Is NIO a brand of good quality, good reputation, high configuration, but in the end it does not have a good sales volume?

We conducted a small survey on our official Weibo last month, in which the number of people who believed it was overwhelming than those who didn’t.

Here we won’t discuss whether NIO is or not for the time being (but we welcome your comments), through this survey result, we can actually see that NIO’s product quality, reputation, etc., are still largely recognized, and its sales have the potential to do much better than it is now.

However, there is a distance from potential to ability, and for now, it is undeniable that the potential NIO has built for a long time is already being discounted into ability, and its performance is also showing an overall upward trend.

But the embarrassing thing is that NIO’s pace is always fluctuating, and the rhythm is sometimes stable and sometimes chaotic, reflecting in NIO’s Q4 2023 and the annual financial report, it is a number that can talk about NIO’s efforts all last year, and it is basically not pretty.

A financial report that is both a step back and a step forward

Q4 2023 Financial Report

First, let’s look at some key financial indicators of NIO in Q4 2023:

- Vehicle sales revenue was 15.439 billion, a year-on-year increase of 4.6%, and a quarter-on-quarter decrease of 11.3%;

- The gross profit margin for vehicles was 11.9%;

- Total revenue was 17.103 billion, a year-on-year increase of 6.5%, and a quarter-on-quarter decrease of 10.3%;

- Gross profit margin was 7.5%;

- The net loss was 5.368 billion, a year-on-year decrease of 7.2%, and a quarter-on-quarter increase of 17.8%.

Due to the total deliveries in the fourth quarter were 50,045 vehicles, a quarter-on-quarter decrease of 9.7%, so in the fourth quarter, NIO’s revenue fell, and the loss further intensified after a contraction in the third quarter.

Meanwhile, due to the growth of sales staff, and the increase in sales and marketing activities, NIO’s sales, general and administrative expenses continued to rise in the fourth quarter, reaching 3.972 billion, a year-on-year increase of 12.6%, and a quarter-on-quarter increase of 10.1%.

In addition, NIO’s investment in R&D continued to increase in the fourth quarter, reaching 3.972 billion, a year-on-year decrease of 0.2%, and a quarter-on-quarter increase of 30.7%.

However, one thing to be thankful for is that NIO’s single vehicle gross margin increased slightly in the fourth quarter, which NIO believes is primarily due to the “decline in unit material cost”.

It can be seen that NIO is still in a severe state of expenditures exceeding income in the fourth quarter, but the cost reduction has also given NIO a little more breathing space.

As for the first quarter of this year, NIO gave the following business outlook:- Deliveries range between 31,000 and 33,000 units;

- Revenue between RMB 10.499 billion and RMB 11.087 billion.

So far, LI Auto’s total deliveries in January and February were 18,187 units, which means that NIO needs to deliver at least 12,813 units in March to meet this performance forecast. Clearly, this is a relatively conservative estimate.

2023 Annual Financial Report

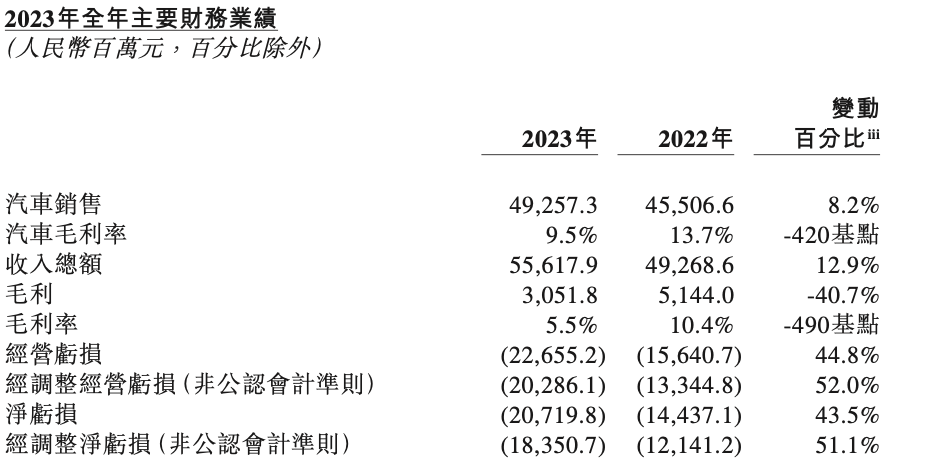

Next, let’s look at some key financial indicators for NIO in the full year of 2023:

- Vehicle sales revenue was RMB 49.257 billion, up 8.2% compared to 2022;

- Gross vehicle margin was 9.5%, compared to 13.7% in 2022;

- Total revenues were RMB 55.618 billion, a 12.9% increase compared to 2022;

- Gross margin was 5.5%, compared to 10.4% in 2022;

- Net loss was RMB 20.72 billion, up 43.5% compared to 2022;

NIO’s deliveries in 2023 were 160,038 units, up 30.7% compared to 2022. Thanks to the increase in deliveries, NIO’s total revenues for the whole year of 2023 saw a significant growth.

However, despite the prominent increase in revenue, the rate of increase in losses was larger than the rate of growth in revenue, and the gross margin was nearly halved compared to 2022. This suggests that on one hand, NIO’s deliveries in 2023 were not large enough, and on the other hand, its input-output was in a relatively inefficient state.

Nonetheless, as of December 31, 2023, NIO had a cash reserve of RMB 57.3 billion on its balance sheet, which can continue to support its continual adjustments for a certain period of time to reverse the continuous loss situation.

Regarding this financial report, Li Bin remained as optimistic as ever. He mentioned in the report:

We are about to start delivering the NIO 2024 model, which has the most powerful computing power in mass-produced cars, and continue to enhance the driving and digital experience of our users. At the same time, we plan to push the NOP+ City Navigation Assistance feature to all NT2.0 users in the second quarter. Our continual investments in technology, battery swapping network, and user community will strengthen our advantages in future competition.

Sales Capacity Dragging Down Revenue

In fact, NIO’s revenue could have been higher this year, an important reason restricting its higher revenue is that the sales volume did not keep up.

At NIO’s face-to-face media event on December 14, 2023, Li Bin told us:

The biggest lesson of this year is that we started upgrading our sales capacity too late, it should have started in February. By around June or July, we could have seen results in sales volume. At that time, we had a lot of potential sales, but they were lost due to inadequate and untimely follow-ups…… Otherwise, I think it would not have been a problem to sell an additional 10,000 to 20,000 units.The year 2023 is a pivotal year for NIO, having launched and delivered a plethora of models from April to September. The addition of EC7, ES6, ET5T, ES8 and EC6 refines NIO’s portfolio. This shift from NT1.0 models to NT2.0 models is met with an offering of 8 different vehicles, treating consumers to an extensive assortment of sedan, SUVs, station wagons, and sports SUVs.

Regrettably, a full feast served has a missing touch – the shortfall in the number of sales consultants.

Despite having debuted the new generation of products in September, NIO hastily began fortifying the number of sales consultants only in the fourth quarter. As stated by Li Bin, the CEO of NIO, there were already 5,700 sales consultants by the middle of December last year, rapidly hiring approximately 3,000 of them in the months of October and November.

Moreover, for sales consultants to contribute in a significant way to sales growth, NIO must provide ample training and time for their development. According to Li Bin, by the second quarter of this year, the majority of NIO’s sales consultants will mature. The time gap between product transition and sales consultants maturing is significantly lengthy.

In conclusion, the belated construction of sales capabilities compared to product launches has resulted in NIO falling short on a possible steep incline in sales and revenue in the crucial year of 2023.

However, NIO is making rapid strides to catch up. Li Bin declared that the sales consultants are maturing admirably and the company’s distribution network is expanding. He is optimistic about monthly sales reaching 20,000 units this year.

When Nio Begins to Show Pragmatism and Steadiness

Indeed, it’s unfortunate that sales capacity dragged down revenue. However, 2023 saw several major transformations in NIO that have refueled its growth trajectory.

In terms of battery swap service, NIO added 1,011 swapping stations in 2023, amounting up to 2,316 stations. Entering 2024, NIO aims to construct over 3,310 swapping stations, including 4th generation stations.

In addition, NIO expanded its collaboration in battery swap service in 2023, announcing cooperation with Chery and Geely Holdings in areas such as standard setting for battery swap, research and development of battery swap technology, construction of swapping stations, and development of swappable battery car models.

In January and February of this year, NIO also finalized battery swap cooperation agreements with JAC, Chery, and Southern Power Grid Storage. Moreover, it entered strategic cooperation agreements with Anhui Energy Group and the provincial transportation control group, planning to build 1,000 storage and charging stations in Anhui Province.In 2024, how NIO gradually implements these collaborations will be a matter of great interest. Once successful, a win-win situation will be formed among NIO, its partners, and its users.

_20240305221513.png)

In regards to brand building, despite the bloody price war in 2023, NIO has managed to achieve moderate growth in sales without getting too deeply involved in the price war. Behind this, the product strength of NIO itself has played a part, and the brand power contained in the name “NIO” also has made an indelible contribution.

In addition, NIO has particularly emphasized its own technical characteristics in 2023. At the NIO Innovation and Technology Day in September 2023, numerous software and hardware solutions such as the NIO Phone, Yang Jian chip, and the whole vehicle domain operating system SkyOS made their appearances.

Notably, on the Innovation and Technology Day, NIO surprisingly unveiled the secret of one of the four NVIDIA Orin chips that NIO insisted on using, which serves group intelligence.

Based on group intelligence, the miles opened for NIO’s intelligent urban driving exceeded expectations rapidly since then. According to official data, as of February 1 of this year, the mileage of NIO’s urban intelligent driving has exceeded 650,000 kilometers, and 398 cities were added to the network, totaling 606 cities. In the second quarter of this year, as stated above, NIO’s intelligent urban driving will be pushed to all NT2.0 users.

_20240305221531.png)

Arriving at NIO Day in December 2023, NIO showcased its hard-core side in vehicle R&D and manufacturing, focusing on driving controls, safety, and interior and exterior design centered around the ET9. Interestingly, it even imitated the champagne tower play of the Lexus LS from back in the days. It is also worth mentioning that NIO launched its self-developed intelligent driving chip, Shenji NX9031, on NIO Day, raising its voice in the intelligent driving market.

All in all, through a series of marketing promotions, NIO has loudly declared that it not only provides services, but also possesses the technical characteristics of a high-end brand.

In terms of supply chain, a critical step for NIO in 2023 was the acquisition of JAC’s factory.

This signifies that NIO has officially evolved into a complete car company, capable of managing the process from production to sales with improved ease and efficiency. It is likely that issues such as sales being dragged down by production will hardly reoccur for NIO.

It’s also notable that there was a significant change in Li Bin personally in 2023. He started to frequently emphasize organization efficiency, short-termism, no longer pursuing a laid-back, major expansion philosophy, concentrating on fine management, promoting the cutting of projects that would not boost financial performance in 3 years, and even started to make layoffs for efficiency improvement.In essence, facing the current state of ongoing skepticism and substantial losses, NIO desperately needs to rally its forces from top to bottom, starting with Li Bin, to promote short-term sales volume and revenue growth through more pragmatic strategies and realistic tactics. This will allow the company to unleash intense and surging energy in a longer-term dimension.

Of course, all these transformations would be meaningless if they don’t translate into actual sales numbers. Let’s let NIO spin a little bit more first.

The downward Alps, emphasizing scale and efficiency

The official launch of the models under the Alps brand (internal code name) is a particularly pragmatic move by NIO this year and will be a key force driving NIO upwards.

Contrary to NIO’s willing sacrifice of sales volume to maintain its high-end position, the Alps, focussing on a price range of 200,000-300,000, will prioritize efficiency, chasing gross profit and sales volume.

It’s reported that the first model from the Alps targets Tesla’s Model Y, boasting larger dimensions and a bigger screen. It supports not only battery swapping but also faster charging.

According to Li Bin, the cost of the Alps’ first model is about 10% lower than that of the Model Y, hence the price will naturally be friendlier. As such, Li Bin even suggested that those considering buying the Model Y should wait a bit.

Of course, in the 200,000-300,000 market, the first Alps model will face significant competition not just from the Model Y, but also from Xpeng’s G9, ZEEKR 001, AITO’s M7, and the upcoming LI Auto L6.

However, NIO plans to bide its time with the Alps roll-out, opting for a latecomer strategy. Li Bin states, “Let them make the first move.” But the harsh reality is that the market competition in the 200K-300K price range is far fiercer than that above 300K. This time, NIO’s sales capacity and product delivery need to be well-coordinated.

Moreover, if the Alps can achieve huge sales, this will help improve NIO’s financial performance and facilitate the rapid iteration and evolution of NIO’s overall intelligence. After all, a larger fleet size can provide more data for its intelligent drive, ultimately further boosting the sales growth of both NIO and the Alps.

According to what Li Bin said at the earnings call, the first Alps model will go on sale in the third quarter of this year and deliveries will start in the fourth quarter. The second model, targeting the larger family market, will be launched next year.

We are eager to see whether the Alps development will go as Li Bin hopes.

In Conclusion

Although NIO’s financial report for 2023 is still not encouraging, it continues to trend upwards. In 2023, NIO has accumulated new strength and experience.

It must be stressed again that although NIO didn’t resort to a price-for-volume strategy, it still managed steady growth in the 2023 price war, further reinforcing its brand strength.The contradiction currently facing the NIO brand is that, despite possessing certain high-end attributes, it has not yet developed the premium pricing ability of a high-end brand. From high-end attributes to premium pricing ability, NIO still has a long way to go.

For the present, NIO needs to withstand the impact generated by some competitors entering their product cycle this year, in a situation where the overall upgrade intensity of the NT 2.0 platform vehicles is not strong. On the other hand, it needs to demonstrate a resolute determination to succeed by breaking into the 200,000-300,000 level market with the Alpines, not only to win but also to excel – the organisational efficiency which has been emphasized for so long must be implemented effectively.

A quarter of 2024 has now nearly passed, the price war continues, and the intense competition for smart driving and large-scale onboard models has already begun. The competition in 2024 is not only an attritional battle comparing endurance, but also a fiery breakout battle within the knockout stages. For NIO, the nerve to make good products and services while avoiding financial risk is becoming more and more sensitive.

Here are the key contents presented by the NIO automotive management team during their financial report conference call, edited without changing the original meaning.

Q: What is the plan for the NIO sub-brand Alpine and its related battery exchange stations?

A: We are going to launch the Alpine brand in the second quarter, release the first model of this brand in the third quarter, and start delivering in the fourth quarter.

In terms of store setup, the Alpine brand adopts an independent sales network; in aftermarket, it will use part of NIO’s aftermarket system. Alpine will utilize a shared battery exchange network, which will be shared with other brands and NIO cars can also connect to it. But we have some battery exchange stations that are exclusively for the NIO brand.

The fourth-generation battery exchange station is compatible with different brands, including the NIO brand and Alpine. These stations started being deployed in April and most of this year’s battery exchange points will be the fourth-generation stations.

Q: Will NIO continue to maintain its delivery target for 2024?

A: The market competition will be rather fierce this year. Our 2024 models are still world-leading in terms of performance. This year we are focusing on delivering in terms of software, including our NOP+ co-pilot assistant, as well as NOMI GPT.

From a channel perspective, we have nearly 500 brick-and-mortar stores, and we will still expand. Our sales team that we have recruited began to mature. Our sales team performance has been good in February, proving the improvement of our sales capabilities.

This year, our battery exchange stations which are compatible with both NIO and Alpine will focus on driving up sales volume. We are very confident in our sales volume this year. We believe that the sales volume will improve, and monthly sales will return to the level of 20,000 vehicles.

Q: What is the plan for more products of the NIO sub-brand?

A: About our first car for the mass market, we have been conducting various tests.

Our second brand is focused on the family market. We will introduce different products according to the sizes of families. We have deeper research for the family market, have a late-mover advantage, so we believe it will be very competitive. We think our competitor is Model Y, but ours can be charged. We believe it can be about 10% cheaper than Model Y.

Our sub-brand’s second car is an SUV. The development for this car has been smooth, and we plan to launch it next year. The third car is currently under development, but details are still scant.

Q: How does NIO view the relationship between pricing, gross margin, and sales volume?

A: NIO will begin selling two brands from the second half of this year. The NIO brand will not introduce any car cheaper than ET5; we prioritize gross margin over volume. We will not engage in price wars to boost sales volume.

The second brand targets the family market, which is highly competitive. It can leverage our advantages in smart technologies. The priority for this brand will be volume, not gross margin.

Both brands will apply different strategies. A combination like this, I believe, is a better strategy for the company’s long-term development.

Q: How does NIO view and respond to competition and cooperation in the Chinese market?

NIO faces diverse competition in China, including from Tesla, as well as various private and state-owned enterprises. It’s an extremely open car market, so competition benefits the consumers but makes things challenging for businesses. Ultimately, businesses that prioritize the customer will prevail.

Alongside competition, cooperation is also vital. We collaborate with CCAG on battery swapping, and also with Geely, Chery, JAC, amongst others. NIO is very good at cooperating. I believe that intense competition will persist but, from another perspective, external cooperation is necessary.

Q: What are NIO’s overseas plans?

Our focus is definitely on China – the market with the most intense competition. But we will not stop exploring worldwide. We will be operating meticulously in five European countries and have plans to enter new countries this year such as UAE, as Abu Dhabi has invested in us.

From a strategic standpoint, we will be launching two brands for the second half of the year and another brand next year targeting the affordable car market. The second and third brands are more likely to cater to a broader market.

In China, we will operate directly, while, in overseas markets, we respect the local conditions and adopt more flexible methods with quicker investment returns. We are open to collaborating with local companies.

Q: How do you view super-fast charging technologies like 5C?

A: From a battery technology standpoint, we have always focused on both super-fast charging and battery swapping. We have the most charging stations in China. We will be following the trend for fast charging technology in the Chinese market.

Regardless, even with extremely fast charging rates, battery swapping is still the fastest. We have always emphasized that batteries should be rechargeable, swappable, and upgradable. We emphasize upgradability because it benefits the customers.

The longevity of batteries, especially calendar life, is very crucial from an industry standpoint. The issue of longevity is what we plan to solve next. We have been heavily researching this over the past few years, and this remains a problem for the entire EV industry to address.

Car products are designed to last 15 years, therefore, a solution must be found. Hence, this is why we chose to incorporate battery swapping. Soon, we will have discussions regarding this with the market.Q: How does NIO achieve a healthy cost through scalability?

A: We have a considerable investment in R&D, which we utilize to reduce manufacturing costs.

All in all, we do not need a large volume to attain the mentioned cost levels. A monthly production of 10,000 vehicles in a plant is generally a healthy target. Hence, we do not require a scale of 1 million to realize such costs.

Q: What is your perspective on the correlation between swapping stations and fast charging?

A: From a charging perspective, everyone’s efforts in constructing charging piles are commendable. More charging piles certainly improves the usage efficiency of electric vehicles.

When it comes to swapping stations, we host the most. Some of our partners are contemplating joining us, which mirrors the trend in the Cloud area. We’ve never perceived charging and swapping as conflicting; each has its respective merits. For instance, home charging offers the best experience, whereas swapping affords unique benefits such as energy storage, upgradeability, and battery health.

Q: How does NIO view the lower-tier market?

A: Indeed, addressing the lower-tier market is a challenge we aspire to overcome. Up to this point, first-tier cities account for 70% of our total sales. Our goal is to address efficient market penetration. We also acknowledge the importance of infrastructure to the third and fourth-tier markets, deploying a considerable portion of our charging and swapping facilities there to enhance our competitiveness. We aim to devise more effective strategies to boost sales in these markets.

Q: What are the expansion plans for NIO’s brand and Alpina’s sales network this year?

A: Speaking from NIO’s perspective, we currently host 500 stores which we aim to make more efficient. Our team, which already encompasses over 5,000 members, is primarily focused on improving effectiveness.

For our secondary brand, we’re adopting an entirely new channel. We’ve earmarked ample resources, striving towards a sales network of no fewer than 200 stores. Given that there’s only one model this year, its sales efficiency will be higher. We’ll also draw from NIO’s brand resources to have sales staff ready to take off as soon as the model is launched.

Alpina will layout its sales network based on its target customer group, following independent site selection principles. Prioritizing efficiency, it will not need to establish a sales network like NIO House. Its approach will be more akin to Tesla’s where efficiency is prioritized.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.