advice from a certain industry insider to launch LI’s first product, a low-priced electric sports car called the S01. It was released in early 2019 at a subsidized price between 119,900 and 150,900 CNY, with a wheelbase of 2.5 meters, a length of just over 4 meters, and a three-door four-seat layout. The powertrain uses a front-mounted single motor with 170 horsepower, and can accelerate from 0 to 100 km/h in 6.9 seconds. The battery pack has a maximum capacity of 48 kWh, offering two versions of estimated driving ranges at 305 km and 380 km.

If LI could produce a coordinated and cute small sports car with a similar look as the Audi TT or A1 at this price, the S01 might have harvested sales from potential customers such as those who like cats or dolphins. Unfortunately, it went with an unconventional and eerie design approach.

According to the sales data, the S01 has sold a total of 2,919 units since its release in January 2019, including demo models and internal use vehicles.The first model suffered a tragic defeat, but fortunately, Leapmotor did not invest much in the S01, which is far from the hundreds-of-thousands high-end models like NIO ES8 and Ideal ONE. Leapmotor quickly learned its lesson and changed its strategy to focus on cost-effectiveness and practicality. In May 2020, Leapmotor launched the T03, a microcar with a starting price of 5.98 thousand yuan and a top configuration no more than 7.58 thousand yuan.

It is certain that T03 was not inspired by Wuling Hongguang MINI EV, which was released two months later. However, before that, there were already successful examples of low-priced micro EVs, such as Chery eQ1 (Little Ant), Ora R1 (Black Cat), and Nio N01. While Xu Xiaoli and each other were still struggling in the early stages, T03 was the most reliable positioning product that Leapmotor could think of at that time.

After a few months of climbing, the sales potential of Leapmotor T03 gradually emerged. In 2021, cumulatively sold nearly 40,000 units, and the monthly sales remained steady at 4-5 thousand units. Even in April of this year, when the national market was greatly affected by the epidemic, T03 still sold nearly 6 thousand vehicles.

In terms of sales, T03 helped Leapmotor enter the second-tier new forces of Xu Xiaoli, which was a timely recovery and prevented Leapmotor from being eliminated from the car-making track after the heavy blow of S01. However, low-priced microcars are obviously not the products that Leapmotor really wants to make. Only half a year after T03 was launched, Leapmotor introduced the C11, a mid-size SUV positioned at 200,000 yuan. It was from this car that Leapmotor truly found its positioning, and the outside world gradually had a clear and unified understanding of Leapmotor.

C11 was pre-sold at the end of 2020, but actual delivery did not start until October 2021, only half a year ago. One word that describes its characteristics is “cost-effectiveness”. This cost-effectiveness is not like Wuling’s giving an unexpectedly low price in a certain level of models but providing a product with specifications that far exceed the same-priced models in a price range that is not particularly low.

For the positioning of electric mid-size SUVs, Leapmotor C11’s price of 180,000 to 230,000 yuan is not really high. However, what really makes it feel of great value is not its size, but its “hard” materials, such as the double-wishbone front suspension, five-link rear suspension, frameless doors, and full-range L2 level driving assistance. At the same time, the styling and interior are quite textured, and the three large screens were still quite impactful at that time. The appearance was no less impressive than the NIO ES6 in terms of appearance but with a price only half of the latter.“`

In terms of store construction, brand marketing, and overall popularity, Zero Run and Weixiaoli are not in the same league. But since the delivery of C11 began in October last year, the cumulative number of insured vehicles has exceeded 12,000, and 8,700 vehicles have been sold in the first four months of this year, with the best performance in March, selling 3,218 vehicles in a single month. This achievement is not very prominent in the market, but compared with the performance of Weixiaoli’s main models such as ES8, Ideal ONE, and P7 before delivery, C11 is already quite successful.

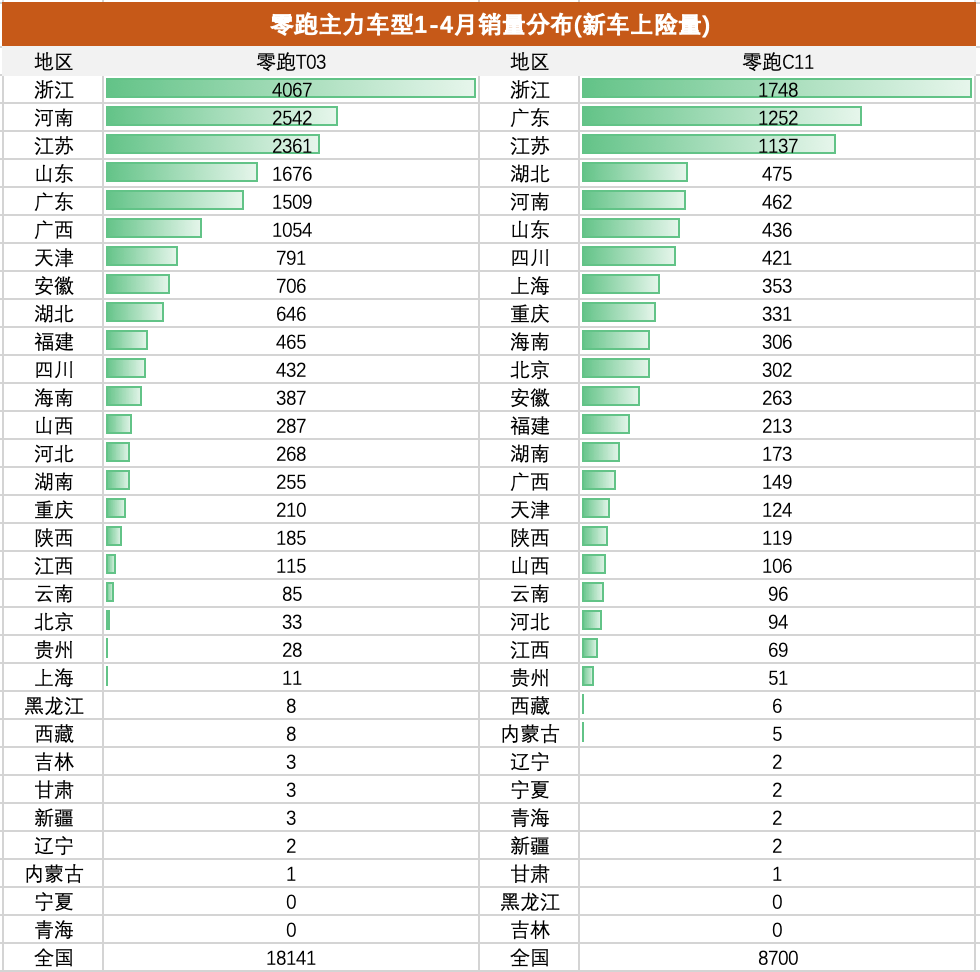

In addition, the large-scale delivery of C11 has also changed Zero Run’s customer base and sales distribution, which can be clearly seen from the insured vehicle data of T03 and C11 in various provinces and cities across the country.

As shown in the table above, the sales distribution of the low-end microcar T03 in various regions in the first four months of this year is relatively balanced. As a car company from Zhejiang, Zhejiang’s sales ratio of T03, accounting for nearly one-fifth of its total sales, is expected. Excluding this factor, its largest regional market is Henan, Jiangsu, and Shandong in turn, among which Henan and Shandong are the best-selling areas for low-priced electric small cars, similar to the distribution of Hongguang MINIEV, Euler Black Cat, Chery Little Ant and other models.

As for C11, which is priced at 200,000 yuan, although Zhejiang is still the largest market, its proportion has been much smaller. Outside of Zhejiang, Guangdong and Jiangsu have the highest sales, while the sales in Hubei, Henan, Shandong and other places are much lower than those in Guangdong and Jiangsu. This means that C11’s main market has become economically developed cities and regions, and it has also gained a certain scale in Shanghai and Beijing.

Overall, Zero Run’s existing vehicle sales do not rely heavily on local provinces and first-tier cities. T03 has gradually spread to economically relatively backward populous provinces, while C11 has obtained initial recognition in economically developed areas.

In the first four months of this year, Zero Run’s cumulative number of insured vehicles was approximately 27,000, while Nio, XPeng, and Ideal were 31,000, 44,000, and 36,000, respectively. In terms of sales volume, the gap between Zero Run and Weixiaoli is already small, and its current sales distribution is relatively balanced, laying a good foundation in the market. If its subsequent products are strong enough, Zero Run undoubtedly still has considerable growth potential.

So, are Zero Run’s upcoming products powerful enough?

What kind of car is Zero Run C01?

“`C01 is currently in the pre-sale stage, with a price range of 180,000 to 270,000 yuan. It belongs to the mid-to-large size sedan category, one level larger than C11. However, due to the generally lower prices of sedans compared to SUVs, the starting price of C01 is basically the same as that of C11, which is positioned as a medium-sized SUV. But the top configuration price of C01 is about 40,000 yuan higher than that of C11. In addition to the recent general price increase of new energy vehicles, C01 does have higher overall design, materials, and configuration specifications compared with C11.

The overall design of C01 continues the main features of C11, including a simple and rounded body, a center console with a triple-screen display as the core component, and hidden door handles and frameless doors that are also expected. One distinctive feature is that unlike pure electric platform models that have become popular with a long wheelbase and short body, the C01 has a relatively long rear overhang, and the roof line extends straight to the tail of the car, presenting a hatchback-like appearance.

Of course, like BYD Han and Tesla Model 3, the C01 does not actually come with a hatchback-style tailgate, but its appearance is indeed the least characteristic of a sedan’s trunk, but more has an elegant station wagon or hunting vehicle vibe.

The mid-sized or mid-to-large sedan category is almost a must for every new automaker, including NIO ET5 and ET7, XPeng P7, NIO’s NIO S, and Zhi Ji L7, the first model of which was aimed at the ET7, all have strong sports genes, while BYD’s new Han clearly replicates the proportions of Tesla Model 3.

Among these models, the C01 may not be the most beautiful, but it is the most distinctive in overall appearance. From this, it can be seen that ZERO RUN did not blindly follow the trend in design, but had its own ideas.

At the more core technical level, while ZERO RUN does not have much voice, it does not lack the technology that can be used for marketing or boasting. Firstly, in terms of basic performance and range, the C01 uses a maximum 90kWh battery pack and achieves a range of 717 kilometers under the CLTC operating condition in the 2WD version, while the performance-oriented dual-motor high-performance version has acceleration capability of 3.66 seconds from 0 to 100 km/h. Both of these indicators are in the absolute first tier in the market.The recently emerging battery integration technology has not been neglected by the ZEROPRO team. The C01 model adopts the Cell to Chassis (CTC) technology. The technology is explained in detail in the article “Tesla’s Apprentices Learn to Run Ahead | Tech Flow”. The official claim is that the C01 is the first mass-produced vehicle in China to use this technology, which is basically in line with Tesla and similar to the CTB (Battery Body Integration) on the recently pre-sold BYD Dolphin.

According to ZEROPRO, the CTC technology increases the battery layout space of C01 by 14.5%, the vertical space of the body by 10mm, while reducing 20% of the number of parts and 15% of the structural component costs. At the same time, the body torsional stiffness, which affects safety, handling, and NVH, is increased by 25% with CTC technology, reaching 33,897N·m/°.

In summary, ZEROPRO has been making efforts to independently research and develop core technologies for electric vehicles from the beginning, and following the market in key technologies. Although the brand has not attracted high attention like other major first-line brands, the company’s technical level has always kept pace with the times.

However, in terms of intelligent driving, ZEROPRO did not deliberately pursue the ultimate configuration and parameters. In today’s era where NIO and Li Auto’s onboard chip processing power both reach hundreds of TOPS, the C01 achieves a total of 8.4TOPS of computing power by carrying two self-developed Lingchips 01 chips. This is a great advantage compared to traditional models, but it lags behind the products of new forces in the same period.

ZEROPRO’s statements in this regard are pragmatic. With 11 cameras, 12 ultrasonic radars and 5 millimeter wave radars, the C01 realizes L2+ level intelligent driving assistance, including lane changing with turn signals. However, ZEROPRO did not equip higher-specification lidar. Apart from cost and price considerations, ZEROPRO believes that the current lidar technology is still far from mature, and it is expected to be suitable for lidar in 2024, when higher computing power platforms can also be matched with the product.

It is worth mentioning that ZEROPRO founder Zhu Jiangming clearly stated that when lidar technology is mature, ZEROPRO can “easily” launch a multi-sensor fusion solution including lidar. This shows that ZEROPRO has also been accumulating technological reserves in this area.

ZEROPRO, how far can it go?When LI (零跑) launched the C01, BYD brought out their first midsize electric sedan under the pure electric platform called HB, NETA released their first high-end sedan, the NETA S, and Changan’s subsidiary, Shenlan, introduced their first sedan product, the SL03. Meanwhile, the 20,000 yuan range that C01 aims to hit has recently seen the entry of smart elf #1 and the Ora Ballet Cat, which specializes in the female market. In a short period of time, what was a sparsely populated 200,000 yuan pure electric car market has suddenly become crowded.

Although the positioning of the mentioned models is different, they all have their own characteristics. When it comes to cost-effectiveness, however, the LI C01 is almost an indisputable representative. What supports its high value image is not a price lower than its competitors’, but the fact that it maintains a low price while achieving excellence in almost all aspects. After careful inspection, you might even find that it performs better than many expensive cars in many aspects.

With a range of 700 kilometers and a four-wheel drive that can reach 100 km/h in just 3.66 seconds, the C01 boasts double-wishbone front suspension, frameless doors, multi-layer soundproof glass, Nappa leather seats, suede headlining, electrically adjustable backs for the rear seats, and interactive user interfaces. LI has built the C01 to 30,000 yuan standards of performance, quality, configuration, and comfort, but has provided a starting price of 180,000 yuan.

Many people who have come in contact with LI cannot help but ask the same question: “How can your cars be sold so cheaply?” Zhu Jiangming’s answer is, “LI achieves economies of scale through comprehensive independent research and development,” and “demands the same profit margin as traditional automakers in the 100,000 to 150,000 yuan price range.” Another reason for not equipping C01 with a lidar device, according to Zhu Jiangming, is that using lidar too early “will waste everyone’s pocket money.”

In summary, LI makes people feel like they are saving money in various ways, rather than trying their best to make money. This is what sets LI apart from other new forces, as well as all other traditional automakers. Its cost-benefit advantages are reminiscent of Xiaomi in the mobile phone industry, but LI has a more low-key brand style compared to traditional automakers.

It’s difficult to predict how far LI will go, but what we can confirm is that LI has established a certain market foundation and is continually introducing excellent and cost-effective products. At least for now, LI’s state is healthy and it is running fast enough. It is not prominent in the marathon of car manufacturing teams, but we may see its figure at the final finish line.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.