Israel is becoming a new focal point for Chinese new energy car exports.

Ever since SAIC MG opened up this new territory, in recent years, a surge of Chinese new energy car brands have moved into this territory – just recently, ZEEKR and Xpeng have officially announced their entry into the Israeli market on the same day.

So, why do major Chinese automakers choose to ‘set sail’ in Israel? How is the Chinese new energy performing in Israel?

The New Variable in the Israeli Car Market

The Growing New Energy Market

The new energy is becoming a highlight in the Israeli car market.

In fact, in Israel, a country completely dependent on imported cars, local consumers rely heavily on passenger cars. As a small and highly urbanised country, Israel’s population is concentrated and the residential density is high. According to 2021 statistics, out of more than 9.5 million people in Israel, 237, 000 families, 93% of these families are located in cities, and up to 35% of them live in the same city.

Among them, 54.9% of the people were working elsewhere, hence, two-thirds of the families in Israel have at least one private-owned car, nearly a quarter of the families have two or more cars, and 12% of family expenditures were spent on cars. Therefore, the number of privately-owned cars in Israel is very high, in 2022, the number of privately-owned cars in Israel was over 3.4 million.

However, in terms of annual sales, the Israeli car market is indeed not very large.

Specifically, in 2022, the annual car sales in Israel were 268,145, a 7.8% decrease compared to the annual sales of 290,952 in 2021. Furthermore, in the past five years, the annual sales of the Israeli car market were all below 300,000.

However, in this not-so-large car market, new energy cars, represented by pure electric, are growing rapidly.

In 2022, the number of electric cars delivered in Israel was 27,671, a 253% increase compared to the sale of 10,935 pure electric cars in Israel in 2021. Accompanying this sales performance, within a year, the penetration of pure electric cars in the Israeli car market rose from 3.8% in 2021 to 10.3% in 2022.

Therefore, Israel, the only country in the Middle East that is considered as developed, is actively embracing new energy.

From the market perspective, mainstream car models in Israel are mainly passenger cars such as SUVs and sedans. The current average price of electric cars in Israel is 165,000 New Shekels (about 314,000 RMB), focusing on the high-end car market. The relatively high price of pure electric cars targets the local consumer group with higher economic income in Israel.

There’s an argument that says if new-energy vehicle companies focus on more niche markets, the launch of electric vehicles priced between 14-14.5 thousand New Shekels (roughly ¥26.7-27.6k RMB) with over 400 kilometres of range, could gain more competitive edge in Israeli domestic market, attracting more gasoline vehicle consumers to switch to electric vehicles.

Moreover, electric vehicles primarily used in cityscapes, or promoted as a family’s second vehicle, suit Israel’s automotive consumer market demands adeptly. Additionally, with a per thousand car ownership of over 400, which is relatively low compared to other developed countries, Israel left ample room for the growth of the electric vehicle market.

China’s New Energy – Taking the Lead

What does the performance of China’s pure electric new energy vehicles look like in such an automotive market?

Judging by the current Israeli market, China’s new energy brands have already become a significant part of the pure electric vehicle market. In 2022, Chinese brands of new energy contributed to half of Israel’s annual pure electric sales. With 6,861 units sold, Geely takes the lead in pure electric market, defending China’s new energy’s position in pure Israeli electric market with BYD’s 3,710 units sold.

According to data released by the Israel Vehicle Importers Association in July, BYD and Geely – have become the bestselling Chinese brands of electric vehicles in Israel for first half of the year 2023, with 9,389 and 4,489 units sold respectively.

In the first half of the year 2023, the share of Chinese new energy brands in Israeli electric vehicle market rose from last year’s 50% to current 60%. As for brand-wise, the top four brands contributed to as much as 73% of electric vehicles delivered in Israeli market in first half of the year, the top two of which are from China:

- BYD, with 9,698 units sold, owning 33.6% of the total market share, nearly quintupling 5.8% of the same period last year.

- Geely, with 4,492 units sold, owning 15.6% of the total market share.

- Tesla, with 3,298 units sold, owning 11.4% of the market share.

- HYUDNAI, with 3,134 units sold, owning 10.9% of the market share.

Interestingly, as Chinese auto manufacturers are moving into Israeli market, the number of electric models in Israeli automotive market is increasing rapidly, rising from mere 12 pure electric models in 2019 to 79 models in 2022—new Chinese brands entering the Israeli market keep showing up as of July this year.### Supply Inadequacy in the Refueling Landscape

Is Israel keeping up with the rapid proliferation of electric vehicles in terms of the refueling ecosystem?

Unsurprisingly, as in other markets where renewable energy has gained fast traction, Israel too grapples with the issue of supply not meeting the demand for refueling.

After all, in addition to pure electric vehicles, Israel has a significant hybrid fleet that inevitable faces issues such as difficulties in charging and long charging times. As a result, Israeli car owners often resort to extension cords for refueling. They may also opt to install home charging posts, provided they have private parking slots. With the parking struggle prevalent in dense urban areas of Israel, adding to the complications in refueling.

Moreover, the Israeli government has been taking strides to enhance the local refueling conditions.

As early as 2018, the Israeli Energy Department issued the “Initiative on Approving Electric Vehicle Charging Stations” four times, outlining the plan for a nationwide charging network. It has explicitly allocated 30 million new shekels (around RMB 57.23 million), with the goal of building 60 public fast charge stands and 2,500 private charging posts by 2021 and 13,000 public fast charge stands and 100,000 private charging posts by 2029.

According to the initiative, by 2030, Israel would need around 60,000 public slow charging posts and 1,000 fast charging posts, costing approximately 1 billion new shekels.

Charging infrastructure majorly concentrated in city centers aligns well with the charging needs of urbanized Israeli population. The Energy Department of Israel has stated that charging posts will be installed near highways, cinemas, large malls’ parking lots and the vicinity of some large working units.

However, as per the actual implementation, by the end of December 2021, there are approximately 190 electric vehicle charging infrastructures open to the public throughout Israel, with a total of 871 charging stations – only about 35% of the set target.

Overall, it’s clear that in terms of charging infrastructure layout, Israel’s progress in establishing the charging station has been far slower than anticipated.

Why Israel?

An Untapped Goldmine

Chinese New Energy market made its foray into Israel in 2019.

At the end of 2019, SAIC Group launched the MG ZSEV in the Israeli market, which opened up the new energy automotive market in Israel. This was the first pure electric vehicle from a Chinese auto maker to land in Israel and the first pure electric vehicle on the market – a monthly sales performance of over a hundred units was quite impressive at that time.

In 2021, SAIC’s MG sold nearly 3,000 units in Israel. Although its auto sales ranking didn’t make it to the top 20, the overall uptrend was robust, with a year-on-year increase of over 100%. In 2022, MG’s sales directly jumped to the 13th place on the sales roster, totaling 5,081 units, up by 71.9% year-on-year.

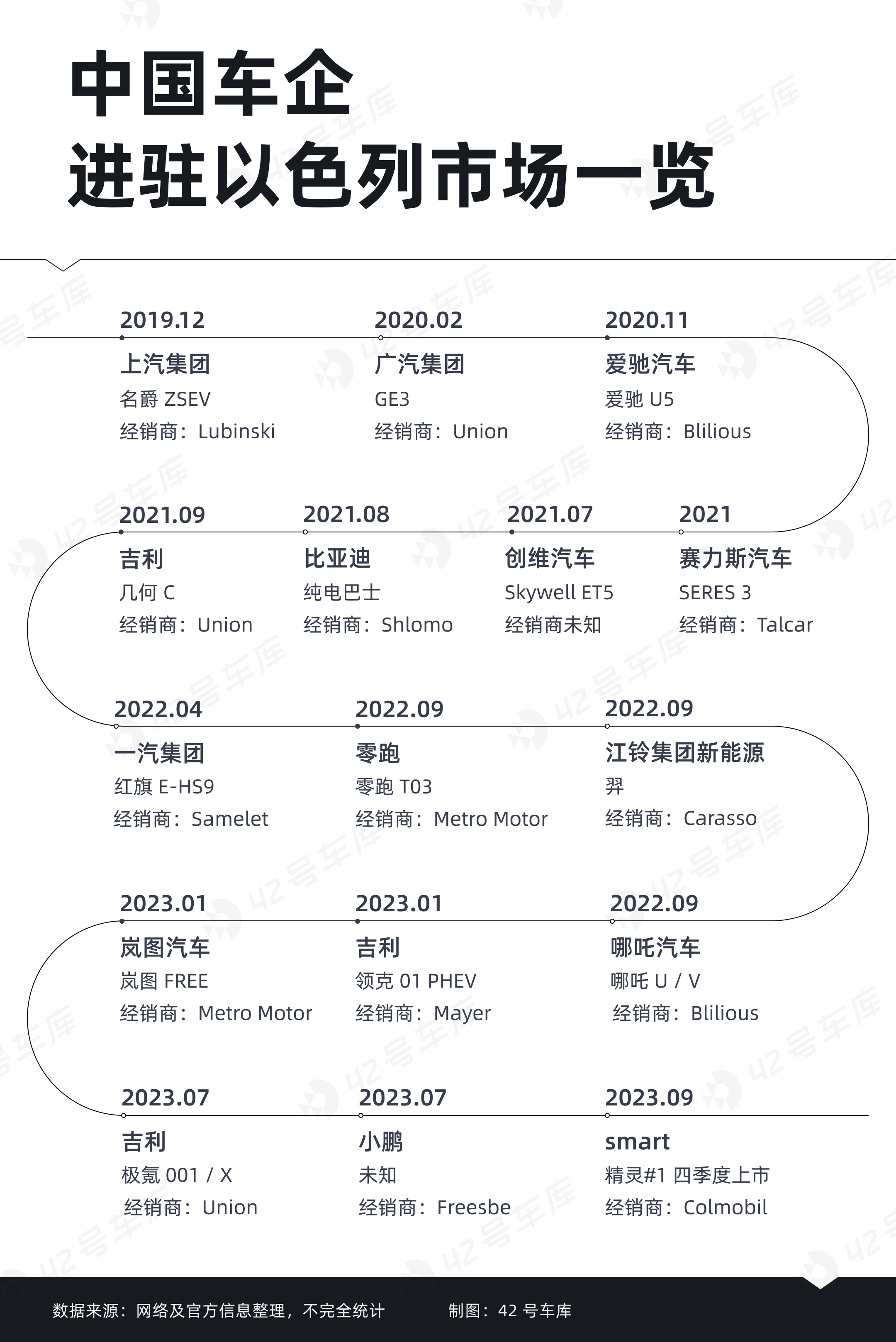

From then on, Chinese new energy brands have sprung up in the Israeli electric vehicle market like mushrooms after a rainstorm —

From then on, Chinese new energy brands have sprung up in the Israeli electric vehicle market like mushrooms after a rainstorm —

- In November 2020, ALWAYS launched its first model, ALWAYS U5, in Israel. It was delivered in the second quarter of 2021, with annual sales exceeding 1,500 units, ranking among the top three in Israel’s national electric vehicle sales for that year.

- In July 2021, SKYWORTH auto, established for only three months, announced exports to Israel, introducing the model Skywell ET5, with a top price of 190,000 new shekels, equivalent to RMB 376,000. However, the same EV6 model in the Chinese market has a top price of only 240,000 yuan.

- On August 2, 2021, BYD announced entry into the Israeli market, appointing Shlomo auto company as the national distributor in Israel, responsible for the sales and after-sales service of electric vehicles locally.

- On September 7, 2021, Geometry, under the banner of Geely, received 2,000 orders. By the end of the same year, Geometry C was launched in Israel. In 2022, Geometry C had a high market share of 22% in Israel’s pure electric vehicle market and was rated as the “best buy of the year” by the local auto magazine. The annual sales reached 6,816 units, ranking ninth in Israel’s electric vehicle sales.

- On September 8, 2022, LEAPMOTOR began its journey to Israel. In November, it opened several overseas stores in Israel, and in December, LEAPMOTOR T03 entered the Israeli market.

- On September 22, 2022, JMEV collaborated with Israeli auto importers, and its pure electric car “Yi” was exported to Israel.

- On September 28, 2022, HOZON announced its march into the Israeli market, partnering with the distributor Blilious Group, with HOZON U and HOZON V entering first.

- On January 16, 2023, Lynk & Co 01 PHEV officially went on sale in Israel, priced at about 229,900 new shekels (equivalent to RMB 453,000).

- On January 28, 2023, VOYAH officially entered the Israeli market with a brand launch in Tel Aviv, starting pre-sales of VOYAH FREE simultaneously.

- On July 10, 2023, ZEEKR announced a partnership with Union Group in Israel, introducing ZEEKR 001 and ZEEKR X.

- On July 10, 2023, Xpeng announced its entry into the Israeli market in Q4, with local auto dealer Freesbe responsible for its sales and service network.

It’s worth mentioning that in mid-September, smart announced a deal with the Colmobil Group, taking advantage of Colmobil’s extensive luxury brand operating experience in Israel to better expand the Israeli market. smart’s #1 is expected to officially launch in Israel in Q4 this year, followed by smart’s #3, which will enter the Israeli market in 2024.Accompanied by this movement, the current Israeli new energy vehicle market is increasingly becoming a foreign ‘arena’ for Chinese brands.

Israel’s Positive Transition to New Energy

Chinese car companies are actively pouring into this land, which is inseparable from the local strong support for new energy.

In fact, to encourage the transition to new energy vehicles, the Israeli government has introduced a series of supportive policies:

- As early as 2018, the Israeli government announced that from 2030, it would completely ban the import and sale of gasoline and diesel vehicles.

- Prime Minister Naftali Bennett announced that Israel aims to achieve a net-zero emission target by 2050.

- Energy Minister Yuval Steinitz said the plan is to reduce the tax on electric vehicles to ‘almost zero’, and through subsidies, invest an expected 25 million and build more than 2,000 new charging stations.

As for taxes, the tax on electric vehicles is relatively low. Compared to the traditional fuel vehicle’s tax rate of up to 83%, the pure electric vehicle’s purchase tax is only 10%, and the plug-in hybrid electric vehicle is levied with a 40%-60% purchase tax. In such a comparison, the tax on pure electricity can be said to be ‘almost zero’.

In 2019, the Israeli government announced that the tax benefits for pure electric vehicles would be extended until 2024. By 2022 the purchase tax on electric vehicles will be 10%, rising to 20% by 2023, then gradually increasing to 35% by 2024.

Iliya Katz, Deputy Director of the National Budget at the Treasury, said that increased taxation is used to cover the regular high maintenance costs of public electric vehicles. This implies that to some extent, Israel is encouraging people to shift towards public transportation and transform public buses and government vehicles into electric vehicles.

Even more crucially, Israel overall has a developed economy, with a GDP per capita exceeding 50,000 dollars, a high degree of industrialisation and technological level mainly led by knowledge-intensive industries. It is the breeding ground for many tech startups, therefore, Israel is also known as the ‘Nation of Innovation’, and the ‘Silicon Valley of the Middle East’.

Under such highly developed conditions, local consumers have a higher acceptance to new technologies and are more likely to accept new brands from China.

Challenges for Chinese New Energy Car Companies

It should be noted that under this wave of new energy, Israel’s technology sector has also emerged with many vital industry players.

Represented by the autonomous driving company Mobileye, Israel has been leveraging its robust technological foundation and military applications to cultivate and drive the development of a series of relevant technology companies in the field of autonomous driving of electric vehicles. Besides intelligence, in the area of electrification, Israeli car importers Shlomo Sixt and Union Motors have acquired charging companies, and there are also Israeli companies researching to improve the performance of the batteries needed for electric vehicles.

In such a land eager for new energy, which has not yet seen domestic new energy brands, is willing to accept new technologies and participate in them, the market also exudes a strong vitality, providing more opportunities for Chinese car companies. Meanwhile, Israel’s vehicle regulations refer to the American FMVSS regulations, the EU EC / ECE regulations and the Canadian CMVSS regulations, all of which provide convenience for Chinese new energy brands to test the waters overseas early.In this market where the development of new energy vehicles is pending segmentation, China’s new energy industry also finds itself amidst various dilemmas.

First is the issue of localization. Beyond creating vehicle models that meet local demands, strategies such as branding, distribution, sales, and others all pose significant challenges. Establishing partnerships with local dealerships is the most common approach adopted by many Chinese car companies to gain a foothold in the Israeli automobile market. By collaborating with major local car dealerships, these companies can access local resources and opportunities.

Following partnership agreements with dealerships, the question arises as to whether Chinese car companies can maintain their unique brand and sales model as it is, or whether they need to develop a new format to secure their uniqueness and withstand the competition posed by Tesla, which sells directly in Israel.

Secondly, it is crucial to observe the trends and changes of Japanese and South Korean car manufacturers within the Israeli market. According to statistics, South Korea was the largest source of cars in Israel in 2022 with over 60,000 car importations, followed by Japan which imported 47,000 cars. China was third with an importation of 25,000 cars. In terms of sales, the top five brands in Israel in 2022 were HYUNDAI, Kia, Toyota, Mazda, and Škoda, accounting for 55.9% of total annual sales with 149,974 units sold.

Thus, there is a substantial potential market within Israel for Chinese new energy brands. However, they may have a considerable path to traverse before they can truly capture this market.

Conclusion

A significant market space remains within the Israeli market for Chinese companies operating in the new energy vehicle industry.

By 2025, the Israeli Energy Department predicts around 177,000 new energy vehicles on the road, reaching a figure of 655,000 by 2028 – whereby electric vehicle sales will account for 35% of total new vehicle sales.

At present, although the overall volume is not large, the space offered by the Israeli market in terms of exports is enough to present an opportunity for domestic Chinese new energy companies.

Moreover, Israel is not just an important market from the angle of vehicle electrification and intelligence. It is also an innovator and explorer in the field of electric vehicle technology – in such an open car environment, through the Israeli market, the commencement of overseas markets.For the further exploration, the value for Chinese new energy vehicle companies has already outstripped the sales volume itself.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.