In 2023, the intelligent driving industry in China found itself in a baffling quandary over computational power.

On one hand, whether it’s the vehicle manufacturers in the process of building their intelligent driving systematic abilities, or consumers in their cognition of intelligent driving as a point of purchase decision, the basic computational power remains an important factor. Meanwhile, the race for greater computational capabilities has not ceased in the supply chain of intelligent driving.

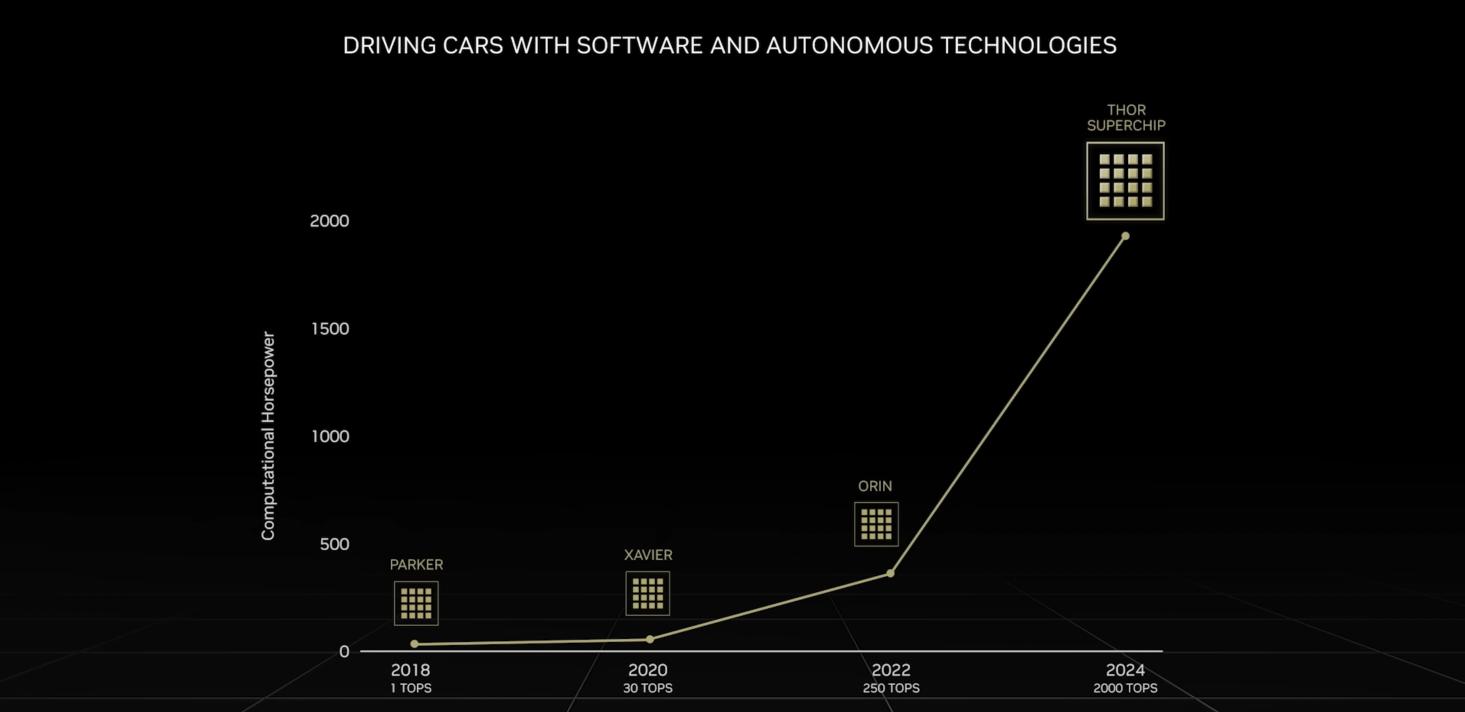

A typical case was NVIDIA’s release of its latest-driving computation platform, Thor, in September 2022. The computational power of Thor reached a staggering 2000 TOPS, nearly 8 times the power of its predecessor, Orin-X.

On the other hand, as intelligent driving begins to be featured in mass-market models of mainstream car manufacturers, consumer’s focus on the experience is growing. Computational power is no longer the only deciding factor; they’re also starting to emphasize concerns over the cost of high-power computing. Industry experts are asserting that the cost of computational power is not directly proportional to the user experience and value, calling for a return to rationality.

Some businesses specializing in intelligent driving solutions have started to adopt less computationally powerful solutions.

Clearly, this conundrum around computational power is due to the Chinese intelligent driving industry being at a crossroads of technological advancement and market rollout; both paths are fraught with uncertainties.

However, observing from the perspective of the rapid popularization of high-speed NOA and the implementation of city NOA projects, we see that the application of intelligent driving computational power has essentially formed two vaguely defined dividing lines within the double-edged selection of manufacturers and the market. Invisibly drawing these lines are the BEV+Transformer, a paradigm for implementing intelligent driving.

Hence, going into 2024, this conundrum gradually clarifies.

From FSD Computer to the Dual Orin-X Solution

An easily overlooked fact is that as of now, the computational power standard adopted by the entire intelligent driving industry when mass-produced, has yet to transcend the computing platform framework established by Tesla in April 2019.

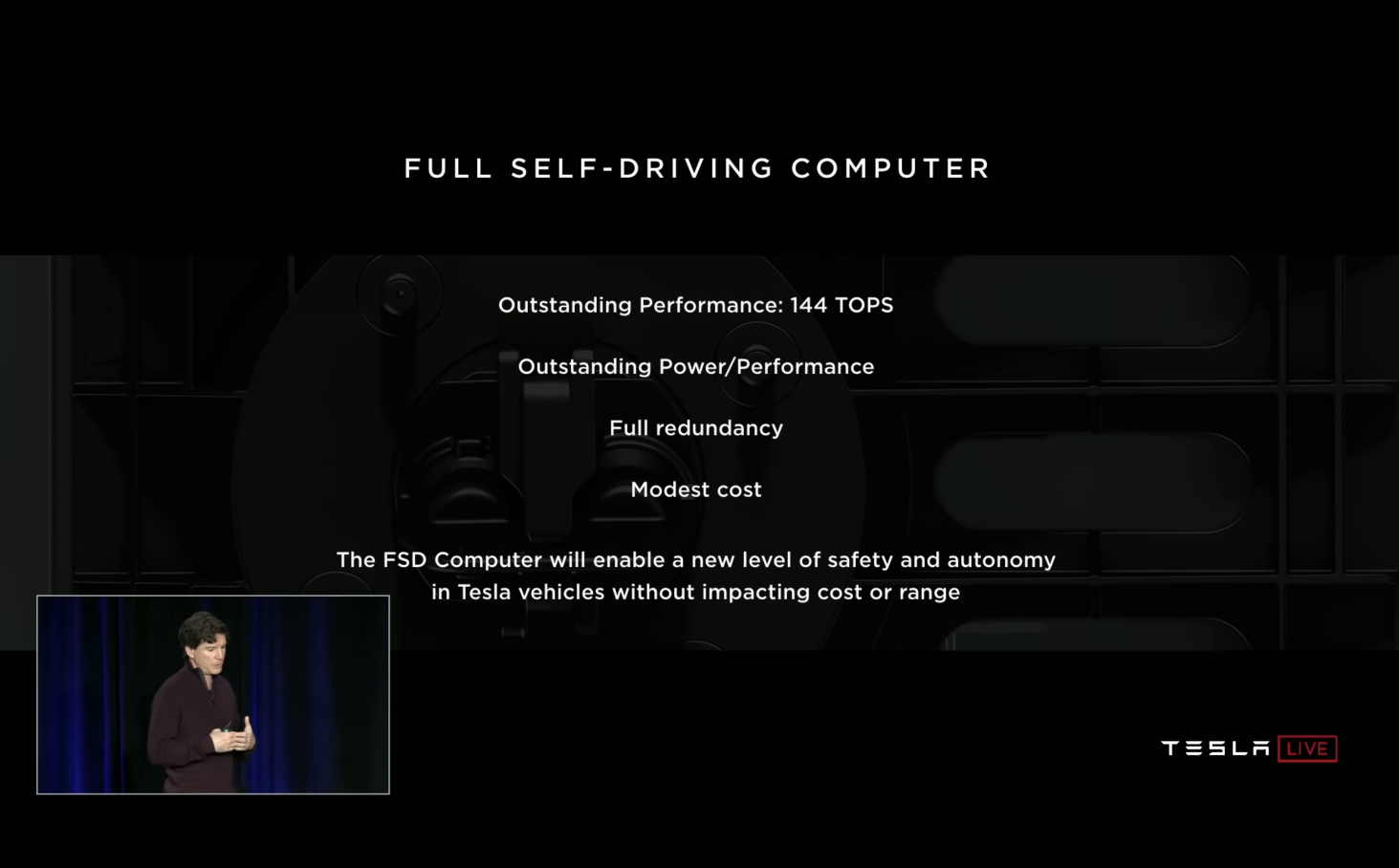

This computing framework is built upon Tesla’s proprietary FSD Chip, forming the FSD Computer.

Let’s go back to Tesla Autonomy Day on April 22, 2019.

On that day, Pete Bannon, Tesla’s Vice President of Autopilot Hardware, revealed the FSD Computer, boasting a total computational power of 144 TOPS, encompassing two FSD Chips each having a computational power of 72 TOPS and utilising a 14nm processing technology. This was followed by Elon Musk’s confident repeated assertion that all Tesla models in production possess the hardware foundation (including computational power and more) necessary to achieve full self-driving.

It was announced that all the user has to do next is to improve the software.

Indeed, over the following years, on Tesla’s timeline, 144 TOPS remained the benchmark for computing power in the evolution of intelligent driving — despite at least three significant changes to Tesla’s software algorithm during this process. Specifically:

- In August 2021, Tesla unveiled a restructured new neural network architecture at AI Day 2021. The key to this was the introduction of the Transformer model for more efficient BEV conversion.

- In October 2022, Tesla released the Occupancy Network and the closely aligned NeRF algorithm at AI Day 2022. Additionally, new algorithms for planning and other tasks beyond autonomous driving perception were introduced.

- In April 2023, Musk announced on social media that FSD V12 would adopt end-to-end AI algorithms — that is, an end-to-end AI system from image input to vehicle steering, brake, and acceleration output. By August 2023, Musk demonstrated the actual effect of end-to-end AI during a live stream.

However, be it the widely adopted BEV+Transformer structure in the industry, or the Occupancy Network based on this structure, along with the end-to-end solution Tesla launched this year, Tesla’s software algorithm’s fundamental computing power has always been based on FSD Computer. Not only that, but the hardware foundation of Model S, driven by Musk in his live-streamed test drive in August of this year, was also Tesla HW3. Thus, the computing power was based on the 144 TOPS FSD Computer.

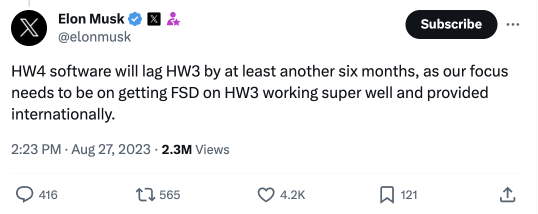

Musk even directly declared on Twitter:

HW4 software will be at least six months behind HW3 because we are focused on making FSD extremely smooth on HW3, in order to deliver globally.

Therefore, despite the new generation of FSD chips already being incorporated with HW4 in Tesla’s most recent car models, the 144 TOPS FSD Computer, capable of bearing the continuous evolution of autonomous driving algorithms, remains the choice for Tesla.

Of course, a major contributing factor is that Tesla’s self-developed chip advantage – a significant optimization in software and hardware integration – has allowed the 144 TOPS computing power to remain solidly in place for over four years.However, it is within these four years that players in China’s intelligent driving industry have collectively undergone a significant leap in their choice of computing power.

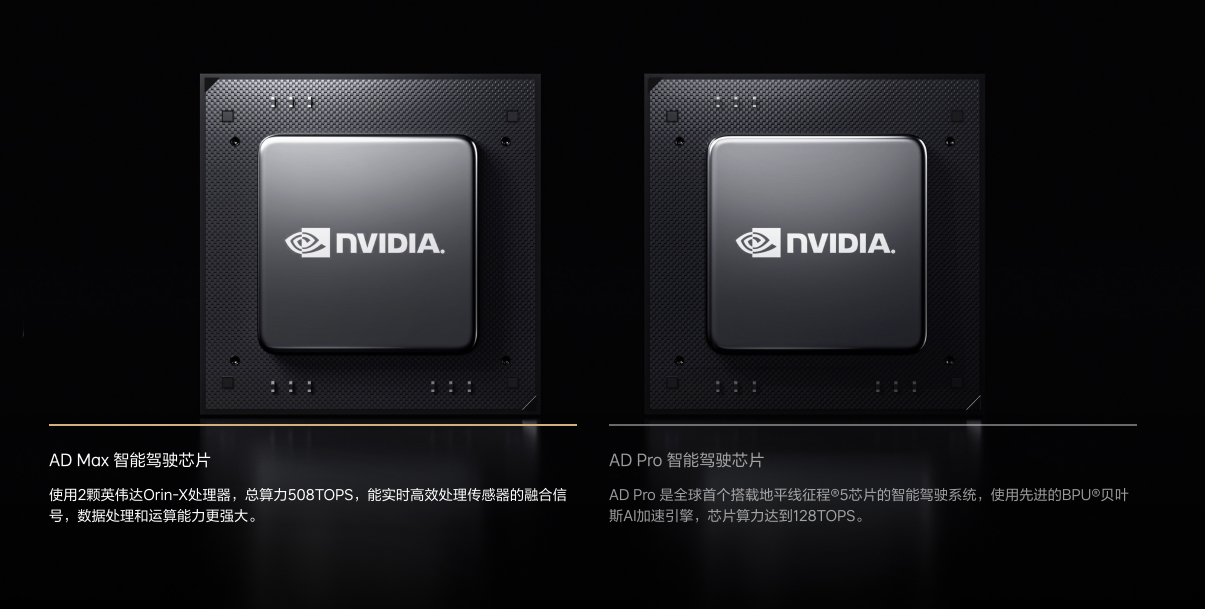

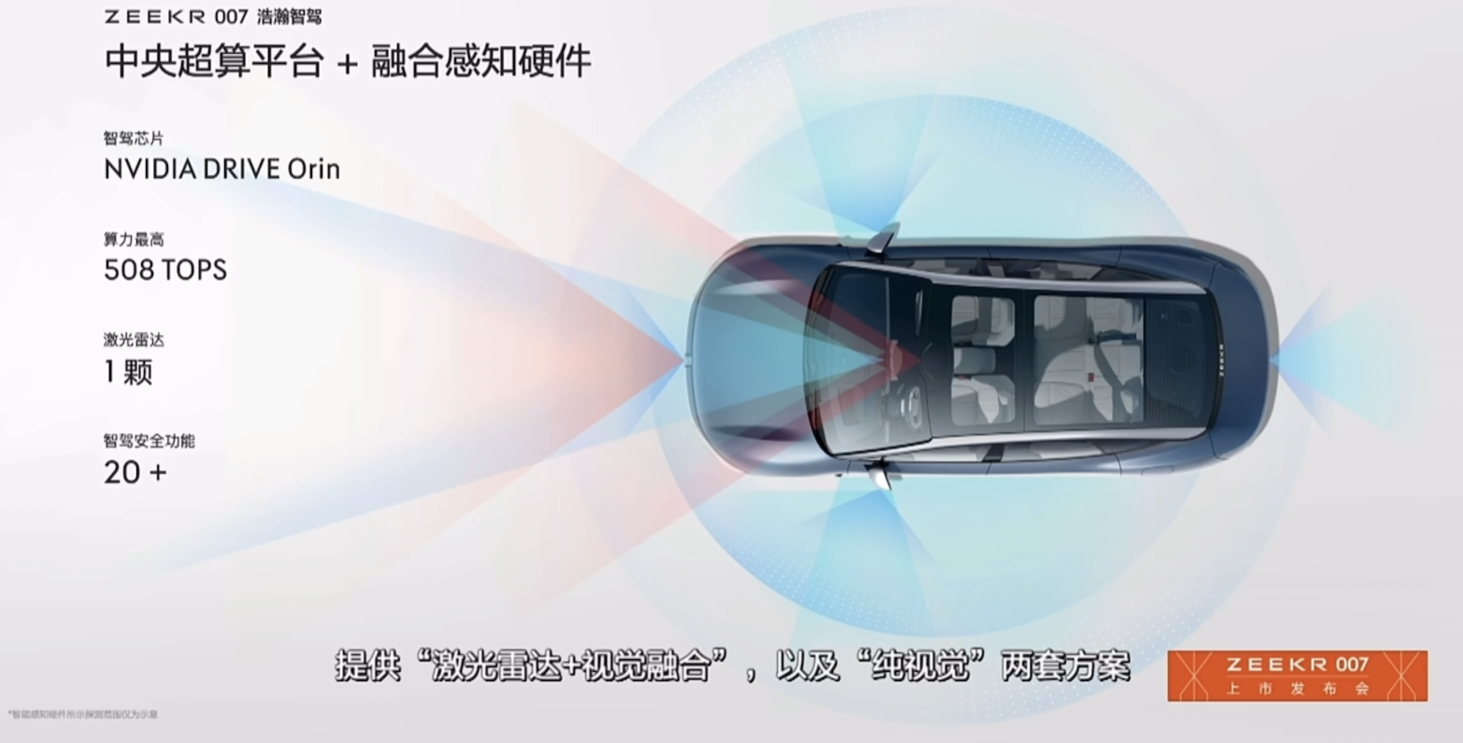

Particularly in 2022, with NIO, LI, Xpeng, and other Chinese auto manufacturers devoted to independent research—the new forces of the automobile industry—one after another released their new models equipped with advanced intelligent driving assist features. The dual Orin-X plan with a total of 508 TOPS seems to have become the mainstream choice for high-level intelligent driving solutions in China’s intelligent driving industry—Huawei is the only exception among the mainstream players.

However, even though the dual Orin-X chip has a computing power of as high as 508 TOPS at the parameter level, in the actual operating scenarios of intelligent driving, the operation of computing power requires close coordination between the chip itself and various software algorithms to finally play its role. Therefore, merely looking at the parameters themselves is of little significance.

Interestingly, at the media communication meeting in March of this year, LI Auto’s CEO Li Xiang mentioned the concept of “effective computing power,” stating:

The efficiency of the FSD chip is really high because FSD is a dedicated BPU. Even though it only has 144 TOPS, its effective computing power is essentially the same as that of two Orin-X units. Its effective computing power is about three times that of GPU, so two FSD units with 144 TOPS are basically similar to two Orin-X units with 508 TOPS.

From this perspective, many manufacturers’ dual Orin-X computing power solutions, which they adopted when deploying their models, have not transcended the 144 TOPS computing power framework employed by Tesla’s in-house plan at the effective computing power level. The reason for this may be that Nvidia referenced Tesla’s FSD chip capabilities when designing Orin-X. Regardless, this does not seem to be a coincidence.

A Dividing Line in Product Implementation of Auto-Driving Technology

Based on current developments, Tesla still plays the leading role in advancing auto-driving technology; guided by Tesla, many Chinese automakers are pushing their own development of intelligent driving and have established the computing power foundation of their advanced auto-driving plans at two Orin-X chips of 508 TOPS.

However, from a product and business standpoint, Chinese automakers have taken a different path to implement their intelligent driving solutions and therefore have different computing power plans from Tesla.

In fact, to popularize auto-driving technology, collect and iterate data, and spread the cost of in-house chips, Tesla employs a consistent intelligent driving implementation plan for both its high-end Model S/X series and its mass-market-oriented Model 3/Y series, thereby maintaining consistency in auto-driving computing power.However, on the other side of the ocean in the Chinese market, things have started to change. Specifically, with the availability of the City Navigate on Autopilot (referred to differently by various companies, henceforth referred to as ‘City NOA’), a clear divergence has arisen in the Chinese intelligent driving industry in terms of product construction and commercial implementation. This divergent point in time is largely centered around September 2022.

Xpeng Motors was the first to make a move.

In late September, Xpeng officially released the Xpeng G9, emphasizing its advancement towards the next stage of intelligent assisted driving. On the product level, the Xpeng G9, which has weathered storms and been adjusted, introduced on the wisdom drive level the Max version supporting XNGP and the Pro version supporting XPilot (the G9 also has a Plus version, but its wisdom drive configuration is the same as the Pro version’s.)

In terms of functionality, the Max version of the G9 can support city NGP function at its highest, while the Pro version can only support highway NGP at its highest. From the perspective of hardware configuration and computational power, the Max version uses dual Orin-X chips and the perception hardware includes two LIDARs, while the Pro version uses a single Orin-X chip and does not have LIDAR.

Next, LI Auto also launched the L8 Pro and L8 Max versions when releasing its new L8 series.

The key difference between the two versions lies in the MAX version using the AD Max solution, carrying two Orin-X chips at the computation level, and one LIDAR in perception hardware, capable of supporting city NOA at its highest. The Pro version uses the AD Pro solution, carrying a single Horizon Journey 5 chip with a computation power of 128 TOPS, without LIDAR, capable of supporting freeway NOA at its highest capacity.

Ever since then, represented by Xpeng Motors and LI Auto’s approaches, the smart drive market in China, on volume production car models, has started distinguishing City NOA as a dividing line, segmenting into Max and Pro versions.

The Max version signifies the highest level and leading technological exploration in intelligent driving for car companies, its representative function being city NOA, corresponding to a comparatively higher technical computation power standard. The launch of the Pro version, on the other hand, leans more towards a market behavior under current technology and cost conditions. The aim of the Pro version is to offer mature products to customers by showcasing the existing intelligent driving technology’s performance on freeway NOA. Therefore, there are different choices for computation power.

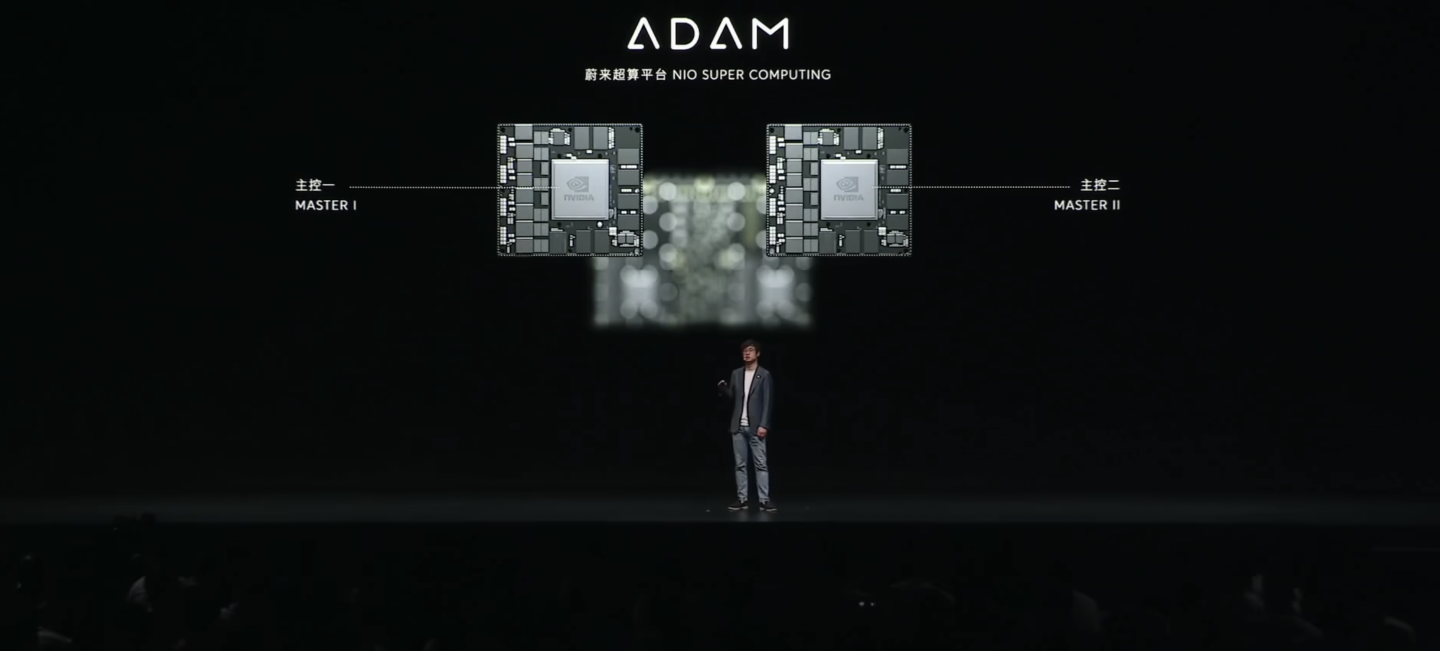

Of course, aside from LI Auto and Xpeng, other players adopt different strategies.In line with their own business and brand development considerations, all second-generation platforms under NIO have uniformly adopted the computing power solution equipped with 4 Orin-X chips. Among them, two Orin-X chips are used to realize intelligent driving capabilities, the third chip is used for swarm intelligence, and the remaining one is reserved for backup redundancy.

Despite different paths, overall, there is no fundamental difference between the computing power standard adopted by NIO in intelligent driving (i.e., dual Orin-X) and that of LI and Xpeng.

In addition to the “NIO-LI-Xpeng” trio of newcomers, there is also a unique standout in the process of China’s autonomous driving industry: Huawei.

Leveraging their advantages in system and software integration, Huawei utilize their own MDC series in their propulsion. Specifically, the HI system adopts MDC 810 (400 TOPS of dense computing power) complemented with three LIDAR systems. Their recently released ADS 2.0 system, however, uses MDC 610 (200 TOPS of dense computing power) with a single LIDAR system.

At the same time, while Huawei is not an automaker, it has a significant impact on the vehicle manufacturer’s selections. Notably, avatr, a company closely collaborating with Huawei under the HI mode, has also adopted a full-line standard for its intelligence drive system.

However, looking at the situation in 2023, whether it’s LI Auto’s subsequent L7 series, L9 Pro, Xpeng’s successive launch of P7i, G6, 2024 version of G9, or Huawei’s launch of the LUXEED S7 series under the HarmonyOS Intelligent Driving Framework, all have adopted the Max version and Pro version in their intelligent drive system selection.

On one hand, marked by the Max version, the development of intelligent driving continues to explore based on the existing city NOA technology. On the other hand, marked by the Pro version, the intelligent driving market is broadening to the existing high-speed NOA performance, leading to a clear market differentiation.

High-speed NOA is becoming mainstream, computing power is becoming fragmented

The differentiation in the current intelligent driving market is largely due to the maturity and popularisation of high-speed NOA.

In fact, the high-speed NOA (Navigate on Autopilot) feature was first introduced by Tesla on October 26, 2018. Later in the domestic market, NIO, Xpeng, LI, and other new players that opted for in-house development successively launched their own high-speed NOA (variously named) features between 2020 and 2021. However, these automakers’ high-speed NOA features were all based on chips with relatively lower computing power, such as Moblieye EyeQ4 (NIO), Nvidia Xavier (Xpeng), or Horizon Journey 3 (LI) to implement the feature.

Subsequently, in August 2021, Tesla announced a novel software and algorithm architecture at AI Day, leading to the creation of a BEV+Transfomer algorithm paradigm with enhanced perceptual efficiency, among its many featured. In the following two years, Xpeng, LI, and NIO all revisited and rewrote their algorithm infrastructure, all whilst adopting a technical pathway similar to the Transformer and BEV formula utilized by Tesla.

Consequently, be it Xpeng’s XNGP released in October 2022, or LI’s AD Max 3.0 revealed in April 2023, the applicable Max vehicle models equipped with twin Orin-X chips all fundamentally strive to realize urban NOA.

However, objectively, due to their employment of the more efficient BEV+Transfomer algorithm architecture and a vast 508 TOPS computation power, they are also backward-compatible with high-speed NOA capacities. Hence, under the significantly improved high-speed NOA performance, reinforced by urban NOA grade perception and planning technological capacities, these vehicles have made great strides.

In other words, the auto manufacturers’ exploration of urban NOA has indirectly endowed their Max model variants with a high-speed NOA performance dimension reduction. To illustrate, this is clearly reflected in the Xpeng G6 Max and LI L8 Max iterations.

Besides the Max versions from these new, up-and-coming car manufacturers, the landscape of high-speed NOA is gradually becoming mainstream in 2023, exhibiting a complex scenario in the process of widespread implementation.

In short, amidst the continual refinement of high-speed NOA capabilities, the importance of autonomous driving in car purchase decisions has been on the rise, and high-speed NOA has gradually become an essential element in high-speed driving scenarios. Therefore, even some comparatively traditional auto manufacturers have started to deploy lower-threshold high-speed NOA capabilities in their key vehicle models. Thus, the entire auto market has begun to realize a differentiated approach to implementing high-speed NOA, leading to a fragmented choice of computational power in this domain.

To elucidate further, let’s explore some specific vehicle instances:

- The Pro versions of Xpeng’s G6/G9/P7i models, equipped with a single Orin-X chip featuring a 254 TOPS computational power, still maintain the BEV+Tranformer architecture similar to their Max counterparts. Hence, the high-speed NGP performance of their Pro versions can also be enhanced. Currently, this function has been rolled out to users with the introduction of Xmart OS 4.4.0.

- The new Xpeng P5 employs a 30 TOPS Nvidia Xavier chip, which doesn’t support the BEV+Tranformer algorithm architecture, yet it can still uphold high-speed NGP through previously applied algorithm solutions.* The Pro version of LI L series models uses the Horizon Journey 5 chip with a computing power of 128 TOPS. According to official statements, it can also run a BEV+Transformer architecture similar to the Max version. However, this feature has not been officially launched yet.

- The LUXEED S7 Pro is equipped with Huawei’s MDC610 chip boasting a computing power of 200 TOPS. According to the official statements, S7 Pro supports the advanced version of Huawei’s ADS 2.0 featuring high-speed NCA capabilities.

- The DEEPAL SL03i and S7i, set for release in November 2023, are based on two Horizon Journey 3 chips. With a computing power of 10 TOPS, the chips enable high-speed NOA capabilities in DEEPAL’s advanced assisted driving, the Deepal AD.

- The new VOYAH Free model supports Baidu’s Apollo Highway Driving Pro assisted smart driving feature. Its computational capabilities are powered by two Texas Instruments TDA4 chips with a computational power of 16 TOPS.

- DENZA’s N7 launched an optional high-speed smart driving package in September. It’s based on Nvidia’s newly launched Orin-N computing platform, boasting a maximum computing power of 84 TOPS and supports high-speed and quick road navigation-assisted driving features.

As a whole, by 2023, as intelligent driving technology is increasingly implemented, the high-speed NOA function has quickly become available in multiple pricing levels below 300,000, even extending to those below 200,000. The computational power of high-speed NOA varies greatly, ranging from as low as 10 TOPS, to as high as 254 TOPS.

However, from a technical perspective, while all are high-speed NOA functions, each carmaker’s approach varies considerably. A key differentiator is whether it’s based on the BEV+Transformer platform, where we can observe significant variations in computational power.

Specifically, new energy tenders such as Xpeng, which have made technological breakthroughs in urban NOA are more inclined to apply their algorithmic solutions developed for the Max version to the Pro version. LI takes a similar approach, but because the computational platforms used between the Pro and Max versions of LI L series come from different manufacturers (Max version uses Nvidia, Pro version uses Horizon), the implementation of their algorithms becomes more complex.

Furthermore, among those startups, many traditional automotive companies that lag behind in intelligent driving capabilities tend to rely on solutions provider of their choice to achieve high-speed NOA. This results in widespread diversity in computational power selection, further fragmenting the market solutions for high-speed NOA.However, it is this fragmentation that determines the various manufacturers could present diverse quality in achieving high-speed NOA. In other words, although all claim to achieve high-speed NOA, it can be implemented based on the BEV+Transformer algorithm framework, as well as independently of the algorithm framework. Due to different underlying computational power, implemenation approaches differ, coupled with the disparity in engineering capabilities amongst manufacturers, customer experiences will vary greatly.

We can anticipate that after 2024, this ability gap brought about by computational power differentiation, which ultimately leads to experience differentiation, will exhibit an even more pronounced trend. This is especially notable in the segment of vehicles priced below 200,000.

Urban NOA enters the platform stage, engineering becomes a challenge

For the development of intelligent driving, the popularization of high-speed NOA is a periodical achievement in the long-term exploration of user value of the entire industry. However, in reality, from a technological standpoint, the development of intelligent driving is far from mature. Even city NOA, which has been deployed in some vehicles, finds it challenging to reach the general consumer.

Nevertheless, from the perspective of technological advancement, the development of urban NOA has now entered a relatively stable platform phase.

After all, over the past few years, under the leadership of Tesla, the intelligent driving industry has formed a general framework of BEV + Transformer + universal obstacle recognition for city NOA implementation on the algorithmic level. Under this framework, each manufacturer is unique. Specifically:

- Xpeng uses a dual Orin-X chip + Lidar hardware solution. Its latest XNet 2.0, based on the BEV+Transfomrer, will add an occupancy network. Notably, Xpeng also integrates spatial-temporal understanding capability based on large models in XNet 2.0, enabling the perception architecture to understand text information, have a temporal concept, and understand traffic elements with unique city characteristics.

- LI’s AD Max adopts a hardware solution similar to Xpeng. In algorithms, it uses a BEV + Transfomer + Occupancy network plan, while integrating an NPN prior network + TIN traffic light network in its intelligent driving solution.

- NIO uses four Orin-X chips to their full advantage in its smart driving solution, dedicating one to collective intelligence, effectively boosting the opening speed of urban intelligent driving mileage.

- Huawei’s ADS 2.0 uses an MDC610 + Lidar hardware solution. Huawei has added GOD (General Obstacle Detection, similar to the occupancy network) network and RCR (Road Topology Inference Network) to the ADS 2.0 solution, in addition to the BEV + Transformer framework.* JIYUE’s city NOA solution is still based on two Orin-X chips, however, it utilizes the pure visual pathway, without the aid of Lidar sensors. The software architecture that it employs is built around the BEV + Transformer + OCC network framework.

It can be evidently seen that among the current city NOA solutions, which include NIO, Xpeng, LI, Huawei, ZEEKR, and XiaoMi, BEV + Transformer + OCC network framework is widely used. This is a widely accepted algorithm for intelligent driving. This commonality extends to chip computational power; with the exception of Huawei, who opts for self-developed software and hardware.

Beyond the computational capabilities and algorithm structure, the engineering process based on actual road conditions is the real challenge in bringing intelligent driving to customers. This entails vast data collection, simulation emulation, road testing, etc., all of which are costly in terms of manpower and resources. Moreover, these efforts require several years to materialize into tangible results.

Therefore, each participant has their own unique approach to elevate the practical implementation of their solution. Some examples of these ‘tricks’ include introducing large-scale models, improving lidar sensor integration, incorporating various specialized networks within their algorithm framework, etc. Interestingly, Huawei places considerable importance on human factors research and even specifically hires expert drivers for intelligent driving data collection and testing.

Looking at it from this perspective, the overall software and hardware frameworks utilized in the city NOA have indeed reached a relatively stable state.

However, there are exceptions. For example, avatr’s 11/12 models that use Huawei’s HIS concept still employs the MDC 810 + tri-lidar sensors in the Huawei ADS 2.0 stage.

Additionally, both DENZA N7 and IM LS7, which are based on the supplier technology solution from Momenta, utilize a single Orin-X chip + dual lidar sensors to support city NOA. While LS6 under IM adopted a single Orin-X chip + a single lidar sensor to also support city NOA. These decisions are largely dictated by cost considerations.

In fact, one insider revealed in a conversation with 42 Garage, that some autonomous driving suppliers, in a bid to secure orders, often put forward city NOA technical solutions that appear to have low computational power requirements and minimum perception hardware. These solutions are aimed at attracting the attention of cost-sensitive automakers; as for the actual effectiveness of these solutions, remains uncertain.

Generally speaking, in the current industry scenario, the focus is no longer purposed at algorithmic innovations. Instead, major efforts are directed towards promoting the development of city NOA on the engineering level. This necessitates a vast amount of engineer resources to be deployed towards road testing and other aspects of practical application. Though this may appear laborious and raises engineering costs, it is a necessary step forward for the industry.Even to some algorithm engineers, intelligent driving no longer seems sexy.

However, upon reflection, in the technological evolution of autonomous driving, there are still aggressive players in the industry who are continuing to explore.

For instance, Tesla has introduced an end-to-end smart driving solution in its FSD V12 version, a solution that has transcended the existing framework of smart driving technology. Moreover, in August, Musk even live streamed a test of this solution, during which there was only one take over. Currently, Tesla has yet to host a technical sharing event like AI Day to explain the technical principles of this end-to-end solution.

Beyond end-to-end, Tesla’s AI team is building the next generation of autonomous driving models, using a method based on a single fundamental video network. According to Tesla’s job postings, these models will utilize generative models, foundational models, and more.

Essentially, Tesla’s move is to adopt a large model mindset for intelligent driving. Although it remains uncertain when Tesla will be able to realize this, there is no doubt that, conceptually, this represents a complete innovation to the BEV + Transformer + Occupancy Network technical paradigm. It may even be considered a revolutionary approach to Tesla’s end-to-end smart driving solution, which was publicly live streamed in August.

Indeed, under Musk’s urgent desire for autonomous driving, Tesla has twice made disruptive choices in just one year.

However, multiple industry experts have indicated that, unless Tesla can deliver a user experience capable of undercutting the current BEV+Transformer solution through its end-to-end approach, it will be difficult for China’s smart driving industry to invest more in rapid follow-up amid the current intense price wars. This applies even to leading smart driving players such as Huawei and Xpeng.

This implies that, in the coming few years, local players will temporarily part ways with the aggressive Tesla on their choice of technological pathway.

L3 Testing Is Here, But Selling More Cars Is Key

Interestingly, as 2023 draws to a close, there have been new developments in the computational power of autonomous driving.

During this year’s Guangzhou Auto Show, Horizon announced its next-generation smart driving computing platform, Journey 6 flagship version, which boasts a computational capability of up to 560 TOPS. This version was primarily designed for city navigation-assisted driving and has been specially optimized for Transformer models. However, this chip will only begin mass production and be installed in vehicles in the fourth quarter of next year, making it a product geared towards the smart driving market of 2025 and beyond.

Through this chip, Horizon has clearly shown its determination and confidence to compete with NVIDIA’s Orin-X series in the field of urban NOA. However, the hidden premise behind this competition is that, in Horizon’s view, the development of the intelligent driving market in the coming years will still be within the technological framework of BEV + Transformer + general obstacle recognition.

Through this chip, Horizon has clearly shown its determination and confidence to compete with NVIDIA’s Orin-X series in the field of urban NOA. However, the hidden premise behind this competition is that, in Horizon’s view, the development of the intelligent driving market in the coming years will still be within the technological framework of BEV + Transformer + general obstacle recognition.

Even NVIDIA’s Thor, which was initially planned to be launched in 2025, has been optimized for the Transformer.

Moreover, another evident example is NIO’s latest 5nm process in-house intelligent driving chip, the Shenji NX9031, which was released on NIO Day. This chip is specifically optimized for algorithms such as BEV and Transformer. The specific computing power of this chip has not yet been revealed, but it will be delivered to users through the NIO ET9 model in 2025.

Therefore, 2025 is a turning point for computing power, but it may not necessarily be a turning point for major changes in the algorithmic framework.

In regards to this, several veteran professionals in the intelligent driving industry have told 42 Garage that the development of intelligent driving will be difficult to move away from the current technology system built on the Transformer algorithm. Right now, this system has just been established and is far from perfect. There is still much to be done.

Interestingly, on the opening day of the Guangzhou Auto Show, the competent authorities issued a notice to carry out pilot work for the access and road traffic of intelligent connected vehicles, which supports L3 and L4 function intelligent connected vehicle products to conduct traffic pilots in designated areas. Within one month after this policy was released, enterprises including Benz, IM, BMW, ARCFOX, avatr, and DEEPAL have all obtained L3 level autonomous driving test licenses.

The policy-level release for L3 testing indeed signifies that the development of intelligent driving has reached a certain node that is considered suitable for application. However, to the general public, L3 is still a distant term; when introducing intelligent driving functions, car manufacturers have been repeatedly emphasizing that the user is the primary responsible entity and should always be ready to take over.

However, intelligent driving is just one aspect of the development of the entire automotive industry. It still needs to be implemented through mass-produced models and market choices. The competition in the automotive market is becoming increasingly fierce.

Therefore, based on this premise, among the many technical achievements in the field of intelligent driving, high-speed NOA has been singled out. This is a selling point that automakers have started to deploy and attract users from the perspective of intelligent driving. Furthermore, the price range has been continuously investigated, starting from the 300,000 level. Even a product director of a new energy vehicle manufacturer told us that by 2025, a car without high-speed NOA functionality priced at 150,000 might have difficulty selling.

From this perspective, the high-speed NOA can be considered as a tangible return to the market and users after years of capital and social resource investment in autonomous driving.

This return is not perfect, but it’s sufficient to instill confidence in the market for the next steps of autonomous driving, and request patience.

Looking back, in the mired battlefield of city NOA, before this feature truly becomes an enticing selling point for purchasing a vehicle, everyone is struggling over the same technological framework, balancing pragmatism and idealism amid choices of computing power, user experience, and cost.

Therefore, 2023 is merely the starting point of the muddy road to autonomous driving, and 2024 and 2025 are but steps along the way. Before reaching a critical point where autonomous driving brings about a qualitative change, all players have to face a brutal battle in the car market.

Undoubtedly, autonomous driving has become a necessary weapon in this battle, with it, victory may not be guaranteed; however, without it, defeat is getting closer and closer.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.