The pure electric sedan race in 2024 is presenting an increasingly imbalanced state.

On the one hand, looking at the sales situation, the overall market performance of pure electric sedans is in a weak position.

Although Tesla Model 3 launched a new model, it seems to lack follow-up. It performs significantly worse than Model Y. While ZEEKR 007 was full of confidence, it failed to amplify volume. The halo of Xpeng P7 is no longer present and its monthly sales are merely round about three to four thousand. The price of BYD Seal keeps falling. The starting price has fallen from 209,800 Yuan at first to 179,800 Yuan now, yet the sales volume remains average.

Other electric sedans such as NIO ET5/5T, BYD Han EV, GEELY Galaxy E8, etc., their selling capacity is not ideal, worse than the sales of fuel-burning vehicles like BMW 3 Series, Benz C-class, FAW Audi A4, Long Yi, Xuan Yi, etc.

On the other hand, although the overall market volume is not large, the track for pure electric sedans is becoming more and more crowded. In addition to the recently intensively listed ZEEKR 007, Galaxy E8, XiaoMi SU7, LUXEED S7, the upcoming electric sedans also include key models like IM L6, JIYUE 07, Xiangjie S9.

This unhealthy digestion in the market and the influx dwindles from the supply side. The lane for electric sedans, in its noisy show, hid a glimmer of loneliness. There are major challenges facing the development of electric sedans currently. For the manufacturers stepping into this field, the risks are also significant.

Where will the pure electric sedan market head then?

The growth narrative of SUV

Sedan starts to fall behind

In the first episode of the TV show “Blooming Flowers”, General Bao stepped out of Peace Hotel, Toyota Crown, Audi 100, Nissan Duke and other expensive sedans were lined up in two rows.

Like the scene presented in “Blooming Flowers”, in the 80s and 90s of the last century, sedans were symbols of status, style, and flamboyance in people’s minds. Sedans represented by Santana and Jetta ruled the family, official, and operational markets.

However, people might not have thought at that time that after the heyday decades of sedans, SUVs would start to gradually replace sedans from 2000 onwards, and its development trend is becoming more like fire in oil.

What needs to be stressed is that at that time, the name SUV did not yet form a consensus like it is today. Most people referred to these high-chassis, large-space, boxy vehicles as Jeeps or off-road vehicles. This type of vehicle was more associated with military use and was rugged but rough in people’s impression.

As for why this rougher type of vehicle can pull people from the symbolic meanings of identity, style, and flamboyance embedded in sedans, the direct reason has to start from the second-generation Honda CR-V.

In 2004, the second-generation Honda CR-V began to be launched domestically through INSPIRE.The second generation Honda CR-V is a compact SUV built on the platform of the seventh generation Huizen sedan. At the time, although it had an off-road vehicle shape which people were familiar with, its design still looked far more refined than that of an off-road car, more in line with the aesthetics of the era, while also balancing maneuverability and comfort in driving performance.

More importantly, the second generation Honda CR-V, despite being almost the same length and width as typical sedans like the Santana, had a height nearing 1.7 m. This created plenty more headroom and cargo space compared to such sedans.

For Chinese consumers who often have to consider the needs of the entire family when buying a car, a sedan can certainly fit a family, but it’s not quite enough. The larger second generation Honda CR-V, on the other hand, was clearly more capable of accommodating the seating comfort of the elderly and children in the family, as well as the loading needs of the entire family.

In addition, compared to sedans, the second generation Honda CR-V had a higher chassis and better off-road capability. Faced with road conditions that often required traversing bad roads, dirt roads, and mud pits, the adaptability of the second generation Honda CR-V was significantly stronger than that of sedans. At least, users did not have to worry too much about hitting the chassis.

Moreover, the launch of the second generation Honda CR-V coincided with China’s rapid economic development, swift urbanisation, rising overall consumer spending, and increasingly open and diverse thinking. More and more scenarios for individual and household car use were emerging.

In summary, at a time when there was a lack of SUV supply but strong demand, despite the twenty-plus thousand price tag of the second-generation Honda CR-V, it still achieved considerable sales success due to its greater practicality.

Rapid Rise of SUVs

The second-generation Honda CR-V was not China’s first SUV, but it was the vehicle that brought the SUV into millions of Chinese households.

Because the second generation Honda CR-V showed users the greater practicality of SUVs, suitable for personal driving, family use, and business travel. Meanwhile, it also showed the market that SUVs, with greater practicality and broader user coverage, particularly in better accommodating to family users, had massive sales potential.

With the success of the second-generation Honda CR-V as a precedent, joint venture, domestic, and imported SUVs began to emerge, giving birth to high value for money domestic SUVs such as the Haval H6 – sparking the rapid takeoff of the Chinese SUV market.

In 2005, China counted annual SUV sales for the first time. That year, SUVs sold 196,400 units. Although it seems small in hindsight, it was exciting to note that in just five years, annual SUV sales in China had exceeded 1 million. Even more exciting was that seven years later, in 2017, annual SUV sales in China had exceeded 10 million.

However, the rapid rise of SUVs does not signify the abrupt decline of sedans. After all, around 2017, the Chinese auto market was still in a growth phase, where SUVs and sedans could easily coexist. Nevertheless, an overall decline of sedan sales is witnessed due to the swift augmentation of SUVs.

Between 2017 and 2020, the Chinese auto market transitioned into a saturation phase, undergoing a decrease in initial demand and replacement volume. Concurrently, the slowed economic growth, scaled-back car-purchasing policies, and heavy real estate consumption affected the annual sales of both SUVs and sedans adversely.

Between 2020 and 2022, the double crises of COVID-19 and chip shortage unfolded. Despite unprecedented challenges in the auto industry, the outbreak of COVID-19 encouraged new policies to stabilize the economy, stimulating domestic automobile consumption and promoting exports.

At the same time, private transportation emerged as a safer alternative to public transit due to the pandemic’s rampage. This supplemented the accelerated growth of the electric vehicle market. Under the push of electrification and intelligentization, the auto industry revitalized, stimulating demand in lower and upper market segments.

Therefore, from 2020 to 2022, a steady collective rebound in annual sales of SUVs and sedans was observed.

Entering 2023, Tesla ignited the eruption of a price war. The entire automotive market, from new energy vehicles to fuel vehicles, started crumbling in its pricing system. The old system, based on fuel cars, fell into ruins, whereas the new system, centering on new energy vehicles, was reshaping at an extremely slow pace. Under the stimuli of demand and price, the annual sales of SUVs and sedans consistently grew.

Against this backdrop, SUVs – with their low price and superior practicality – outperformed sedans and became a dominant force in the Chinese automotive market. This transformation reflects the inherent market capacity changes of electric sedans—an external overall reflection.

Electric Sedans: A Challenging Journey Ahead

The Eroding Market Share of Electric Sedans

A very easy-to-ignore fact is that electric sedans once had their heyday in the initial phases of the Chinese new energy vehicle market, which was relatively small.

As illustrated, during the early stages of the new energy market development in China, electric sedans played a significant role and held a dominant position. In 2020, electric sedans had a very high market share of 64.3% in the entire Chinese new energy vehicle market, standing out uniquely.

However, as can be seen from the above figure, the market share of pure electric sedans in the new energy vehicle market has been continuously squeezed after reaching its peak in 2020. The market share of plug-in hybrid (including extended-range) sedans, which is not rich in the first place, is stagnating, while the market share of plug-in hybrid SUVs is vigorously expanding. The market share of pure electric SUVs basically remains around 25%.

However, as can be seen from the above figure, the market share of pure electric sedans in the new energy vehicle market has been continuously squeezed after reaching its peak in 2020. The market share of plug-in hybrid (including extended-range) sedans, which is not rich in the first place, is stagnating, while the market share of plug-in hybrid SUVs is vigorously expanding. The market share of pure electric SUVs basically remains around 25%.

So, how did pure electric sedans once occupy half of the new energy vehicle market, and were strong enough to approach 70% in 2020? And why did they start to lose half of the market share gradually from 2020?

Let’s rewind to 2019. That year, the domestically produced Tesla Model 3 and the Xpeng P7 were launched. These two models have achieved great success, especially the sales of Model 3 are still strong.

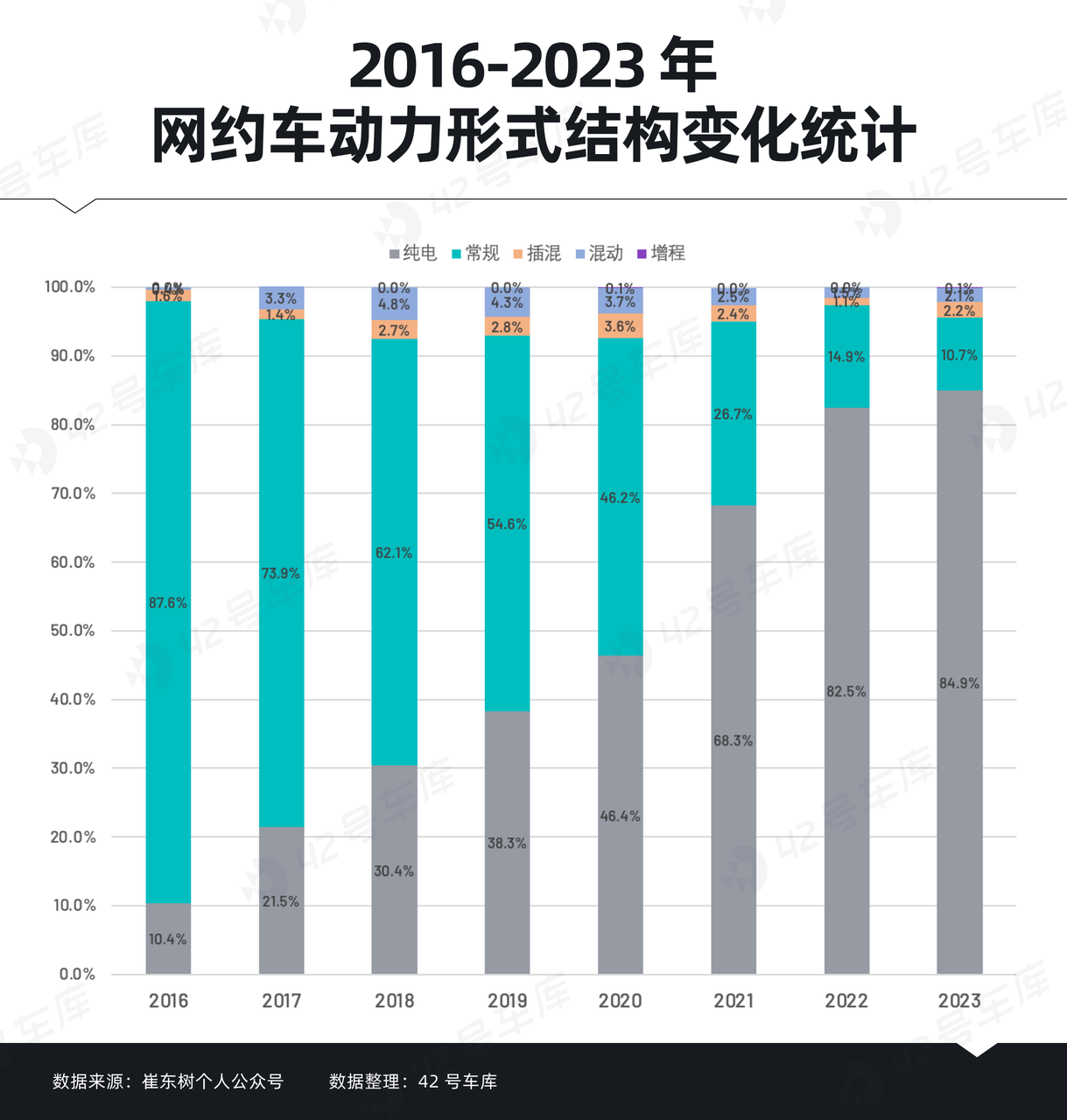

However, the sales of a small number of models cannot support the overall market of electric sedans. What really props up the overall market of electric sedans is actually rental and ride-hailing vehicles.

According to our comprehensive calculation of China Passenger Car Association (CPCA) data, nearly 40% of the pure electric sedans sold in 2019 were rental or ride-hailing vehicles. Among the top 10 best-selling pure electric vehicles in 2019, the top two were typical models of taxi and ride-hailing services, namely BAIC EU5 and BYD E5.

This has led to a rapid increase in the market share of pure electric sedans. With the rapid development of ride-hailing vehicles, some new forces have used this to earn their first pot of gold in starting their businesses, such as AION and HOZON.

However, with the saturation of the market for rental and ride-hailing vehicles, the market share of pure electric sedans has now become a spent force. In contrast, new energy SUVs, which are a strong force, have been firing strongly since 2020.

By 2020, there were many changes in the new energy market. LI ONE became a popular model, tapping into the potential of the extended-range family SUV market; NIO ES6 sold nearly 30,000 units; although BYD was not as flourishing as now, the Dynasty Network had grown, and the Ocean Network was gearing up. In short, they were keeping a low profile while preparing for a big move.

After entering 2021, the standard range version of the Tesla Model Y officially went on sale in China, priced at 276,000 yuan, only 25,100 yuan more than the starting price of the Model 3 at the time, which completely shattered the pricing method for SUVs and sedans of the same level.

As expected, the Model Y delivered on its promise, achieving high volumes as soon as it went on sale and receiving 100,000 orders on its first day. However, after the Model Y went on sale, the sales of the Model 3 immediately declined. At the same time, due to the success of the Model Y, the industry’s customary pricing rules for SUVs and sedans of the same level gradually fell by the wayside.

A more epoch-making event occurred in March 2022, when BYD finally released its big move – it announced the official cessation of production of gasoline cars, going all in on new energy vehicles. It continues to drive cost reduction through scale advantages, vertical integration of supply chains, and technological innovation. It also proclaimed the slogan “same price for electric and petroleum vehicles” in early 2023, making the price war even more intense.Given its cost advantage, BYD, with its “same price for oil and electricity” model, has almost become a hit maker. In 2023, BYD sold over 3 million vehicles, with annual sales of the Song and Yuan models reaching over 400,000.

During this process, the price of new energy SUVs has been constantly lowered, and their cost-effectiveness has been continually increased. Consequently, the market share of pure electric sedans, propped up by ride-hailing services, has been gradually squeezed out by new energy SUVs. Specifically, from 2020 to 2023, the proportion of pure electric SUVs in the Chinese new energy vehicle market has increased from 17% to 26.8%, and the proportion of plug-in hybrid SUVs has increased from 9.3% to 21.5%.

The market share of pure electric sedans has become the biggest victim of this erosion.

Cost Reduction and Bi-Directional Rush

The pricing rules between SUVs and sedans were broken by Tesla; BYD forced the entire industry to lower the cost of new energy vehicles; price wars launched indiscriminate attacks on every automaker. These changes all lead to the same result – a significant reduction in the direct car purchase cost for SUV buyers.

The cost of using an SUV is also decreasing, not just the direct purchase cost.

When driving a gasoline vehicle, the same accelerator pedal gives a much stronger impression of burning money with an SUV than with a sedan. However, in new energy vehicles, whether a sedan or an SUV, there’s hardly any difference in the feeling once the pedal is pressed.

Firstly, no one thinks about how much electricity cost is incurred when they press the accelerator on a pure electric SUV. Secondly, many plug-in hybrid SUVs are now coming with larger batteries, which allow them to be driven as pure electric vehicles for daily commutes, significantly reducing their overall usage costs compared to gasoline vehicles.

Therefore, in the new energy vehicle market, the direct purchase cost of an SUV of the same class nears that of a sedan, and the usage costs of both are essentially equivalent. What’s left to differentiate them are more direct and significant value perceptions like space size.

Given the not so friendly economic environment and the more practical consumption approach taken by the users, opting for a new energy SUV is undoubtedly a more cost-effective choice. How users choose between new energy SUVs and pure electric sedans, the perpetual decrease in market share of the latter has already provided the answer.

If viewed from the perspective of the automaker, manufacturing a new energy SUV is an easier path to commercial returns. That’s also a crucial reason why NIO, Xpeng, and Li Auto’s first mass-produced vehicles are all SUVs.

As mentioned earlier, SUVs, with their larger space and higher chassis, can cater to a broader user base, especially satisfying the needs of family users. The market potential for family vehicles in China is enormous. The CEO of LI Auto, Li Xiang, once stated that the family-oriented market captures 89% of users in the 200,000 RMB and above market. By 2030, capturing 35% of the 200,000 RMB range market for family users can create a business reach of trillions of RMB.

It’s evident that in the new energy market, whether it’s an SUV or a pure electric sedan, the choices of automakers and consumers are converging from both directions.## What is the future of pure electric sedans in 2024?

In the new energy market, both automakers and consumers rushed towards SUVs. But what about the pure electric sedans?

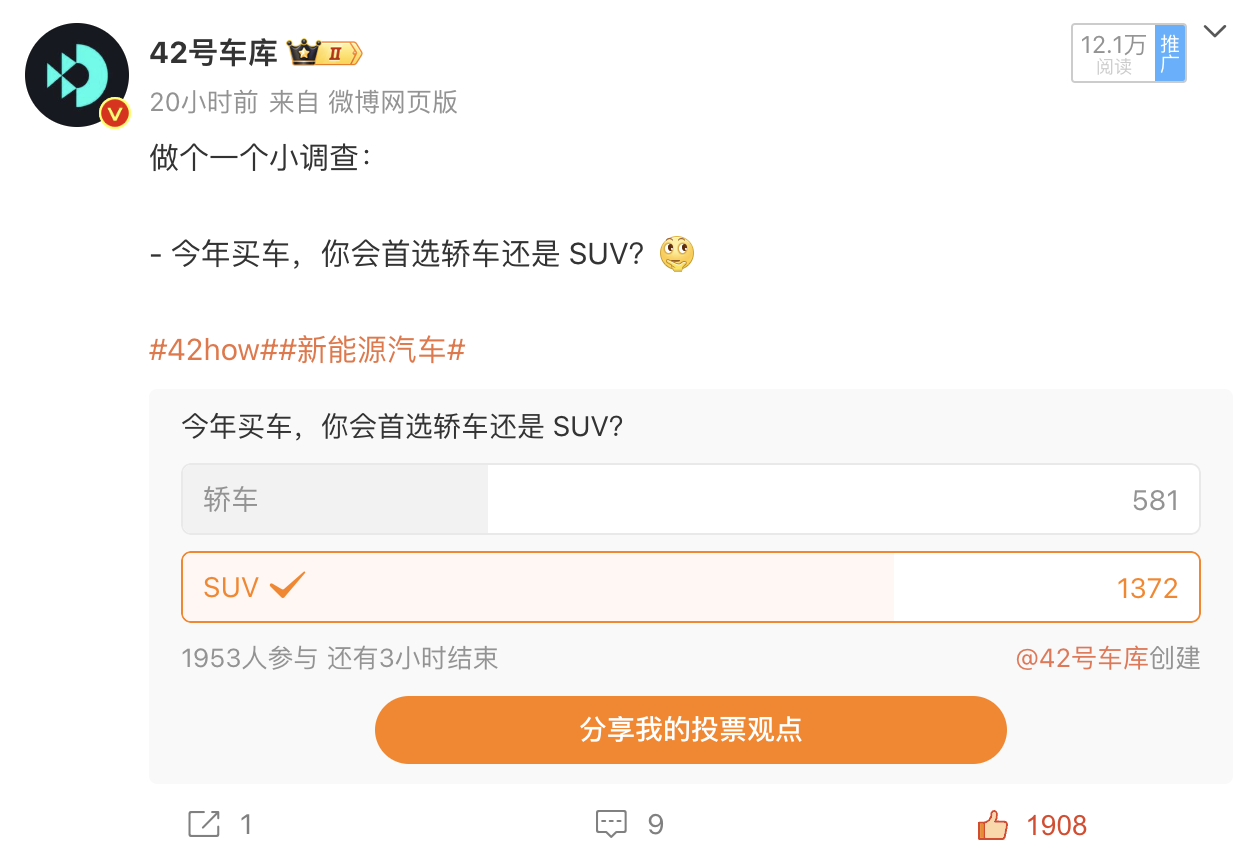

We conducted a survey on our official Weibo account regarding the preferred choice of car purchase in 2024, car or SUV? The result showed that 70% of the people chose SUV— the sedan buyer segment is shrinking. If we zoom in on the pure electric sedan, the buyer segment is even slimmer.

As one category of electric cars, the driving range anxiety brought by pure electric sedans can inherently limit consumer acceptance. However, in terms of consumer acceptance, several extremely realistic factors affecting consumer decisions are currently at play.

Firstly, the spaciousness and practicality of pure electric sedans have done a round of screening for different target consumer groups based on different needs.

In reality, pure electric cars often have a large wheelbase, seeming spacious, but often feel cramped when sitting in it. This is because the entire chassis space of the electric car is more ample due to the absence of fuel tanks, engines, and gearboxes, replaced by batteries and motors. Therefore, the wheelbase can be larger compared to gasoline cars.

However, to guarantee driving range, the battery of a pure electric car often needs to be large, which can only invade the longitudinal cabin space due to the necessary ground clearance for safety reasons. This is why many pure electric cars seem thick and uncoordinated, and the floor seems high when seated.

Not only that, to ensure driving range, electric car needs to lower the drag. Hence, pure electric sedans often have a large fastback shape, which further compresses the longitudinal cabin space.

In contrast, new energy SUVs can effectively avoid such problems. After all, even though the battery will invade the longitudinal space, the vehicle itself is large enough, thus ensuring the comfort and loading capacity. This kind of loading capacity, for family users, means very attractive practicality, which is something that pure electric sedans do not have.

Secondly, the early market attributes of pure electric sedans have also influenced their image in users’ minds to a certain extent.

Due to their high share in the ride-hailing market in the early days, the low-end image of pure electric sedans in consumers’ minds has begun to consolidate. As an online joke goes, driving a BYD Qin back to hometown would make friends think you are a ride-hailing driver.

Also, the best-selling products of pure electric sedans are concentrated, with brand effects being very distinct. In the market below 200k, BYD is king; in the market above 200k, the Tesla Model 3 is the ruler. To the extent that decrease in prices from some brands cannot salvage their sales volume, such as the GEELY EC8, Rising F7, and Xinyiji ES, etc.Of course, despite this, pure electric sedans are not without prospects.

Although pure electric sedans are facing many issues that put them at a disadvantage, and their market share has been declining continuously, it is undeniable that they still possess certain unique advantages compared to new energy SUVs at the product level. These, if exploited well, can still unleash considerable market forces.

Firstly, pure electric sedans are designed lower and center of gravity is also lower, which is more conducive to performance handling. This is precisely part of the reason why Xiaomi chose to produce a sedan for their first vehicle. At the same time, due to their design, pure electric sedans have superior energy efficiency than SUVs, which although doesn’t save a lot of money, it does effectively enhance the vehicle’s range and alleviate range anxiety.

Secondly, if the driving scenarios are mostly urban-based or rarely involve bad roads, pure electric sedans, though smaller in space, are no less comfortable than SUVs, and may even be better.

Moreover, it should be emphasized that since space is a major disadvantage for electric sedans, making them spacious becomes a possible solution. A typical example in the past sedan market is that to increase domestic sales, BBA’s sedans all preferred to launch long-wheelbase versions. Similarly, in the pure electric sedan market, there are similar examples, like NIO lifting the tail line of ET5 to create ET5T, becoming more sellable and popular.

Of course, in user’s inherent perception, sedans are carriers of high-end business attributes. For instance, Benz’s S series remains representative of high-end business vehicles. Looking at new forces, when they manufacture their highest-end business vehicles, they also choose sedans, like NIO’s ET9, and LUXEED’s S9 – provided that they make the product itself well, electric sedans still have potential market space in this field.

In conclusion

So, what should be done with pure electric sedans? Perhaps there are some basic answers now.

Firstly, it needs to be clear that electric sedans will of course still be needed in 2024, and will be needed in the future. However, auto manufacturers launching electric sedans is also a concentrated exploration of how to create a popular electric sedan model. Although it’s very likely that while some models become popular, many more become sacrifices on the exploratory path.

Looking at the market performance of several electric sedans, the future development direction for electric sedans is becoming clearer.

From the product dimension, if electric sedans want to foothold in the market, they not only need their strong points to be strong enough, but also no obvious weaknesses.

For instance, the XiaoMi SU7, it owes its success not only to competitive pricing, influential CEO, and national brand recognition, but also to its handling, power system, and Automobile Intelligence all benchmarking Model 3, and its size is bigger compared to most main competitors. Another example is ZEEKR 001, it abandoned the common sedan design and surprised the market by making a lifted vehicle. It focused on price, space, control, and comfort configurations, not only demonstrating product capability, but also creating a new niche market with category advantages.

Interestingly, whether it’s the Tesla Model 3 or the XiaoMi SU7 and ZEEKR 001, handling is a very distinctive product tag for them.From a market perspective, pure electric sedans have no other choice but to enter an already competitive market and seek ways to break out based on the qualification of product strength. Especially with the launch of the XiaoMi SU7, the role of marketing will be further elevated. Faced with the personal influence of Lei Jun and the tremendous traffic of XiaoMi automobiles, each major OEM must strive to grab traffic, seek market presence, and convert it into market share.

In addition, one could also look at the issue from a different perspective – does a pure electric sedan have to sell well by engaging in a death match in the domestic market? Searching overseas for a new market might provide an incremental entry point.

However, generally speaking, in the new energy vehicle market, pure electric sedans are more difficult to sell compared to new energy SUVs, especially in the 200k and above market. For those OEMs that build pure electric sedans with a conventional mindset, similar to that of the gasoline car market, the path of constructing pure electric sedans will be extraordinarily challenging.

Although crafting pure electric sedans is a more difficult path, in the long run, with the development of the new energy vehicle market and the gradual replacement of gasoline vehicles by new energy vehicles, the sales volume of pure electric sedans in the overall auto market is expected to increase.

At present, Tesla, ZEEKR, and XiaoMi have each established their own successful precedents in the pure electric sedan market. Even if they further catalyze the internal competition of the pure electric sedan market, more excellent pure electric sedans are potentially on the way due to the pressures of the intense competition.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.