Author: Tao Yanyan

The three-day 2023 China Electric Vehicle 100 People Summit has come to a close on April 2nd. We previously shared some highlights of the conference, and today we are summarizing the battery-focused sessions.

Unexpectedly, CATL did not attend this time. The main battery manufacturers participating included ZC-Voyage, Eve Energy, Funeng Technologies, Cubic Weiye, Farasis Energy, Xingwangda Electric Vehicle, BIC Battery, and Ruike Power.

ZC-Voyage

ZC-Voyage attended the conference to present their products, mainly focusing on two directions:

-

One-Stop (OS) battery products and systems: The OS LFP battery pack boasts an industry-leading energy density of 153 Wh/kg, a height of 110mm, and a range exceeding 600km; the OS ternary version has a range exceeding 1000km.

-

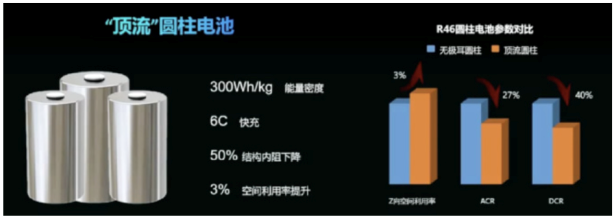

The “Top Flow” large cylindrical product continues the extreme OS simplified manufacturing concept. Through the integrated current collector structure connected vertically to the top, the energy density can reach 300 Wh/kg, supporting 6C+ fast charging and reducing internal resistance by 50% compared to the full-tab cell structure.

Eve Energy

-

Chinese lithium batteries are no longer lagging behind, but they require long-term commitment; it is impossible to achieve sudden wealth or surpass others in one year.

-

The battery industry has entered a stage that prioritizes cost; safety concerns have fundamentally changed due to efforts across the industry over many years.

-

The industry will make directional choices in structural optimization and cost factors to find a perfect balance between performance and cost. Currently, performance is centered on fast charging capabilities, which must be improved to approximately 10 minutes.

-

Eve Energy is determined to pursue large cylindrical and large LFP batteries, introducing the 4695 large cylindrical battery, which will be mass-produced and delivered this year.

### Zener Technology

### Zener Technology

The main points discussed include:

◎ The current electric vehicles face issues of low actual range, slow charging, and high raw material prices, which restrict the development of new energy vehicles;

◎ To improve power batteries from “available” to “excellent”, we can focus on four aspects: increasing actual range, eliminating charging anxiety, reducing battery pack costs, and relying less on scarce resources;

◎ Implement a “fixed-term retirement” system for electric vehicles, such as requiring them to exit the market after 10 or 15 years, to avoid uncontrollable risks like power battery fires.

Review: Regarding the last point, it is indeed difficult to manage the expected lifespan of a vehicle, and it’s also challenging to bring the price of lithium carbonate down to 100,000 or below.

Giant Bay Research

The focus is on fast charging, endorsing fast charging technology:

◎ XFC extreme fast charging battery technology is a crucial aspect of the new energy revolution, and the key limiting factor for achieving extreme fast charging is the development of high-energy-density, high-rate fast charging power batteries, and the layout of high-power charging facilities.

◎ XFC extreme fast charging technology is the accelerator for electric vehicles to disrupt traditional gasoline vehicles. The United States recognizes XFC as a critical challenge to be overcome for the widespread adoption of electric vehicles and has set a near-term goal for 2023.

◎ Chinese automakers and power battery companies are rapidly taking action around the extreme fast charging of electric vehicles. Giant Bay Research’s XFC extreme fast charging battery technology has achieved charging 80% of the battery in 15 minutes and has been used in GAC Aion for the world’s first mass production.

Review: Suggestions are somewhat aggressive, such as: incorporating extreme fast charging technology into the top-level design of the automotive industry, establishing an extreme fast charging industrial system and ecosystem; formulating a series of policies and security measures for the accelerated development of XFC extreme fast charging technology, products, and ecosystems; using commercial models such as taxis and rideshare vehicles in urban public service areas as demonstration windows for promoting XFC extreme charging vehicles comprehensively; providing appropriate subsidies or rewards for XFC extreme charging infrastructure/ecosystem construction, encouraging moderate anticipation in building extreme fast charging infrastructure/ecosystem.### Far Horizon Energy

The first half mainly discusses some vehicle concepts:

◎ Uncertainty stems from the “dimensionality reduction challenge” and homogenized competition in the electric vehicle industry. Electric vehicles have become personal consumer goods with the attributes of consumer electronics, posing significant challenges to traditional automakers.

◎ Development speed is crucial to the success of the electric vehicle industry, particularly in consumer electronics where software development spans the entire lifecycle. The primary revenue for future automakers will come from software profits, which have relatively low marginal costs, requiring only an OTA update.

◎ New energy vehicle companies have recognized the importance of software, but there is still a long way to go for implementation. The core of software-defined automobiles is to focus on creating value.

The second half discusses the energy attributes of electric vehicles and batteries, as well as the impact and challenges of energy consumption:

◎ Energy transformation is the foremost concern in the four modernizations; electric vehicles are essentially large-scale energy-consuming terminals.

◎ The demand for fast charging will pose challenges to future power grids, necessitating consideration of battery monetization and utilization throughout their lifecycle. Tesla’s energy business is its ultimate goal, and the synergy between vehicles and energy storage will yield benefits.

◎ Electric vehicles and batteries have strong energy attributes that need to be recognized and their value fully exploited.

Xinwangda

Perhaps due to dealing with foreign manufacturers, the focus is on adherence to certain rules:

◎ Power battery companies should pay attention to the two main threads of the “battery passport”: quality management and carbon management throughout the battery lifecycle;

◎ Currently, domestic battery companies are inadequately prepared for full lifecycle carbon management, including insufficient ambition to reduce emissions, weak digital foundations for carbon footprint measurement, lackluster promotion of low-carbon supply chain management, heavy reliance on overseas core resources, insufficient motivation to pass low-carbon requirements onto suppliers, and the nascent stage of battery recycling industries.Translate the following Markdown Chinese text into English Markdown text, maintaining the professionalism and retaining the HTML tags within the Markdown. Only output the result.

◎ In terms of quality management, it is necessary to establish an integrated digital platform for battery quality to achieve end-to-end quality management; and establish a big data support platform for battery applications. In terms of carbon management, it is recommended to establish a digital blockchain platform for battery carbon management.

BIC

Mainly discussing large cylindrical batteries, with the following key points:

◎ Large cylindrical power batteries are the solution to pain points of electric vehicle safety, driving range, and charging capabilities;

◎ Large cylindrical batteries can guarantee the safety of the whole pack at the level of not damaging the sidewalls of the cell in any extreme conditions, through design and experimental verification;

◎ Cylindrical batteries are suitable for all current energy density systems, including semi-solid and solid-state systems;

◎ Large cylindrical batteries use full-ear technology to reduce Ohmic heat and waste of energy needed for heat dissipation during use, thereby providing longer range;

◎ Large cylindrical batteries do not have the low-temperature issue of lithium iron phosphate, and still provide uncompromised range at low temperatures with a low impedance structure and low-temperature electrolyte formulation;

◎ Large cylindrical batteries have a cost advantage in terms of cost, with the lowest processing cost brought by high efficiency and consistency, and the potential for massive cost savings through industry standardization and scale in platform upgrades for automakers;

◎ To thoroughly replace gasoline vehicles, the next generation of electric vehicles must be at least on par with gasoline vehicles in all key indicators. Large cylindrical batteries are one of the few solutions that make sense.

Reput

Affected by the weak demand in the domestic new energy vehicle market in recent months, an unexpected downturn has emerged in the entire battery industry, with relatively high inventories for raw material and battery companies and an industry-wide relatively low production rate.

Europe and the United States’ new energy vehicle market continue to develop rapidly, with both national policies and automotive companies attaching great importance to new energy vehicles. Compared to the domestic “Red Sea” market, foreign markets are still “Blue Oceans” with government incentives and subsidies for new energy vehicles. Therefore, going overseas is still an option.

In summary, there is no significant breakthrough in battery technology overall, and everyone discusses their concepts at conferences. At present, the focus is on survival, reducing costs, retaining customers, and developing around differentiated fast charging performance.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.