On July 19th, Tesla announced its Q2 financial results, hitting a historical high of 24.927 billion dollars in revenue. However, gross margin hit a near two-year low of 18.2%.

Prior to diving into Q2, let’s review some happenings regarding Musk and Tesla since Q3.

On July 1st, Tesla announced cash discounts ranging from 35,000 to 45,000 RMB on the Model S/X ;

On July 7th, Tesla upgraded the referral rewards for the Model 3/Y;

On July 12th, Musk announced the establishment of an AI company, xAI;

On July 13th, Tesla’s children’s motorcycles were listed on China’s official website;

On July 15th, the first Cybertruck rolled off Tesla’s Texas plant;

In this month, the mass production of the supercomputer Dojo commenced.

Observably, the trend of market expanding at the sacrifice of prices that started in Q1 has transferred into Q3. Tesla’s growth in revenue and profit, predominantly driven by Model 3/ Y, is shifting; Musk’s vision of “full self-driving” is drawing closer.

With the scale of sales expansion, the rich product matrix and the rapid leap in autonomous driving technology, Tesla is sparking another fundamental transformation in early Q3, while Q2 is the “calm before the storm”, harboring “energy waiting to be unleashed”.

Gross Margin Reduction, Preparing for A Rebound

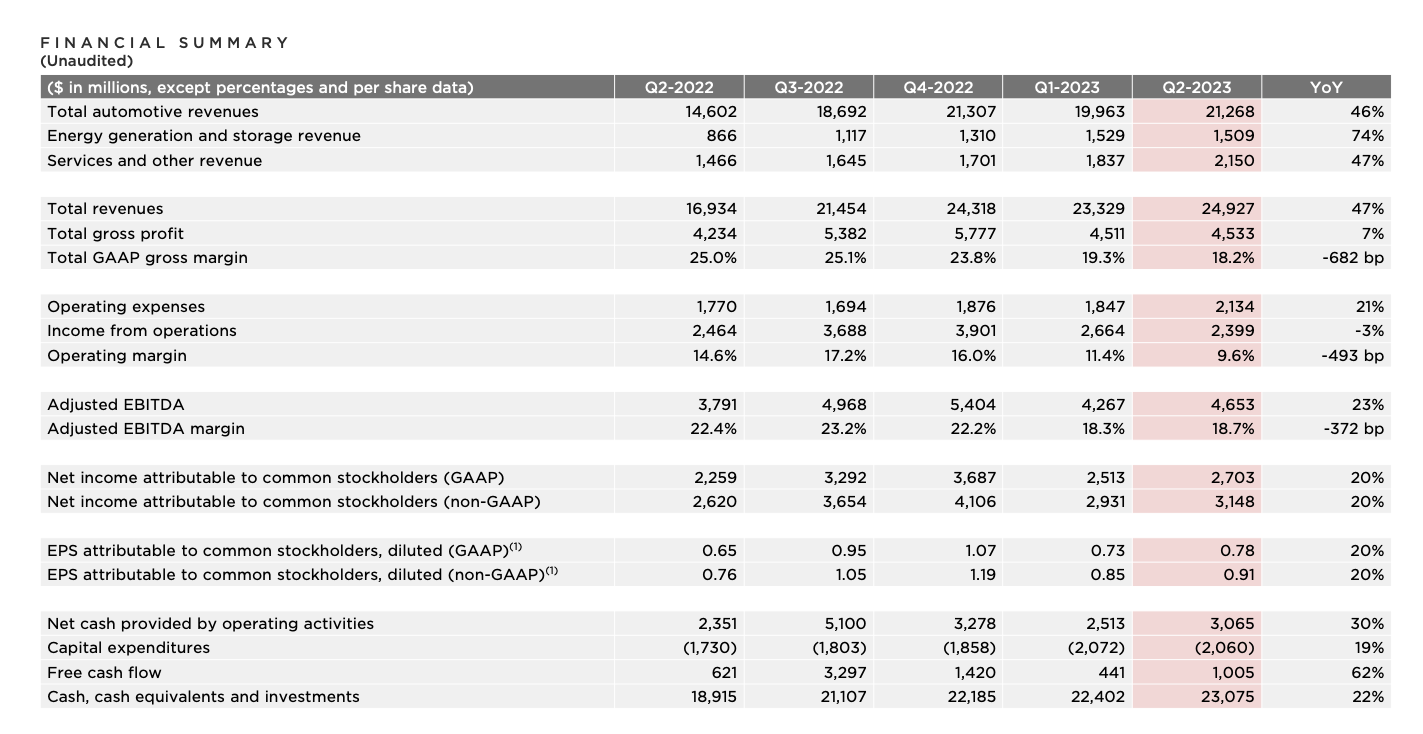

Let’s first look at the major financial information regarding profit and revenue:

- Total revenue was $24.927 billion, up 47% YoY and 7% QoQ;

- Auto business revenue was $21.268 billion, up 46% YoY and 6.5% QoQ;

- Energy storage business was $1.509 billion, up 74% YoY and -1.3% QoQ;

- Service and other revenues were $2.150 billion, up 47% YoY and 17% QoQ;

- Gross margin was 18.2%, up -27% YoY and -5.7% QoQ;

- Net profit was 9.6%, up -34% YoY and -16% QoQ.

In overall, Tesla’s Q2 financial performance maintains a healthy level. Although the revenues from the energy and storage business has decreased, the total revenue regained the level of Q4 2022. On the downside, the profit margin continues its decline.

Tesla attributed this to the following:

- Reduction in the average selling price of cars;

- The cost of producing 4680 batteries and related expenses;

- Increased operational management costs due to Cybertruck, AI, and other large projects;

- Adverse foreign exchange impact.

The impact of price reductions and foreign exchange is self-evident, amidst uncertain circumstances, competitors are lowering prices to vie for market share.

The other reasons indicate that Tesla has focused a lot of energy on high-input but high-return projects like the 4680 battery, Cybertruck, and AI in Q2.

Hence, decreased profit margins are not surprising. Although it seems to be decreasing continuously, it is actually brewing a rebound.

As Musk stated in the earnings call, “We will continue to make meaningful capital expenditures to lay the groundwork for the future.”

Delivery Volume Continues to Break Through the Upper Limit

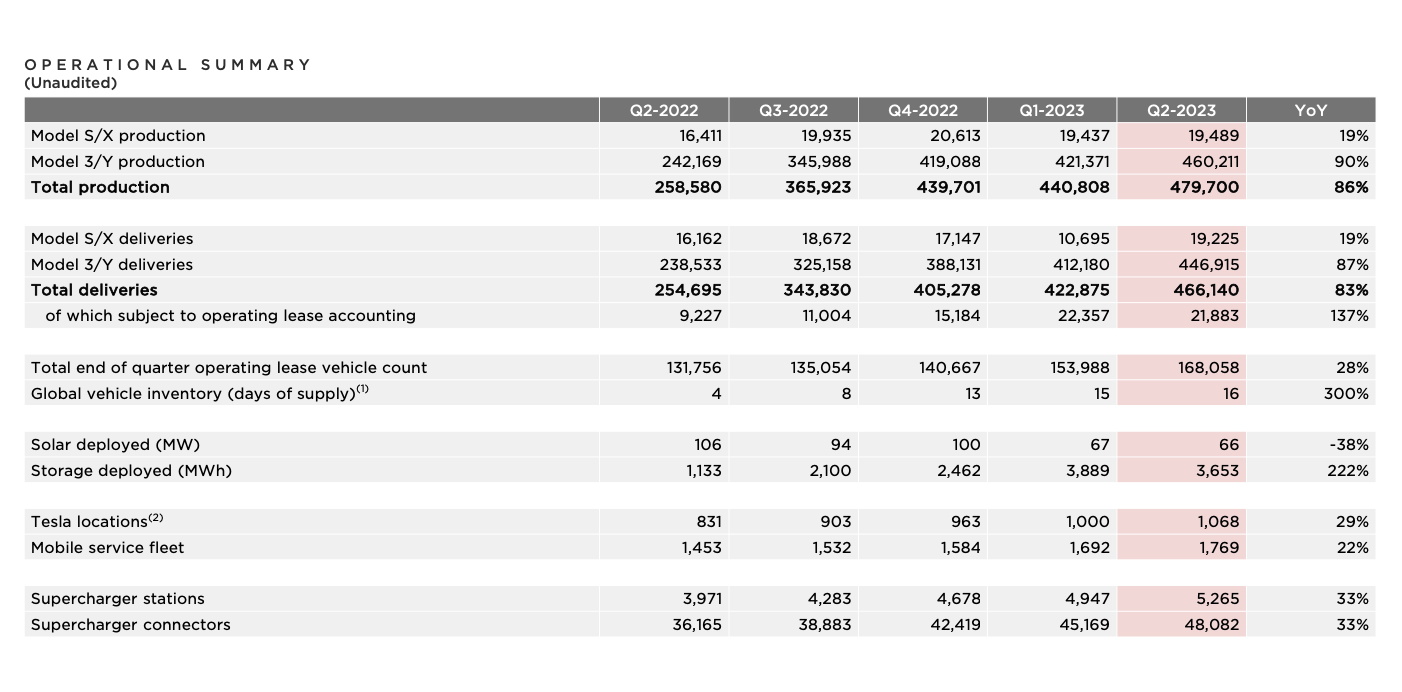

One aspect of building the foundation for the future is the scale of delivery volume. Tesla’s Q2 deliveries reached a new historical high:

- Model S/X delivery: 19,225 vehicles, an increase of approximately 20% YoY, and approximately 80% QoQ;

- Model 3/Y delivery: 446,915 vehicles, an increase of approximately 87% YoY, and approximately 8% QoQ;

- Total deliveries: 455,140 vehicles, an increase of approximately 83% YoY, and approximately 10% QoQ.

Quarterly deliveries hit a new high, and the Model 3/Y continues to be the major driving force for Tesla’s sales. Meanwhile, the Model S/X also achieved substantial growth of 80% QoQ.

The reason for this all-time high in deliveries is closely related to further capacity increases:

- Model S / X production: 19,489 vehicles, about 19% YoY growth, and an approximately 0.2% QoQ growth;

- Model 3 / Y production: 460,211 vehicles, about 90% YoY growth, and approximately 9% QoQ growth;

- Overall vehicle capacity growth: about 85% YoY and approximately 9% QoQ.

According to Tesla’s financial report, the Shanghai and Fremont Gigafactories greatly contributed to the increase in capacity. The Shanghai Gigafactory has been operating at near full capacity for months.

Due to the Shanghai Gigafactory, Tesla began to penetrate the Southeast Asian market. Tesla had begun deliveries in Thailand in February and launched the Model Y in Malaysia in July. Tesla’s market expansion is growing larger, and 455.14K vehicles are merely a phase record.

However, Musk mentioned that factory upgrades would be carried out in Q3, causing a temporary shutdown and slight drop in Q3 capacity. Still, after the upgrade, they will push for delivery volume to break through the upper limits again.### Explosive Growth in Service Revenue is Primed

With the expansion of the charging network, Tesla’s energy replenishment business has been steadily growing. According to the latest data from the official website, Tesla already has over 45,000 supercharge stations worldwide.

However, the revenue is primarily contributed by Tesla users and comes from a single source. But with Tesla’s NACS establishing more partnerships in Q2, the company’s service revenue is poised to explode.

NACS stands for North American Charging Standard and is a specialized charging specification created by Tesla. This standard offers twice the power and half the size of the official United States’ CCS (Combined Charging System).

In Q2, Tesla inked agreements with FORD, General Motors, Benz, Nissan, Polestar, Rivian, VOLVO, and Volkswagen’s American subsidiary Electrify America, opening up Tesla’s charging network to these partners.

The charging industry in North America appears to be consolidating under Tesla.

Simultaneously, on April 25, Tesla also opened pilot charging stations to a few brands in Mainland China, which include 10 supercharging stations and 120 destination charging stations.

With widespread coverage in North America and a toe in the water in China, Tesla’s charging network is growing rapidly, paving the way for a potential surge in its service revenue.

Energy and Storage Business Growth Slows

Energy and storage business revenue experienced its first drop in nearly a year, and the growth rate of storage deployment has also decreased. The Q2 total storage deployment was 3.7 GWh, a 6% decrease quarter-over-quarter.

The report attributes this decline to the “high-interest rate environment causing the industry to delay solar purchases.”

Elon Musk stated, “With rising interest rates, affordability for everything decreases,” but the expansion and deployment of Tesla’s storage business appear to be “steady and promising.”

In April, Tesla’s mega energy storage factory officially landed in Shanghai, set to start producing MegaPack in Q2 next year. The company’s energy storage super factory in Lathrop has also started production and is being ramped up to full capacity.

Musk stated that the MegaPack continues to show strong demand on a global scale, with several large projects waiting for Tesla in 2024.

The Breakthrough Point for Growth has Emerged

In the earnings conference call, Musk said, “The Model Y has become the best-selling car in the world, leading in all types of vehicle sales.”

Although led by Model 3 / Y, Tesla tops global electric vehicle sales rankings. Still, Model 3 has already been around for seven years, and Model Y for four.

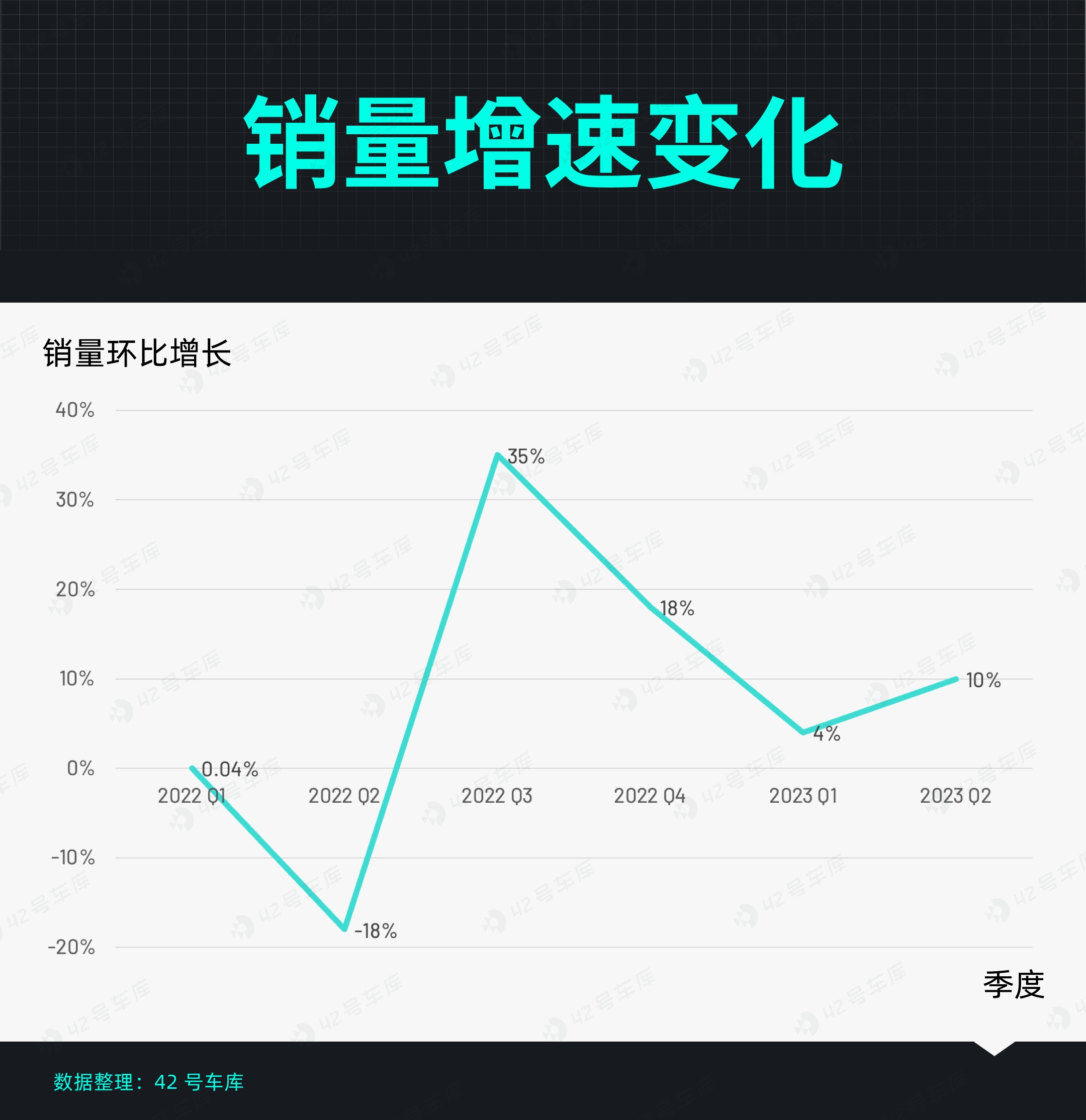

“The arrow is at the end of its arc, unable to penetrate the fortified city.” The Model 3 / Y, these two massive bows are still formidable but their “force” indeed has started to wane.Since a ‘revenge’ recovery after the pandemic in Q3 2022, the growth rate of Tesla’s sales has been slowing down. Even with recurrent promotional policies, its peak performance is hard to regain.

Meanwhile, Tesla’s reign has been eyed by the upcoming forces in the global new energy market.

With more competitors emerging in the new energy market, Tesla products, though advanced, are facing intensified competition. It’s time for Tesla to make changes to their products to stimulate new consumer interest.

The first batch of Cybertrucks, which could potentially be the new interest point, are now offline.

In the earnings call, Musk revealed some details of the Cybertruck:

- Four-door design;

- Approximately 1.8 meters long cargo bed, and around 5.8 meters long body;

- Due to be delivered within the year.

The Cybertruck was officially launched in 2019. After several delays, it is finally coming out.

According to statistics, Cybertruck has accumulated 1.94 million orders, each with a reservation fee of $100. Despite the final conversion rate being uncertain, it is foreseeable that Cybertruck’s sales will be considerable due to the large base of orders. It could potentially become another key sales pillar for Tesla.

The current key sales pillar, Model 3, is finally about to undergo a major update amidst a flood of spy shots and configuration information.

Worth mentioning is that, Musk stated, by Q3, FSD will support account transfers, rather than being solely tied to a car. But this function will only be available in Q3.

If the redesigned Model 3 really comes out in Q3, the FSD’s ability to transfer accounts could potentially boost Model 3 sales. Tesla might have another win.

With the upcoming release of the redesigned Model 3 and Cybertruck’s delivery within this year, this year might be a turning point for Tesla in terms of model expansion. Meanwhile, the redesigned Model Y and new Model Q are also on the line.

With the expanded model matrix and market, the profit structure of Tesla’s auto business might become more reasonable, and the profitability might be improved to a certain degree.The dawn of new breakthroughs signals the impending arrival of a stronger Tesla fleet.

For the entire year of 2023, Tesla remains on track to achieve its persistent objective, maintaining a 50% compound annual growth rate and an annual delivery volume of 1.8 million vehicles.

FSD Turning Point

Morgan Stanley analyst Adam Jonas once mentioned: “We believe that the market is willing to consider Tesla primarily as an AI company, with car manufacturing being secondary.”

Indeed, Musk has clearly stated: “We could even afford to sell at zero profit now and reap significant economic benefits in the future through autonomous driving.”

By competitively pricing its products, developing AI, and researching the supercomputing Dojo, Tesla is essentially laying the groundwork for a future business framework centered on FSD.

The financial report highlights that four technological pillars are necessary to achieve large-scale vehicle automation: a massive real-world data set, Neural Network training, vehicle hardware, and software.

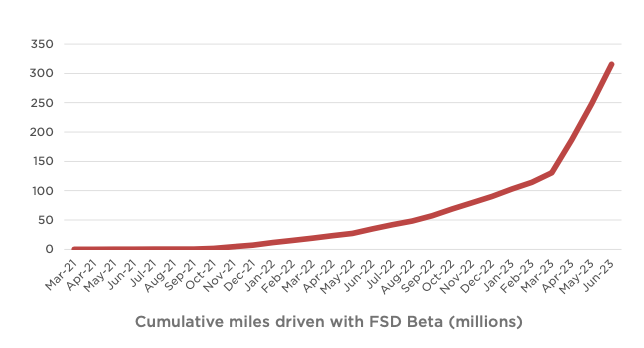

The report shows that FSD’s test mileage is growing exponentially. In Q1, the test mileage was still 150 million miles, but by Q2, it had grown to over 300 million miles.

Meanwhile, Tesla USA is still recruiting testers at a starting wage of $20 per hour to help the Tesla ADAS team with testing and to advance improvements in the autonomous driving system.

Consequently, the accumulation of a real-world dataset is also growing exponentially.

Constructing a real-world data set is fundamental, but it necessitates a supercomputer to undertake neural network training based on the data set. The Dojo is specifically engineered by Tesla for this purpose, serving as a pivotal arsenal for achieving fully automated driving.

Dojo is a supercomputer Tesla developed specifically for neural network training, boasting low latency, high bandwidth, and cost-efficiency. According to Tesla’s roadmap, by February 2024, propelled by Dojo, Tesla’s computational power will rank amongst the top five worldwide; by October the same year, Tesla’s total computational scale will reach 100 EFlops, equivalent to the combined computational power of 300,000 NVIDIA A100 graphics cards.

Musk stated: “The Dojo is incredibly important to Tesla, and by year-end, our expenditure on Dojo should exceed $1 billion.”

This signifies that FSD is rapidly maturing at an unprecedented rate. Musk stated: “We will make rapid progress on the new version of FSD – it will be safer and better than human drivers.”

However, it is clear that achieving fully autonomous driving is a capital and time-intensive project, which greatly impacts Tesla’s short-term profits.At the earnings conference, Musk expressed his willingness to license AP and FSD to companies in need, and preliminary discussions have already been initiated with a large vehicle manufacturer.

Once this collaboration materializes, the scale that Tesla has been so dedicated to achieving will be expanded to a greater extent, thus building a larger user base for future profits with FSD.

Given the commonality between the technologies of Tesla’s humanoid robot, Optimus, and FSD, the progression of FSD will also drive the development of Optimus.

Regarding the Optimus business, Musk stated, “Currently, approximately 5 – 10 Optimus robots have been produced…more tests are planned for November, with the hope of putting Optimus into production next year. This technique, combined with neural network training, can also be applied in other scenarios.”

During the earnings call, Musk also mentioned xAI, stating, “The AI of xAI will bring more value to Tesla, with talent being a crucial part.”

Starting from the global leadership in engineering implementation and technological R&D capabilities, Tesla’s past accumulation in supercomputing, AI, autonomous driving, etc., is now emerging with the mass production of Dojo, and exponential rise in FSD testing mileage.

Even if the Optimus business is just starting and the future of xAI is yet unclear, on the whole, Tesla continues to advance towards a software payment business model with FSD as the main profit driver.

Prior to this, the entity carrying FSD, namely Tesla’s electric cars, their primary task is to enter households everywhere, even if it necessitates price reduction.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.