– The ET5 will be delivered in September this year.

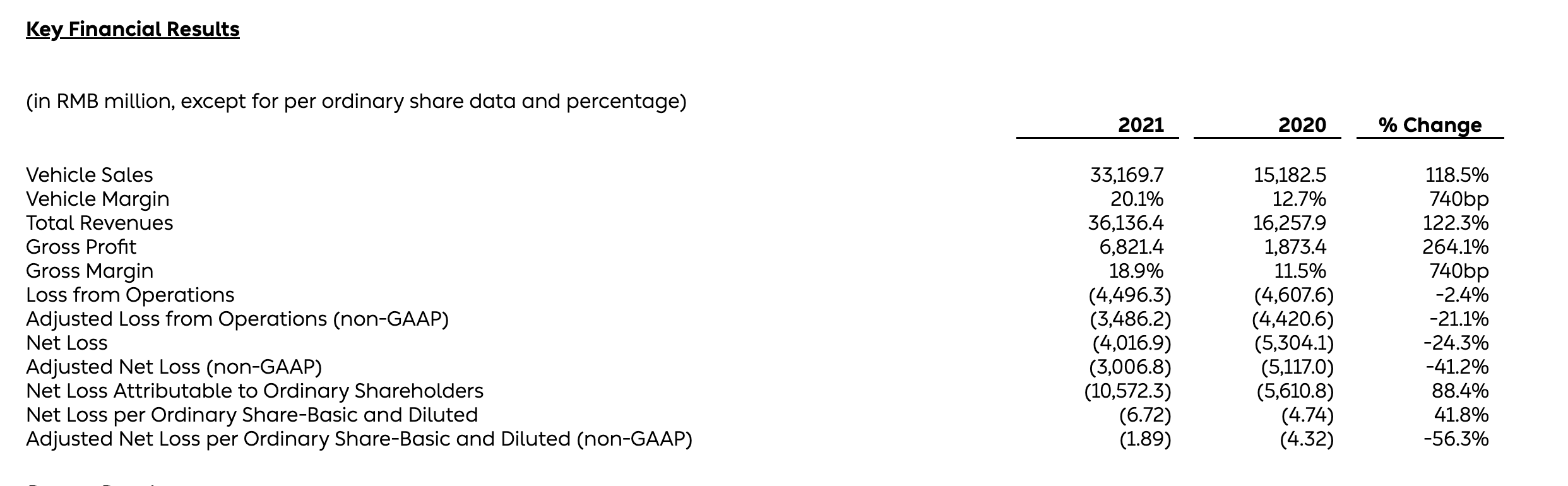

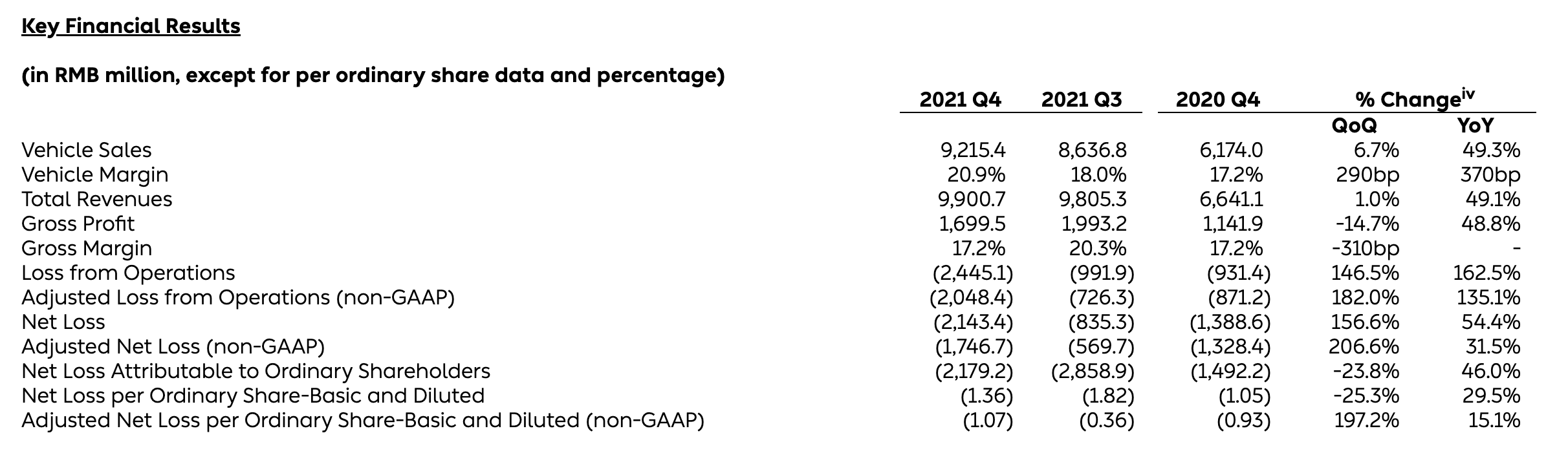

– The Q4 revenue was RMB 9.9 billion, up 49.1% YoY and 1% QoQ. The total revenue for 2021 was RMB 36.14 billion, up 122.3% YoY.

– The Q4 automotive business revenue was RMB 9.22 billion, up 49.3% YoY and 6.7% QoQ. The full-year automotive business revenue was RMB 33.17 billion, up 118.5% YoY.

– The Q4 gross margin for a single vehicle was 20.9%, compared to 18% in Q3. The full-year gross margin for a single vehicle was 20.1%, as compared to 12.7% in Q4 2020.

– The Q4 overall gross margin was 17.2%, almost the same as in the same period last year. The Q3 overall gross margin was 20.3%. The full-year overall gross margin in 2021 was 18.9%, while it was 11.5% in 2020.

– The net loss for Q4 was RMB 2.14 billion, up 54% YoY and up 146.5% QoQ. The full-year net loss was RMB 4.02 billion, down 24.3% YoY compared to RMB 5.3 billion in 2020.

– The net loss attributable to shareholders of the Company’s ordinary shares in Q4 was RMB 2.18 billion, up 46% YoY and down 23.8% QoQ. The full-year net loss attributable to shareholders of the Company’s ordinary shares in 2021 was RMB 10.57 billion, up 88.4% YoY.

– The R&D investment in Q4 was RMB 1.83 billion, up 120.5% YoY and 53.3% QoQ. The full-year R&D investment was RMB 4.59 billion, up 84.6% YoY.

– The sales and administrative expenses in Q4 were RMB 2.36 billion, up 95.4% YoY. The full-year sales and administrative expenses in 2021 were RMB 6.88 billion, up 74.9% YoY.

– As of December 31, 2021, the Company’s cash and cash equivalents were RMB 55.4 billion.

– The delivery guidance for Q1 2022 is 25,000 to 26,000 vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.