Author | Wang Lingfang

Editor | Qiu Kaijun

As the saying goes, “Xiao He wins battles for you, and Xiao He loses battles for you.”

When Tesla Model 3 switched from induction motors to rare earth permanent magnet synchronous motors, it became a milestone event driving up China’s rare earth prices. Now, a single statement claiming no use of rare earths has led to a sharp drop in China’s rare earth prices.

On March 2 during the Investors Day event, Tesla announced that the next-generation motor would not use any rare earth materials, resulting in a heavy fall of the rare earth permanent magnet industry in the A-share market.

So, will Tesla’s rare-earth-free motor eliminate the rare earth motor?

No, at least not in China. Rare earth motors are still the mainstream direction for automotive applications.

Just as Musk switched back to rare earth permanent magnet motors from induction motors, at this stage, the rare-earth-free motor is not the best solution in terms of performance-price ratio.

The rare earth permanent magnet motor is an advanced technology that emerged from the 1960s-80s. Prior to that, non-rare earth motors were used for more than 160 years.

In a sense, not using rare earths is a technological regression. Of course, just like how Musk had his reasons for using high-nickel ternary batteries, and then phosphate lithium batteries, he also has his reasons for not using rare earths.

The rare-earth-free motor has a long history

In the nearly 200-year history of motors, humans have been using non-rare earth motors for about three-quarters to four-fifths of the time, and the rare earth permanent magnet motor is a new technology route invented in the 1960s.

In the 1820s, the world’s first motor was an energized permanent magnet motor. Its rotor was a permanent magnet that utilized the principle of like poles repelling and opposite poles attracting to rotate the rotor by interaction between the magnetic field produced by the stator’s electric current and the magnetic field of the rotor’s permanent magnet.

However, the permanent magnet material used at the time was not rare earth permanent magnet material, but natural magnetite ore, which had low magnetic energy density. To make the motor meet the required usage, it had to be manufactured at a large scale.

Since the energized permanent magnet motor was too bulky and impractical, it was soon replaced by the electric-excited magnet motor.

In other words, from the 1820s to the 1960s, the world mainly used non-rare earth motors, such as ferrite permanent magnet motors, excited motors and induction motors.

In 1967, the first generation of rare earth permanent magnet material samarium-cobalt was invented. Due to its high cost as it contained the strategic metal cobalt and the scarce rare earth metal samarium, it was difficult to be popularized in civilian fields and was only used in military, aerospace and other fields.The fate of permanent magnet motors was completely changed with the advent of the third-generation neodymium iron boron rare earth permanent magnet material, known as the “magnetic king,” in 1983. Not only does neodymium iron boron permanent magnet material exhibit excellent performance and record-breaking high magnetic energy density, but it also replaces the expensive strategic material cobalt and scarce samarium with low-cost, abundant iron and neodymium. It is hailed as the “king of modern permanent magnets.”

Thanks to its low cost and excellent performance, neodymium iron boron permanent magnet material laid the foundation for its application in the civilian field and became an opportunity for permanent magnet motors to surpass excitation motors.

Because of the significant significance of neodymium iron boron rare earth permanent magnet materials, they were listed as one of the world’s top ten important technological achievements in 1983.

Performance Inferior to Rare Earth Permanent Magnet Motors

The advent of neodymium iron boron permanent magnet material has essentially cut off the prospect of rare earth motors being used in new energy vehicles.

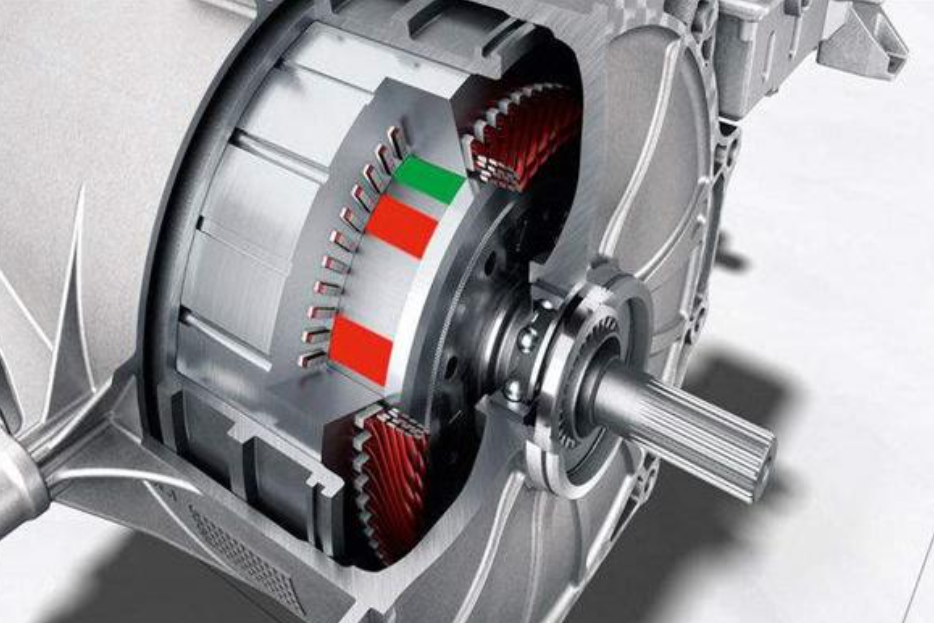

Mr. Li, the head of a well-known electric drive supplier, specifically explained to “Electric Car Observer” that currently, non-rare earth motors are mainly divided into asynchronous induction motors, synchronous reluctance motors, mechanical external excitation synchronous motors, and induction external excitation synchronous motors.

According to Mr. Li, although asynchronous induction motors have been used in new energy vehicles, they have lower power density and average efficiency, larger volume, and are generally used as auxiliary drives. For instance, early on, they were used in Tesla Model S and Model 3 models. Later, Tesla switched to rare earth permanent magnet synchronous motors on a large scale.

Synchronous reluctance motors are mainly used in industries, such as textiles, wind turbines, water pumps, conveyors, transportation, and so on. Considering this type of motor’s torque pulsation and high noise, poor NVH effect, low efficiency, large and bulky volume, current technology is not suitable for application in new energy vehicles.

There is also a mechanical external excitation synchronous motor where excitation is transmitted to the rotor coil through traditional carbon brushes and slip rings to generate a magnetic field. It has been widely used in the industry, and there have been applications in new energy vehicles, such as the BMW iX3.

However, mechanical excitation brings many problems, such as mechanical wear, requiring maintenance within the product cycle, and increasing the design difficulty of high-performance motors, thus only being used by a few car manufacturers at present.

In addition, there is an induction external excitation synchronous motor where the excitation is transmitted to the rotor coil through non-contact electric energy transmission to generate a magnetic field. Because of the unique excitation energy wireless transmission, all kinds of drawbacks brought by mechanical excitation are also eliminated.

However, some experts have expressed that the excitation magnetic field of electric excitation motors originates from excitation current. Assuming the fundamental amplitude of air gap magnetic flux density is the same, the mass and volume of the rotor of an electric excitation motor will exceed that of a permanent magnet motor, resulting in a low torque and power density for electric excitation motors.And the comprehensive performance of rare earth permanent magnet motors is much better.

For example, NdFeB permanent magnetic materials combine the advantages of AlNiCo and ferrite permanent magnets, with high residual magnetism, coercive force, and magnetic energy product. The maximum magnetic energy product of rare earth permanent magnets is 5-8 times higher than that of AlNiCo and 10-15 times higher than that of ferrite. Under the same effective volume conditions, it is 5-8 times higher than that of electric excitation, and second only to superconducting excitation. The demagnetization curve of NdFeB permanent magnetic materials is almost a straight line, and the recovery curve and demagnetization curve basically coincide, with a reversible magnetic conductivity close to 1.0 and strong anti-demagnetization ability.

In the words of Professor Cai Wei, a doctoral supervisor at Harbin University of Technology, “There is currently no motor with significantly better overall performance (including volume and reliability, etc.) than rare earth permanent magnet motors for use in low-speed and light-load cars.”

Of course, we can expect Tesla to come up with more advanced technology, but for now, most improvements are made on existing technology, and both rare earth and non-rare earth motors are improving, but no clear signs of better technology have emerged.

Giving Up on the Best Solution of “Rare Earth”

Therefore, in terms of performance, choosing a motor without rare earth permanent magnets may be a step backwards for Tesla.

When the Tesla Model S was launched in 2012, it was equipped with an induction motor. In 2017, Tesla began to use permanent magnet synchronous motors in the Model 3.

Compared with induction motors, permanent magnet synchronous motors are smaller and more compact, more efficient and conducive to endurance, and easier to control. In the Model Y, Tesla continues to use a permanent magnet synchronous motor scheme. Data shows that the permanent magnet motor used in the Tesla Model 3 is 6% more efficient than the induction motor used previously.

It can be seen that induction motors have the advantage of low cost, but they also have the disadvantages of large size, low efficiency, and affecting endurance.

According to Cai Wei, the switch from induction motors to permanent magnet synchronous motors by Tesla early on was probably for the purpose of improving efficiency, and now they can return to their original path.Mr. Zhang, the person in charge of a domestic electric drive supplier, stated to “Electric Vehicle Observer” that using rare earth permanent magnetic materials, the motor efficiency can reach 97\%, without rare earth it can reach 93\%, but the cost can be reduced by 10\%, which is still cost-effective overall.

Perhaps the low-cost new car Model 2/Q that Tesla will introduce later, will be the first to adopt rare earth-free motors.

In addition to Tesla, Japanese and European car companies are also trying to get rid of rare earth permanent magnet synchronous motors. For example, BMW, Audi, Nissan, Mahle, and Continental Group have all begun to develop and produce excitation motors.

Overall, there are two main reasons. First of all, it is to get rid of dependence on rare earth permanent magnetic materials, which means getting rid of dependence on resources, and the possible environmental burdens brought about by mining.

Secondly, for technical reasons, excitation motors balance efficiency and high-speed output. Since the excitation is provided by the rotor winding, the excitation can be adjusted, so it can provide appropriate excitation according to the operating conditions whether running at low speed or high speed. Therefore, its high and low-speed performance is relatively excellent. It can also be understood as a motor that combines the advantages of the other two kinds of motors.

In other words, the supply chain and cost are the primary considerations for car companies. If possible, the main products in the supply chain should be self-controlled.

According to data from the US Geological Survey (USGS), as of 2021, the total global rare earth resource reserves were approximately 120 million tons, with rare earth oxide (REO) reserves as the statistical basis. They are mainly distributed in China, Vietnam, Brazil, and Russia. The reserves of these four countries account for 86.4% of the world’s total reserves, with China’s reserves accounting for 44 million tons, and the reserves of Vietnam, Brazil, and Russia each exceeding 20 million tons.

Currently, China’s rare earth reserves account for 35.2% of the global total, the mining output accounts for 58% of the world’s total, and rare earth consumption accounts for 65% of the world’s total. In all three aspects, China ranks first in the world and occupies a dominant position as the largest producer, exporter, and user in the world.

New energy vehicles have become an important application area for rare earth magnetic materials. Data shows that new energy vehicles and the electronic industry have the highest proportion in the global rare earth consumption, reaching 35%.

The secretary of Zhongke Sanhuan previously stated that on average, the amount of neodymium iron boron permanent magnet materials used in each new energy vehicle is about 2.5 kg. Based on this calculation, the global demand for rare earth magnetic materials for new energy vehicles will reach 30,000 tons in 2025.

Meanwhile, China is tightening its control over rare earth elements. In 2016, the Ministry of Industry and Information Technology (MIIT) released the “Rare Earth Industry Development Plan (2016-2020)”, proposing reasonable regulation of the total amount of rare earth mining and production, with the annual mining volume controlled to within 140,000 tons by 2020. At the same time, it vigorously cracked down on illegal and irregular rare earth production, strictly controlled the market access system, and did not add any new mining rights except for the six large rare earth groups. In 2021, MIIT and the Ministry of Natural Resources released the “Notice on the Total Control Targets of Rare Earth Mining and Smelting and Separation Indicators for 2021”, with the targets for rare earth mining and smelting and separation being 168,000 tons and 162,000 tons respectively, an increase of about 20% compared to 2020. The previous draft clearly stated that no unit or individual who has not obtained approval is allowed to invest in the construction of rare earth mining and smelting and separation projects. It also established a general guideline for follow-up domestic rare earth mining and separation, which is to continue to implement total volume target control. Driven by Tesla, neodymium iron boron materials have become the main materials for driving motors in new energy vehicles, and have also become an important force driving up the center of rare earth prices.

Meanwhile, China is tightening its control over rare earth elements. In 2016, the Ministry of Industry and Information Technology (MIIT) released the “Rare Earth Industry Development Plan (2016-2020)”, proposing reasonable regulation of the total amount of rare earth mining and production, with the annual mining volume controlled to within 140,000 tons by 2020. At the same time, it vigorously cracked down on illegal and irregular rare earth production, strictly controlled the market access system, and did not add any new mining rights except for the six large rare earth groups. In 2021, MIIT and the Ministry of Natural Resources released the “Notice on the Total Control Targets of Rare Earth Mining and Smelting and Separation Indicators for 2021”, with the targets for rare earth mining and smelting and separation being 168,000 tons and 162,000 tons respectively, an increase of about 20% compared to 2020. The previous draft clearly stated that no unit or individual who has not obtained approval is allowed to invest in the construction of rare earth mining and smelting and separation projects. It also established a general guideline for follow-up domestic rare earth mining and separation, which is to continue to implement total volume target control. Driven by Tesla, neodymium iron boron materials have become the main materials for driving motors in new energy vehicles, and have also become an important force driving up the center of rare earth prices.

Under the influence of the rapid rise in rare earth prices under total quantity control, Japanese and European and American automakers have begun to develop and use rare-earth-free motors as a second-best option.

Chinese automakers do not need to follow

Do Chinese automakers need to follow suit? Let’s take a look at the total amount of rare earth first.

In fact, rare earth elements on Earth are not rare. Cerium, yttrium, lanthanum, and neodymium are the most abundant rare earth elements. Their average abundance in the Earth’s crust is similar to that of common industrial metals such as chromium, nickel, zinc, molybdenum, tin, tungsten, and lead. For example, the content of neodymium in the Earth is about two-thirds that of copper.

Even the two rare earth elements with the smallest reserves in rare earth elements have an average crustal abundance that is nearly 200 times that of gold.

The reason why rare earths are expensive is that the grade of rare earth ore is low, the extraction process is complex, and it is easy to pollute the environment.In a worldwide perspective, rare earth minerals are not particularly rare and can support the development of new energy vehicles without any problems. Moreover, the global reserves are abundant, and there is no “neck-chock” issue.

Therefore, in terms of cost-effectiveness, rare earth permanent magnet motors are currently the best choice for Chinese new energy vehicle enterprises.

Multiple domestic new energy technology officials have stated that from a comprehensive performance perspective, if rare earth minerals are not used currently, it will inevitably affect the electric vehicle’s range and bring a series of troubles such as revalidation, which is not worth it.

Mr. Li also believes that the permanent magnet synchronous motor will continue to maintain its position in the new energy main drive application with its high-performance advantage. The final decision on choosing between rare earth-free or rare earth permanent magnet motors depends on the actual application goals and positioning of the entire vehicle, as well as whether the automaker relies on rare earth and other factors.

“Since each motor technology route has its strengths and weaknesses, the position of rare earth permanent magnet motors worldwide will not be quickly shaken,” says Mr. Li.

In the view of the aforementioned electric drive supplier Mr. Zhang, China and foreign countries share the same goal of reducing rare earth usage in motors. “Electric drive enterprises will also generally reduce the use of rare earth minerals by increasing the motor’s speed to reduce the motor volume,” says Mr. Zhang. “After all, all actions and concepts are ultimately aimed at reducing costs.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.