On July 10, The Cadillac LYRIQ comes with great offers.

The LYRIQ, originally priced at RMB 439,700 – 479,700, has its price adjusted to RMB 379,700 – 419,700. Plus, customers who place their orders before August 31st will possess the rights to deposit RMB 2,000 against RMB 20,000 or deposit RMB 3,000 against RMB 20,000 along with free home charging installation, adding up to a comprehensive discount of around RMB 80,000.

As the price drops, the privileges underwent a simultaneous adjustment. Customers can choose whether to purchase the rights package according to their actual needs.

After the discounts, customers can now purchase a luxury mid-to-large electric SUV for what was previously the price of a luxury medium gasoline SUV. Cadillac has taken the daring step of matching electric and gas prices.

With discounts approximating 80,000, optional privileges, electric and gas price paring, this is a great time to nab a Cadillac LYRIQ.

Lower Price, Higher Competitive Edge

With discounts around 80,000, the LYRIQ, which was originally in the range of 450,000, now plummeted into the 350,000 price competition zone.

When priced at 450,000, the LYRIQ, in spite of its appealing style and powerful product offerings, found it tough to stand out in the crowded market, as it lacked a unique feature to specially attract customer preferences and a clear positioning relative to its competitors. But everything changes when it comes to the 350,000 market.

Firstly, the positioning of the LYRIQ becomes clear – the only ‘luxury mid-to-large size electric SUV’ in the 350,000 range.

In the 350,000 market, whether gasoline or electric, the majority of luxury brand SUVs are mid-size SUVs, with some even being compact SUVs, like the NIO ES6, Benz EQB, etc.

Even the BMW iX3, with an official guidance pricing of 405,000 – 445,000, is still a mid-size SUV. Luxury mid-to-large SUVs like the Benz EQE SUV come with a whopping official guidance price range of 486,000 – 630,600.

Therefore, in the 350,000 range, the ‘luxury mid-to-large electric SUV’ market is virtually vacant, which the LYRIQ dips into accurately.

Secondly, with the price drop, the LYRIQ’s product competitiveness rises when compared with vehicles in the same price range.

Customers in the 350,000 market possess a degree of economic power. When making decisions, they tend to place a higher value on brand, luxury, ride quality, uniqueness, etc. Particularly in terms of ‘brand’, as cars for them are not just a personal space, but also an essential tool for expanding their social relationships.These areas are exactly what joint venture brands like Cadillac, with their profound car-making skills and heritage, excel in. We can pull out the LYRIQ and compare it with its competitors.

LYRIQ VS BMW iX3

Despite the official guide price of the BMW iX3 being 405,000 – 445,000, the current discount level at BMW dealerships has made the iX3 a product in the 350,000 range, creating strong price competition with the LYRIQ.

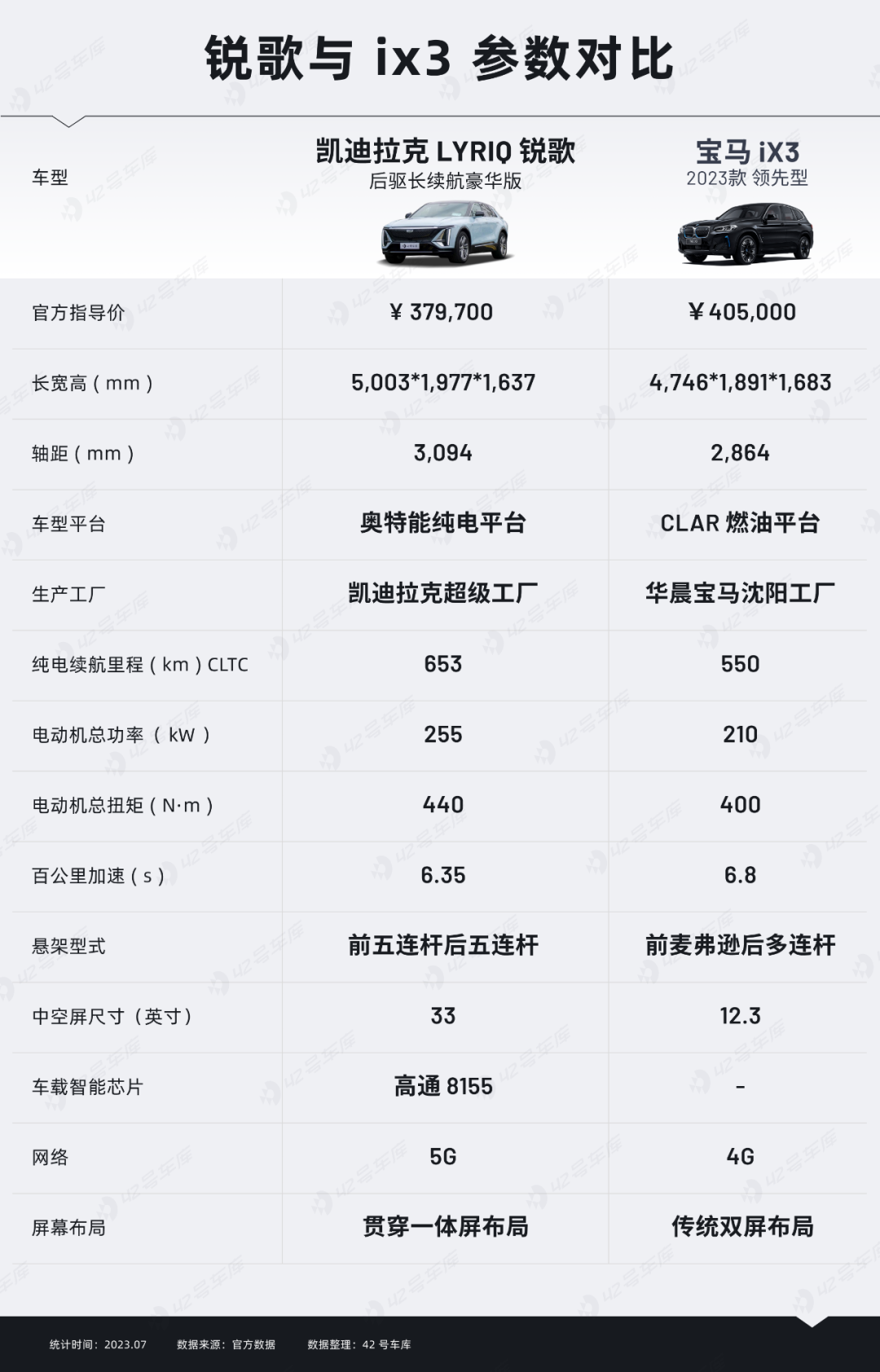

We can first look at their data comparison.

It can be seen from the data table that in areas of practicality such as space and range, the LYRIQ has overwhelming advantages over the iX3, given the ‘medium to large SUV’ physique; in terms of suspension and intelligence, the LYRIQ makes more sincere use of materials; the seamless screen layout also makes the LYRIQ more in line with the current aesthetic requirements of electric vehicles compared to the iX3.

Compared to the iX3, the LYRIQ’s main advantage comes from the ‘pure electric platform’, which is its ‘hard advantage’ in terms of production hardware.

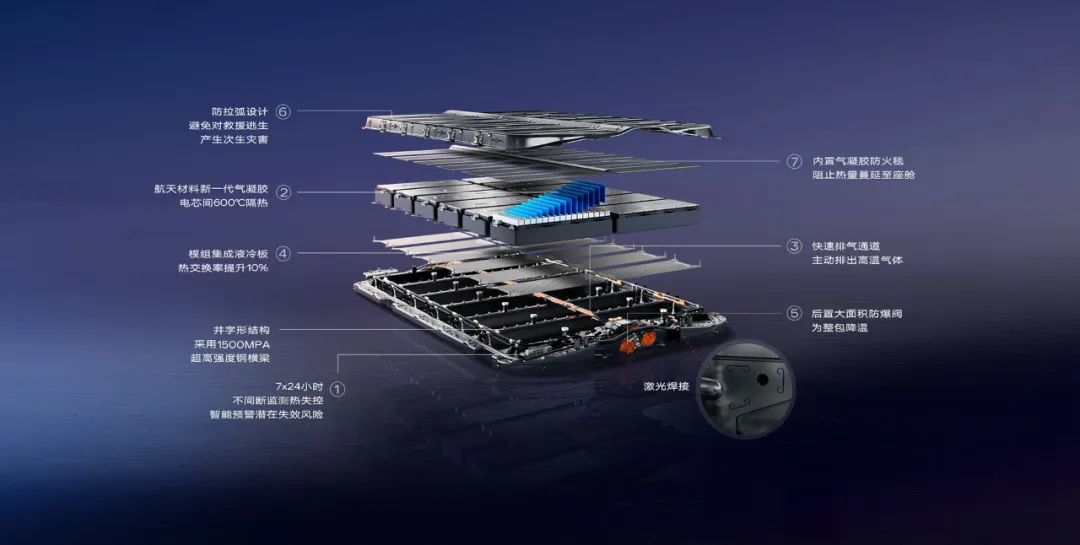

The LYRIQ is produced on the Altium pure electric platform. The Altium platform is a new electric-only platform launched by SAIC GM in 2021, with better top-level design and planning for ‘pure electric vehicles’, far superior to the hodgepodge battery and electric drive production method of oil-to-electric platforms.

The Altium platform reduces 90% of the wiring harness for battery modules to optimize battery layout, thereby improving the product’s range. In terms of safety, the Altium platform uses structural protections for the battery made with 1500MPA ultra-high-strength steel beams and has developed a wBMS wireless battery management system that can monitor battery health in real time 24 hours a day.

From the brand perspective, although the iX3 has certain advantages in traditional brand perception in the Chinese market, the value assessment of mainstream luxury brands in luxury new energy vehicles is being blurred. As long as the product is strong enough, the leverage of the brand can play a varied role.

LYRIQ VS Products of Independent Brands in the Same Price Range

The biggest advantage of products under the same price range of independent brands compared to the LYRIQ is ‘intelligence’, which is something that joint venture brands like LYRIQ need to relentlessly pursue.

However, in other aspects, the competitiveness of LYRIQ is quite apparent.

Firstly, regarding brand, SAIC GM’s Cadillac brand has a history of 120 years and having formally entered the Chinese market in 2004, it has already been cultivating for nearly 20 years. Compared with the relatively younger brands, Cadillac has established historical and customer foundations for its luxury identity.

Secondly, on the practicality front, LYRIQ provides ample space, and the comfort of the ride which has always been a primary concern for American luxury cars, along with its battery life that is able to satisfy the demands of most scenarios.

LYRIQ is also equipped with a front and rear five-link suspension system, a traditional strength of luxury brands like Cadillac.

Unlike homegrown brands in the same price range which mostly focus on family and outdoor scenarios, LYRIQ, because of its brand tonality, loading capacity, and driving characteristics, can cater to a broader set of scenarios, including business, home use, and outdoors.

Thirdly, in terms of car-making, Cadillac itself possesses deep auto manufacturing heritage. It can provide more assurance to users in terms of quality and reliability. Its exterior design boasts a classic foundation combined with an ‘electric’ core, offering high recognizability.

Overall, LYRIQ demonstrates strong competitiveness in terms of space, driving experience, safety, etc., which are higher frequency demands in daily driving scenarios. The Cadillac brand also greatly enhances the appeal of LYRIQ.

Taking the characteristics of the 350K market and its competitors into consideration, LYRIQ has proven to be highly competitive in the 350K pure electric luxury SUV market with its price and value becoming more proportionate.

In the era of ‘same price for oil and electricity’, Cadillac chooses to go first

As user demand for new energy vehicles becomes stronger, the new energy vehicle market continues to grow, and the slogan ‘same price for oil and electricity’ is resounding louder.

According to related research, from 2018 to 2022, the new energy version of the same car usually sells at an average of RMB 46,000 higher than the fuel version. Certainly, expensive prices are an unavoidable reality before the new energy vehicle industry reaches a sufficient scale to spread costs.

After all, before FORD revolutionized the car manufacturing industry with assembly lines, handcrafted and expensive fuel cars were a luxury for the few. It was the assembly line production that scaled down the costs and popularized the cars.

In the 1980s, with the emergence of automotive platforms, standardization and generalization of car parts and simultaneous production of different car models reduced production costs, extended the production value, and lowered the threshold for car purchases.

The same applies during this era of new energy vehicles. Once the market matures and companies have the capability for mass production, overcoming the ‘small scale – high cost’ bottleneck, a premise for the reduction of new energy vehicle prices will naturally arise, turning ‘same price for oil and electricity’ from mere slogan to reality.

‘Price Reduction’, LYRIQ Shows Confidence

Since the official launch of the Ultium platform in September 2021, SAIC GM has noticeably shifted into ‘Sports Mode’ in its transition towards electrification.

In October of the same year, the Shanghai Jinqiao Ultium factory was completed and put into operation. In June of the following year, the first mass-produced model, the LYRIQ, hit the market; in December, the Wuhan Ultium factory was completed and put into operation. In April of this year, the second mass-production model, the Buick E5, hit the market; in June, the third mass-produced model, the Buick E4, hit the market; in July, construction of the third Ultium factory, the Yantai Dongyue factory, commenced, with expected production in the first half of 2025.

If the Ultium factory is the fist that SAIC GM wields, then the supply chain is the lifeline. The Ultium factory has established a highly localized business chain system, achieving more than 95% localization of parts procurement.

According to General Motors’ plan, by 2025, GM will launch more than 15 pure electric models on the Chinese market based on the Ultium platform, and achieve a production capacity of 1 million electric vehicles on the Chinese market.

By expanding production and increasing control over the entire production system, SAIC GM begins to show the ‘Scale effect’. Backed by SAIC GM, LYRIQ has the confidence for price reduction.

‘Leading’, the Responsibility of Luxury Brands

The explosive growth of the new energy vehicle market and the rise of new brands have already challenged the traditional luxury value system, and the market’s ‘invisible hand’ is restoring the true value of luxury.

Even though the price reductions of luxury car brands are usually out of necessity, in reality, at this historic industrial transformation towards new energy, the luxury brands no longer fit holding onto the ‘old values’ of the automotive industry and setting prices for new energy vehicles that disregard user needs and emotions for profit and brand stature.

On the contrary, luxury brands should, like when the automotive industry just started, be the vanguard guiding the automotive industry forward, benefitting the users with technology.

Now, at another transition point in the automotive industry, luxury brands such as Cadillac, due to their large scale and influence accumulated over a century, should extend a hand to the users while moving forward, not reaching for the money in their pockets, but serving as a bridge, continuing to deliver the benefits of the era to the users.

Even though the LYRIQ only entered the market last year, compared to the entire market of new energy, Cadillac is a ‘latecomer’. However, as a luxury brand, with its scale advantage, Cadillac should take the lead in entering the era of ‘oil and electricity parity’, drive the return of value in the luxury electric car market, and benefit the users.

It’s not just Cadillac, every luxury brand should take on this responsibility.## In Conclusion

The price drop of the Lyriq will position both the users and Cadillac in a win-win situation.

On one hand, users will be able to reduce the cost of acquiring a “luxury mid-sized pure electric SUV”, yielding them with more abundant and potentially superior choices within the 350k market.

On the other hand, through discounts, the Lyriq avoids the intensely competitive price brackets, in which it has no apparent advantage. However, the increase in sales may lead to new breakthroughs for Cadillac, also presenting a more accurate pricing and value placement in this new era.

Viewing from a broader perspective, during the early stages of new electric vehicle development, products from new energy brands have severely impacted the product lineup of joint venture luxury brands like Cadillac.

However, in this latter stage of new energy vehicles, particularly at the juncture of entering an era with similar prices between gasoline and electric vehicles, joint venture luxury brands might utilize their large-scale advantages to in turn, severely impact the pricing system of the new energy brands.

After a discount on the Lyriq, realizing cross-grade competition with higher competitiveness gives off this kind of signal.

When “price parity between oil and electricity” starts becoming a mainstream trend, the competition may once again arrive at a juncture filled with uncertainties. Will the “price parity” Lyriq help Cadillac successfully establish itself in the world of electric vehicles?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.