Translate the following Chinese Markdown text into English Markdown text in a professional manner, retaining the HTML tags in Markdown, only outputting the result:

Author: Tao Yanyan

Seoul Battery Show 2023 opens in South Korea, a showcase for the country’s battery and materials companies to display their latest battery technology. First, let’s take an overall look at the trends of the three major battery companies:

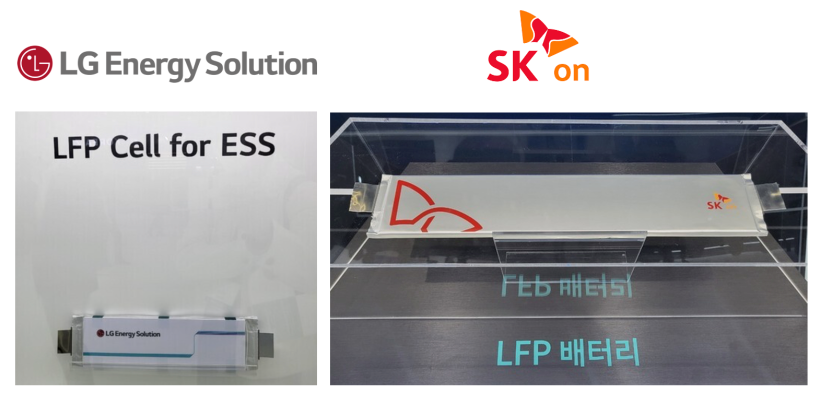

● LG Energy showcased its latest LFP energy storage battery and displayed an LFP-based battery station, also presenting the soft-pack battery developed with General Motors for the electric Hummer

● Samsung SDI mainly exhibited

● SK On showed cobalt-free batteries, LFP batteries, and next-generation batteries, as well as a similarly squared battery to Volkswagen

During the exhibition, several seminars and lectures focused on the applications of battery technology in sustainable energy and electric vehicles, which can be summarized later.

Of course, the three South Korean battery companies are also quite persistent in researching and developing solid-state technology, showcasing their latest technological advancements.

SK On

SK On debuted its square battery at the show for the first time. Previously only producing soft-pack batteries, SK On plans to develop various battery shapes to meet the diverse needs of automotive manufacturers. The company has completed the development of square battery cell samples and will begin mass production as early as this year. The shape of this battery is somewhat similar to the standard battery cell announced by Volkswagen, with adjustments made in size specifications. SK On is in talks with Volvo on the supply of square batteries to support subsequent CTP/CTC designs.

Translate the following Markdown Chinese text into English Markdown text, maintaining the HTML tags in Markdown professionally and outputting only the results:

Translate the following Markdown Chinese text into English Markdown text, maintaining the HTML tags in Markdown professionally and outputting only the results:

The technology surrounding the soft-packed S-pack is similar between LG and SK On, so under the leadership of European automakers, the application of comparatively shorter knife-shaped battery cells has become a current research focus.

Of course, SK On also focuses on the development of high-nickel cobalt-free (SK On improved the energy density of cobalt-free batteries through its High-Ni technology) and LFP batteries. As the popularity of electric vehicles accelerates, global demand for low-cost LFP batteries will increase. SK On announced its entry into a new market for electric vehicle LFP batteries, but no large-scale production plan for electric vehicle LFP batteries has been revealed.

The realization of next-generation batteries appears challenging in the short term.

LG Energy Solution

1) Product Development

This time, LG showcases its ESS in the energy storage battery sector. According to SNE Research data, the three Korean battery companies only had a 16GWh share in the 44GWh global ESS installations in 2021. As energy storage grows to 122GWh in 2022, the market share of the three Korean batteries will only be 18GWh.

### 2)Solid-state Battery Objectives

### 2)Solid-state Battery Objectives

LG Energy Solutions aims to complete polymer-based all-solid-state batteries by 2026, lithium-sulfur batteries by 2027, and sulfide-based all-solid-state batteries by 2028.

Samsung SDI

In terms of product technology roadmap, Samsung SDI is developing cobalt-free NMX anode materials and plans to use these NMX materials for low-cost ESS batteries before transitioning to electric vehicle applications. Of course, for SDI, the LFP battery is also one of the important battery platforms, and they are accelerating the development of LFP batteries accordingly, albeit lagging behind by several years.

In summary: Currently, SK On is the most proactive in exploring new technologies; SDI’s pace may speed up with the change of attitude from Samsung’s heir, while LG is likely working around Tesla’s needs.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.