Author: Tao Yanyan

Editor’s note: We have selected ten power battery companies based on 2022 data and look forward to their future development. Overseas: LG, SK on, Samsung SDI, and Panasonic. From today on, let’s take stock of China’s power battery companies.

When it comes to China’s battery companies, there are only two unquestionable players.

CATL has become a representative of Chinese manufacturing from a battery giant in China and is also a darling of the capital market. Looking back along its path of development, CATL is a very interesting enterprise. As we will discuss in this article, rather than focusing solely on technological aspects, we will analyze and study it more from the perspectives of the market, customer relationship, and manufacturing base layout, particularly the impact of the two different technological development directions (cylindrical and prismatic) on CATL.

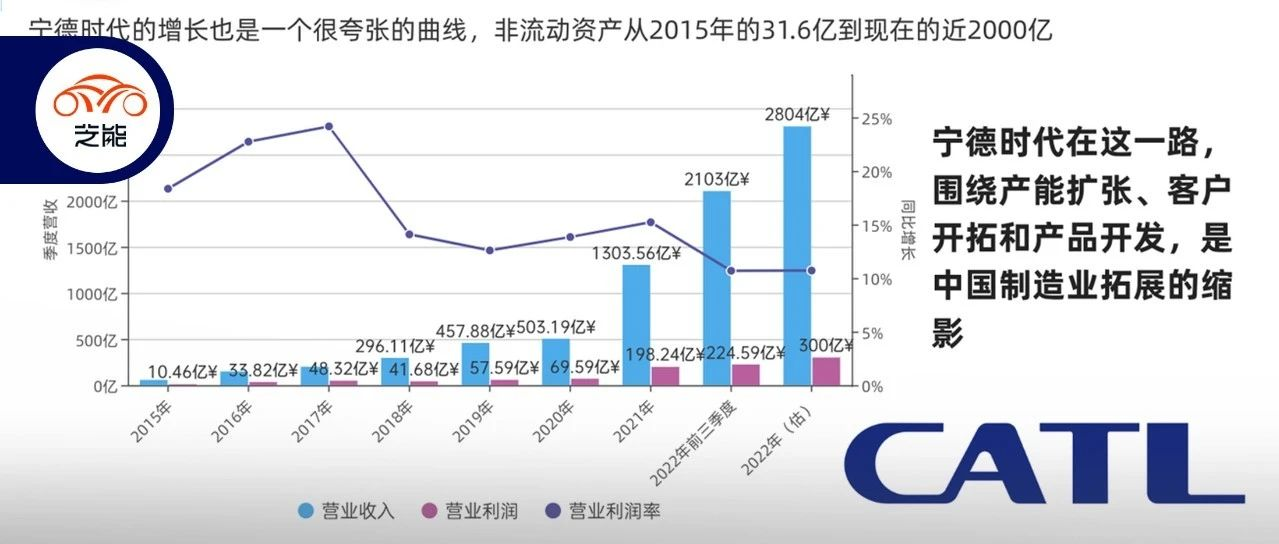

CATL’s growth curve is dramatic, with non-current assets increasing from CNY 3.16 billion in 2015 to nearly CNY 200 billion now. It can be said that CATL’s expansion in production capacity, customer base expansion, and product development epitomizes the expansion of China’s manufacturing industry.

2022 Power Battery Market Overview

Due to CATL’s size, it is mainly affected by overall demand. Therefore, we can first take a look at the overall market demand.

Global and Power Battery Review

In 2022, the total global battery consumption was 517.9 GWh, a year-on-year increase of 71.8%. CATL’s global installation amounted to 191.6 GWh, accounting for 37% of the market share, with a year-on-year increase of 92.5%. This growth rate outperformed the overall industry.

In 2022, the estimated power battery consumption in foreign electric vehicle markets was about 219.3 GWh, a year-on-year increase of approximately 45.2%. CATL’s usage overseas reached 48.8 GWh, with a year-on-year increase of 131%, leading by a large margin in terms of growth rate. With sales increases in Tesla Model 3 (exported to Europe, North America, and Asia from China), Peugeot e-208/2008, and MG ZS, CATL ranked second in the non-Chinese market.“`

Market Demand in 2023

◎ The global consumption of power batteries in 2023 is expected to be approximately 749GWh, a year-on-year increase of 44.62%.

◎ The consumption of overseas power batteries in 2023 is expected to be approximately 310GWh, a year-on-year increase of 41.36%, mainly including the US and European markets.

Customer Relationship of CATL

In the past few years, the demand for electric vehicles has been soaring, but there are actually not so many power battery companies that can guarantee production capacity, price, and reliable quality. From 2015 to 2022, CATL has accurately adjusted its production capacity and customer demand, covering both foreign-funded Tesla and domestic customers through standardized square shell battery products.

Here, if we divide the demand of new forces and domestic old brands separately, we can see more clearly. If an auto company wants to split its batteries and establish second source, there are many problems to be faced.

◎Need to consider the game with the first source(CATL): Most OEMs have a large demand for the first source. If there is a problem with the key battery supply, how to cope with it?

◎The problem of secondary source: price, production capacity, quality, and whether there are patent disputes with CATL.

◎Whether it can be platformized: Effectively integrate the products of the first and second sources into its own product portfolio without increasing complexity.

Before 2022, there were not many choices for auto companies.

“`

Most of China’s state-owned enterprises were built by establishing production capacity through joint ventures.

Energy Storage Market

According to SNE’s data, the energy storage system (ESS) market grew from 44GWh in 2021 to 122GWh in 2022, an increase of 177%. Ningde Era had an installation volume of 53GWh in this field (this estimate includes large-scale energy storage). With the deepening cooperation between Ningde Era and Tesla, we can say that this area has a particularly large incremental growth.

Technological Succession

Ningde Era’s technological succession is mainly divided into chemical system and Pack grouping (which is becoming more and more standardized in the shell).

I. Chemical System

● Solutions for Low- to Mid-End Vehicles

◎ Lithium iron phosphate: Ningde Era’s product covers 180-200Wh/kg, mainly with significant differences in capacity.

◎ Sodium-ion batteries have significant advantages in resource abundance and cost, but due to the limitations of their chemical system in energy density, Ningde Era currently uses CTP and AB combined batteries to meet low-energy density requirements or replace its low-end solutions in mid-to-low-end scenarios, achieving 150-200Wh/kg.

◎ It should be noted that in terms of volume energy density, lithium iron phosphate is 400-450Wh/L, while sodium-ion batteries can only achieve 250-380Wh/L. If we calculate, for a capacity of over 50 kilowatt hours, the two require volumes of 125L and 200L, respectively, which is a significant difference. If we imagine it as a cubic rectangle, it would be long and thick, and difficult to lay out.

● Solutions for Mid-End Vehicles◎ High Voltage Nickel (220-260Wh/kg): Contemporary Amperex Technology Limited’s products cover those with 180-200Wh/kg, mainly due to significant differences in capacity. Logically, Contemporary Amperex Technology Limited prefers the high voltage route and has abandoned the high nickel upgrade path.

■ From the perspective of energy density: high voltage allows more lithium to be removed, which can achieve higher specific capacity, and the average discharge voltage has also increased, making the increase in energy density much greater than specific capacity. Under the charging cut-off voltage of 4.5V, the specific capacity and energy density of NCM622 are basically equivalent to NCM811 at 4.3V.

■ From a safety perspective: the thermal stability of the high voltage system is significantly higher than that of the conventional voltage system with high nickel.

■ From a cost perspective: currently, this is also a relatively good solution, with a volume energy density of 520-630Wh/L.

◎ Switching and Changing: switching to the composite M3P scheme of lithium iron phosphate and manganese.

■ The specific capacity is slightly lower at 210-230Wh/kg, and the volumetric energy density is 450-500Wh/L.

The high-end solution is to use the high nickel with silicon anode scheme, mainly for overseas market demand, which we will not delve into.

2. Differentiated Competing Routes

We can see that outside of the shell, the main alternative routes are the short blade battery and the large cylindrical battery, with the former mainly revolving around the domestically-run economic route.

The latter is dominated by foreign markets and is a technology route that is being heavily invested in globally. Especially in this field, there is no logic for patent blockade, and the only difficulties are in the technology itself. Once there is a breakthrough, there will be a significant change in the current situation. For an enterprise, the greatest challenge is still technological change.

In conclusion: It is not easy for China to produce Contemporary Amperex Technology Limited, but it is currently unrealistic for China to export batteries to the world. Thus, we will have to wait and see how this field develops in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.