In the first quarter, the auto industry has been experiencing the “price war”. The China Association of Automobile Manufacturers (referred to as C.A.A.M.) pointed out that since the beginning of this year, the decline in new energy prices and the promotion wave since March have caused a considerable impact on the terminal consumer market, and the overall economic operation of the auto industry is facing greater pressure.

Looking at the overall auto market in the first quarter, from January to March, the production and sales of cars completed 6.21 million and 6.076 million respectively, a decrease of 4.3% and 6.7% year-on-year, slightly lower than the same period. Overall, the domestic effective demand for the automobile market has not been fully released. New energy vehicles have maintained a relatively rapid growth, and their market share reached 26.1% in the first quarter.

The pressure is mainly concentrated on traditional energy passenger cars. According to C.A.A.M. statistics, except for the C-class car market, the markets of other level fuel vehicles have shown different degrees of decline. Currently, the sales volume of fuel vehicles is still mainly concentrated in the A-class, with a cumulative sales volume of 2.029 million vehicles, a year-on-year decrease of 19.7%.

Compared with fuel vehicles, new energy passenger vehicles still maintain a good growth trend. From January to March, the cumulative production and sales of new energy vehicles reached 1.65 million and 1.586 million respectively, an increase of 27.7% and 26.2% year-on-year, and the market share reached 26.1%. Among the main types of new energy vehicles, compared with the same period last year, pure electric vehicles and plug-in hybrid electric vehicles showed a significant increase in production and sales.

Among them, new energy vehicle models in the 100,000-250,000 and 350,000-500,000 price ranges showed positive growth compared with the same period last year. It is worth noting that new energy vehicle models in the 200,000-250,000 price range have the largest increase. In contrast, the market share of A00-level new energy vehicles has significantly declined, with a year-on-year decrease of 55.3% in the first quarter. Currently, the main sales of new energy passenger vehicles come from the 150,000-200,000 price range, with a cumulative sales volume of 453,000 vehicles, a year-on-year increase of 68.3%.

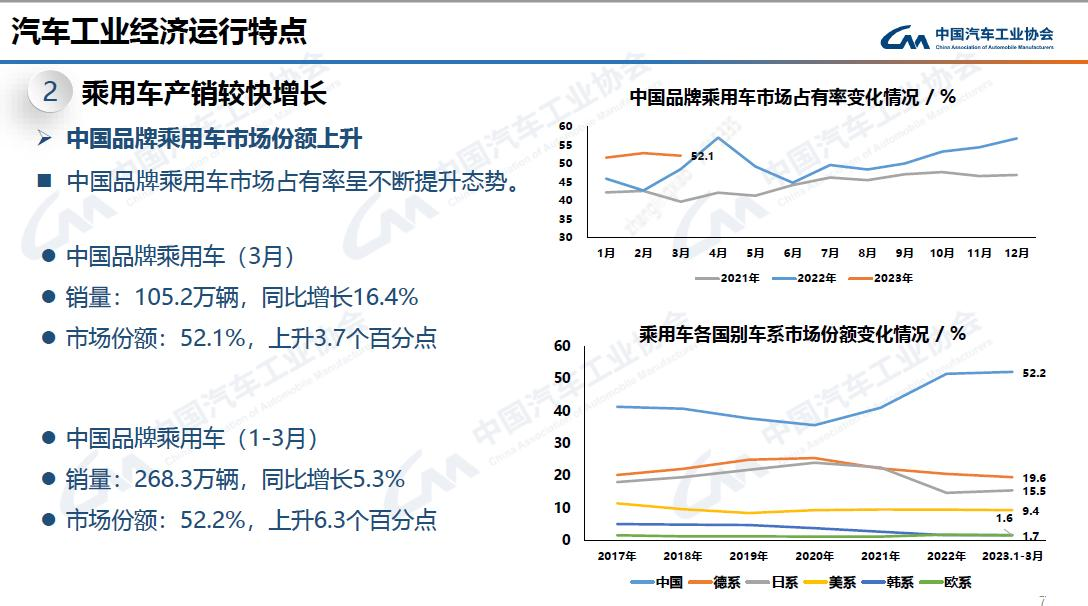

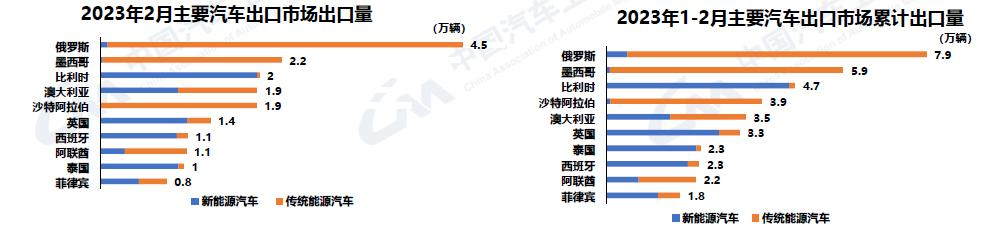

Under the triple pressure of shrinking demand, supply shock, and weakening expectations, China’s automobile brand market share achieved a counter-trend rise. From January to March, the sales of Chinese brand passenger vehicles reached 2.683 million, an increase of 5.3% year-on-year; the market share rose 6.3% month-on-month to reach 52.2%.In terms of exports, from January to February, the export volume of cars reached 682,000, a year-on-year increase of 1.4 times, among which the export volume of new energy vehicles reached 256,000, a year-on-year increase of 4 times. Among the top ten countries in terms of car exports, the Russian and Spanish markets performed well. The top three markets for the export of new energy vehicles are Belgium, the United Kingdom, and Thailand.

In addition, the China Association of Automobile Manufacturers (CAAM) also released the ACI, a quarterly index for the Chinese automobile industry. The research results show that the Q1 ACI for the automobile industry in China is 34, which is 22 points lower than that of the fourth quarter of 2022 and is in the light blue light area, indicating a cooling trend. In the first quarter, the composite index for the automobile industry was 83.75 (based on the data for 2010), a decrease of 8.87 points from the previous quarter. Overall, the automobile industry has not yet entered the prosperous zone and still faces a lot of pressure.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.