On the night of April 1st, in the Huawei store located at Beijing Heshenghui, the original label “HUAWEI M5” in front of M5 display car was torn off, only 24 hours after Ren Zhengfei’s statement of “not making cars within five years”.

This label had been on display for less than a month. In early March, “AITO M5” was just renamed “HUAWEI M5”, and now it has received an order to “remove overnight”.

On the same day, after being pushed to the forefront by the “not making cars” statement, Yu Chengdong attended the China Electric Vehicle 100 (EV100). Despite the unconfirmed online speculations, Yu Chengdong reiterated, “Removing Huawei’s logo and making a fuss online, actually Huawei has always insisted on not making cars but helping carmakers to build good vehicles”.

“Persistently not making cars” seems to be a recurring topic within Huawei ever since the company got involved in the automotive business. It appears that making cars has always been an assumption of the outside world. So, who really wants to make cars? Is making cars Huawei’s “original sin”?

What did Huawei, being grilled on fire, do wrong?

“We wanted to call M5 ‘Huawei M5’ at that time and make it an ecological brand. However, some leaders had different opinions. Therefore, a document was issued to remove ‘HUAWEI,’ but the essence has not changed.”

At the China Electric Vehicle 100 (EV100), Yu Chengdong responded to the controversy surrounding M5’s recent name change, saying. Some people say that Yu’s remark has put Huawei’s “internal strife” on the table. However, since Huawei first entered the automotive market, a “horse-racing model” has been popular online; although it has never been confirmed, Huawei’s multi-line strategy to penetrate the automotive industry has always been there.

In 2021, at the Shanghai Exhibition where Huawei officially announced the launch of the smart car SF5 with Seres, I attended two Huawei press conferences upon invitation. One was the Seres SF5 debut conference aimed at consumers, and the other was the Huawei Intelligent Vehicle BU conference for the B-end market.

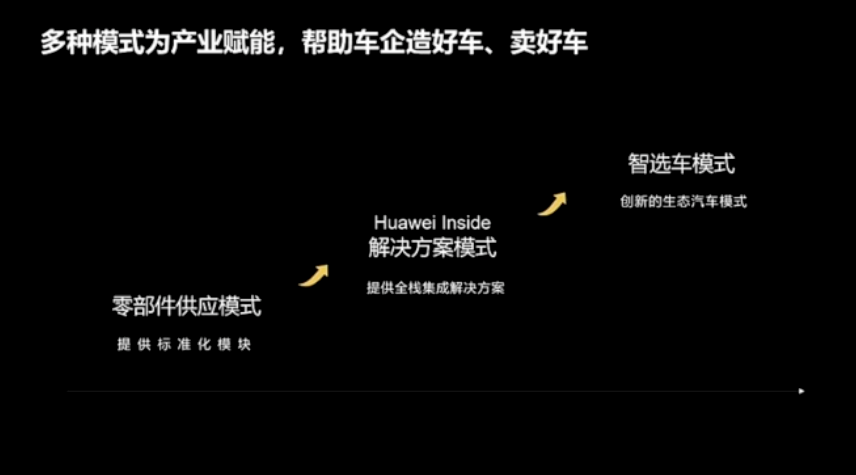

Different organizers, styles, and positioning represent Huawei’s various approaches to entering the automotive industry:

- First, the component supplier model, providing standardized components;

- Second, the HUAWEI Inside model, offering full-stack solutions for smart cars, targeting B-end automakers, resulting in the BAIC ARCFOX Alpha S HI Edition and Avatar 11 HI Edition;

- Third, the Huawei Select Car model, providing component and solution support, deeply involved in the entire product process, directly targeting C-end consumers, resulting in the subsequent Envision series.

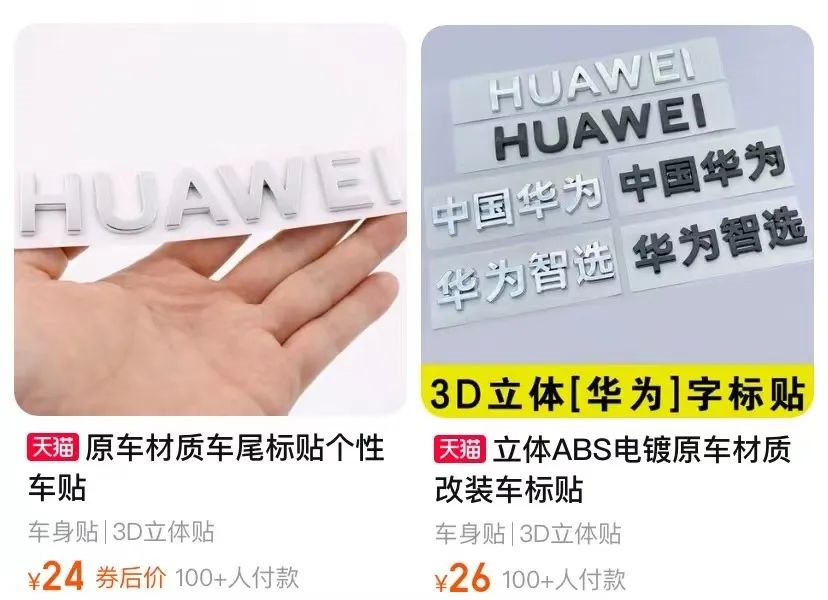

However, such a complex business model is not easy for consumers to understand. Although Huawei has emphasized multiple times that they do not manufacture cars, in the eyes of consumers, these models are all labeled as “Huawei’s cars,” with the best-selling emblem on the orange shopping app being “HUAWEI.”

It’s not just consumers; the industry is also puzzled: Apart from Huawei, there are only a few players targeting both B2B and B2C, such as Baidu. The outside world is skeptical about the difference between the HI mode and Select Car mode, whether B2B and B2C businesses will compete for customers, and whether Huawei’s entry into the auto industry aims to grab the growing smart car market share or automakers’ lunch…Translate the following Chinese Markdown text into English Markdown text in a professional manner, retaining the HTML tags in Markdown, and only output the result.

A series of suspicions, prejudices, and attempts at new collaboration have led to the suspension of Wang Jun, who was originally responsible for the HI model and once served as the president of the car BU, in early 2023. Meanwhile, the original partner GAC terminated the cooperation with the HI model. On the other hand, after experiencing promotions, discounts, and renaming to “HUAWEI Wenjie” at the beginning of the year, the sales of Wenjie models have declined.

If the speculation about Huawei’s “car-making” is not dispelled immediately, the fire that is roasting Huawei now seems to be about to burn its eyebrows.

Isn’t it difficult to understand not making cars?

In 1997, Huawei’s handset division first developed the earliest domestic digital telephone. However, due to the outsourcing nature of the product, quality control was an issue, leading to frequent faults, complaints, and repairs, which damaged Huawei’s reputation.

At that time, Ren Zhengfei made up his mind: “Huawei will never make mobile phones again. Whoever proposes making mobile phones will be laid off!“

Does this history sound familiar? Of course, more than a decade later, in 2011, Huawei eventually chose to enter the terminal mobile phone business. By then, Huawei’s technology accumulation, the market’s demand for mobile phones, and even the definition of mobile phones had changed dramatically.

If it weren’t for this experience, there wouldn’t be so many voices urging Huawei to make its own cars. “If you can make mobile phones, why can’t you make cars?” Congratulations, Lei Jun thinks the same way.

In the mobile phone circle at that time, there was a popular saying: “Whoever masters the core of the mobile terminal business will rule the world.” Core technologies, represented by chips, operator resources, and product definition capabilities, were vital to making mobile phones; as for manufacturing, Apple’s partnership with Foxconn’s foundry model had no impact on iPhone product quality.

However, when it comes to the exponentially more complicated automotive industry, things are not so easy. For example, a few early emerging forces that started with the foundry model, upon gaining scale, the first thing they did was to form their own research and development team and build their own production lines, keeping their core technologies and entire vehicle production in-house.

So if Huawei were to enter the car-making industry, the first step would be to fill up the blank experience in traditional industrial fields. It is revealed that Huawei’s investment in the intelligent automobile business exceeds 10 billion every year; if it wants to make cars on its own, this investment will have to be more than doubled.Regarding the revenue, Huawei’s Smart Car BU generated 2.1 billion in the recently concluded 2022, which was built on the success of selling over 70,000 units of the AITO Wanjie series in its debut year. If Huawei were to launch its own car, how much higher would the sales volume be compared to Wanjie? What would be its market positioning? Would there be a capacity crisis? What to do in case of component sanctions similar to the smartphone chip bottleneck?

Since experiencing sanctions in the mobile phone business in 2020, Huawei’s shift to the smart car industry is to explore a new market, not to dig a bigger hole. Before there are clear answers to these questions, isn’t not building a car quite easy to understand?

What exactly does Huawei want to do?

From the moment Huawei entered the automotive industry, some argued that it would inevitably become the Bosch or Continental of the intelligent era. Even Ren Zhengfei himself said, “The original idea was to become a supplier like Bosch and Continental in the automotive field, but it seems infeasible in today’s era. It’s difficult to sell intelligent increment at a large scale like standardized increment. Instead, it requires in-depth involvement with car manufacturers and continuous OTA and iteration.”

However, from the beginning, Huawei was not aiming to become purely an intelligent increment component supplier.

Huawei’s investments in smart cars include well-known aspects like autonomous driving and the Hongmeng cockpit, as well as electric drives, thermal management, computing platforms, and even components like Lidar and AR-HUD. If we were to calculate the market prospects for each business segment individually, this would amount to a massive market worth nearly a hundred billion; it seems that in every incremental market segment, there are competitors with competitive products and a decent performance.

For example, in the first three quarters of 2022, Yikatong’s revenue reached 20 billion RMB; with Horizons’ chip shipments at only 160,000 units in 2020, its revenue was between 2 and 2.3 billion RMB, and by 2022, its cumulative shipments exceeded 2 million units; Huawei Intelligent Vehicle BU, which holds autonomous driving, Hongmeng cockpit, computing platform, sensors and more, had a revenue of 22 billion RMB in 2022.

For example, in the first three quarters of 2022, Yikatong’s revenue reached 20 billion RMB; with Horizons’ chip shipments at only 160,000 units in 2020, its revenue was between 2 and 2.3 billion RMB, and by 2022, its cumulative shipments exceeded 2 million units; Huawei Intelligent Vehicle BU, which holds autonomous driving, Hongmeng cockpit, computing platform, sensors and more, had a revenue of 22 billion RMB in 2022.

They are all new players in the intelligent incremental market and need to cooperate closely with auto manufacturers in R&D. The difference is that Yikatong and Horizons have targeted specific areas of the intelligent cabin or driving, whereas Huawei aims to provide a bundled, comprehensive intelligent solution. The 21 billion milestone is not the limit for the intelligent incremental market, but the current bottleneck for this type of holistic solution.

Can consumers accept this mode? Judging by the current HI mode focusing on advanced intelligent driving, how many consumers are willing to pay a significant premium for a high-end intelligent driving experience? In the past year, every new car boasting intelligent driving features has experienced a cold reception in the market, demonstrating that far fewer consumers are willing to pay a premium for intelligent driving than the industry has anticipated.

Can the automotive industry accept this mode of cooperation? Huawei itself is well aware that “they (Li Bin, He Xiaopeng) are unlikely to choose Huawei for intelligence because they have their own aspirations; foreign giants, due to Huawei’s sanctions, will not choose us; traditional automakers, if they fear losing their souls, will not choose us either.”

Ren Zhengfei’s “no car making in five years” was meant to reassure automakers, but it seems to be insufficient. When Huawei is involved in numerous aspects of car development, decision-making, and production management under the HI mode, it is no longer a simple supplier position.

Huawei is ambitious in changing the automotive manufacturing model, yet the industry itself seems reluctant to comply. If Huawei’s wholesale solution is dismantled and relegated to the role of the supplier it is supposed to occupy, Huawei appears not to be content with it.

In conclusion

Years ago, insiders within Huawei stated that Ren Zhengfei almost never intervened in specific businesses, appearing only when major strategies were at stake. “Not making cars” has remained a steadfast strategy for Huawei.As for tactics, at least the approach of replicating the success of the mobile phone industry in the automotive field is no longer viable – even for Huawei, which still needs to conform to the rules of the automotive industry.

This feeling has been particularly noticeable this spring. The new technologies and products that we thought could revolutionize the automotive industry overnight have not arrived as quickly as we anticipated. New forces and budding automakers seem to be faring less well than we imagined, while some traditional car manufacturers are not struggling as much as we had expected.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.