Great Wall Motors is currently facing a severe crisis of declining sales growth.

In 2021, Great Wall Motors had a total sales volume of 1.28 million vehicles, total revenue of 136.4 billion yuan, and a net profit of 6.73 billion yuan, with a year-on-year sales growth rate of 15.24\%. This marks the sixth consecutive year with sales exceeding 1 million vehicles. However, in 2022, the situation began to plummet, with total sales dropping to 1.067 million vehicles, a year-on-year decline of 16.64\%. Total revenues were 137.35 billion yuan, and net profit was 8.279 billion yuan.

This downward trend in sales is expected to continue in 2023 and worsen.

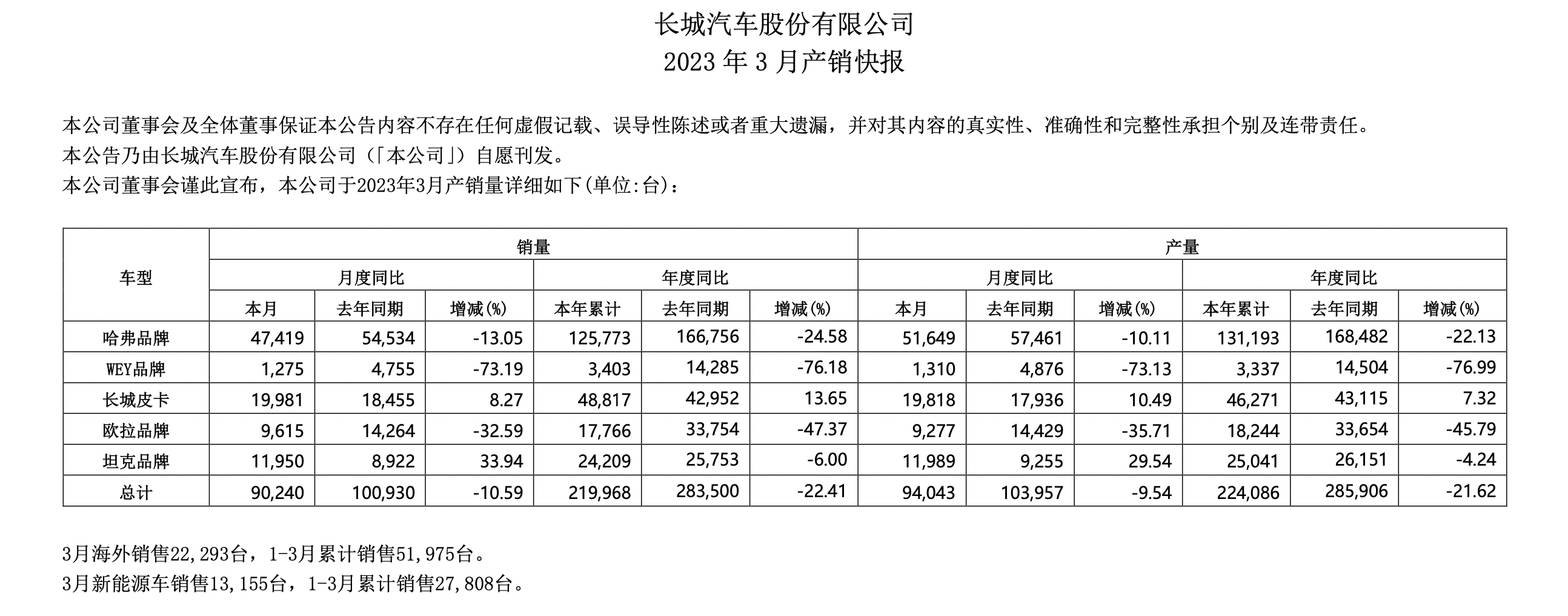

From January to March of this year, Great Wall Motors’ total sales volume fell by 22.41\% year-on-year – the sales of its passenger car brands, Haval, Wey, and Ora, all showed varying degrees of decline, especially Wey, which saw a year-on-year decline of up to 73.19\%.

In addition, in terms of the transformation towards new energy, Great Wall Motors’ sales performance is discouraging. From January to March of this year, cumulative sales were 27,808 units, down 21.5\% compared to last year’s 35,403 units, while the entire industry trend shows an increase in sales of new energy vehicles.

So, with the dual challenges of declining sales and the need to transition to new energy, how can Great Wall Motors recover and grow amid fierce industry competition?

On April 18th, Li Ruifeng, the Chief Growth Officer of Great Wall Motors, gave an interview to the media at the Great Wall Motors booth at the Shanghai Auto Show. The following is the important information from the interview.

Q: What experience or positive progress did Little Blue Mountain bring to you? How should Great Wall defend or counterattack the price war?

A: The popularity of Little Blue Mountain is only a good start, and it still needs to be tested by customers in the long run. Beginning in 2022, Wey went all in on new energy, fully transforming its positioning to “0 Anxiety Smart Electric.” However, due to our limited insight into new energy at the time, we encountered many problems during the strategic transformation process. But this can empower various brands under Great Wall Motors, helping us improve our understanding of new energy, including Haval’s and Tank’s transition to new energy. This will make our brand strategic deployment and product planning clearer, resulting in excellent products like the Little Blue Mountain 6-seater.# Markdown Text in English

In January of this year, Tesla led a price cut trend in the Chinese market. In March, some joint venture brands may have started cutting prices severely due to inventory. This is not good news for Chinese domestic brands that have worked hard to establish brand recognition and trust. Although the pricing trend in April no longer pursues price cuts, without being in a rational state, without a steady business strategy, and without balancing short-term and long-term strategic thinking, it is unclear how long a company can survive without seeing its business operations and profit models.

For us, it is important to focus on the concept of “one Great Wall”. With so many categories and brands, including profitable vehicle models and strategic vehicle models for new energy transformation, we cannot look at our profit level in terms of a single product. Instead, we should let each brand have its mission and form a balanced force to ensure Great Wall’s vehicle sales. Profit and market are a balance relationship. In addition to sustaining Great Wall’s development, we must also have balanced and high-quality market share. After 32 years of car manufacturing, our core technology reserves, forest ecology, vertical integration, cost sharing for millions of sales, and global market layout, this heavy system and single-scale system are completely different. This is the risk resistance brought by the system’s operational capacity.

Q: You mentioned that Great Wall is now “all set, just lacking the east wind”. What do you understand by “east wind”?

A: Bluesky is the east wind. The east wind is a momentum build-up, followed by vehicles like the Fighter Jet, the Tank 400, and the Bluesky MPV. First, the sales volume must be high for it to be considered a success. Secondly, there must be a steady profit to ensure that our customer service promises are not interrupted for the long term, to guarantee good quality vehicle production and on-site support to protect consumer rights. With the introduction of China 6B emissions regulations and the continuous strengthening of emission regulations, including the cost of intelligent transformation in R&D, price cuts do not generate profits, and cannot guarantee the quality of vehicle production and the after-sales service chain.

Of course, we cannot say that if you don’t play the price war at this time, and wait until the polarization becomes apparent, then you can go all in. We need to be aware of evolving markets and deploy products in an organized manner, such as the Haval Fighter Jet and H6. Large single products must be given time to penetrate the market and create a large sales volume. Therefore, having more products is always a good thing for us.

Q: At auto shows, everyone seems to be obsessed with price and technology. Where do you think Great Wall’s future space is?A: Some media claimed that Great Wall Motors has been slow in the development of new energy vehicles, but in fact, GWM is not lacking in speed. Rhythm is more important than speed. GWM’s strategic direction is very clear now, and its reserves in new energy are very abundant. The technological advantages brought by the vertical integration of the forest ecosystem will be popularized in various products in the future, and many products have already met the conditions for SOP.

Q: Facing strategic transformation, what is the core or central business goal of GWM’s next battle?

A: First, stability. The “squatting” process took a longer time last year, so we want to launch new products intensively at the Shanghai Auto Show. However, we must be stable and steadily move forward. Second, balance. GWM must balance sales and profits among its various brands and products. This is not a multiple-choice question, but rather a proportional allocation problem. GWM adopted corresponding strategies when it reduced prices in March. But for certain models, we must maintain the upward trend of the brand name and strive for market share with quality while ensuring profits. Third, profitability. Healthy profitability is a driving force for the long-term development of enterprises. Fourth, efficiency. We must consider not only our factory’s single vehicles, individual stores, and star products, but also the channel’s management quality and healthy development. Both strategic and tactical thinking must be taken into account, so transformation cannot be rushed.

Q: During the auto show, it seems that manufacturers are all focused on sales and giving profits. Does the GWM internal senior management have this consensus and awareness?

A: The positioning of products in the brand pyramid is different, including main product categories, main levels, main prices, and main styles. Haval is a main product category, with price range from 90,000 to 150,000 yuan, so it must contribute to sales and scale in its main product category and main price range. Therefore, in terms of brands, we will over-deploy resources to ensure the success of Haval’s transformation and the creation of a Haval Star product. Each product has its own mission in each price range, and there is a certain sales scale to support it. We have multiple brands, categories, and products, and we will adopt different strategies to ensure long-term healthy scale and profits.

Q: How is the current effect of “541”? What is the current progress of Haval’s new energy vehicles? From the sales point of view, why doesn’t GWM adapt to the external environment and make adjustments?

A: “541” means 5 middle platforms, 4 categories, and “One Great Wall”. The 5 middle platforms include communication middle platform, channel middle platform, user operation middle platform, sales and service middle platform, and digital middle platform. These middle platforms run through 4 operational organizations. It is particularly difficult for the management mode, talent team, and incentive mechanism to be effectively implemented. The problem of high synergy and mechanism running through cannot be completed simply. We need to continuously promote and expand the “Five Middle Platforms” and fully empower these brands, so “541” has just begun and we cannot be blindly confident. There will be many difficulties in the process.# Translation

For Haval’s progress, now the manufacturer and dealers have highly consistent goals and strategic directions. Everyone is working day and night to build the entire system, including channel exploration, store construction and renovation, recruitment and training of exclusive personnel, and the operation of the entire new store. We expect to have a coverage of 400-500 including 4S stores and supermarket networks before the first half of the year. Later, with the continuous enrichment of new energy products, there will be approximately 900-1000 comprehensive network constructions before the end of the year. This is the current progress situation. New energy construction should not be judged by simple progress, it should also be judged by the overall sense of reliability, whether the dealer trusts it, and how much time it may take to make end dealers have a clear recognition and high recognition of its strategic transformation, and to follow it without reservation. This is a very long process.

Regarding sales volume, first, as a listed company, we must consider the long-term operation and take long-term responsibility for our upstream and downstream, dealers, employees, and shareholders. Therefore, we must consider the health of long-term operation, and we must not do it just for a simple short-term data. Second, why do we dare to do it differently from others? When we have a long-term business vision, we are confident to adhere to it during the process, and we will not change our strategy due to short-term external pressures. Third, we have a high level of self-reflection. When no one provides suggestions for us, and we do not make mistakes, this may be the biggest mistake. When our sales volume encounters many controversies, all the team members of Great Wall Motors will reflect on our strategy.

Q: A few years ago, Chairman Wei proposed to merge resources and build a Great Wall. What are the specific ideas?

A: We used to implement a “one car, one brand” strategy, requiring each brand to fight on its own, with independent resources and sales to its own customer base. In this process, we found that there was no interconnection between them, resource utilization was not high, and experiences were not shared. Sometimes, differentiation was too fast, and the company wasted too much resources, such as media and platforms, which should actually be planned together. That’s why we have a matrix management system. The five major middle platforms coordinate the shared resources and platforms between various brands, achieve unified management and unified voice to the outside world, shared resource, and experience sharing. This is a change in management mode. However, what has not changed is that each brand’s fighting team still has great empowerment and authorization to give them autonomy and flexibility. The power of the sub-brand is still substantial.

Q: Is Euler’s insistence on female positioning too narrow? What are the reasons and considerations behind Euler’s adherence to female positioning?A: Categorization is the essence of Great Wall Motors’ focus. While everyone is dividing new energy vehicles by fields, the reason we boldly entered the female market is that women have become increasingly dominant in their families and have more decision-making power. In this era of fierce competition, Great Wall Motors firmly gives women the definition and R&D of some products from a female perspective, defining ORA with a “love women” brand, which is a firm and correct direction that may bring great dividends in the future.

Q: A few days ago, a leader of a car company made a judgment that by 2030, there will probably only be 8 car companies left. What do you think?

A: I think this view is correct. With the increasingly fierce competition in the entire automotive market, it is certain that the process of survival of the fittest will be accelerated, and companies with sales scale and comprehensive strength will survive, leading to a K-shaped differentiation in the future. In such a state, just like the century-old German or American automotive companies, there will only be a few remaining. China may also follow this trend, which means that only those who can operate healthily until 2025 will have the possibility of making strategic plans for 2030. If the operation during this process is poor, it is impossible to reach such scale. This is why it is necessary to have long-term management thinking, as mentioned earlier.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.