LI Auto, once again, made its ‘historical best’.

In the recently released Q2 financial report for 2023, LI Auto delivered its best quarterly performance since its listing: Revenue scale reached a new peak after Q1; the gross profit margin achieved steady growth, even surpassing Tesla; net profit performance was also very impressive, markedly improved from the last quarter.

Clearly, LI Auto is riding on a very strong upward momentum.

In fact, based on the Q2 performance, it’s not a surprise that LI Auto could present such a financial performance – after all, LI Auto’s L series has indeed formed a very competitive product system. Behind the product system, LI Auto repeatedly validates itself in organization, system, process, and other aspects.

On this basis, LI Auto is also laying a solid foundation for its long-term layout of ‘Pure Electric + Range Extension’.

The ‘Historical Best’ Score: Gross Margin surpasses Tesla

Unsurprisingly, the financial report that LI Auto presented is stunning, and it’s the ‘historical best’.

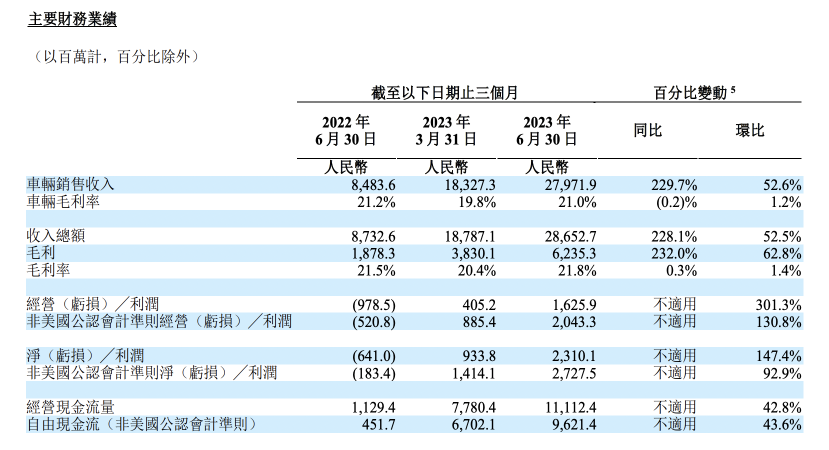

Overall, in the Q2 this year, LI Auto’s revenue was 28.65 billion yuan, a YoY increase of 228.1% compared with 8.73 billion yuan in Q2 of last year, and a QoQ increase of 52.5%.

Of which, income from vehicle sales was 27.97 billion yuan, an increase of 229.7% YoY, and 52.6% QoQ. Such yearly increase owes to not only increased delivery volume (up by 201.6%), but also a slight boost in average delivery vehicle price.

Then, let’s look at the gross margin performance.

In Q2, LI Auto’s gross profit was 6.24 billion yuan, a YoY increase of 232% compared with 1.88 billion yuan from last year, and a QoQ increase of 62.8%.

From the gross margin perspective, LI Auto’s Q2 gross margin was 21.8%, a significant growth compared with Q1’s 20.4% – this gross margin even exceeded Tesla’s gross margin in the same period (18.2%).

Also, as for vehicle gross margin, LI Auto’s performance was 21% in Q2, a clear increase from Q1’s 19.8%, whereas it was 21.2% in the same period last year. LI Auto also mentioned that if excluding the effect of LI ONE, the gross margin for the L series remained stable compared to Q1 of 2023.

In terms of profit:

- Q2 operating profit was 1.63 billion yuan, a QoQ increase of 301.3%, with a loss of 978.5 million yuan in the same period last year.

- In Q2, the net profit was CNY 2.31 billion, marking an increase of 147.4% over the first quarter. With this, LI Auto has realized profitability for three consecutive quarters.

Furthermore, LI Auto’s Q2 operating cash flow was CNY 11.11 billion, a rise of 42.8% QoQ; CNY 1.13 billion YoY and CNY 7.78 billion QoQ.

Overall, whether in terms of revenue size or profit making, LI Auto demonstrated its best performance since it went public in the second quarter, reflecting its continuous self-improvement.

Worth mentioning is that by the end of the second quarter, LI Auto’s cash and cash equivalents, restricted cash, term deposits and short-term investments (i.e., cash reserves) reached CNY 73.77 billion – such cash reserves also lay the foundation for LI Auto to enhance its risk resistance, long-term stable development, and continuous deepening of R&D investment.

Regarding this financial performance, LI Auto’s CFO, Mr. Li Tie also commented:

Our second quarter performance was robust, setting historical records with our revenue, net profit and free cash flow. Specifically, thanks to a marked rise in vehicle deliveries, our revenue increased 228.1% YoY to CNY 28.65 billion; our net profit grew to CNY 2.31 billion, and free cash flow reached CNY 9.62 billion. Our strong financial performance will support our deepening investment in R&D, speed up business development, and strive to create greater value for users, shareholders, and society.

After breaking the 30,000 monthly sales milestone, the next target is 40,000

From the second quarter business performance, LI Auto has become an undisputed ‘dark horse’ among Chinese automakers.

Specifics are as follows:

- In April, LI Auto’s deliveries reached 25,681 units, a fivefold YoY increase. In the same month, the L8 Air began deliveries and the L7 series had its first delivery month, already exceeding 10,000 in the month.

- In May, LI Auto’s deliveries reached a new high of 28,277 units, and the L7 deliveries surpassed 10,000 again. Notably, May saw LI Auto’s revenue breaking CNY 10 billion, marking the first monthly revenue exceeding CNY 10 billion.

- In June, amidst LI Auto ONE’s complete market exit and slight factory capacity increase, LI Auto’s monthly delivery volume for the first time surpassed 30,000, reaching 32,575 units, a 150.1% YoY increase. Consequently, LI Auto became the only luxury brand in China with monthly deliveries exceeding 30,000 units.

Besides, there were several highlights in Q2 for LI Auto’s delivery performance.

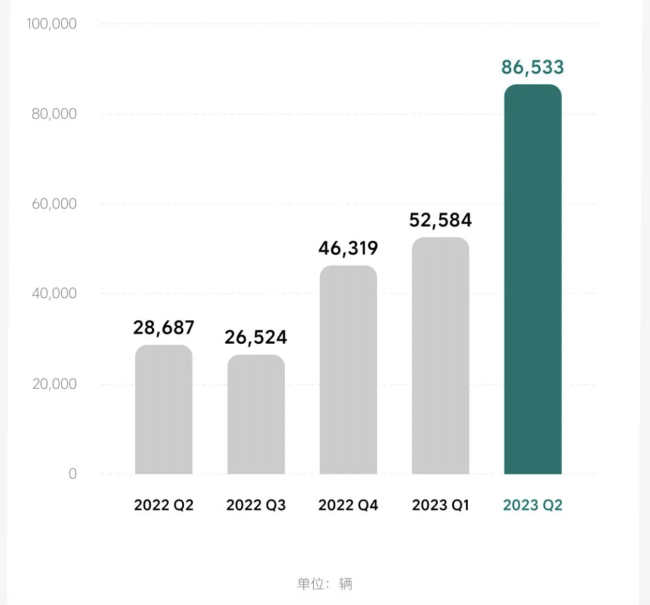

For example, in the price range of CNY 319,800 to CNY 459,800, LI Auto not only achieved more than 25,000 deliveries every month but also exhibited month-on-month increase, breaking the 30,000 monthly delivery volume in June and thus successfully fulfilling Mr. Li Xiang’s expectations from the previous quarter’s financial report conference call.In the overall perspective, in the second quarter of this year, the total deliveries of LI Auto reached 86,533 vehicles, a staggering increase of 201.6% year-on-year compared to the 28,687 vehicles during the same period last year. In contrast, during the Q2, Xpeng’s delivery declined by 32.6% year-on-year, and NIO’s delivery decreased by 6.1%. Even individually, the deliveries of LI Auto exceeded the total of Xpeng and NIO.

Such results are difficult not to envied by competitors.

Moreover, accompanied by these achievements, the deliveries of LI Auto for the first half of 2023 have already exceeded the total of its full-year deliveries in 2022. Conversely, this sales performance far exceeds LI Auto’s delivery expectation (from 76,000 to 81,000 vehicles) presented in the last quarter’s financial report.

On this, Chairman and CEO of LI Auto, Li Want, said:

We have crossed the important milestone of thirty thousand monthly deliveries in June. The second-quarter deliveries have soared to a record high, and all three models of LI series have led the sales in their respective sub-markets. These achievements have consolidated LI Auto’s market position as the preferred luxury car brand for families and have laid a solid foundation for the goal of breaking through RMB 100 billion in operating revenue in 2023.

Worth mentioning is that, in the disclosed sales data for July, LI Auto’s deliveries set a new record, reaching 34,134 vehicles. It broke through 30,000 units for consecutive two months, achieving a year-on-year growth of 227.5% – of which, on July 5, LI Auto also achieved a cumulative breakthrough of 400,000 deliveries.

Such delivery performance stands out not only among the new force brands but also in the whole Chinese new energy car market.

Based on the existing achievements, Chairman and CEO of LI Auto, Mr. Li, stated that the targets for the third quarter are for LI L8 and LI L9 to exceed ten thousand monthly units, and for LI L7 to challenge 15,000 monthly delivery target. Furthermore, to challenge the target of 40,000 monthly deliveries in the fourth quarter.

Additionally, as per the performance guidance given by LI Auto in its financial report, it predicts to achieve the delivery target of 100,000 to 103,000 vehicles in the third quarter, presenting a year-on-year growth of 277% to 288.3%. Considering that the delivery data for July has already been released, it implies that LI Auto is prepared to maintain delivery performance above 30,000 vehicles for both upcoming August and September.

This underscores the confidence of both Mr. Li and LI Auto.

Increased R&D investment, LI Auto strategically advancing pure electric layout

Although existing achievements are stunning, LI Auto remains vigilant.

Regarding R&D investment, LI Auto’s research and development cost reached 2.43 billion RMB in the second quarter. This is an increase of 58.1% year-on-year compared to 1.53 billion RMB during the same period last year, and a growth of 31% from the first quarter. LI Auto declared that this rise is due to the increase in employee compensation owing to more recruits and the cost of LI Auto expanding product line and technology.In response to this, Mr. Li personally stated in the financial report that in the increasingly fierce competition in China’s new energy vehicle market, LI Auto will enhance its competitive advantage through continuous investment in R&D, rapid business expansion, and improved organizational processes and operational capabilities.

In fact, LI Auto is already making ongoing business arrangements for the future.

For instance, in terms of product arrangement, on August 3rd of this year, based on the previous L series three models, LI Auto launched the L9 Pro priced at RMB 429,800. The main difference between it and the L9 Max lies in its autonomous driving level. Specifically, it no longer includes the AD Max that supports City NOA but it can still support Highway NOA.

Clearly, this product is a complement to the entire L series product line, benefiting LI Auto by seizing the market space from RMB 400,000 to RMB 450,000, and boosting its higher sales target. By now, this model has started delivery.

At the same time, to support sales growth, LI Auto is aggressively expanding sales channels and actively reaching out to third and fourth-tier cities. According to data released by LI Auto, as of July 31, 2023, LI Auto had 337 retail centers covering 128 cities and operated 323 after-sales repair centers and LI Auto authorized sheet-spray centers in 222 cities.

Interestingly, while expanding sales channels, LI Auto is also promoting an upgrade in the organizational process of a new business system in sales. A recognized change is: the transition from past regional management to refined provincial management, with direct management to storefronts by province.

With the new management framework, whether it’s resources allocation for customer acquisition or conversion, it has transitioned from being handled by the headquarter to being autonomously managed by each province and each store. A significant benefit of this is that the output of each LI Auto store and each product specialist has greatly increased, and the conversion rate from leads to orders has seen a remarkable improvement.

In the field of autonomous driving, LI Auto also held its first Family Technology Day in June, demonstrating its technological progress in intelligent space and intelligent driving and the open plan for City NOA and Commute NOA, both of which started test driving in June 2023. LI Auto stated that the City NOA and Commute NOA are expected to be pushed to 100 cities across the country by the end of 2023.

Of course, the most eye-catching is LI Auto’s first pure electric model.

Previously, at LI Auto’s Family Technology Day, LI Auto announced its 5C super flagship pure electric model, named LI MEGA, which will be launched by the end of 2023. The main feature of this model is its commitment to achieving 5C charging and optimizing the battery and thermal management system.

Simultaneously, for LI’s electric models, LI Auto is extensively deploying its supercharging network. LI Auto has already established 37 supercharging stations, and plans on building over 300 rapid charging stations by the end of this year and more than 3,000 supercharging stations by the end of 2025.

Regarding the LI MEGA, Li himself has high expectations. He stated in the financial report:

Our first 5C pure electric flagship model, the LI MEGA, will be released in the fourth quarter of this year. We are confident that the LI MEGA, the culmination of the latest technological achievements from our dual strategy, will become the new hot product with more than 500,000 in annual sales.

In Conclusion

This first half of the year was indeed one of rapid growth for LI Auto.

This growth can be seen in product portfolio, delivery results, and financial reports. More crucially, as a new entrant in the automotive industry, LI Auto has successfully built an organization, processes, and system capable of sustaining its positive business cycle. These structures are also in a phase of continuous growth.

This is what has made LI Auto a force to be reckoned with in the industry.

In fact, “growth” has become the core tag for LI Auto. In the financial report, Li also stated: As a growth-driven organization, LI Auto will continue learning, training, and growing, continuously producing products and services that exceed customer needs.

Looking from a growth perspective, we can see that LI Auto has already accomplished a phase of growth from 0 to 1, but this process was relatively long; In the phase of growth from 1 to 10, LI Auto’s pace is even quicker. Moreover, the next phase of development is already being planned under its dual strategy.

It’s worth mentioning that for the 1 to 10 phase, LI Auto has set a target of reaching a revenue scale of hundreds of billions this year – in the first half of this year, LI Auto’s revenue had reached 47.44 billion yuan. The expected revenue for the third quarter given by LI Auto is between 32.33 billion and 33.3 billion. Therefore, judging from the current revenue, reaching the goal of hundreds of billions in revenue is not far away.

Of course, in the long term, LI Auto still needs to continue growing.

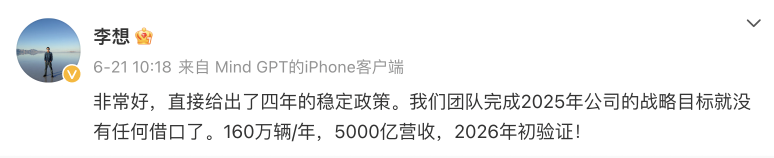

Currently, LI Auto’s product layout of “one super flagship + 5 range-extender electric + 5 high-voltage pure electric models” has already been determined for 2025. In addition, LI Auto also announced the overall strategy targets for 2025, aiming to reach 1.6 million scaled annual sales and a revenue of 500 billion yuan – these targets are still a long way off.Not only that, from 2023 to 2025, LI Auto will undergo what its founder Li Xiang defines as the “three-year elimination race of smart electric cars”. Despite the turbulence during this race, LI Auto must keep evolving and moving forward.

The key points discussed by LI Auto’s management in their finance call meeting are edited below without changing its original intention:

Q: What caused the bottleneck in LI Auto’s deliveries? Can it achieve 40,000 monthly deliveries in Q4?

A: Currently, LI Auto has two production lines at its Changzhou manufacturing base, and the total production of double shifts can reach 50,000 units. The main bottleneck is the supply of parts. As our sales have exceeded expectations, the supply of parts cannot keep up. However, this will soon be adjusted and confirmed. We are confident in increasing our sales target, and we are well prepared for it.

Q: What’s the latest progress of LI Auto’s organizational change? How do you assess the progress of the change?

A: Significant resources have been invested in upgrading the matrix organization. We believe that culture is essential for organizational change, such as prioritizing customers and choosing the right path over the easy one. The process indeed is our most important product for internal staff. In summary, the product upgrade brings us benefits and the organizational upgrade brings efficiency.

Q: What trend can we expect for the gross margin?

A: We anticipate an ongoing increase in gross margin and we are already observing positive elements.

Q: What’s the plan for LI Auto’s self-driving?

A: The City NOA and the Commute NOA functions of LI Auto will be activated following the previous logic. This mainly still refers to the local ownership of LI Auto. If a place has more owned units, there will be more data. As for the complete implementation of the NOA based on large models, we are confident to fully launch it in cities and on highways next year. The development test is currently underway.

Q: How do you provide Q3’s sales guidance? What’s the future sales target?

A: Our sales guidance reflects the maximum production capacity. We can achieve the target of 40,000 deliveries in Q4 after increasing the production capacity, and there’s no problem at all. In 2024, we are self-assured to challenge BBA’s sales in China. We aim to become the top-selling luxury brand in 2024.

Q: What is the progress of Mind GPT?

A: With regard to Mind GPT, we have full-stack self-research capabilities, mainly divided into four sections: data, algorithm, evaluation, and delivery. We also increased our search and recommendation capabilities. The current Mind GPT has 16 billion parameters, and we hope it can better align with our users and achieve conversational interaction with LI mates. Ultimately, it will become a set of products, making LI mates family members or car experts. We will share more progress in September. At present, internal testing has begun in the company, and will later be released to early users through OTA.Q: What are MEGA’s production capacity, sales expectations, and future all-electric plans?

A: MEGA aims to achieve over 500,000 sales, not limited by energy type or vehicle form. Next year, we will unveil four models: one range-extender SUV and three all-electric cars.

Q: LI Auto does not export, but there are some grey market exports. Does LI Auto consider supporting this?

A: No.

Q: Isn’t the goal of City NOA too aggressive?

A: We will roll out incrementally, not all at once, but our target for this year is still 100 cities. Compared with other players, we have advantages in perception, planning, our NPN network, and TIN network. Plus, our vast autonomous driving fleet gives us the maximum amount of training data for ongoing iteration of our algorithm. This is our greatest advantage.

Q: How can LI Auto further increase the operating efficiency of its stores?

A: Quality products and efficient channels are two sides of the same coin. Our internal goal is for each store to achieve a monthly sales target of 100 units within six months. We value store efficiency but do not focus solely on the short term. We will launch multiple models in the next two years and open more stores. The secret here is already clearly laid out by the BBA (Mercedes Benz, BMW, Audi) trio’s approach, which we will follow to support our sales.

Q: What’s the rationale behind LI Auto’s construction of charging stations?

A: Our target is to build 300 Super Chargers on highways by 2023 and cover 90% of highway miles and major cities by 2025. The financial pressure involved is completely manageable. We will self-build and manage fast chargers on highways, but use a dealership model for cities.

Q: Will LI Auto’s R&D expenditure increase in the future?

A: We will invest more in R&D, whether it’s towards autonomous driving or other aspects.

Q: If LI Auto enters the 200,000 – 300,000 price range, how can it maintain its competitiveness?

A: We are very confident about our L6. We believe it will be the highest-selling model in the L series. The key is to maintain our competitive edge as the first choice for household users within the same price range.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.