Adjacent to the north and south by the United States and Latin America, Mexico is becoming a significant bridgehead for the Chinese new energy automotive industry to step out onto the global stage.

From recent years, it is evident that the Chinese new energy automotive industry has started to emerge on this traditional automotive territory. Besides astonishing growth in vehicle sales, Chinese new energy vehicle companies and supply chain manufacturers have been focusing on establishing factories and planning local new energy industry chains in Mexico.

Their visions have never only been on Mexico alone.

An Emerging New Energy Vehicle Producer and Market

For Chinese new energy vehicle companies, Mexico is becoming a potential overseas market due to the local automotive industry development and the auto market conditions.

Current State of Mexican Automobile Market

The automotive industry is Mexico’s largest manufacturing industry sector and a pillar industry. According to statistics by the Mexican Association of the Automotive Industry (AMIA), the automobile industry output accounts for 3.8% of Mexico’s Gross Domestic Product (GDP) and 20.5% of the manufacturing industry output.

What distinguishes Mexico from other car-manufacturing giants is that its automobile manufacturing industry is very much fragmented from its domestic car market.

As the sixth-largest automotive production base in the world, the number of cars produced in Mexico for 2022 was 3.308 million. Impressive growth from the 3.028 million produced in 2021, a YoY increase of 9.2%. Even amidst the global pandemic in 2020, Mexico’s annual auto production reached 3.04 million. Although well short of the historical high of 4.665 million in 2014, the annual output remained steady around the three million mark.

Simultaneously, Mexico is also the fourth-largest exporter of light vehicles in the world, with cars manufactured locally mainly for export. In 2022, out of the 3.308 million vehicles produced in Mexico, 2.866 million were for export, accounting for as much as 86.6% of total production. These vehicles are mainly shipped to North America, South America, and Europe. Each year, almost 80% of exported vehicles are destined for the United States market. Just in 2022, Mexico exported 2.222 million vehicles to the United States, an astounding 77.5% of total exports.In terms of sales, the annual sales of new cars in the Mexican auto market are approximately one million units. According to the statistics of the Mexican Automotive Industry Association (AMIA), in 2022, a total of 1,095,000 cars were sold in the Mexican auto market, a 7.8% increase from 1,015,000 in 2021. Despite the impact of the new crown, the lowest point of the Mexican car market in 2020 also had new car sales of 950,000 units.

Under such a volume, the proportion of new energy vehicle sales is very small.

For example, of the average annual one million new car sales, a total of 51,065 new energy vehicles were sold in Mexico in 2022, accounting for 4.7% of the 1,095,000 new car sales. This includes pure electric, hybrid, and plug-in hybrid new energy vehicle data. If subdivided, the annual sales of pure electric vehicles are 5,631 units, accounting for only 11% of the new energy vehicle sales, and 0.5% of the total new car sales nationwide.

Compared to pure electric cars, hybrid cars are more popular in the Mexican market. According to data from the Mexican Automotive Industry Association (AMIA), only 1.8% of electric vehicle registrations in Mexico in 2020 were pure electric vehicles, which rose to 2.4% in 2021, and jumped to 8.8% in 2022, with hybrids still accounting for the majority.

Of course, the overall sales of new energy vehicles are also increasing year by year, soaring from 24,405 units in 2020 to 47,079 units in 2021, and reaching 51,065 units in 2022. Following this trend, the National Institute of Statistics and Geography (INEGI) in Mexico predicts that by 2030, the nation’s electric car sales will reach 72,655 units.

Interestingly, Mexico, as an important global base for automobile production, primarily serves non-local markets in its automobile production, while local auto sales rely mainly on auto imports.

Statistics show that a total of 651,710 vehicles were imported globally by Mexico in 2022. Among these, 153,707 vehicles were from China, accounting for approximately 23.6%, which is double the number in the same period of 2021. Currently, Mexico is the largest market for Chinese vehicle exports, with one in four imported vehicles in Mexico coming from China. China has also leapfrogged from being the fourth major supplier to the first, followed by the United States (92,591 vehicles), Brazil (88,592 vehicles), and Japan (65,714 vehicles).

Further perpetuating this trend, the head of Mexican Automobile Dealers Association (AMDA), Guillermo Rossles, stated that from January to August 2023, vehicles from China constituted 19.4% of Mexico’s vehicle imports, more than three times the 5.7% share in the same period of 2018.

This annual market of millions of new vehicle sales, along with the burgeoning new energy market, undoubtedly offers immense potential for any Chinese automobile brand.

Economical Models More Favored

Mexican automobile consumption both benefits from and is limited by the economy.

On one hand, as an economic powerhouse in Latin America, Mexico has an ever-increasing demand for vehicles. On the other hand, due to economic disparities, local consumers prefer less expensive, lower-end vehicles.

In 2022, Mexico’s GDP reached $1.29 trillion, ranking second among Latin American countries. Given Mexico’s economic growth and poor public transportation, the demand for private cars has surged, with Mexico’s per capita vehicle ownership reaching 330 in the past year.

However, Mexico is still a developing country, with problems like unequal resource distribution and a sizable lower-income group. These issues reflect the local population’s purchasing power. It’s either big, typical American pickup trucks like the Ford Explorer or Chevrolet Suburbans, or small, compact cars like the Nissan Sentra or Chevrolet Aveo.

Predominantly, the market bears low-grade small sedans, compact SUVs, and small pickups, classified as Class-A vehicles, known as ‘obsolete models that were phased out two or three decades ago’.

The Mexican market lacks influential domestic vehicle brands, making it a massive dumping ground for global car manufacturers. Nissan, General Motors, Volkswagen, Toyota, and Kia dominate the top five in Mexican vehicle sales, building upon their groundwork in the conventional fuel era.

Although Chinese automakers currently hold a much smaller market share in Mexico compared to multinational car manufacturers from Europe, America, Japan and South Korea, the growth in sales is exceptionally notable. According to the National Institute of Statistics and Geography (INEGI), as of January to July 2023, Chinese car brands accounted for 9.3% of total sales, which is over ten times higher than 0.6% in 2019.

In 2022, SAIC Motor’s MG brand sold 48,112 vehicles in Mexico, taking a market share of 4.4\%, an increase of 194.1% compared to last year’s sales of 16,358. JAC Motors sold 16,357 vehicles, a market share of 1.5\%, with an increase of 99.4% compared to last year’s sales of 8,203.

In terms of price, the MG brand in Mexico starts at 298,000 Pesos (equivalent to approx 125,000 CNY), and JAC Motors at 299,000 Pesos (equivalent to approx 125,000 CNY), which are generally on par with the mainstream prices of small cars on the market.

Although this price range fails to give an edge to some upscale electric vehicle brands, the large base number allows Chinese new energy vehicle manufacturers to put more price-friendly and popular models on the market and win over Mexican consumers.

Chinese Automakers Beginning to Make Their Mark

With the support of sales volumes, many Chinese brands are making their presence felt in the Mexican market.

The National Institute of Statistics and Geography counted the most popular six Chinese brands in the local market for 2023.

-

SAIC Motor’s MG brand sold 4,925 vehicles in the Mexican market in March 2023.

-

Chery, one of the newest Chinese car brands in the Mexican market, sold a total of 3,369 vehicles in Mexico in March 2023.

-

JAC Motors, which entered Mexico in 2017 and is one of the earliest Chinese car brands in Mexico, sold 1,713 vehicles across Mexico in March 2023.

-

BAIC, JMC and CCAG, jointly sold under the name Motornation in Mexico, sold 1,035 vehicles in March 2023.

In addition to the traditional car export model, Chinese automakers, including those for new energy, are gradually exploring models of establishing local factories in Mexico or deepening cooperation with local agents.As of now, the Chinese new energy vehicle companies entering Mexico include, but are not limited to:

-

In 2019, JAC Motors officially launched its new energy vehicle in Mexico. JAC has always been one of the main suppliers in the local electric vehicle market and has established an assembly plant in the state of Hidalgo.

-

In 2022, Chery entered the Mexican market under the name CHERY, aiming to build a factory with an annual output of 400,000 vehicles that will primarily be used to produce new energy vehicles. In October 2023, Brian Wu, executive vice president of Chery Mexico, announced plans to return to the U.S. market and revealed the first batch of cars entering the U.S. would include pure electric and PHEV models produced in the Mexican factory.

-

In December 2022, Jetour Motors signed a cooperation agreement with the Mexican LDR Group, officially entering the Mexican market. In March 2023, Jetour announced a $3 billion investment to establish a new plant in either Aguascalientes or Guanajuato. The factory is expected to open in 2024, initially producing gasoline cars and transitioning to purely electric vehicles within two to three years.

-

On March 15, 2023, SAIC Motor announced the inaugural voyage of its self-operated Ningde – Mexico international route, transporting MG MULAN vehicles to Lazaro Cardenas port in Mexico. In April, MG Motors announced plans to build a new factory in Mexico and enter the U.S. market.

-

In March 2023, Great Wall Automobile established a subsidiary in Mexico and successively launched two new energy vehicles. Relevant officials reported initiation of investment project research for a local factory. On September 7, 2023, a brand unveiling and product launch event with the theme “Hello Tomorrow” was held for Great Wall Automobile (GWM) and Haval H6 HEV, officially announcing market entry and operational start in Mexico city.

It’s worth mentioning that Chinese new energy vehicle giant BYD has also entered the Mexican market.

- As of now, BYD has established 6 offline dealerships in Mexico, plans to operate 50 by the end of this year and extend its business layout to all 32 states. In September 2023, BYD Dolphin made its debut in Mexico and officially started sales, with plans to sell up to 30,000 vehicles next year. Stella Li, executive vice president and president of BYD Americas, expressed that BYD will launch five new electric vehicle models in Mexico in 2024 and reaffirmed plans to establish a manufacturing plant.

According to incomplete statistics, over ten Chinese auto companies announced their entry into the Mexican market in 2022, and this year has seen even more Chinese new energy vehicle brands setting up shop.

Why Mexico?Besides market potential, the reason Chinese car companies have set their sights on Mexico is intricably linked to their industrial accumulation, geopolitics, and treaty dividends.

The United States’ “Backyard” for Automobiles

When discussing Mexico, the United States inevitably comes up.

In the early 20th century, Ford Motor Company established a complete car assembly line in Mexico. Car manufacturers around the world started to flood into the Mexican market in the 1950s and 1960s. In the 1960s and 70s, the Mexican government issued new regulations, and many car and parts companies chose to establish factories in Mexico for manufacturing. As the Mexican economy developed along with the growth in car sales in the Mexican market, this attracted a large number of car manufacturers to Mexico. The car manufacturing industry gradually developed into Mexico’s largest manufacturing industry and evolved from initial assembly to a car manufacturing center with full manufacturing and research and development capabilities.

Mexico’s economy heavily depends on the United States, with its primary economic sectors, including the oil industry, manufacturing, and export processing industry, all oriented towards the U.S market. Mexico’s mineral resources are also very abundant. As one of the major oil-producing countries in Latin America, oil product exports are a primary source of fiscal income for Mexico. Secondly, remittances primarily from the United States are Mexico’s second-biggest source of foreign income.

And with the hollowing out of industries in the United States, combined with the advantage of a convenient geographical location, abundant and low-cost labor, and an advantageous supporting industry, Mexico has become the main production base for U.S. light vehicles, further promoting the development of Mexico’s car industry.

In 1994, the North American Free Trade Agreement (NAFTA) officially came into effect. According to the agreement, Mexico’s duty-free processing factories could be exempt from import duties, and they could enjoy tax benefits for specific products. Under such conditions, the development of Mexico’s manufacturing industry was accelerated. The bilateral trade between the United States and Mexico under NAFTA contributed to the rapid development of Mexico’s economy and further promoted car sales in Mexico.

In 2020, the United States, Mexico, and Canada signed the new trade framework agreement, United States-Mexico-Canada Agreement (USMCA). Unlike NAFTA, the USMCA explicitly stipulated that by 2025, at least 75% of the parts used by car manufacturers must come from North American countries. NAFTA stipulated a proportion of 62.5%. This means that 75% of the parts in cars produced in Mexico must come from Mexico to pass customs duty-free. Therefore, if overseas car manufacturers wanted to enter the U.S. market after producing in Mexico, they needed to first manufacture in Mexico, providing convenience for businesses facing the U.S. for production and exports.

In August 2022, the United States introduced the “Inflation Reduction Act,” claiming to provide subsidies to support the production and investment of electric vehicles. This includes nine tax benefits. However, the prerequisite is that the new energy vehicles produced and sold in North America should not use batteries made in China. Only electric vehicles meeting these conditions can obtain a tax reduction of $7,500 per vehicle.

In addition, Mexico has signed 14 Free Trade Agreements (FTAs) with 52 countries and regions, enhancing Mexico’s export advantage and facilitating products manufactured in Mexico to enter these countries and regions.

These agreements have bolstered trade between the United States and Mexico, offering more conveniences for Mexico and further accentuating its label as the United States’ “backyard”. Most importantly, it provides a visible breakthrough for companies hoping to enter the American market, making Mexico the “chosen one” for investment in the automotive industry.

The Gap in the New Energy Industry Chain

In terms of the new energy vehicle industry, the Mexican government has given some support to the electrification of the automotive industry.

Whether it’s global energy security and climate change issues or Mexico’s domestic economic development, the Mexican government has realized the significant role that the new energy vehicle industry might play in national development, and it has been sending positive messages to the world. Policy support and foreign investment have accelerated the pace of Mexico’s automotive industry’s electrification.

Marcelo Ebrard, a strong rival for the next Mexican presidency, and the current Foreign Minister, has publicly stated:

The government plans to achieve a target of electric vehicles making up half of domestic car sales by 2030.

In relevant documents, the “Nationally Determined Contributions (NDC)” of the “United Nations Framework Convention on Climate Change” referred to the vision of electrification in the transportation sector among Latin American countries. Among them, Mexico’s electric vehicle policy goal is to reach a 5% proportion of electric vehicles in new car sales by 2030; raise this proportion to 50% by 2040, and to 100% by 2050.

In terms of specific measures, by 2024, the Mexican government will temporarily exempt electric vehicles from import taxes, while the import tax for fuel cars stands at 8%-20%; they will provide incentives including exemption from inspection and maintenance plans to various central states and simultaneously waive registration taxes.

Interestingly, the Mexican government has an open attitude towards new energy vehicles, yet lacks a complete new energy industry chain as support. According to a report by LatePost, suppliers required for electric vehicle electrification, thermal management, and intelligence make up only 2.2% of Mexico’s auto supply chain, while the proportion in China is 8.8%. This has spurred multinational automakers from the oil vehicle era to carry out factory electrification upgrades and has allowed newcomers to Mexico to participate in the establishment of the new energy industry chain.

Now, Mexico appears to have also become a nexus for the global layout of the new energy industry chain.In 2021, numerous multinational companies in Mexico began upgrading their manufacturing facilities to produce electric vehicles. GM, FORD, Stellantis, Volkswagen, and other European and American automotive groups have planned for electric car production capacity in Mexico:

-

On April 29, 2021, General Motors announced they would invest $1 billion into a plant in Coahuila, Mexico, planning to manufacture electric cars in this factory by 2023.

-

In May 2022, FORD’s factory in Cuautitlan, Mexico finished a comprehensive upgrade, opening up new orders for the Mustang Mach-E.

-

In August 2022, Stellantis considered renovating its factories in Mexico for the production of hybrid and pure electric vehicles, contemplating an investment of billions of dollars in a factory in Mexico.

-

On October 27, 2022, Volkswagen stated that it would invest $763.5 million in a factory in Puebla, Mexico between 2022 and 2025, planning to manufacture multiple electric SUV models there.

-

On February 3, 2023, BMW announced an investment of €800 million to establish its first BMW electric car factory in San Luis Potosi, Mexico. General Motors anticipated producing electric cars in its Mexican factories by 2024. Furthermore, Volkswagen and automotive parts supplier Continental also committed to making substantial investments in Mexico.

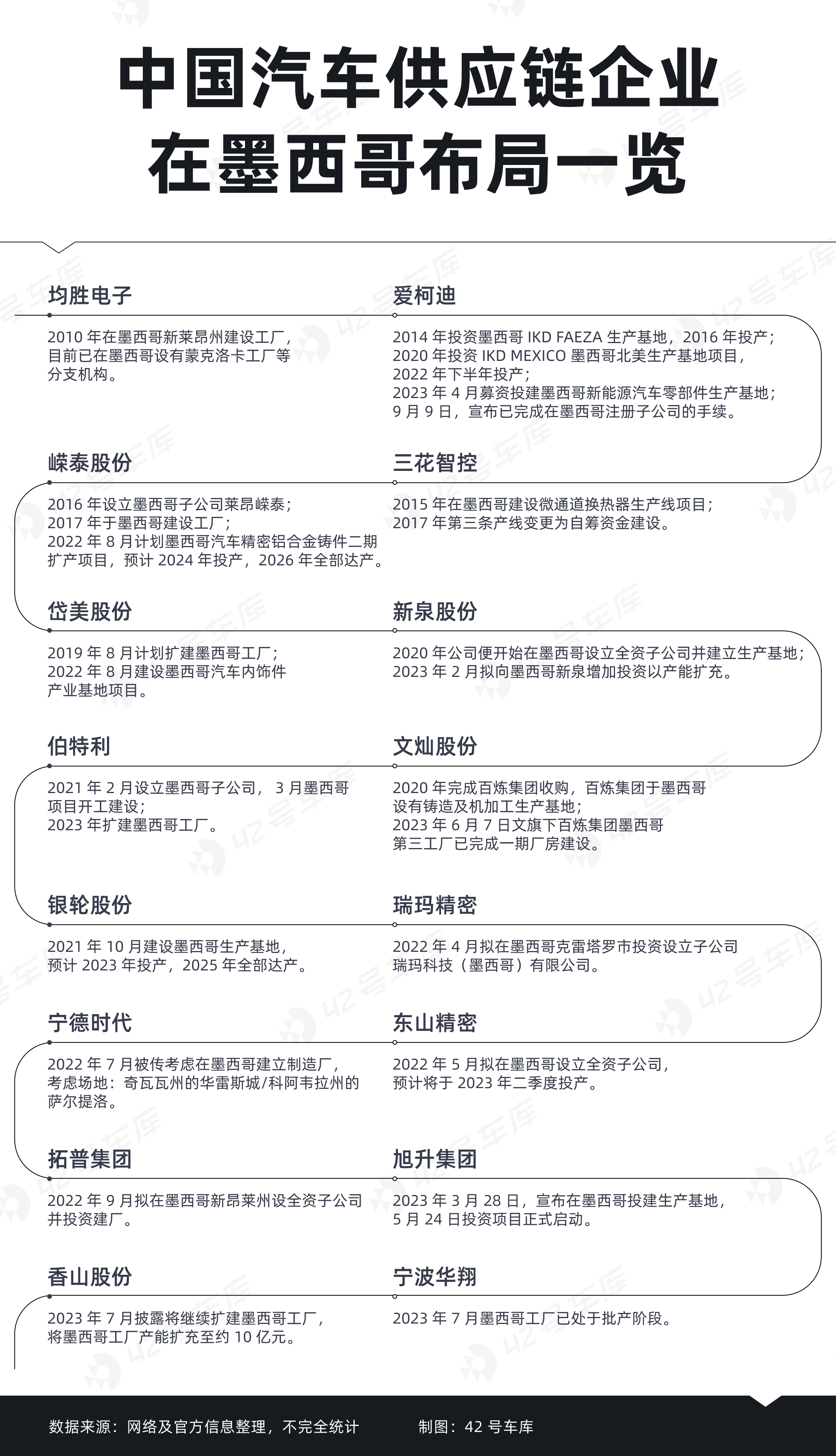

The Chinese new energy supply chain manufacturers also perceived this business opportunity, mainly deciding to establish a presence in the industrial zones of Northern Mexico.

Respectively, Tesla announced its establishment of a factory in Mexico, pushing Chinese new energy industrial chains to pioneer the Mexican market to a new peak.

In March of this year, Musk announced a $5 billion investment plan to build a mega (giga) factory in Mexico. Following this, reports emerged that Tesla was mobilizing Chinese supply chain companies to construct factories in Mexico. According to Samuel Garcia, the Governor of Nuevo León, Mexico, it is expected that Tesla’s Chinese suppliers will provide nearly $1 billion in investment.

Rumors surfaced that Tesla informed the Chinese ‘Tesla Chain Companies’ that if they failed to achieve localized production in Mexico by 2025, not only would they struggle to secure new orders from Tesla’s Mexican factory, but existing orders being exported to American factories could also potentially be canceled. From the manufacturers’ perspective, they certainly wouldn’t want to miss out on any lucrative opportunities, regardless of whether or not they’ve been included in the ‘Tesla Chain.’ If they manage to establish a presence in Mexico, they are also likely to secure steady business from other buyers in North America.Tesla urges its Chinese “Tesla-linked companies” to replicate its past achievements, facilitating a more rapid development of Mexico’s new energy industry.

Challenges and Difficulties Lurk in the Shadows

Despite the seemingly advantageous conditions for corporations, there are obstacles to overcome, suggesting that expanding operations in Mexico is not as simplistic as it appears.

On October 18th, at Tesla’s third quarter financial meeting, the discussion turned to the Mexican super factory. Musk confirmed plans to build a factory in Mexico, but due to the global economic climate, the commencement date for the construction remains uncertain. The Mexican factory may begin its construction phase in early 2024. It was also suggested that cost-cutting initiatives to boost profits may delay the pricy construction effort in Mexico.

The delay in the completion of Tesla’s Mexican super factory casts a shadow on Mexico’s automotive industry’s push towards electrification.

Tesla is facing such uncertainties, and for Chinese corporations, the prospect of building a factory in Mexico requires a preparedness to face high construction costs, higher labor costs, and poorer infrastructure conditions.

Ignoring initial outlay in terms of finances and time commitments, labor cost alone presents a substantial expense. As reported by “LatePost”, the hourly wage for manufacturing workers in the state of Nuevo León is approximately $4.8, slightly higher than the $4.5 hourly wage for Chinese workers. Mexican manufacturing workers’ proficiency is also lacking, which leads to businesses paying substantial overtime fees, with two hours of overtime work costing 200% of the hourly wage, and four hours costing 300%.

Beyond this, Mexican law does not allow for contract-based labor and requires corporations to pay social security for their employees at 35% of the full salary, provide commercial health insurance, and various bonuses. This is not even mentioning the local wage payment systems, bi-monthly paydays may even face issues with employee instability.

For the local consumers, procuring an electric vehicle entails a significant expense. A wide wealth disparity exists in Mexico, with a small proportion of the population being wealthy, and a majority being low-income individuals. The market is filled with older vehicles and entry-level cars, with those capable of purchasing new energy vehicles being the minority. The lack of an established new energy industry in Mexico means that subsidies for new energy vehicles are not applicable to manufacturers, therefore, these subsidies mostly aim at consumers.

At present, Mexico’s subsidization policies for new energy vehicles include:

-

Tax exemptions of approximately 30%-50% on new cars, with a 16% exemption on property tax depending on the specific vehicle model.

-

Taxis are eligible for an income tax reduction of up to 250,000 pesos (around CNY 100,000)In addition, a bevy of preferential policies have been instituted in the capital city of Mexico, including waiver of registration fees, free parking, toll reductions, and relaxed transit regulations.

However, affected by geographical factors, the prices of domestic new energy vehicles entering the Mexican market are typically 30-40% higher than those of fuel vehicles. Even factoring in subsidies, the cost is still about 20% higher than fuel vehicles. Taking into account the high electricity costs, this prevents new energy vehicles in Mexico from establishing a significant price advantage over traditional fuel vehicles.

Besides the above two points, the local refueling environment can also restrict the market sales of new energy vehicles.

According to the Mexican National Auto Parts Industry Association (INA), in 2022, there were only 1,189 charging stations for electric vehicles in Mexico. These stations are primarily located in the capital and other major urban areas. The five states with the highest number of charging stations are Mexico City (272), Jalisco (126), Nuevo León (101), State of Mexico (95), and Baja California (51), respectively.

The Mexican Federal Electricity Commission predicts that by 2041, Mexico would need another 38,000 charging stations to provide power for 700,000 electric vehicles. However, this requires a timeline of 8 years. In contrast, the installation speed of charging stations cannot keep pace with the growth of electric vehicle sales.

Clearly, whether it’s the new energy industry chain, electric vehicle sales, or refueling facilities, Mexico’s electrification journey is just beginning.

Concluding Remarks

Undoubtedly, Mexico holds promise as an important station in the global layout of the new energy vehicle industry. This is closely tied to its vast market potential, strategic location, and supportive stance towards the new energy vehicle sector.

Yet, Mexico’s path to electrification seems longer than in other countries or regions, or perhaps it’s just not as clear as it could be.

During the actual implementation process, even globally distinguished new energy vehicle manufacturers like Tesla face significant challenges. As confessed by Musk during a financial meeting, building a factory in Mexico might result in high-cost pressures.

The current situation in Mexico is not sufficient to support the rapid development of new energy. Nevertheless, the Chinese new energy vehicle supply chain companies that chose to establish factories in Mexico believe that Tesla’s Mexican factory will stimulate the growth of new energy in Mexico. Chinese new energy vehicle companies are also optimistic about the vast blue ocean that is the Mexican market, predicted to increase by a million new vehicles annually.

After all, beyond Mexico, the larger and more substantial market to watch is undoubtedly the United States.

This article is a translation by AI of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.