Recent times appear to see a return to form for NIO.

Rewinding back to Q2, NIO’s total revenue stood at 8.77 billion yuan, marking a return to its 2021 performance. However, gross profit was a meager 87 million yuan, with the margin dipping to 1%. The proximity of several key financial indicators to the danger zone painted a picture of fatigue for the future of NIO.

But stepping into Q3 and Q4, NIO revived its momentum, staging innovation tech-days, embraced new partner collaborations with CCAG and Geely for its battery swap service, and struck an agreement with JAC about acquiring factories.

Apparently, NIO seemed to exhibit increasing control over its spread, and a gradual release of the long-term value it had accumulated.

With the vigorous stride started since Q3, NIO’s sales performance experienced almost a dramatic twist, providing a welcomed relief reflected in the Q3 earnings report released today.

Profits within range of sales

NIO’s Q3 financial report is finally filled with words related to ‘growth’.

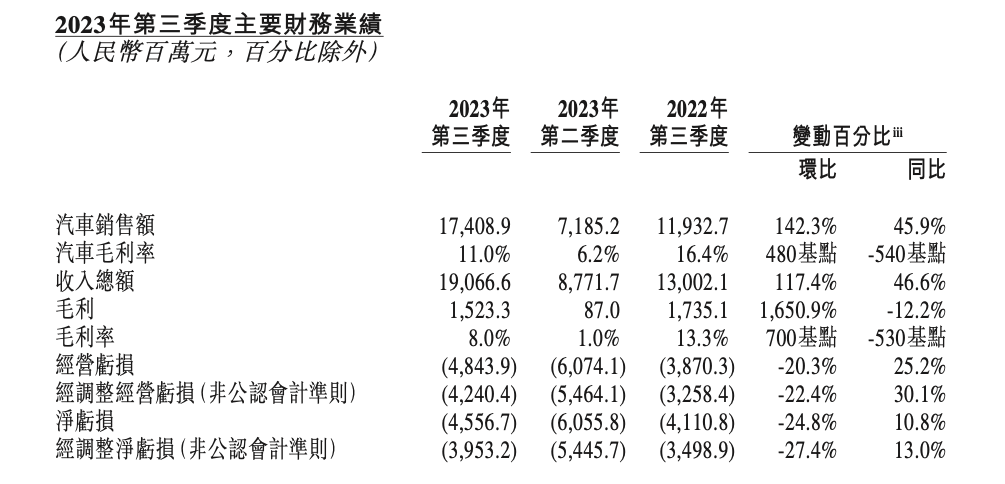

Let’s examine some key financial indicators:

- Total revenue was 19.07 billion yuan, an increase of 46.6% year on year and 117.4% quarter on quarter;

- Gross profit was 1.52 billion yuan, a decrease of 12.2% year on year but grew by 1,650.9% quarter on quarter;

- Gross margin was 8%, compared to 13.3% in the same period last year and 1% in Q2;

- Net loss was 4.56 billion yuan, an increase of 10.8% year on year but a decrease of 24.8% quarter on quarter;

- As of September 30, 2023, cash reserves stood at 45.2 billion yuan, compared to 31.5 billion yuan at the end of the second quarter.

As evidenced, NIO’s Q3 financial report no longer invokes pessimism but offers a quite inspirational upturn attributed to an increase in revenue among other metrics.

With revenue, gross profit, and cash flow all trending upwards and narrowing losses, the key lies in substantial growth in car sales revenue.

According to the report, NIO’s Q3 auto sales revenue hit 17.41 billion yuan, an increase of 45.9% year on year and 142.3% quarter on quarter. The auto gross margin was 11%, compared to 16.4% in the same period last year and 6.2% in Q2.

Even though the company witnessed a significant increase in auto sales revenue and auto gross margin, the cost-effectiveness of achieving such growth isn’t encouraging. The report revealed that NIO’s sales cost in Q3 was 17.54 billion yuan, an increase of 55.7% year on year and 102% quarter on quarter.

Blaming the rapid increase in sales costs on factors such as auto delivery volume, energy solution provision, and increment in charging pile sales, NIO also cited organizational efficiency as an underlying issue. Bin Li stated:

We have completed a comprehensive planning process for our two-year operational plan to set our key objectives, priorities, and action plans. We identified opportunities for organization optimization, cost reduction, and efficiency improvement. We will continue to focus on advancing our core technologies, developing key products, and enhancing our sales and service capabilities. We are confident in NIO’s long-term competitiveness in the intelligent EV market.Despite confident in their long-term competitiveness and significant improvement in Q3 performances, NIO’s revenue forecast for Q4 takes a conservative turn, ranging between 16.079 to 16.701 billion, down by 3 billion from Q3.

False Start

The cautiousness over Q4 forecast can be credited to the disappointing sales.

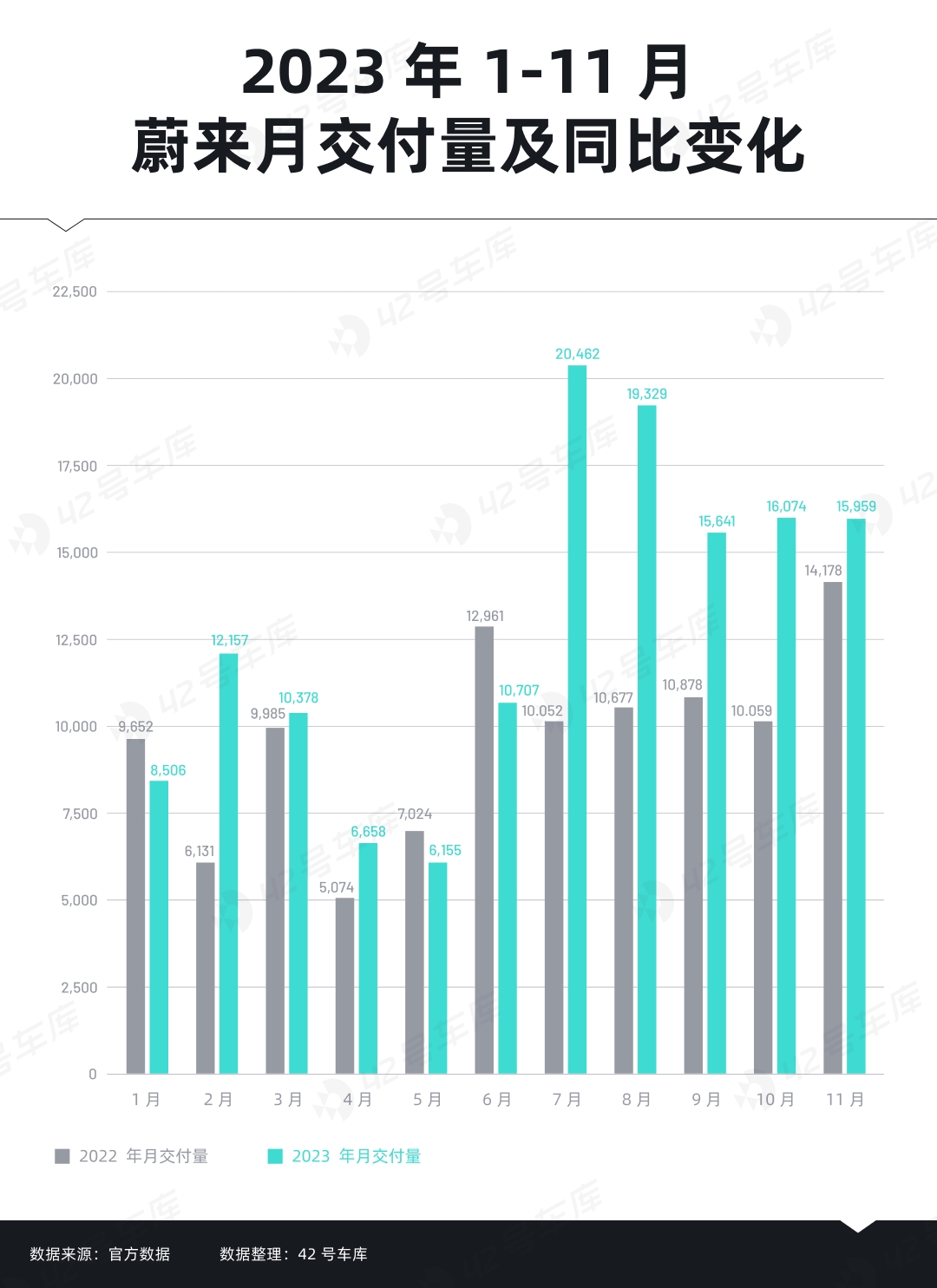

In Q3, NIO delivered a total of 55,432 vehicles, a YoY growth of 75.4%, and a sequential growth of 136.7%, achieving the Q3 delivery objectives set in the Q2 financial report of 55,000 – 57,000 vehicles.

It was a monumental victory for NIO. However, the celebration is cut short with sales numbers taking a dip from July.

In July, NIO recorded a sales volume of 20,462 vehicles, doubling that of June, which was a pleasant surprise for the market.

However, with heightened expectations over NIO’s sales, the following months saw a steady decline in the numbers; 19,329 vehicles in August, 15,641 in September, 16,074 in October, and 15,959 in November.

This means, NIO did not fulfill its earlier forecast established in Q1, aiming for monthly sales of 20,000 in the second half of the year. It even fell short of NIO CFO’s aim of working towards a target of 30,000 monthly sales, despite the company building a sales system and production capacity compatible with such high monthly sales.

Given the highly unlikely scenario of surpassing Q3 sales, NIO’s sales target for Q4 remains conservative – 47,000-49,000 vehicles. Which means in this December, NIO only has to reach a sales volume of 14,967 vehicles to meet its Q4 sales target.

This isn’t much of a challenge or a motivational target for NIO. Perhaps underlying this is Li Bin’s concern over organizational issues.

NIO, having numerous business lines, cannot possibly avoid an overstaffed and inefficient organization during expansion. This greatly affects its overall organizational efficiency and the prowess to support a sales and production system capable of 30,000 monthly sales.

On November 2, Li Bin announced in a private letter that NIO would lay off 10% of its workforce.

In the letter, Li Bin said they will “reform inefficient internal workflow and division of labor, eliminate ineffective positions,” and “improve efficiency of resources, delay, and reduce investment in projects not improving financial performances for three years.”

When the news broke out, NIO stocks rose by 4.5% at night, followed by a steep rise of over 7% in NIO’s Hong Kong stocks the following day.For NIO at present, it is crucial to enhance organizational efficiency in order to fully harness the power of its extensive system.

Although NIO’s sales performance achieved a historic high in the third quarter, this should not be the upper limit for NIO. NIO itself ought to see this as a threshold and swiftly climb above it and distance itself from it as much as possible.

Sales warming up, other aspects even hotter

Despite hitherto failing to relay market confidence in its sales figures, NIO sees frequent good news and favorable conditions in its other operations.

Firstly, in the area of battery swapping, NIO has achieved successful cooperation with CCAG and Geely, focusing on the establishment of battery swap standards, development of battery swap models and construction of battery swap stations.

Moreover, partnering with CCAG has allowed NIO to expand its battery swap market model in the C-end market. Similarly, a partnership with Geely has opened up the B-end battery swap market for NIO.

For quite some time, externally and even internally, NIO’s battery swap business was criticized due to high construction costs and slow layout. However, with the unfolding of partnerships with CCAG, Geely and other ‘four or five companies’ as stated by Li Bin, NIO’s scale advantage in battery swapping and their influence in this aspect are expected to rise rapidly.

As of December 5, NIO’s battery swap stations reached 2,196. NIO’s battery swap stations are being constructed at an increasing speed, persisting in ‘charging ahead’ with developments.

Secondly, in terms of production, reports show that NIO has signed a definitive agreement with JAC on December 5. NIO will purchase production equipment and assets of the first and second advanced manufacturing bases from JAC, with a tax-free total price of approximately 3.16 billion yuan.

Though the investment of 3.16 billion yuan only accounts for around 7% of NIO’s current cash reserves of 45.2 billion yuan, its significance to NIO is immense.

After all, having absolute control over the factory means NIO can better integrate its entire system – to ensure coordination and order from production to delivery. This reduces risks of severe under-delivery as seen with ET7.

_20231205200926.png)

Thirdly, in terms of R&D, even though NIO hasn’t employed technology as a label, its R&D expenses continue to grow. However, a rarity occurred in Q3, where NIO’s R&D expenses dropped – 3.04 billion yuan, a year-on-year growth of 3.2%, and a quarter-on-quarter drop of 9.1%. Nevertheless, this R&D spending still exceeded LI’s 2.82 billion yuan and Xpeng’s 1.31 billion yuan.

At NIO’s Innovation Technology Day in September, NIO first showcased what results it achieved from its extensive R&D investments – from intelligent driving, intelligent cockpit, panoramic interconnection, artificial intelligence, among other 12 large components, NIO forged a comprehensive ‘tech stack’. Its specific practical performance is manifested through NIO Phone, Yang Jian chipset, Sky OS and more.The extensive funding invested in research and development with abundant achievements ultimately serves for profit margin. After all, as Li Bin emphasized, the underlying logic of NIO is “to exchange recent research and development for long-term gross margin”.

Final Remarks

The release of the Q3 financial report coincides with the recent successive good news about NIO. Through the rising numbers in the financial report, the expansion of the battery-swap service, and the acquisition of factories, NIO may also be boosting market confidence and demonstrating its growth potential.

But for NIO, what’s more, needed is to impress the market and consumers with actual market performance. Otherwise, it would seem like over-promising and risk losing the trust of the market and users.

In the meantime, against the backdrop of the price war, other auto makers are continually launching brand-new models, unyieldingly competing in product strength. In this situation, whether NIO can withstand the successive challenges from the outside world remains a big question mark.

However, perhaps the only thing that NIO needs to do at present, as Li Bin said in the lay-off letter, is to improve organizational efficiency and sell as many cars as possible:

To earn the qualification for the final competition, we must further improve execution efficiency and ensure adequate resources are deployed in key businesses.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.