The Chinese new energy vehicle market rolled to new heights in the first half of this year.

On one hand, the price war sparked by Tesla’s price reduction plunged many new energy vehicle companies into disarray, forcing them to respond proactively in various ways.

On the other hand, with the trends of electrification and intelligence becoming market drivers, new energy vehicle companies are racing to implement high-speed/urban NOA and 800V technologies, leaving people overwhelmed.

Such a level of intense competition is truly world-class.

However, amidst this unparalleled competition, the Chinese new energy vehicle market as a whole still maintains an upward trend, and under this upward trend, some new development trends are becoming increasingly clear.

Half-Year Overview of China’s New Energy Vehicle Market

In the first half of the year, new energy vehicle sales continued to grow, but the growth rate has slowed.

Data from the China Automobile Association shows that the overall sales of new energy vehicles in the first half of the year were 3.747 million units, a year-on-year increase of 44.1%. Compared to the 120% year-on-year growth in the first half of 2022, this year’s first-half growth shows fatigue.

A similar situation also occurred in penetration rates. The penetration rate of new energy vehicles in the first half of the year was 28.3%, only a 2.7% increase from the 25.6% at the end of 2022. Compared to the average semi-annual growth rate of about 5.1% in the past two years, the growth of the penetration rate in the first half of this year has also slowed down.

Obviously, while the Chinese new energy vehicle market is still growing overall, its growth capabilities are starting to wane.

Data from the Passenger Association shows that BYD’s retail sales in the first half of the year reached 1.154 million units, a year-on-year increase of 82.2%, ranking first in the sales of China’s new energy vehicle market with a market share of over one-third. In second place is Tesla China, with sales of 294,000 units, a year-on-year increase of 48.9%.

AION, in third place, achieved sales of 209,000 units, a year-on-year increase of 103.5%, truly outstripping its competitors. It certainly lived up to GACGROUP General Manager Feng Xingya’s ambitious slogan of changing “NIO, Xpeng, and LI” to “AION, Xpeng, and NIO”.

However, whether “NIO, Xpeng, and LI” will change to “AION, Xpeng, and NIO”, looking at their sales data for the first half of the year, the landscape of “NIO, Xpeng, and LI” has indeed changed.

Among “NIO, Xpeng, and LI”, LI Auto is undoubtedly the biggest winner.

In the first half of the year, LI Auto achieved sales of 139,000 units, a year-on-year increase of 130.3%, and with an average product selling price of over 300,000, it was virtually thriving.

NIO’s sales in the first half of the year reached 55,000 units, a year-on-year increase of 7.4%. Despite unimpressive performance, they managed to sustain growth, whereas Xpeng experienced a steep drop of 39.9%, selling only 41,000 units.

NIO’s sales in the first half of the year reached 55,000 units, a year-on-year increase of 7.4%. Despite unimpressive performance, they managed to sustain growth, whereas Xpeng experienced a steep drop of 39.9%, selling only 41,000 units.

It’s worth mentioning that despite the fluctuating sales across automakers in the first half of the year, they share the common caveat — most are still some distance away from reaching 50% of their annual sales target.

This indicates that the auto industry’s days of price war struggles in the first half of the year were grueling. With the pressure to boost sales in the second half, times will be no less easing.

Another notable truth is that while the overall sales growth of new energy vehicles slowed down in the first half of the year, Plug-in Hybrids (including range extenders) are making significant strides.

Statistics from the China Automobile Association show that the PHEV segment sold 1.025 million units in the first half of the year, up 91.1% year-on-year. Although far behind the sales of BEVs which totalled 2.719 million units, the sales increase greatly outstripped that of pure electric models at 31.9%.

The surge in the sale of plug-in hybrids is largely attributed to the continuous launch of new models throughout the first half of the year and a drop in their prices.

New models, such as GEELY’s L7, Haval’s Owl, Wei’s Blue Mountain, Qin’s PLUS DM-i 2023 Champion Edition, and more have emerged. Among them, the PLUS DM-i 2023 Champion Edition reduced the starting price of PHEV to under 100,000RMB which made the model especially poised for growth.

In the context of the Chinese automotive market already entering the stage of inventory, any novel car category that emerges tends to squeeze the existing ones — facing an ever-growing number of PHEVs entering the field, BEVs are inevitably facing greater competitive pressure in an already uncertain new energy vehicle market, which further exacerbates market uncertainty.

Warfare of Pricing: Visible and Invisible Battles

The launch of pricing wars is one significant reason behind the sales results in the new energy vehicle market during the first half of the year.

On January 6, Tesla announced a price reduction for Model 3 to RMB 229,900 and for Model Y to RMB 259,900. Even though Musk has repeatedly stated that Tesla’s price cut is not aimed at competitors, it is unlikely competitors would stand still in the face of such moves.

Therefore, soon after Tesla initiated the price reduction, the domino effect quickly followed.

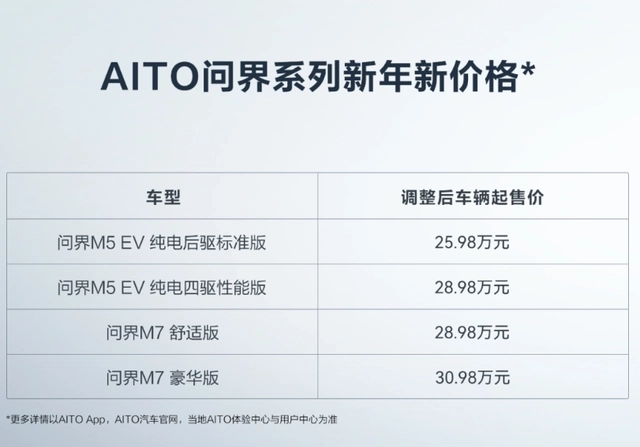

First off was AITO, announcing around a 30,000 RMB price reduction across all models. Then, on the heels of just three days, Xpeng announced a price cut with a maximum amount at 36,000 RMB. Soon, LEAPMOTOR and BYD also joined the fray.

However, this was just “localised firefighting” in the new energy car market. The tipping point that pushed this price war into “full blast” happened in March when Citroen offered up to 90,000 RMB in subsidies, which turned the pricing war into a free-for-all.In the Chinese automobile market that has already entered the era of stock, the pie is only so big, if someone eats more it means someone else eats less. “A Citroen C6 that cost 200,000 is old and outdated, a C6 that cost 120,000 is dignified and calm”. Some fuel vehicles that didn’t seem attractive became sought-after suddenly due to astonishing price reductions, which means that some new energy vehicles have to sit on the bench.

Thus, with the help of Dongfeng Citroen, the price war in the whole automobile market has officially erupted, and the new energy vehicle market is under pressure once again.

Interestingly, in this price war, besides the “open competition” with blatant price reduction, there is also the “covert struggle” with indirect price cuts.

On February 8th, LI L8 Air was launched, and LI Auto managed to reduce the product price by rolling out cheaper new versions of the model. However, BYD has pushed this method to its limits.

On February 10th, the Qin Plus DM-i Champion Edition, which only cost 99,800 yuan ({currency=USD, value=15624}), hit the market, afterwards, BYD Han EV Champion Edition, Tang DM-i Champion Edition and other champion edition models covering as many as 8 types were successively introduced.

Following LI and BYD, similar “champion edition” models have been increasing, such as AION’s AION Y Younger, Avatr’s Model 11 Single-Motor Version, and IM’s LS7 Urban Fit Edition.

NIO and ZEEKR have their unique tactics in the “covert struggle” besides launching “champion edition” models.

On June 12th, NIO announced a price reduction of 30,000 yuan throughout the whole lineup and braced for the price war. However, NIO didn’t rush forward blindly, but left a move in reserve.

As NIO stipulated, users who purchase after the price cut will no longer enjoy the rights such as four free battery swaps every month. If needed, users can spend 30,000 to buy back these rights before July 31st.

ZEEKR only talks about “value war” without mentioning price war. Their core strategy is to not reduce the product price but to offer more value for the same amount of money.

Therefore, ZEEKR launched a free upgrade package that allows users to enjoy up to 80,000 yuan worth of benefits including “Extreme Blue” exterior, air suspension, three-year zero-interest financing up to 200,000 yuan and other services, as long as they place an order.

In the first half of the year, all automakers have been struggling openly and secretly in the price war, squeezing their brains to sell cars, and even started to roll out volume sales on a weekly basis led by LI. But just like the overall data of the first half of the year shows, the increase in sales volume and penetration rate has slowed down, the actual return and the efforts of the automakers are not proportional.

Due to reasons including policy phasing out and holidays in December last year, the consumption demand for new energy vehicles had been overspent in advance, which resulted in a difficult start for this year, with sales down 48.3% MoM and 6.3% YoY in January.Although the sales of new energy vehicles have been increasing month by month since January, the year-on-year growth rate, apart from two concentrated bursts stimulated by price wars in January and March, has started to decline month by month after that.

By the end of the first half of the year, although the price war is still ongoing, it has begun to ease.

However, with the listing of Xpeng G6 as a turning point, the price war has taken a new turn, and growth may generate new momentum.

On June 29, the Xpeng G6 officially launched with a starting price of 209,900 RMB, 800V, XNGP, Xpeng G6 with standard configuration does not choose to install, the pricing style is a “bust”. Looking at the situation afterwards, the first month’s sales of Xpeng G6 exceeded 3,900 units, and the positive market feedback swept away the clouds accumulated by Xpeng over the past year. However, this has added a layer of cloud to its competitors.

After all, a product of 200,000 level has already carried the most advanced charging method (800V) and intelligent driving assistance (XNGP). In this way, how should its competitors price their products? It will likely be affected by Xpeng G6, making the price attractive and competitive in value.

Under the joint drive of price and value, the growth of the new energy vehicle market may generate new momentum, but for car companies, this could be a brutal real fight for comprehensive technology, production and sales, and supply chain competitiveness.

Some definite trends emerged from the “roll-out”

Although the growth rate of the new energy vehicle market has slowed down in the first half of the year in the fiercesome price war, the long-term development of the entire Chinese new energy vehicle market has some very clear trends.

Urban NOA landing, BYD enters the game, intelligence has reached a turning point

On March 31, Xpeng announced that its XNGP, based on China’s first and only mass-produced BEV sensing: XNet deep vision sensing neural network, has freed itself from its dependence on high-precision maps and opened the first stage of XNGP ability to users in Guangzhou, Shenzhen and Shanghai.

Within a month, great wall smart, IM, avatr and LI have all announced their own plans for urban NOA landing. Specifically:

- Great wall smart announced that it will realize urban NOH function in the third quarter of this year and open 100 cities by 2024;

- IM has released its urban NOA and is expected to officially start public testing by the end of this year;

- Avatr said that its NCA will land in 45 non-map cities within this year;

- LI’s urban NOA will push to 100 domestic cities by the end of this year.

At the same time, Tesla’s FSD has also moved to a new stage. As of Q2, Tesla’s FSD test mileage has exceeded 300 million miles, and the test mileage is increasing at an exponential rate. In addition, in July, Dojo supercomputing began mass production. Everything is ready, Tesla’s pursuit of fully autonomous driving is advancing step by step.With all players’ eagerness, the phase of intelligent assisted driving technology “entering the city” has been unveiled, which continues to drive forward the wave of intelligence in new energy vehicles.

Firstly, from a technical perspective, based on the BEV + Transformer technology scheme, intelligent assisted driving is not just restricted to simple scenarios such as automatic parking and high-speed leading, but it is gradually capable of dealing with more complex and ever-changing urban driving scenarios, stimulating demand with technology.

Secondly, from a business perspective, using intelligent driving to promote scale, accumulating data with scale, iterating intelligent driving with data, and ultimately utilizing intelligent driving to attract users’ payment, the business model has taken another significant step towards profit.

At the same time, this also signifies that automakers, having just passed the stage of hardwares, have to quickly move on to the stage of rolling up software.

The city NOA’s “entry” has advanced the wave of intelligence, but there is another force pushing this wave to a new height, and that is BYD.

On July 3, BYD released its self-developed high-level intelligent driving assistant system — Divine Eye, marking the opening of the second half of BYD’s intelligent journey. This suggests that BYD’s recognition of the trend has overcome Wang Chuanfu’s view that “autonomous driving is all bullshit.”

BYD’s formal entry will undoubtedly encourage more traditional automakers to recognize and exert effort in intelligence, changing the situation where intelligence has almost only been pulled by companies like Tesla and the new forces, and moving towards the direction of joint advancement by the entire industry.

Once the industry’s power is consolidated, the development of intelligence is also expected to reach an upward turning point.

Worth mentioning is that amid increasingly intense industry competition, automakers’ developments in the field of intelligent driving are also facing some new variables besides technical and business dimensions. A recent typical case is that as we have confirmed, Wu Xin, the head of Xpeng’s intelligent driving, will leave the company – this personnel change will inevitably bring new shocks to the field of intelligent driving.

However, it is certain that the embrace of intelligence by automakers has become an irreversible trend.

800V No Longer “Noble”

Despite the trend towards automobile electrification, the problem of energy replenishment for purely electric vehicles has been a major obstacle to the process of electrification.

As early as 2019, the Porsche Taycan took the lead in the industry, being the first to carry 800V, which can support a maximum charging power of 350 kW, and can charge the battery from 5% to 80% under ideal conditions within 30 minutes.

However, with a starting price of RMB 898,000 for the Porsche Taycan, 800V was only a privilege for a few.

In the following period, companies such as NIO, Avita, BYD, and Xpeng began to sequentially release their 800V technology, and some have already launched mass-produced models, but on the whole, the price threshold for ordinary users to experience 800V is still high.

Therefore, the market performance of 800V has not really progressed in a true sense.

Bear in mind that 800V represents only a part of the product’s competitive edge. To truly achieve a market progression, a comprehensive, competitive product is required as a driving force, and such a product is none other than Xpeng G6 launched in the first half of this year.

Further explanation of Xpeng G6’s overall competitiveness will not be reiterated here. You may refer to the previous article “The Turnaround Battle of Xpeng Motors Begins with the Fatal Strike of G6”.

In regards to 800V, the product benefits from an 800V high-voltage SiC silicon carbide platform, and all models are equipped with a 3C battery cell. Xpeng G6, while on an S3/S4 super charging pile, could charge in 10 minutes and increase its range by 300 km. Moreover, the charging speed is twice faster, even on a national standard fast charging pile compared to a 400V model.

Meanwhile, Xpeng G6 incorporates an 800V XPower three-in-one electric drive system, which improves its electrical efficiency, thus leading to excellent acceleration and braking performance.

What’s more astonishing is the price of Xpeng G6, starting at only 209,900 yuan. Thus, in the first half of this year, Xpeng G6 further lowered the price barrier of 800V to 209,900 yuan.

For the entire market, 800V is no longer an unattainable product feature.

It’s worth noting that apart from Xpeng G6 and other 800V models launched in the first half of the year, LI, Chery, SAIC, NIO, LEAPMOTOR, and others will also introduce 800V models in the future.

Although at present, most products equipped with 800V are concentrated in the mid-to-high end market, with the continuous iteration and maturity of technology, and the reduction of manufacturing costs, products equipped with 800V will inevitably cover all markets, improving the overall charging speed of electric vehicles.

The ultimate solution for high efficiency charging will be beyond 800V. But from Porsche to Xpeng, what is reflected is the industry’s persistent consideration and exploration on how to recharge electric vehicles.

This consideration and exploration are not limited to within 800V.

For instance, beyond 800V, BYD’s quick charging, also offers new ideas for recharging electric vehicles; while the previously controversial battery swap mode is increasingly receiving encouragement from policy level.

In the future, there will be more recharging technologies arise. Their path to popularity may repeatedly resemble the transition from Porsche to Xpeng, but nevertheless, the electrification of automobiles will become increasingly “out of control”.

PHEVs and BEVs, All-Around Competition for New Energy

In the past, driven by the popularity of pure electric automakers like Tesla, automakers rushed to enter the electric vehicle arena.

However, it is proven that not all automakers can profit significantly from pure electric vehicles acting rashly. Hasty entry into the electric vehicle race can easily lead to homogeneous competition. On the other hand, for traditional brands specialized in manufacturing petrol cars, the cost of transitioning to pure electric in a short time is too high.

Though Plug-in hybrids (PHEVs, including extended-range electric vehicles) are often referred to as ‘transitional products’, they indeed provide practicality and economy that meet consumer needs.

Whether it’s a ‘transitional product’ or ‘ultimate product’, a good product meets the needs of users. In this regard, BYD and LI Auto have tasted many sweet fruits.

As such, new power brands like HOZON and LEAPMOTOR, as well as traditional brands like Geely and Great Wall, are launching their own plug-in hybrid models.

As mentioned above, with the increase of PHEV models, their prices are also gradually going down. Competitive PHEV models such as GEELY EC7 and Haval are crowding the mid-market.

The mid-market holds the highest potential for consumer demand and its users are the mainstream of the car market. Only by fully covering this segment of the market and users can the new energy car market grow stronger, enhancing the market structural power, and evolving into a more mature and stable market.

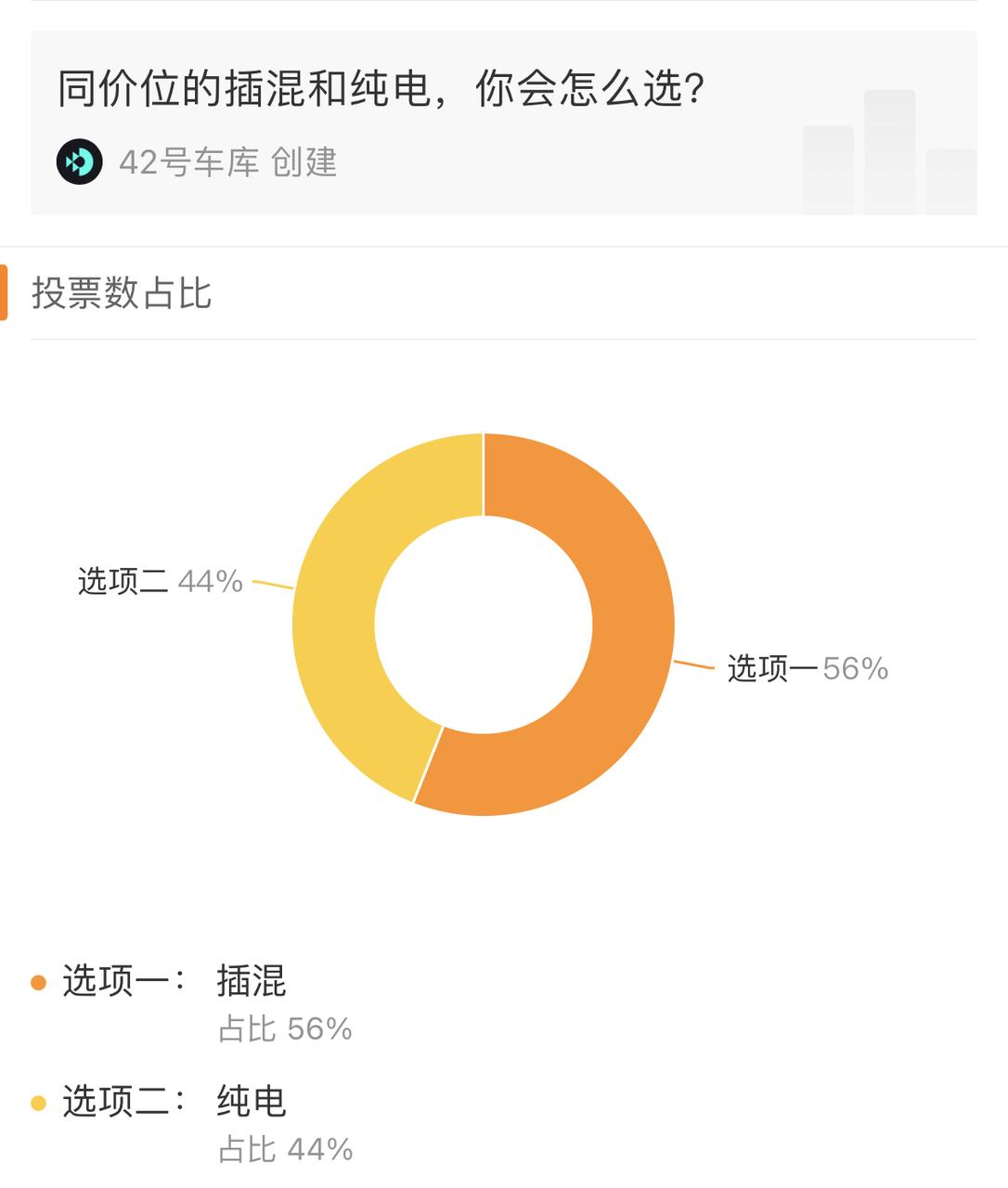

While PHEVs are growing, electrification is the general trend. Hence, we conducted a survey on Weibo on ‘How would you choose between a plug-in hybrid and a pure electric car at the same price’, with 56% of respondents choosing PHEVs and 44% choosing pure electric cars.

Although more people chose PHEV’s, the gap with those who chose pure electric is not large, nearly a stalemate.

This implies that despite falling short of PHEVs in terms of range and energy replenishment, pure electric models still have considerable competitiveness, and this competitiveness is continuously improving.

Compared to PHEVs, pure electric models have taken steps to layout in the mid-range market. With an increasing number of PHEVs and pure electric models fully covering the mid-range market, a competition more intense than previous concentrated in micro-cars and mid-to-high-end markets over ¥200,000 are imminent, which will surely lead to comprehensive competition in the new energy vehicle market across all price segments.

Under such circumstances, both the new power brands coveted for scale and traditional auto companies eager for new energy transition, are beginning to and must accelerate their pace.

Finally,

Whether it’s a price war or rolling with the punches, it’s a necessary means for the new energy car market to weed out the chaff, and an inevitable path for the transition to maturity and stability.

At present, there are too many players on the road and the competition is fierce. However, the market space is only so big. As one grows, the other shrinks, and the survival space of each auto company is squeezing each other.

To make matters worse, with the slowdown in the growth of the new energy car market, electrification has moved beyond its initial stage of rapid growth to a more grueling and slower battle. As the curtain of intelligence is completely drawn, car companies unwilling to lag behind have targeted the mass production of high-speed NOA and city NOA, starting a comprehensive war on multiple dimensions such as technology, product, cost, and experience.

Under such circumstances, the survival space of automakers will only become more constrained, and some are already facing survival pressure.

Thus, under the pressure of survival, automakers are actively seeking changes and looking for new ways of survival.

Traditional automakers like Geely and Great Wall chose to establish new brands or series, such as Galaxy and Owl, to find a new starting point; VW showed cooperation with Xpeng, put down the so-called pride of a magnate, made a more pragmatic choice, and Xpeng also won a breather in terms of finance and technical reputation… Interestingly, emerging power car companies like LEAPMOTOR also began to seek technology export under tremendous market pressure.

In a nutshell, in the rapidly changing harsh market environment, ‘seeking change’ has also become a collective action of new energy vehicle companies.

As the saying goes, ‘poverty leads to change, and change leads to communication.’ The market is changing, and car companies are seeking communication. In the ‘change and communication’ game, some automakers fall, and some stagger forward. There’s no precise time for the dawn of the new energy vehicle market, and until dawn comes, for automakers, survival is the top priority, even ‘like a beast.’

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.